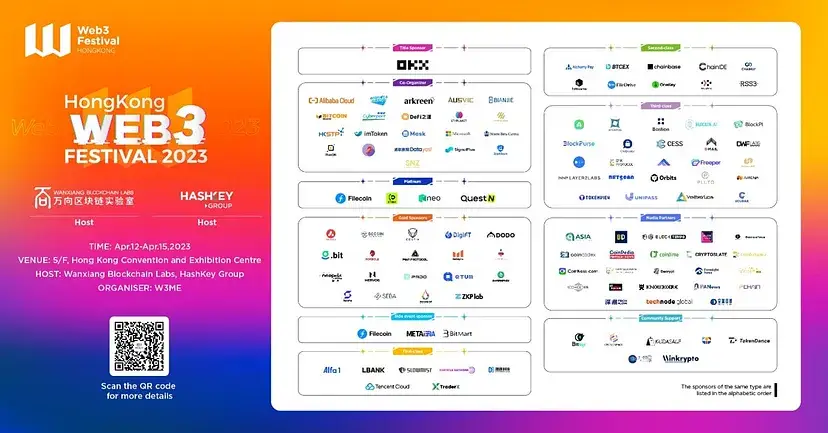

The recently concluded 2023 Hong Kong Web3 Festival has made Hong Kong one of the most discussed topics in crypto.

The rare gathering of crypto OGs, strong support from the policy and environment, and the bustling APAC Web3 world all made this lively festival, with almost 100 side events, buzzing with excitement.

Some people call for a “rising tide of Xiangjiang,” taking a firm long position of HK in the context of overseas and domestic regulation; others believe that such large-scale events are just a way to heat up the market, and the real changes may not have happened yet.

●Editor’s Note: Xiangjiang is a nickname for Hong Kong. The “rising tide of Xiangjiang” refers to the booming Hong Kong economy.

At Moonshot Commons’ Web3 Fireside Chat #19, we are honored to feature Da Shan, founding partner of Waterdrip Capital, Elaine Yang, investment director of Waterdrip Capital, Steven and Daksh, co-founders of Public.AI, and Zixi Zhu, investment manager at Matrix Partners. Key Takeaways:

1.Hong Kong has emerged as a prominent crypto hotspot, with the 2023 Hong Kong Web3 Festival garnering significant attention and support from both crypto OGs and the government.

2.The event was described as crowded, entertaining, and hopeful, with genuine support from the Hong Kong government in terms of policies, funding, and high-profile officials participating.

3.The Web3 investment landscape in Hong Kong has evolved, with improved regulation compliance and more favorable policies attracting Chinese entrepreneurs back to Hong Kong, boosting confidence in the region’s potential.

4.Hong Kong offers opportunities for Web3 projects, particularly in areas such as office space, talent introduction, funding through initiatives like the Web3 Hub Fund, and the development of stablecoins pegged to the Hong Kong dollar.

5.Infrastructure, AI, and non-blockchain decentralized protocols are seen as areas with potential in the Web3 space, along with the exploration of high-traffic Web2 applications transitioning into the Web3 realm.

We mainly discussed:

●How has the Web3 investment landscape in Hong Kong changed?

●Which Web3 tracks and what kind of projects are more worthy of being done in Hong Kong?

●What possibilities will AI+Web3 bring?

●What kind of community ecosystem is being created for Web3 projects and organizations by large-scale events?

●Where do Chinese Web3 projects go from here?

“Bustling, overly fun, and full of hope”

Da Shan:

If I were to share three key descriptions, they are: bustling, overly fun, and full of hope.

It looked bustling like it wasn’t even a crypto event, and a lot of people in the entertainment industry came. In this complicated environment, we still saw hope — people came in, capital came in, and this is the hope of the entire Crypto circle.

The most unexpected highlight was that I saw the genuine support from the Hong Kong government, whether in terms of policy, funding, or some officials, including Ka-Chiu Lee, all of which caught me by surprise.

There were three events that I was most impressed by:

The first one was a conference we organized for LPs where we invited many crypto OGs as speakers presenting to traditional high-net-worth individuals and foreign investment institutions. It went very well, and the content shared was very high-end and in-depth.

The second was the Demo Day, where we looked over more than 20 projects that were selected out of more than 100 projects, all with very high quality.

The third was a special session for the Bitcoin ecosystem, where we gathered many Bitcoin OGs and discussed other possibilities of the ecosystem. When the story of Ethereum has been told, there are still many stories left to be told in the Bitcoin ecosystem, especially in combination with non-blockchain-backed decentralized protocols.

Elaine:

The most memorable thing for me is that the Hong Kong government is taking regulatory matters very seriously, making more favorable policies than expected.

The second is the overall feeling that Web3 in Hong Kong is “chaotic but with orders.” This time, we found that many Chinese entrepreneurs are more relaxed. We used to visit the U.S. for Web3 conferences before, and we had to speak English in a white-dominated group so as to be international and inclusive. This time, attendants rarely spoke English as it was dominated by Chinese. I found many Chinese projects quite pragmatic.

Many Chinese projects are already successful and receiving high valuations. They are the more economical substitutions of some overseas projects outside of China. Chinese entrepreneurs have delivered surprising results this time, bringing confidence back to Asia.

This time we have the opportunity to dive deep into Chinese projects well and have been able to source many good projects. I think “builder” is a big market in China, and thus we must strengthen our expertise and push Chinese builders to become more global. This will bring out a big surprise.

Zi Xi:

At the main conference, I felt that only about 10–15% of the exhibitors were from new projects I hadn’t seen before. The majority were large-scale projects I was already familiar with from Asia. Outside the venue, I saw a lot of early-stage new projects with very young founding teams. I also found plenty of network-reliant projects that are more toward the application side. Maybe in another six months, more projects in Hong Kong will be suitable for our investment.

Nevertheless, we saw some excellent projects and entrepreneurs like Gravity (Hong Yea) and Bloom (Justin), but even those projects are still at a relatively early stage. At least, among the entrepreneurs I saw, those from Hong Kong are more entrepreneurial than those from Singapore. It might be the case that Singaporeans can be well off with governmental policies and subsidies while citizens of Hong Kong may not face the equivalent environment. Steven:

The festival as a whole had a lot of activities. From the main conference to the sub-conferences, there were so many activities organized by project parties and VCs that there were probably more than 100 side events these days.

I found two aspects of this experience most rewarding:

Firstly, it was a great opportunity to constantly meet new people. I was pitching at various exhibitions and events every day and establishing connections with people, building more than 50 contacts each day. We also had numerous opportunities to showcase our project. Conducting three or four presentation sessions got us a lot of attention and helped us gain some traffic.

The second part is centered around learning. We had the opportunity to engage with industry leaders and invite influential individuals to in-depth discussions. Through these interactions, we gained insights into their perspectives on projects and investment strategies and received practical advice that proved highly beneficial to our project.

Currently, our team is focused on the data labeling project (PublicAI), which follows the Label-to-Earn model. A venture capitalist advised us that “X-to-Earn” models should prioritize volume, suggesting that we establish a groundwork in communities within Southeast Asia or Turkey to gather initial data. This insight is crucial for our market success, as without it, we may have overlooked this important aspect. Additionally, we have been impressed by certain organizations that have expressed their commitment to collaborate after direct conversations with us.

Furthermore, engaging with other stakeholders in the industry allowed us to exchange ideas from various perspectives. Some contributions revolved around marketing strategies, while others focused on tokenomics design or real-world implementation, providing valuable inspiration. With the multitude of ideas we have gathered, we can then carefully deliberate and make informed decisions regarding the next steps for our project.

Overall, the key takeaway from this experience is that project parties must have data. In the current market climate, it is insufficient for a project to merely function in theory; it must also demonstrate its traffic through data, such as the number of active users on Telegram or the engagement within our community.

Later on, we will adjust our product strategy accordingly, transforming our demo into an MVP (Minimum Viable Product). Although it may be for limited usage scenarios or with a highly specific feature, it is essential that the product functions effectively. Initially, we will engage with users through our primary or test websites, providing them with an interactive experience while accumulating early adopters. Armed with this valuable data and user profiles, we will be in a stronger position to engage with investment institutions. Daksh:

In April, we observed several notable events focused on Web3 development in Hong Kong, which indicates the official support from the Chinese government. This news suggests that Hong Kong will experience positive growth, including implementing various compliance policies.

Although my primary workplace is currently in Dubai, I have made the decision to relocate to Hong Kong, which emphasizes my strong belief in its potential to regain its position as a leader in the Web3 space.

Amidst the contemplation surrounding Hong Kong’s suitability as a hub for Web3 development, my unwavering conviction is that it undeniably holds immense potential. The ongoing demonstration of Hong Kong’s capabilities serves as a highly encouraging testament to its progressive nature.

“There will be increasingly more ‘front store and back factory’ models.”

Da Shan:

I think Hong Kong is a much better place for Chinese people to flourish than Singapore.

I personally spent some time in Singapore last year. At the end of last year, we came to Hong Kong and launched a compliance digital asset fund with a traditional financial giant in Hong Kong. Geographically, Hong Kong is a buffer zone between China and the Western world; politically, it is also the closest to the Western world and the most open region of China.

Therefore, it is a great opportunity for policy arbitrage — a lot of things that can’t be done in Mainland China can be done in Hong Kong; a lot of things that can’t be done in the U.S. can be done in Hong Kong as well; you can try many things here.

In the absence of clear government regulation, compliance issues posed notable obstacles, dissuading numerous applications from entering the scene. However, with Hong Kong now having established well-defined licenses, an increasing number of projects can confidently enter the market, presenting a wealth of improved development opportunities.

Elaine:

There are many opportunities in Hong Kong. The first is office space and talent introduction. The high talent visa is now attracting a lot of talent back to Hong Kong as a lot of capital and talent did flow to Singapore last year.

Secondly, the Web3 Hub Fund by the Hong Kong government is ready to launch a $100 million investment in Web3, so it is also very favorable to Chinese entrepreneurs in terms of funding.

The third is the Cyberport and Science Park’s site and policy support. Like Zhongguancun in Beijing, the establishment of tech hubs helps Chinese project parties set up headquarters in Hong Kong.

Another crucial aspect is policy compliance, as obtaining improved licenses greatly facilitates conducting compliant business operations in Hong Kong. An instance is the recent expansion of retail trading opportunities in June, which is expected to substantially augment the trading volume of compliant exchanges.

I have observed the substantial offline flow and high demand for account opening on several OTC platforms in Hong Kong, indicating a promising opportunity to serve as a service provider in this domain.

Hong Kong’s largest local Fintech group, including HashKey, has the relevant licenses and can do both capital management and trading. They have already laid out in the early stage and have some first-mover advantage because now these compliance licenses are very difficult to get and have had a waitlist for a long time.

Furthermore, I hold a strong belief in the substantial potential that lies ahead for stablecoins. Through discussions with individuals in the traditional financial industry, I discovered that despite the absence of explicit laws and regulations endorsing a Hong Kong Dollar-backed stablecoin, the prevailing dominance of the U.S. dollar necessitates converting all assets into USDT. However, the introduction of a stablecoin pegged to the Hong Kong Dollar could reshape this landscape.

The Hong Kong government is expected to introduce more initiatives in this domain. However, individuals filling this role must have a substantial background in state-owned enterprises or large banks, which may slow down the progress. Nevertheless, it is highly promising to embark on this endeavor.

Zi Xi:

In general, Hong Kong’s environment is not conducive to the development of user-oriented projects; rather, it is more suitable for external funds to enter. Hong Kong excels in areas such as CeFi, capital management, compliance-related fiat transactions, and gold. Establishing a robust policy framework will serve as the core infrastructure for capital inflows.

Our investment strategy revolves around onboarding development, users, and funds from Web2 into Web3.

A large population base is essential to attract users, and Hong Kong has limitations in that regard. In terms of developers, Hong Kong leans towards traditional finance, which may not be ideal for attracting traffic. The cost of employing development staff in Hong Kong is also considerably high.

Moreover, the trend of adopting a front-store and back-factory model is gaining momentum.

Cyberport’s policy of providing financial incentives has attracted numerous projects, resulting in a growing presence of entrepreneurs and business development personnel in Hong Kong, while core development teams are often based in other countries.

The next step for Hong Kong is to bring in funds from the Web2 sector.

In this direction, we recently invested in Solv Protocol, which offers a new product utilizing the ERC protocol to enhance fund distribution, management, and other strategies. This is beneficial for fundraising and acquiring assets from traditional financial markets in Hong Kong. The key lies in expanding business development efforts among home offices and guiding their asset allocation in the crypto market. A reliable exchange channel is crucial to attracting funds from prominent Web2 financial institutions. We have analyzed that local spot exchanges in Hong Kong may not be cost-effective, whereas on-chain derivatives exchanges prove to be more profitable. Consequently, we recently invested in a derivatives exchange project in Hong Kong, although obtaining a compliance license for such an exchange is currently challenging.

I anticipate witnessing more projects in Hong Kong that possess compliance licenses and attract established funds. These projects extend beyond spot exchanges and encompass centralized fund management, custody projects, and potentially more innovative ventures.

“What kind of web3 opportunities have more potential?”

Da Shan:

Within the realm of infrastructure, we are particularly interested in three main directions.

First, we focus on blockchain infrastructure related to hardware, including distributed computing, distributed storage, and the fusion of blockchain with smart hardware or IoT hardware. We are also intrigued by hardware implementations of ZK technologies, such as a project we recently encountered involving decentralized pledging of LSD using hardware — an intriguing prospect. Secondly, we are exploring non-blockchain decentralized protocols that can fulfill high-frequency micro-applications, achieve low or even zero gas fees with high-performance TPS, and enable complete decentralization in office, social, and gaming environments. Lastly, we recognize the potential of Web3 applications developed by Web2 teams with substantial user traffic. For instance, we have participated in sharing sessions with numerous “graduates” from companies like Alibaba, who possess extensive product experience and aspire to venture into the Web3 realm with high-traffic products. We believe that large-scale applications of this nature can attract a considerable user base.

Elaine:

I also focus on infrastructure, AI, Bitcoin's narrative, and regulatory security. It is worth noting that the meta-universe narrative has diminished significantly while the topic of regulation has remained highly relevant.

Recently, I have been diligently observing TradeFi, where numerous tokens, including those yet to be launched, are undergoing substantial pre-liquidity lock-up. This situation calls for the establishment of a reliable infrastructure that resembles dark pool trading or OTC (over-the-counter) platforms in traditional finance. Unfortunately, the current landscape lacks robust DeFi products that adequately cater to this crucial requirement. DID + SocialFi is also a direction worth exploring. Currently, native Social projects on the chain may not be well-established due to low overall activity and high migration costs from traditional Social products. We need high-frequency interaction scenarios to overcome this, such as deploying decentralized protocols through non-blockchain methods and establishing connections between the chain and centralized world DID infrastructure.

“Stablecoins are gaining enormous traction.”

Elaine:

Last year, Hong Kong engaged in comprehensive discussions surrounding concepts like the metaverse, sandbox, and VRAR. This year, these concepts have converged into Web3, which represents the vision of “building the next generation Internet.”

The government is committed to fostering the flourishing growth of Web3 and witnessing firsthand the transformative power of state-of-the-art technology in people’s lives. However, native Web3 elements have not yet fully materialized. Interaction costs and the adoption of wallets remain as barriers preventing users from entering the field. There seems to be a wide gap between the government and industry practitioners.

Last year, discussions revolved around tokenizing real-world assets, such as using DeFi for lending in traditional finance or converting real estate into NFTs. The government is keen on exploring blockchain’s potential for traceability and confirming ownership rights. However, very few projects have fully realized these ideas. Many initiatives still resemble Lego-like models within the finance industry, leveraging the composability of money to enhance liquidity.

Zi Xi:

Over the past two years, the overall direction and narrative have remained relatively consistent, and the verticals have been well-defined. For example, last year, we focused on ZK hardware acceleration. Despite initial skepticism, the concept has gained more attention this year.

Another noticeable trend is the declining interest in gaming projects this year.

Daksh:

One of the prominent trends I observed was the growing interest in stablecoins. People are keen on creating improved stablecoin structures based on HKD or other currencies, as it benefits both cryptocurrency buyers and sellers.

However, it’s worth noting that most attendees at the event were from Mainland China. Therefore, this event might not fully represent the local Web3 trends in Hong Kong. Based on the conversations I had with attendees, it was evident that stablecoins have emerged as a prominent topic of interest and an undeniable trend.

“Blockchain thrives with the development of AI.”

Da Shan:

We are particularly interested in AI as well. I believe blockchain will benefit greatly from the integration of AI.

AI heavily relies on data for growth and evolution. Only through blockchain can data be filtered and protected. Valuable data, such as medical and private corporate information, can be securely released to AI tools like ChatGPT, ensuring responsible and controlled usage. The Blockchain industry can also facilitate data transactions, further augmenting its role.

Hence, Blockchain is an industry that truly benefits from AI’s development, especially in software applications. This synergy represents an important focus area for our strategic positioning.

Elaine:

During the Demo Day, I noticed many data layers and AI-integrated projects. The combination of AI and Web3 was quite prevalent.

One product that caught my attention was an “AI + fortune-telling” application. It fine-tunes an Avatar to match one’s personality, creating incentives for users to provide more data in the future. I believe this represents a new trend.

AI integrated with Web3, along with compelling use cases that users can readily understand and participate in, offers playability, operability, and ease of comprehension. These factors make it more accessible to users compared to many native DeFi projects.

Large-scale application products can emerge from such scenarios below.

Steven:

AI’s role in Web3 is a topic that garners much discussion, such as leveraging AI for NFT generation and trading bots. In my opinion, AI exploration should occur in two directions: upstream and downstream.

The upstream of AI is how to empower AI with Web3, such as data labeling, which is how we are using Web3 to build a distributed arithmetic network to train AI.

**Note: Data labeling: data labeling is the process of identifying raw data (images, text files, videos, etc.) and adding one or more meaningful and informative labels to provide context so that a machine learning model can learn from it.

The downstream of AI is how AI can empower Web3. Behind AI are algorithms, data, and computing power. How can these three things be combined with Web3?

DeSci is doing well in terms of algorithms, using decentralized science to let people submit papers, assetizing papers and tokens, and empowering model-making and algorithm design.

In terms of data, we are working on an AI data labeling platform that uses Web3 to link communities. Communities can contribute labeling capabilities to train AI and share them with others after earning money.

Regarding computing power, Render Token is a project that uses idle computing power worldwide to do meta-universe rendering. In the AI era, we can also use computing power around the world to form a decentralized computing power network to train AI. One of the directions we are thinking more about is how to use Web3 to empower AI production and optimization.

Daksh:

I also noticed at many events that many Web3 projects are related to AI, which was not at all presented at Token 2049 in Singapore last year.

**Note: Token 2019: a premier crypto event organized annually in Singapore where founders and executives of leading web3 companies and projects share their views on the industry. “Early-stage projects should build a seed user community.”

Da Shan:

This event's theme is Festival, which means that anyone with any role, whether in technology, investing, media, or trading, can participate and connect.

Elaine:

In a dynamic conference environment, establishing a substantial user base is vital for a project’s success, as it plays a pivotal role in shaping perspectives and fostering growth. By attracting and nurturing a core group of 100 dedicated seed users in the early stage, a project gains the potential to cultivate a robust network that holds significant promise. Thus, it becomes imperative to proactively cultivate a dedicated seed community right from the outset of the project.

I have also participated in various conferences, but my current inclination leans towards engaging with technology and engineering-focused events like the Hackhouse, an event that we sponsor. These events bring together educators who attend workshops and panels featuring special guests to share profound insights. Deep connections with seed users are essential at such conferences, while traditional networking is not.

Steven:

We extended invitations to a wide range of individuals at the conference, specifically targeting those from investment institutions, project-related communities, and partner organizations. Our primary objective was to foster meaningful connections by engaging in in-depth conversations. By doing so, we aimed to establish a stronger rapport that would facilitate expedited collaborations in the future.

I am familiar with 0xU, a remarkable student group comprising the chain associations of various universities in Hong Kong. Despite lacking financial support, they have demonstrated remarkable dedication and enthusiasm in organizing numerous crypto and Web3 activities. Their commendable efforts have yielded remarkable success. In a recent collaboration, HashKey partnered with 0xU by providing them with free booths and additional side events to host.

In contrast, China Mainland’s university chain associations have been relatively less active, and their voices have been somewhat subdued, leading to limited resource allocation. To address this disparity, I reached out to select a few students representing the chain associations of Mainland universities, including Peking University and Zhejiang University.

Daksh:

Despite the short duration of the festival lasting only five days, we successfully established connections with numerous institutions, yielding benefits for our financing endeavors. Overall, Hong Kong will likely establish a comprehensive licensing framework for Web3 compliance, thereby attracting an increasing number of companies to set up operations here. As a result, we can expect a surge in capital inflow.

“Leverage the Hong Kong’s main chain to propel the development of the entire Greater Bay Area side chains, fostering a collaborative environment for high-performance operations.”

Elaine:

This conference has highlighted the fact that Hong Kong, as a whole, still exhibits a sense of impetuosity, with a noticeable disparity in terms of innovation and mindset when compared to Silicon Valley. Consequently, I hope that we can swiftly shift our focus back to the building after the excitement subsides. The aim is to enable Hong Kong’s main chain to drive high-performance side chains throughout the entire Greater Bay Area.

To begin with, it is crucial for project teams to thoroughly comprehend the policies at hand. With their headquarters or registered companies in Hong Kong and having developers actively engage in building in Hangzhou, Shenzhen, and Beijing, we can lay a solid foundation for success.

Additionally, fostering a sense of camaraderie within the group is essential. Given the relatively small size of the Chinese coin circle, it becomes imperative to vocalize and showcase the advantages of our products. I particularly admire entrepreneurs who exert effort in expressing themselves effectively, as their ability to articulate ideas attracts community members who share the same values. By initially focusing on seed users within the Chinese community, the project can thrive and gradually expand to overseas communities.

The bull market is short, and the bear is long. Throughout the tumultuous year of 2021, characterized by extensive fluctuations, newcomers might find themselves perplexed in the face of such volatility. It is important to exercise patience, find one’s own position in the ecosystem, and refrain from making hasty bets.

Zi Xi:

This year, we have witnessed positive developments, allowing us to adopt a more assertive investment strategy. We aim to be less conservative and more open to investing in equity projects, including those in the crypto space. When it comes to Web3 entrepreneurship, if your project focuses on development or traffic generation, it may not be directly aligned with Hong Kong. However, the opportune moment has arrived for those engaged in Web3 financial infrastructure, as favorable conditions await.