Back

NTU MOOC Study Notes - Session 12 Stablecoins as the Foundation for On-Chain Financial Infrastructure

Study Notes

By HackQuest

Aug 27,20244 min readDate: 9-10:30 AM SGT, August 20th 2024 / 9-10:30 PM EST, August 19th 2024

Session Title: Stablecoins as the Foundation for On-Chain Financial Infrastructure

NTU I&E x HackQuest MOOC is free and open to all individuals interested in Web3. This session focuses on the role of stablecoins in establishing a solid foundation for on-chain financial infrastructure, led by Anna Yuan. For those who prefer having a text summary and review material, this study note provides a recap of what’s covered during the MOOC. Happy learning!

Overview

Main Topic: Exploring the importance of stablecoins in creating and supporting on-chain financial infrastructure.

Objectives:

1.Understand the different types of stablecoins and their roles.

2.Learn about the challenges and opportunities in the stablecoin ecosystem.

3.Explore how stablecoins are reshaping the financial landscape in Web3.

Section 1: Introduction to Stablecoins

1.1 What are Stablecoins?

Definition: Stablecoins are a type of cryptocurrency designed to maintain a stable value relative to a specific asset, such as a fiat currency like the US dollar. They are crucial in the DeFi ecosystem as they provide a stable medium of exchange and store of value.

●Key Points:

●Volatility Minimization: Stablecoins are essential for minimizing the volatility typically associated with cryptocurrencies. This stability makes them attractive for everyday transactions and financial contracts within the DeFi ecosystem.

●Facilitation of Financial Activities: Stablecoins facilitate trading, lending, and borrowing within DeFi, acting as a bridge between traditional finance and the digital asset space.

●Types of Backing: Stablecoins can be backed by various assets, including fiat currencies (e.g., USDC, USDT), cryptocurrencies (e.g., DAI), and even commodities like gold.

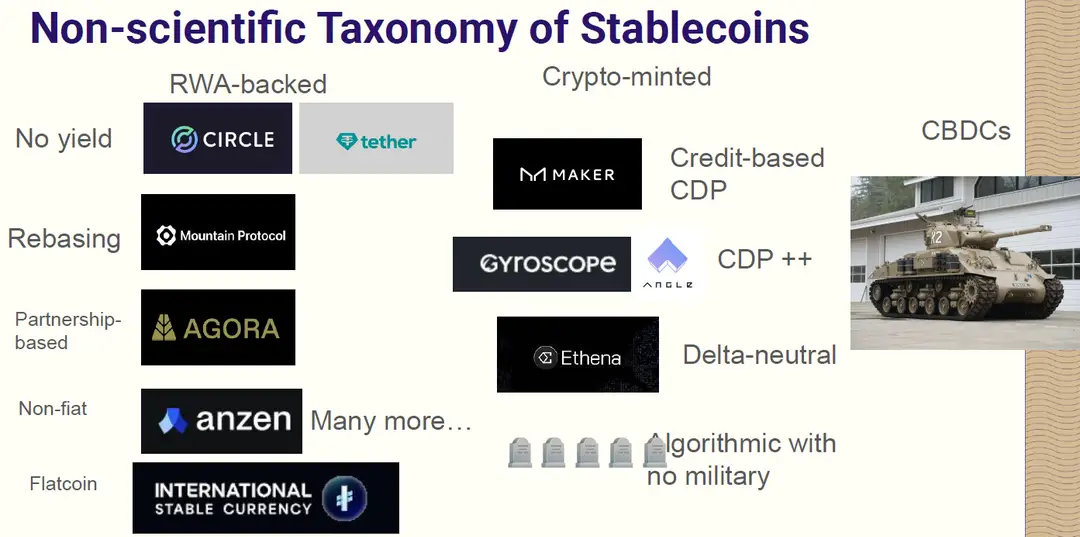

Section 2: Non-Scientific Taxonomy of Stablecoins

2.1 Types of Stablecoins

The stablecoin landscape is diverse, with various types designed to achieve price stability through different mechanisms. Below are some key categories:

●Fiat-Backed Stablecoins:

●Examples: USDC, USDT.

●Mechanism: These stablecoins are backed 1:1 by fiat currencies held in reserve. The value is directly tied to the underlying fiat currency, ensuring stability.

●Characteristics:

●Highly liquid and widely accepted in the crypto ecosystem.

●Subject to regulatory scrutiny and require trusted custodians to hold reserves.

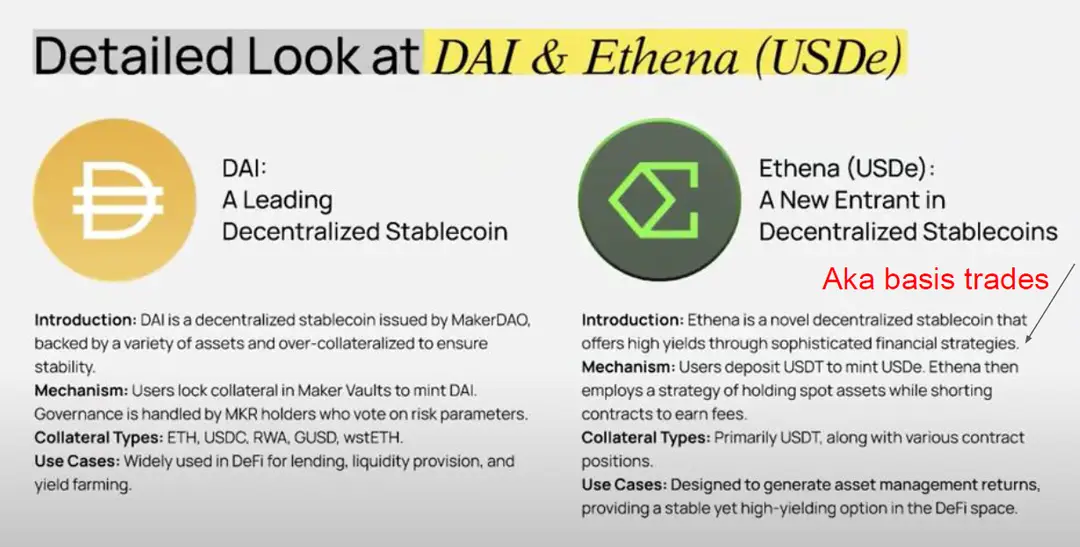

●Crypto-Minted Stablecoins:

●Examples: DAI.

●Mechanism: These stablecoins are backed by cryptocurrencies, often over-collateralized to maintain the peg.

●Characteristics:

●Operates in a decentralized manner without reliance on traditional financial systems.

●More volatile than fiat-backed stablecoins due to the volatility of the underlying crypto assets.

●Algorithmic Stablecoins:

●Examples: UST (before its collapse).

●Mechanism: Rely on algorithms to automatically adjust the supply of tokens to maintain their peg. For example, they might burn or mint tokens in response to price changes.

●Characteristics:

●No collateral is required, relying purely on supply-demand dynamics.

●Higher risk, as seen with the failure of some algorithmic stablecoins.

●Asset-Backed Stablecoins:

●Examples: Gold-backed stablecoins.

●Mechanism: Backed by tangible assets like gold or real estate, which provide intrinsic value.

●Characteristics:

●Offers a hedge against inflation and other economic risks.

●Less liquid compared to fiat-backed stablecoins due to the nature of the backing assets.

●Flatcoins:

●Examples: AMPL.

●Mechanism: Pegged to a measure of purchasing power, designed to remain stable in real terms, rather than to a specific currency.

●Characteristics:

●Aimed at providing stability in terms of real-world purchasing power, not just against a specific currency.

●Experimental and less proven in the market.

2.2 How to Find Out?

●Bluechip

💥

The k-line graphs on Bluechip can help evaluating stablecoins

●RWA.xyz

●stablewars.xyz

●brrr.money and thefed.app

Section 3: Challenges and Opportunities

3.1 Regulatory Landscape

●Beneficiary and Victim of Regulatory Arbitrage:

●Key Points:

●Stablecoins operate in a regulatory grey area, benefiting from the lack of strict oversight but also vulnerable to sudden regulatory changes.

●Unlike bank deposits, stablecoins are not protected by FDIC insurance, making them riskier in the event of a collapse.

●Regulatory bodies may impose freeze authority on certain stablecoins, adding another layer of risk.

●Examples:

●Circle (USDC): Faced challenges related to treasury management, highlighting the importance of robust financial oversight.

●Tether (USDT): Although it has collaborated with entities like FinCEN and the FBI, Tether has a controversial history, raising concerns about its transparency and stability.

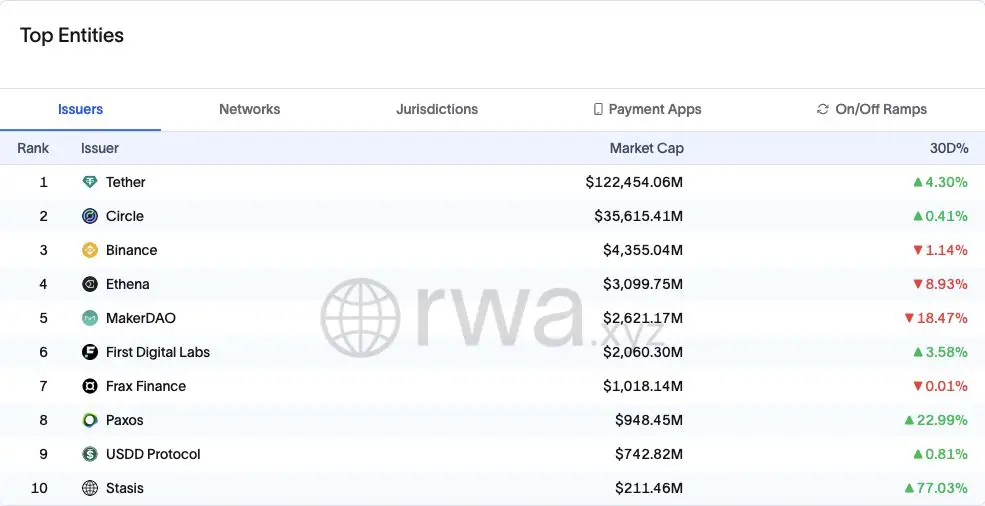

3.2 Market Structure and Liquidity

●Market Challenges:

●The current market structure for stablecoins is relatively primitive, with limited derivatives activity and a lack of robust credit and margining systems.

●Distribution and demand issues can lead to fragmented liquidity, making it difficult for new entrants to establish themselves.

●As the market grows, these challenges may become more pronounced, requiring innovative solutions to maintain stability and liquidity.

●Industry Trends:

●Long-Term Challenges: As the stablecoin market grows, long-term challenges such as liquidity fragmentation and competitive yield-sharing will need to be addressed.

●New Issuers: The entry of new stablecoin issuers adds diversification but also fragments liquidity, making it harder for any single stablecoin to dominate.

●Yield-Sharing Pressure: Incumbent stablecoin providers may be forced to offer more competitive rates to retain users, as new issuers attract attention with generous yield-sharing options.

3.3 Technological and Structural Innovations

●New Issuers and Infrastructure:

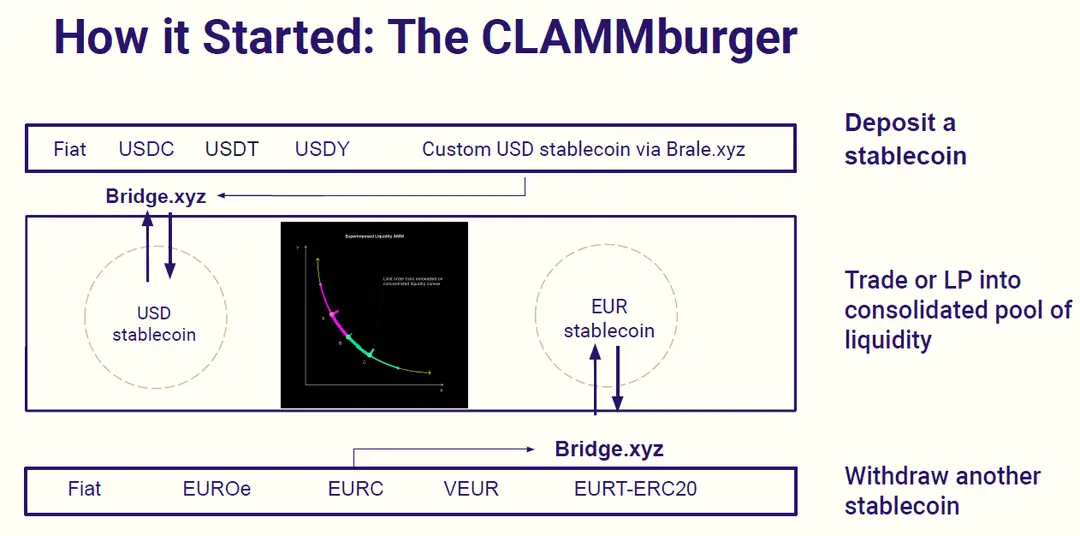

●Emerging Platforms: New platforms like Brale.xyz and Bridge.xyz are creating opportunities for yield through stablecoin issuance as a service, challenging traditional stablecoin issuers.

●Protocol Complexity: The proliferation of stablecoins adds complexity to DeFi protocols, which must now manage multiple types of stablecoins with varying levels of liquidity and stability.

●Reliable Stablecoins: There is a growing need for stablecoins that are not only reliable but also highly liquid, attracting more volume to DeFi protocols.

Section 4: Stablecoins and Financial Infrastructure

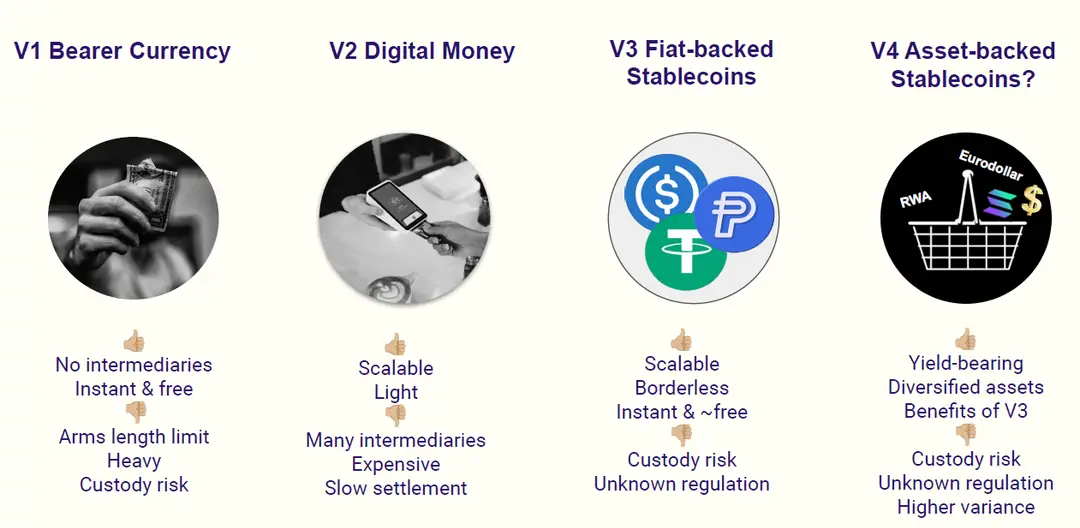

4.1 Evolution of Money and Stablecoins

●V1 Bearer Currency:

●Physical cash, representing the first version of currency, is cumbersome to scale and prone to theft and loss (custody risks).

●V2 Digital Money:

●The advent of digital currencies, which increased scalability and accessibility but still relied on intermediaries like banks and payment processors.

●V3 Fiat-Backed Stablecoins:

●Digital currencies pegged to fiat, offering borderless transactions with instant settlement, making them ideal for global commerce and DeFi applications.

●They offer the benefits of fiat currency, such as stability and familiarity, combined with the advantages of digital assets, like speed and lower transaction costs.

●V4 Asset-Backed Stablecoins:

●The potential future evolution where stablecoins are backed by a diversified basket of assets, reducing risk and providing a more stable store of value.

●These could include not only fiat currencies but also commodities like gold and other valuable assets, offering a hedge against inflation and economic downturns.

4.2 Stablecoin Use Cases

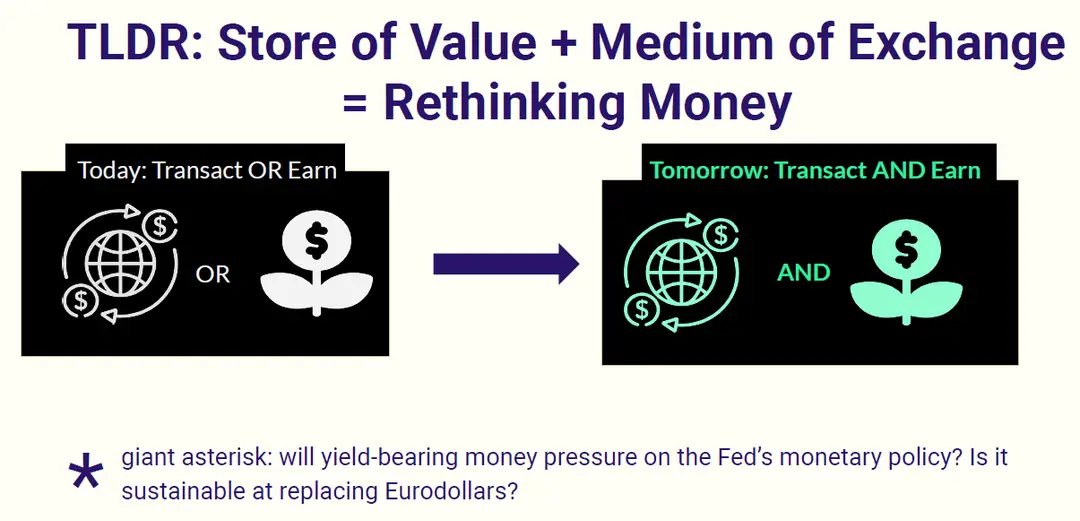

●Store of Value:

●Stablecoins are increasingly being used as a secure, stable medium for holding value in the crypto space. This is especially important in times of market volatility when other cryptocurrencies may fluctuate widely.

●Medium of Exchange:

●As a medium of exchange, stablecoins facilitate seamless transactions within the DeFi ecosystem, allowing users to trade, lend, and borrow without worrying about price volatility.

●They are also used for cross-border payments, remittances, and other financial activities that benefit from their stability and speed.

●Yield Generation:

●The advent of yield-bearing stablecoins allows users to earn returns on their holdings while still using them for transactions. This dual functionality is driving innovation in the DeFi space, as users seek to maximize their returns without sacrificing liquidity.

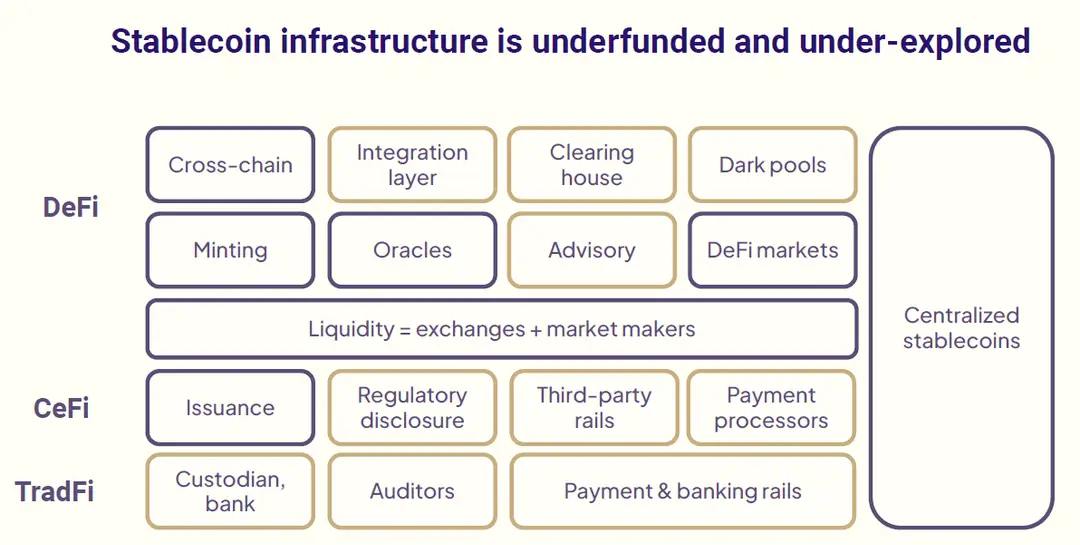

4.3 Integration into Financial Systems

●Issuance and Regulation:

●The issuance of stablecoins is increasingly coming under regulatory scrutiny, with authorities demanding greater transparency and oversight.

●Advisory services and regulatory disclosure are becoming essential for new stablecoin projects to ensure compliance with international laws and standards.

●Infrastructure Requirements:

●The stablecoin ecosystem requires a robust infrastructure that includes custodians, banks, auditors, and integration layers to support seamless operations.

●Decentralized infrastructure for money is also being developed, with a focus on building trust and consensus mechanisms that can replace traditional financial intermediaries.

Section 5: Trends in Stablecoins and Payments

5.1 Trends in Stablecoin Usage

●Increasing Use in DeFi:

●Stablecoins are rapidly becoming the preferred medium for on-chain transactions due to their stability, making them essential for liquidity in the DeFi ecosystem.

●Protocols rely on stablecoins to provide liquidity for trading, lending, and other financial activities, driving demand for reliable, liquid stablecoins.

●The adoption of stablecoins in traditional financial systems is also on the rise, with institutions exploring their use for cross-border payments and remittances.

●Yield-Bearing Stablecoins:

●Platforms offering yield on stablecoins are gaining traction as users seek to maximize returns on their holdings. This trend is leading to the development of new stablecoin models that offer both stability and yield.

●Example: Brale.xyz is one of the platforms offering yield-bearing stablecoins, challenging traditional stablecoin issuers by providing additional financial incentives.

●The growth of yield-bearing stablecoins raises questions about their sustainability and the potential impact on traditional financial systems.

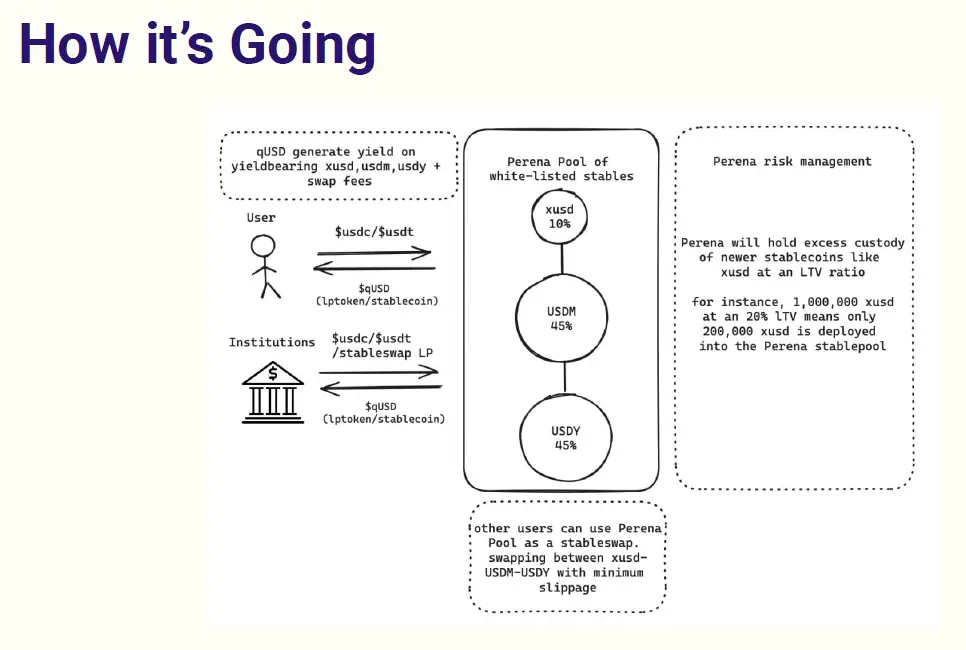

5.2 Perena - A Case Study in Stablecoin Innovation

●Background: Perena is a stablecoin project that has gained significant attention due to its innovative approach to maintaining stability and fostering financial inclusion. The project aims to provide a stable, reliable currency that can be used globally, especially in regions where access to traditional banking is limited.

●Key Features:

●Multi-Collateral Backing: Unlike many stablecoins that rely on a single type of collateral, Perena is backed by a diversified basket of assets, including fiat currencies, commodities, and even other cryptocurrencies.

●Decentralized Governance: Perena operates under a decentralized governance model, where holders of the Perena token can vote on important decisions regarding the project’s future.

●Global Accessibility: One of the main goals of Perena is to provide financial services to the unbanked and underbanked populations around the world.

●Perena’s Impact on the Stablecoin Market

●Market Adoption: Perena has seen significant adoption in various markets, particularly in regions where traditional financial services are either inaccessible or inefficient.

●Partnerships and Integrations: The project has partnered with several DeFi platforms, enabling users to trade, lend, and borrow using Perena across different blockchain networks.

●Regulatory Challenges: Despite its success, Perena faces regulatory challenges, particularly in regions with strict financial regulations. The project’s decentralized nature has both advantages and disadvantages in navigating these regulatory environments.

5.3 Future Outlook

●Potential Risks:

●The sustainability of yield-bearing stablecoins is a significant concern, especially as these models put pressure on traditional monetary policy.

●Regulatory developments will play a crucial role in determining the future of stablecoins, with potential risks arising from changes in the legal and regulatory landscape.

●Industry Shifts:

●The industry is shifting towards more sophisticated financial products, such as tokenized bank deposits and structured products, which are likely to play a key role in the next phase of stablecoin evolution.

●The growth of decentralized finance (DeFi) and centralized decentralized finance (CeDeFi) ecosystems is also driving innovation in stablecoin usage, with new platforms and protocols emerging to meet the needs of a rapidly evolving market.

Q&A Session

1.Q: How does it work founding a startup?

A: I work a lot, every day. I'm also becoming an advisor at the Solana Foundation, so a lot of that is part-time, supporting Solana. Most of my time is full-time work for Parana. It’s highly synergistic, so many calls I'm on are also about explaining to stablecoin issuers what Solana is, how to come to Solana, how to issue. I've been learning a lot for Parana because they give me requests, like "I want to come to Solana; how do I launch a stable swap?" This is what came out after two years of working at Solana Foundation, because all the issuers were asking, "I want to launch on Solana; how do I spin up a liquidity pool? I need AMM, I need this, I need that." So, I decided to come out and do this, so you guys can have a stablecoin launchpad. That’s how it goes.

2.Q: What’s Toli like?

A: Toli sometimes has interesting ideas. He once asked me about airplane tickets for a week, and I was like, okay. But sometimes, his ideas might not work. He has many great ideas, and that's why he's a founder. He has 20 ideas, and maybe 19 of them are kind of shit, but one of them is really good, and he keeps going after that one idea. Yeah, I've enjoyed working with him.

3.Q: Is Breakpoint free to attend?

A: No, unfortunately not, but side events are free. If you just show up in that general area, I'm sure you'll run into a lot of people who will point you in the direction of free food and free things. Side events that are free are on the Breakpoint website as well, so you can check those out. Token 2049 typically comes with a lot of side event lists that are free. If you don't have specific reasons to go to those conferences, you can go to the side events. Breakpoint is going to be online. The videos will be online. Personally, I don't really go to a lot of the talks. I listen to them on 2x speed after the talk happened, and then I just hang out at the side events. When I listen to the talk, I'm at the gym, so it's very efficient.