Back

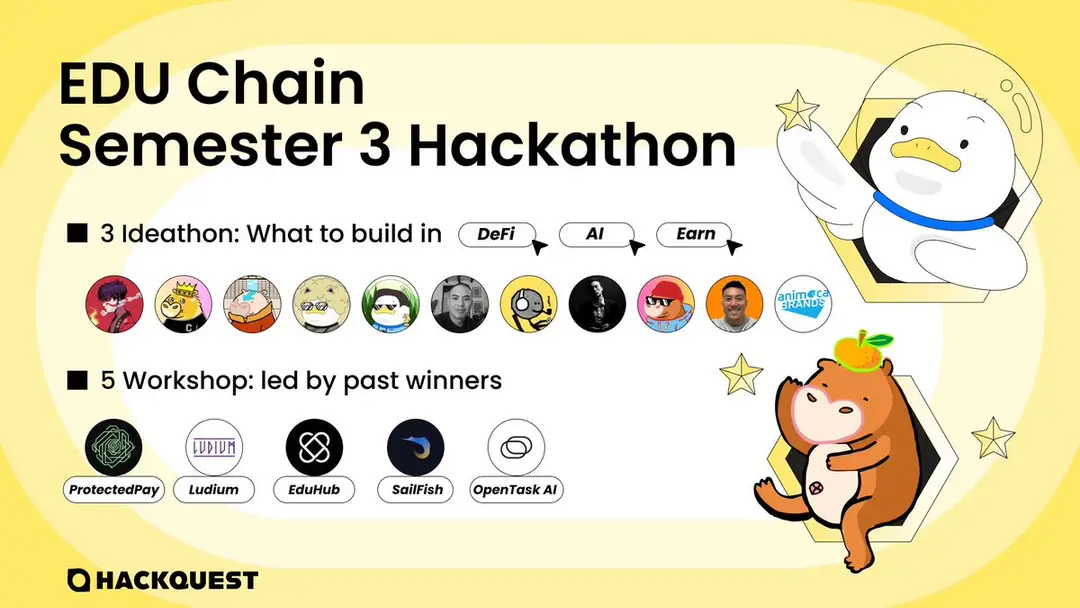

EDU Chain Semester 3 Hackathon Ideathon 1: What to build in DeFi now Recap

Events

By HackQuest

Mar 7,20254 min read

With the launch of the EDU Chain Semester 3 Hackathon, HackQuest hosted an insightful discussion featuring experts from Animoca, OpenCampus, Blend, and HackQuest, including Harry, Troy, Shan, Prince, and Kevin, to explore the current DeFi landscape and its future within the EDU Chain. The session covered the maturity of DeFi, the impact of AI integration for enhanced user experience, and new opportunities in sectors like PayFi and real-world assets.

Panelists discussed the benefits of leveraging existing protocols, such as Blend, and focusing on liquidity utilization within EDU Chain. They also highlighted the importance of a clear vision, security, and a user-centric approach. The AMA also addressed how AI agents can improve user experience in DeFi lending and enhance risk recognition.

Participants were encouraged to join the EDU Chain Semester 3 Hackathon and focus on building a functional, secure product with a clear vision for long-term success, and leveraging resources like the HackQuest Discord. The team emphasized the significance of finding the right founder-project match and capitalizing on the unique opportunities within the EDU Chain ecosystem.

Key Takeaway

●AI-Powered User Experience: AI is revolutionizing DeFi by abstracting away complexity, making protocols more accessible through natural language interfaces and personalized recommendations, effectively serving as a bridge between complex financial instruments and mainstream users.

●Yield Optimization Through AI Agents: AI-driven yield aggregators are emerging as powerful tools for optimizing returns, acting as personal CFOs by making dynamic, real-time decisions across protocols to maximize yield while managing risk according to user preferences.

●Capital Efficiency Opportunities: A major challenge in the EDU Chain ecosystem is liquidity utilization, with only 20% of deposited EDU being borrowed. AI solutions could help create demand-side drivers by identifying yield opportunities and facilitating cross-chain strategies.

●Building on Established Foundations: Successful DeFi builders leverage existing protocols rather than building from scratch, focusing on composability and integration with established liquidity pools to accelerate adoption and reduce security risks.

●Risk Management Applications: AI is increasingly being deployed for security and risk assessment, from flagging suspicious wallet activities to analyzing smart contract vulnerabilities and providing real-time portfolio risk analysis for traders.

Introduction

Harry: Good morning, good afternoon, and good evening to everyone joining from around the world!

We’re joined today by an incredible lineup of guests from Animoca, OpenCampus, Blend, and HackQuest. Before we dive into the ideathon, let’s do a quick round of introductions.

Troy (Founder, Blend): Hello everyone, great to be here. I’m Troy, founder of Blend, a lending protocol built on EDU Chain.

Shan (Animoca Brands & OpenCampus): Hey GM, everyone! I’m Shan, part of Animoca Brands and heading up the ecosystem at OpenCampus. Not many people know this, but I used to be a hedge fund trader before transitioning into Web3 through DeFi—which remains a huge focus for me.

Prince (Product Lead, OpenCampus): Hey guys, I’m Prince, part of the product team at OpenCampus. I lead several product initiatives and have worked across multiple DeFi applications, some that found product-market fit and some that didn’t. I’m excited to talk about how to build successful DeFi projects and avoid common pitfalls.

Kevin (Founder, HackQuest): GM, GM! I’m Kevin, founder of HackQuest. I’ve been in edtech for seven years and have hosted numerous hackathons alongside Harry and the HackQuest team, including in the DeFi space. Excited to share insights today!

Harry: As one of the co-founders of HackQuest, I’m excited to host today’s session and kick things off by discussing why DeFi is such a key focus.

With the EDU Chain hackathon acting as a launchpad for new projects, we wanted to highlight some of the past winning projects and provide insights into how you can build your own successful DeFi application.

This workshop and ideathon is designed to help you get started, refine your ideas, and build towards a winning project. We hope many of you will join the EDU Chain hackathon, take advantage of the resources shared today, and bring your ideas to life!

Our guest speakers have prepared extensively, so I’m excited to dive in. Let’s start with our first DeFi-related question!

The Current DeFi Landscape & Key Trends

Harry: How would you describe the current DeFi landscape, and what are some of the key trends shaping it today? Maybe we start with Shan and Prince on this one.

Shan: Sure. I think it’s quite clear that the DeFi ecosystem has matured significantly compared to what we saw during DeFi Summer.

One of the biggest shifts is the proliferation of multiple blockchain ecosystems. We’re now seeing DeFi primitives being replicated across different chains, which shows how much the industry has evolved.

Currently, I’m particularly excited about:

🔹 New types of derivative products being introduced.

🔹 Innovative ways to generate and utilize yield across different ecosystems.

🔹 AI’s growing role in DeFi, which is making the space more accessible to users by abstracting away complexity.

Consumer adoption is increasing, and new solutions are emerging to simplify the user experience. There’s a lot to explore, and I’d love to dive deeper into some of these areas later in the conversation.

Harry: Awesome, awesome. Prince, what’s your take on the current landscape?

Prince: I agree with Shan that there’s now a set of established standards across DeFi verticals like lending (Borrow/Lend), DEXs, and derivatives. However, that doesn’t mean there’s no room for innovation—far from it.

One challenge we still face is true cross-chain interoperability. While DeFi often highlights composability, the reality is that most chains still operate in silos.

I think incorporating education-driven initiatives into DeFi products on EDU Chain gives builders a unique edge in the ecosystem.

AI & Innovations in DeFi: Trends & Future Impact

What are some of the biggest innovations or breakthroughs in DeFi and AI over the past year? How are they shaping decision-making for new projects? Let’s start with Troy.

Troy: Definitely! On top of existing DeFi infrastructure—such as lending protocols, DEXs, aggregators, and staking solutions—we’re now seeing AI integration unlock new possibilities.

Take traditional lending platforms like Aave or Blend—they can be quite complex for newcomers. Users need to understand technical financial concepts like LTV (Loan-to-Value), APY (Annual Percentage Yield), borrowing, staking, and collateralized assets—which can be overwhelming.

Now, imagine an AI agent built on top of a lending protocol like EDU Chain. The AI could analyze current lending rates and conditions, provide personalized recommendations, allow users to execute transactions seamlessly by just approving with a simple click. This removes friction from the onboarding process, making DeFi much more accessible to a wider audience.

Another interesting use case I’ve seen—particularly on Solana—is an AI-powered yield aggregator. Traditionally, vaults rely on predefined strategies to determine the best yield optimization for users. However, with AI, we now see:

🚩

- More dynamic, real-time decision-making.

- Higher transaction frequency for better returns.

- AI acting as a personal CFO, managing assets across protocols to maximize yield.

These innovations are reshaping DeFi, making it more intelligent, user-friendly, and efficient.

Harry: Thanks, Troy! Shan and Prince, any thoughts?

Prince: Yeah, I definitely echo Troy’s points on AI’s role in yield optimization. The general assumption is that AI in DeFi is primarily about optimizing returns, which is true.

However, one of the open questions is how AI-driven yield optimization will impact DeFi margins—since efficiency could compress profit opportunities.

Another important point is AI’s role in user acquisition. In DeFi, getting attention and onboarding users is crucial, and AI-powered personalization and automation will be key in shaping that.

Shan: Building on what you both said, I think interoperability, yield aggregation, and cross-chain strategies are also exciting areas of innovation.

As more blockchain ecosystems emerge, we’re going to see:

🔥

- Increased cross-chain DeFi integrations.

- More opportunities for yield optimization across multiple chains.

- AI-powered automation making cross-chain DeFi more seamless.

Also, I don’t know if you saw, but recently Su Zhu of 3AC announced a new platform called OX.Fun, which allows users to unlock liquidity from meme coins. This concept—unlocking liquidity from unconventional assets—is another key trend.

These cross-chain liquidity models are becoming more relevant, and I expect more innovations in this space moving forward.

Expanding DeFi Sectors & Capital Efficiency

Harry: That makes a lot of sense. I want to dive deeper into specific sectors within DeFi. We often talk about lending and staking, but recently, we’ve also seen the rise of RWAs (Real-World Assets) and other emerging opportunities in the space.

Many assets now have liquid markets on centralized exchanges (CEXs), perpetual swaps, and funding rates, creating new yield opportunities. But how do we build DeFi infrastructure for tokens that aren’t Bitcoin or traditional T-bills—assets that have been overlooked yet hold significant capital efficiency potential?

Shan: I think my earlier points covered some of this, but fundamentally, the demand for liquidity and yield is driving much of DeFi’s growth.

A few key sectors to watch:

✔ PayFi (Payment Finance): We’re seeing major institutions and centralized exchanges investing in this space. More payment solutions are emerging, bridging Web3 with traditional finance (TradFi).

✔ On/Off-Ramps for Stablecoins: Seamless conversions between fiat and crypto remain a key challenge and opportunity for growth.

✔ TradFi Integration: How do we onboard students, creators, and educators into DeFi? Linking TradFi rails with Web3 infrastructure is a major focus. For example, exploring use cases around student loans, on-chain student cards, and decentralized funding models within EDU Chain.

Harry: That’s a great perspective, Shan. Prince, do you want to add to that?

Prince: I think a major theme over the last 12 months has been the introduction of new asset classes and how they’re increasing capital efficiency in DeFi.

We’re seeing two ends of the spectrum:

🔹 RWAs (Real-World Assets): These involve bringing traditional finance assets on-chain to unlock liquidity in DeFi. Examples include tokenized T-bills and platforms like Athena, which provide yield-bearing stablecoins backed by real-world assets.

🔹 Meme Coins & High-Volatility Assets: On the opposite end, we’ve seen meme coins being integrated into DeFi, with borrow-lend markets, LSDs (liquid staking derivatives), and perpetual swaps emerging around them.

But beyond these extremes, we’re overlooking a key middle segment—what I’d call mid-curve assets. These assets aren’t as low-risk as T-bills, but they also aren’t as speculative as meme coins. For example, assets like EDU (EDU Chain’s native token) fall into this category. They present yield opportunities, yet the challenge remains—how do we expand capital efficiency for these assets? That’s the next big opportunity in DeFi.

DeFi Ideas for the EDU Chain Hackathon

Harry: That makes a lot of sense. Now, I want to shift the focus to something that our hackers and builders will find especially valuable: What would you build if you were participating in the Semester 3 Hackathon?

Kevin: One area that excites me is PayFi (Payment Finance). The idea of combining financial education, DeFi, and PayFi into a single application that also incorporates SocialFi elements could be really powerful.

A great example from Web2 is Zogo, which is essentially a Duolingo for financial education. Users learn about finance, investing, and banking while earning points that can be redeemed for gift cards—sponsored by banks.

If we could bring this model to Web3, merging:

✨

PayFi (on-chain payments & financial services)

DeFi (yield generation & lending protocols)

Gamified Learning (SocialFi incentives for engagement)

As Troy mentioned, many DeFi protocols are complex and difficult to navigate, especially for newcomers. An AI-powered assistant could:

●Automate key processes to simplify interactions.

●Make DeFi more intent-based (reducing complexity for users).

●Incorporate a learning component to educate users before they interact with the protocols.

I think this would be a great opportunity for builders in the hackathon.

Harry: Makes sense! Prince, do you want to add anything?

Prince: I think one of the biggest misconceptions people have when coming up with DeFi ideas is that they think they need to build something entirely from scratch.

In reality, the best DeFi builders leverage existing protocols and add value on top of them. That’s the core ethos of Web3 composability—where assets and capital from one protocol can be reused and extended across the ecosystem.

For example, if I were building on EDU Chain, I’d recognize that: EDU is a highly liquid asset with an active spot market & It has yield potential, but no one has created an LST (Liquid Staking Token) equivalent for it yet—like Lido did for ETH.

So, if I were a DeFi founder, I’d ask myself: How can I tokenize EDU’s yield and create a yield-bearing product? How can I integrate it with other protocols to drive adoption?

Leveraging existing liquidity and infrastructure—makes it far easier to build something impactful in DeFi.

Building DeFi on EDU Chain: Leveraging Existing Models & Driving Liquidity

Harry: Troy, let me throw this over to you—maybe you can validate or challenge what Prince just said.

Troy: Just to echo what Prince mentioned—my first piece of advice for builders entering DeFi, especially on emerging chains, is to study the patterns of more mature ecosystems. Look at how projects have evolved on chains like Ethereum, Solana, and Sui.

Beyond that, innovation happens on top of existing infrastructure. Take Blend, for example—we started as an Aave fork, but we’ve since expanded into BTCFi and are now integrating on-chain credit models for student loans.

For new builders, it’s often difficult to create something purely novel from scratch. Instead, start by building composable products that integrate with existing DeFi protocols—this is the fastest way to gain traction, ecosystem support, and long-term adoption.

Harry: That makes a lot of sense. What’s the biggest challenge you see right now?

Troy: One major challenge we’re facing—and I think EDU Chain is facing as well—is liquidity utilization.

Right now, Blend’s TVL (Total Value Locked) is growing rapidly. At times, our FDV (Fully Diluted Valuation) on MEXC has spiked to $200M, and we’re seeing lending and borrowing TVL approach $600K within just a few weeks.

⛔

But the problem isn’t on the supply side—it’s on the demand side.

People are depositing a lot of EDU, but only 20% of that liquidity is actually being borrowed. The borrowing rate is only 2%, meaning there’s no strong incentive to take out loans.

Now, if someone builds a yield-bearing EDU product, it would create a natural demand driver for borrowing EDU.

This is the missing piece that could significantly increase capital efficiency on EDU Chain. If we can unlock that flywheel, EDU liquidity will flow more seamlessly across the ecosystem.

Shan: Just to build on that—if someone is already working on an EDU yield product, or if you don’t see that as your focus, there’s also an opportunity to introduce stablecoin yield into the ecosystem.

This could open up entirely new capital flows while increasing liquidity utilization within EDU Chain.

Also, as Troy pointed out, the real challenge isn’t just bringing liquidity in—it’s making it productive.

Right now, liquidity is coming into EDU Chain, but the question is: How do we best utilize it? What mechanisms can drive borrowing demand? How do we incentivize builders to create innovative DeFi strategies?

One potential answer lies in user points and incentive mechanisms. In EDU Chain, user points lead to node emissions, which means:

●If you create DeFi strategies that encourage borrowing, you can leverage incentive models to bootstrap user activity.

●There are opportunities for collaborations—for example, a project could integrate with Blend to drive EDU borrowing demand while offering additional incentives for participation.

Before we wrap up this section, I’ll just add—the reason why DeFi liquidity is so critical on EDU Chain is that it enables everything else to thrive.

We’re still in the early stages, but it’s exciting to see the foundation of a strong DeFi ecosystem taking shape on EDU Chain.

Harry: That’s a great discussion. How can DeFi projects truly leverage EDU Chain to differentiate themselves? We’ve seen projects like Blend, EdBank, and Selfish establish their presence, but what makes them unique compared to existing solutions on other chains? What are some advantages builders can tap into, and what would you recommend?

Prince: I think it comes down to two key factors:

1️⃣ A Clear Vision & Purpose – You need to define why you’re building and what makes your project essential in the EDU Chain ecosystem.

2️⃣ User Acquisition & Go-To-Market Strategy – Even the best product won’t succeed if no one knows about it. How do you get users? Are you tapping into existing TVL and user bases like Blend? Are you forming partnerships to bootstrap adoption?

Ultimately, differentiation comes from either: a strong vision that resonates with users OR a feature that doesn’t exist elsewhere

But beyond that, you need distribution. Even if you build something groundbreaking, it won’t matter if you can’t acquire and retain users.

Harry: I want to highlight one massive opportunity—student loans.

We’ve discussed this a few times, but the biggest opportunities lie where a project and an ecosystem align.

When choosing what to build, founders should ask:

👉

What unique opportunities exist in this ecosystem?

What personal experience gives me an unfair advantage in this space?

For example, my background is in education and technology, which makes EDU Chain the perfect ecosystem for me to build in. The education industry is a $7 trillion market, and $2 trillion of student loans remain untapped by Web3—especially in structured markets like the U.S.

Why not bring student loan financing to Web3? The U.S. market is highly structured and remains competitive in Web2, yet Web3 solutions are almost nonexistent. A project in this space could bridge traditional financing models into decentralized funding, creating huge value for students and institutions. For builders with deep DeFi experience, there are plenty of other opportunities, such as:

- Stablecoins – The trend isn’t slowing down, and we need multiple stablecoin solutions to flourish.

- Payments – Cross-border transactions, remittances, and on/off-ramps are still underdeveloped on EDU Chain.

Since EDU Chain is relatively new, there’s still so much room for ecosystem projects to emerge. Healthy competition drives innovation, and we want to see more builders experimenting across different DeFi verticals.

The key takeaway: Finding the right founder-project match is just as important as identifying gaps in the ecosystem. The best projects come from builders who understand both their strengths and the opportunities within their chosen ecosystem.

From Idea to MVP: The Zero-to-One Roadmap for DeFi Builders

Harry: Let’s shift focus to the zero-to-one roadmap. Many builders start with just an idea—maybe they want to create the next Blend. How do they go from idea to MVP? What are the first steps to turning that concept into a working product, especially in DeFi?

Troy: For new builders, the first step is to study existing successful projects. Why?

1️⃣ Most Web3 projects are open-source, meaning you can analyze their smart contract code.

2️⃣ By understanding the technical architecture of established protocols (e.g., Aave for lending platforms), you can see how core functions like lending, borrowing, and collateralization work at a contract level.

3️⃣ You also need to grasp the front-end user flow—how users interact with these protocols and what makes the onboarding process intuitive.

Once you understand both the contract layer and the UI/UX layer, you can:

💥

Fork an existing protocol as a base, making strategic modifications.

Hire a UI/UX designer and front-end developer to refine the user experience.

Leverage tools like Chakra UI to build a minimal but functional interface.

The key here is starting small—launch a basic, working product rather than reinventing the wheel from scratch.

Prince: I think Troy makes a great point—DeFi doesn’t require every project to be 100% novel.

For example, Blend leveraged a well-known lending model—this reduced barriers for adoption and made it easier for users to trust the protocol.

So instead of trying to create something entirely unique from day one:

●Start with a battle-tested DeFi primitive.

●Focus on customizing key areas that make it unique.

●Make incremental improvements instead of overcomplicating the build.

Shan: Yeah, just to build on that—security and trust are everything in DeFi.

●Reusing well-audited smart contract code lowers the risk of exploits.

●The more customization you introduce, the harder it becomes to audit—and that creates trust issues.

●Forking established protocols speeds up development, simplifies audits, and reduces costs.

So if you have a novel idea, maybe don’t start by coding something completely from scratch.

Instead, consider a “stair-step” approach:

1️⃣ Start by forking an existing protocol to establish early traction.

2️⃣ Secure liquidity, users, and community support.

3️⃣ Once you’ve built momentum, expand into more complex, custom features.

If you can tap into Blend’s existing TVL, for example, you automatically gain access to their lenders.

Troy: Shan makes a great point. A smart strategy for new builders is to:

✔ Leverage existing protocols—so you gain instant exposure to an active user base.

✔ Integrate with other projects on EDU Chain—rather than trying to build everything in isolation.

✔ Utilize ecosystem-wide incentives—so you’re not starting from zero.

By doing this, you not only tap into existing liquidity but also increase the overall utility of EDU Chain, making your project more valuable.

Tips for Winning the EDU Chain Semester 3 Hackathon

Harry: Let’s focus on practical tips for hackathon participants—both on how to win and how to turn a hackathon project into a long-term success with real adoption and liquidity. Troy, what advice would you give to builders competing in Semester 3?

Troy: I’d break it down into a few key principles:

Prioritize What Matters Most

Your job as a founder is to identify and focus on the most critical problem. Example: For Blend, we didn’t focus on perfect UI/UX in the early stages—instead, we put 100% effort into smart contract security because in DeFi, trust and security matter more than anything else.

Build a Functional, Secure Core First

Don’t get caught up in non-essential details. Your main goal is to deliver a working, safe, and useful product. Users will still engage with your product even if the UI isn’t polished, as long as the core functionality is solid.

Show a Bigger Vision Beyond the Hackathon

A hackathon project can be more than just a prototype—think about how your idea can scale beyond the competition.

If you demonstrate dedication and purpose, people—including mentors, investors, and ecosystem partners—will take notice and support your project.

Don’t Overcomplicate — Focus on Your Core Users

It’s easy to get distracted by extra features, but the most important thing is making sure your product solves a real need in the simplest way possible.

Security and Trust Matter More Than Fancy Features

In DeFi, if your product isn’t secure, people won’t use it. It’s actually a good thing to reuse well-audited smart contract code rather than trying to write everything from scratch.

A Clear Vision Attracts Users and Investors

Troy’s success wasn’t just because Blend was a good product—it was because he had a long-term vision that aligned with EDU Chain’s goals.

Investors and mentors don’t just look at what you’ve built today—they want to see if you have a bigger plan and if your project can contribute to the ecosystem in a meaningful way.

The Intersection of AI Agents and DeFi: Opportunities & Challenges

Harry: A question from the community, particularly from Indonesia, touches on AI agents in DeFi. As AI-driven solutions become more common in the space, what are your thoughts on how this trend is evolving?

Shan: We're definitely seeing a rapid expansion of AI agents in DeFi, but it's still early. Right now, we're witnessing a surge of experimentation before the industry settles on what actually works at scale.

One of the most promising aspects of AI in DeFi is its ability to abstract away complexity for users. AI has the potential to: simplify onboarding by guiding users through DeFi processes, enhance accessibility by making complex financial strategies easier to use, personalize user experience by tailoring financial decisions to individual risk profiles.

However, the biggest challenge is trust. If AI is handling financial decisions, how do we ensure security, reliability, and transparency?

●Some argue that DeFi users will naturally become more comfortable trusting AI.

●Others believe there must be additional layers of security and validation to ensure users feel safe handing over financial control.

At this stage, we don’t have a clear answer, but how you approach this question will shape your product decisions in DeFi.

Prince: I agree. There are two main categories of AI-driven DeFi solutions emerging:

1️⃣ Consumer-facing AI agents that simplify DeFi interactions.

2️⃣ Yield optimization AI agents that automate investment strategies.

In yield optimization, many AI agents are essentially doing the same thing—scanning DeFi protocols for the best yields. But the real question is: What is the long-term sustainable business model for these AI-driven DeFi products? Will AI agents become more personalized to individual users? Can they understand personal risk tolerance and execute strategies accordingly?

I think we’re still in the experimental phase, but it’s an exciting space to watch.

Harry: Great insights. Let’s take a related question from Prabal, asking: How can AI agents improve the user experience in DeFi lending platforms?

Troy: That’s a great question! I recently saw an AI-driven DeFi lending platform that completely transformed the user experience by replacing buttons and forms with natural language commands.

Example: Instead of manually interacting with Blend, users could speak or type:

●I want to borrow USDT from Blend. What do I need to do?"

●The AI agent analyzes the request and responds with personalized instructions: To borrow USDT, you need to deposit EDU as collateral. Your current wallet balance is X EDU. Would you like to proceed

Why This Matters for DeFi Adoption

🔹 Lower Barriers for New Users

🔹 Better Mobile & Cross-Platform Integration

🔹 Mass Adoption of DeFi Lending

DeFi’s biggest advantage is that it’s global, fast, and permissionless. If AI can remove user friction, liquidity will flow into DeFi rapidly.

Harry: That’s a great perspective. If DeFi AI agents can simplify UX and eliminate barriers, we could see a massive wave of new users entering the space.

Final thoughts?

✅ AI can’t replace security, but it can improve accessibility.

✅ DeFi projects that leverage AI for onboarding & automation will have a competitive edge.

✅ The key challenge remains: How do we establish trust while improving UX?

Exciting times ahead—let’s keep building!

AI-Driven Risk Recognition in DeFi: Enhancing Security & Trader Confidence

Harry: To wrap up today’s session, Padi raised an interesting idea about the intersection of AI and DeFi, specifically in risk recognition for trading and investments.

We often see wallet warnings like:

●“This wallet is likely compromised based on past transactions.”

●“This address has no prior transactions and may be linked to a scam.”

●“This wallet has been flagged due to previous interactions on other chains.”

Is anyone actively working on AI-powered risk recognition for DeFi security?

Shan: Great topic. We’re already seeing basic implementations of risk detection in tools like Rabby Wallet, which provides solid user protection.

The next frontier is taking AI beyond simple flags and creating deeper risk analysis that assesses:

●Hidden risk factors in DeFi portfolios

●Smart contract vulnerabilities in real-time

●Potential liquidation risks for traders

An AI-powered portfolio assistant that scans all of your holdings, trades, and positions, proactively identifying hidden risks before they materialize, could be a major development. This kind of tool could be built into a wallet, portfolio tracker, or standalone DeFi security product.

Prince: I’ve tested a few AI-driven security tools, like Potti Network's Wallet Guard, but they’re still quite limited in scope.

Some interesting use cases I’ve seen include: AI contract analysis for meme coins, scanning for rug-pull patterns and deployer history checks, flagging if the deployer has rugged before

The real question is:

●What problem is being solved?

●What information do users need?

●Who will pay for it—users, traders, or platforms?

DeFi risk assessment has huge demand, but finding a sustainable model for AI-driven security tools is key.

Troy: That’s a great point. I recently saw an AI-powered DeFi tool that transforms complex lending protocols into natural language.

For example, instead of manually interacting with Blend, users could just type: "I want to borrow USDT from Blend. What do I need to do?"

The AI agent then guides them step by step:

●“Deposit EDU as collateral.”

●“Based on market rates, your optimal borrowing amount is X.”

●“Would you like to proceed?”

This kind of AI-driven UX simplification could remove major barriers for DeFi users and increase adoption.

Risk recognition is another area of opportunity. AI could analyze smart contracts on-chain and flag suspicious patterns before a user interacts with a risky contract.

AI has the potential to improve both security and usability, making DeFi more accessible.

Harry: AI-driven risk recognition could be a major differentiator in DeFi, both for security and user experience.

Let’s close with Kevin—any final thoughts before we wrap?

Kevin: I completely agree—AI risk recognition and DeFi security present a huge opportunity.

For those interested in building, here’s my advice:

●Join the HackQuest Discord—many builders are discussing AI and DeFi projects.

●Leverage existing liquidity—DeFi adoption grows when builders tap into current ecosystems (like Blend or AdBank).

●Focus on real-world problems—Security and risk management are major pain points in DeFi.

If you want to get involved:

●EduChain Discord is the best place to ask questions, find mentors, and collaborate.

●Telegram and Twitter DMs are open for direct outreach.

●Submit your project on HackQuest’s portal—there’s a lot of interest in AI and DeFi.

With over 2,000 builders already hacking and more than 300 projects submitted, this is the perfect time to start building.

If you missed the live session, the full discussion will be available as a blog post and article.

Stay connected via Discord, Telegram, and Twitter for updates and next steps.

Thanks, everyone, for an insightful discussion—looking forward to seeing new projects emerge.

Stay tuned for more online events 👇