Back

Moonshot Original #2 | Hash Global: Web3’s Value Investing Practice

Others

By Moonshot Commons

Jul 11,202311 min read

Hash Global is an Asian-based investment institution focused on digital assets and blockchain ecosystems. Founded in 2018, the company is dedicated to investing in Chinese entrepreneurs working on early-stage blockchain projects combining Web2 and Web3 technologies around the globe.

Hash Global is also an early supporter of Moonshot Commons and has invested in numerous other top projects, including but not limited to RSS3, EthSign, Mask Network, SeeDao, imToken, Infinity Stone, Debank, Matrixport, Hashquark, and Meson Network.

In Moonshot Original #2, KK, Founder of Hash Global, shares insights and valuable experience on the Web3 value investing paradigm shifts during the 2023 Hong Kong Web3 Festival.

Since the beginning of 2023, there has been a growing interest in the world of cryptocurrency in Hong Kong, a land of diverse development. In April, HashKey Group and Wanxiang Blockchain Labs hosted the grand opening of the Web3 Festival in Hong Kong. The event covered a wide range of topics related to the Web3 industry and attracted over 300 influential and up-and-coming speakers, as well as over 100 exhibitors from popular Web3 projects, communities, and media outlets. The Web3 Festival also featured representatives from major investment institutions and regulatory agencies who participated in in-depth analyses of regulatory policies and helped to delineate the boundaries of development in the industry.

Key Takeaways:

1.The value and valuation methods concept is constantly evolving and is not static.

2.New technological paradigms create value, and new business models or innovative concepts supported by these new technologies require a new value assessment system, or else one risks significant losses.

3.Hash Global has summed up three investment principles:

●Principle 1: The value of new things won’t be recognized by mainstream valuation judgments and may even be denied.

●Principle 2: The formation of a valuation model for new things requires mutual promotion and co-evolution with the new things themselves.

●Principle 3: Forming a market consensus on the valuation of new technologies takes time, and during this process, there are significant opportunities for investors.

4.Investors should work hard to discover new valuation logic for new assets that don’t have corresponding valuation models.

“For a new business model supported by a new technology paradigm, a new valuation system is needed.”

KK:

Hello everyone. I would like to share Hash Global’s experience in value investing in the Web3 space over the past six years.

Prior to entering the crypto asset management industry, I worked in various financial institutions, including commercial banks, investment banks, and bond and stock asset management companies. Many people talk about value investing during my career, but the definition of value they discuss can vary greatly.

Let’s take a look at the history of value investing. The concept of using a company as a vehicle for capital formation dates back to 1602. However, value investing methods such as P/E and P/S, which are now considered the bible, have only existed for less than 100 years. It wasn’t until 1965 that Warren Buffett began to practice value investing and cigar butt investing. In 1973, the option valuation method was introduced, and in 1982, Bill Gross began to use valuation methods such as Macaulay duration in bond investment. Prior to Gross, bond investments were typically held until maturity. For those familiar with Texas Hold’em, it wasn’t until 2002 when Doyle Brunson introduced the poker value system, including concepts such as positive EV and negative EV, in his book Super System. However, putting these theories into practice is easier said than done, and Brunson was known for favoring the 10–2, a weak starting hand. I would like to say that the concept of value and its valuation methods are constantly evolving and are not static.

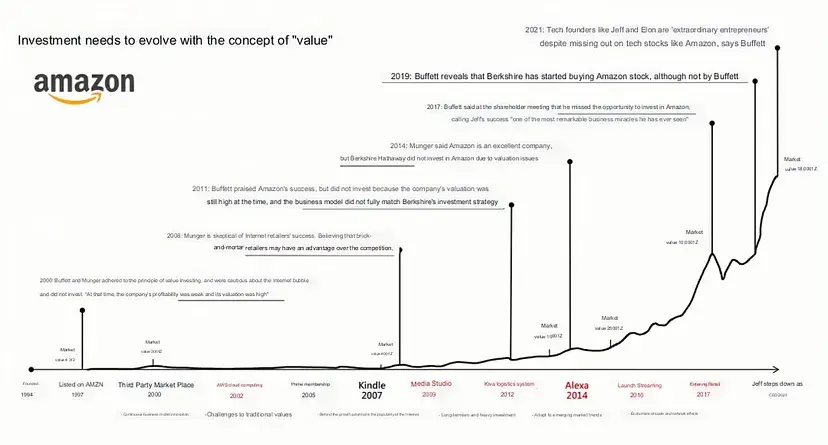

Let’s examine a case where value investing fell short. While I have great admiration for Buffett and Munger, I am also fond of Munger’s Poor Charlie’s Almanac; they had the same confusion about “what is value”.

Amazon went public in 1997 with a market value of $430 million. At that time, Buffett stated that Amazon’s profitability was weak and its valuation was high. In 2008, he claimed that physical retailers had an edge in competition and dismissed Amazon. In 2011, he still insisted that Amazon’s valuation was high. In 17 years, Amazon’s market value reached $1 trillion, and following a 2,500-fold increase in the secondary market. Buffett finally grasped Amazon’s value and began investing in 2019. Amazon is not a unicorn that makes a fortune in silence. It went public in 1997. Jeff Bezos writes a letter to shareholders every year. If you read them carefully, it’s easy to see that this company has been constantly creating value for 30 years and remains true to its “day one mentality”. However, Amazon doesn’t use the traditional PE/PS method that Wall Street is accustomed to, nor does it adhere to Buffett’s value logic. Instead, Amazon uses new internet technologies. New technological paradigms create value. New business models or innovative concepts supported by these new technologies require a new value assessment system, or else one risks significant losses.

We have many lessons learned in the investment field for many years and have summed up three principles to share with everyone:

Principle 1: The value of new things won’t be recognized by mainstream valuation judgments and may even be denied.

I have a friend who manages a bond fund. We discussed the potential value of Bitcoin a few times, but now he has stopped talking to me. I also spoke with a well-known person who was very successful in private equity on a plane. He said that he loves learning and is open to new ideas and asked me to talk about Bitcoin. After a two-hour conversation about Bitcoin during the flight from Shanghai to Chongqing, I still felt it wasn’t fully explained. When I asked my former boss Feng Xiao about this, he explained that value investors who focus on stocks tend to stick to their investment framework, making it difficult for them to understand the value of Bitcoin.

Principle 2: The formation of a value assessment framework for new things requires mutual reinforcement and co-evolution with the new things themselves.

In recent years, investors have been proposing new valuation methods and logical frameworks to understand Bitcoin, Ethereum, and Web3. In the meantime, the entrepreneurial teams of Web3 have been striving to generate and actualize value in a manner that investors can grasp. As a result of this process, the market will slowly develop a consensus.

Principle 3: Forming a market consensus on the valuation model of new technologies takes time. During this process, there are significant opportunities for investors.

The market consensus of the valuation method is determined by the mainstream funds in the market. The P/E and P/S valuation methods have been used for decades. In fact, this consensus is still being refined and optimized. Valuation methods such as bond duration have taken a decade or so. While Web3 is still in its early days, this formative process presents a significant opportunity for investors.

Our journey into the world of crypto assets began in 2016 when we started reading reports and various papers. It was in 2017 that we came across John Pfeffer’s An (Institutional) Investor’s Take on Crypto Assets, which left a strong impression on me. The article was relatively long, but I read it five or six times and still couldn’t put it down. I will read a few sentences:

“Although the originator of value investing denounced Bitcoin as ‘rat poison’ ”, the first principle of value investing is independent thinking based on reliable valuation logic. When new assets first appeared, there was no corresponding valuation logic; value investing Investors should work hard to discover new valuation logic.

Distributed ledger technology (blockchain) has permanently changed the foundation of capital markets. Systems that are carried over the internet are the lowest-cost at a global scale. Therefore, in the not-too-distant future, the vast majority of investable assets will be carried on distributed ledger technology. In crypto asset investing, the “crypto” will eventually be dropped.

It’s just like e-commerce companies no longer need to say the word “Internet explicitly”.

“Work hard to discover new valuation logic.”

Next, let’s talk about Web3 investments.

First, Bitcoin. There are already several valuation models in the market, such as the S2F model, Commodity model, etc. Then there is Ethereum. After Ethereum switched to the POS consensus mechanism in September last year, it has become a “currency” whose total amount is constantly decreasing. There are already several valuation models in the market.

BNB is the platform currency of Binance. The valuation challenge is not as big for us as Bitcoin and Ethereum. Its value stems from transaction discounts, profit repurchases, BSC chain pledges, Greenfield storage network pledges, etc.

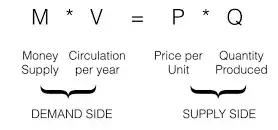

For the valuation of BNB, we respond to John Pfeffer’s call: “Value investors should work hard to discover new valuation logic”. We use currency valuation equations on top of DCF and other valuation methods for our valuations. Let’s take a look at this formula:

PQ is like the GDP of a country, which is the total economic value of the Binance ecosystem. There are two factors in M — the BNB price multiplied by the BNB quantity. V is the circulation speed of BNB in the ecosystem. The biggest challenge here is how to estimate the circulation speed of BNB in the ecosystem.

I thought about it for days, and finally, at a Starbucks near my home, I came up with a solution: We need to make two assumptions:

1.Assume that the circulation speed of BNB on the centralized exchange platform can be used for the circulation speed of the entire ecosystem;

2.Assume that the market price is reasonable and accurate because we have the historical price data. This way, we can calculate the circulation speed of last year. Assuming that the circulation speed remains unchanged, we can calculate the reasonable price of this year’s BNB based on this year’s ecosystem value estimation. Of course, there are assumptions, but this valuation model is the first attempt in the market to include various value factors of BNB in one model. We hope that our peers in this market can optimize on the basis of this model and come up with better methods.

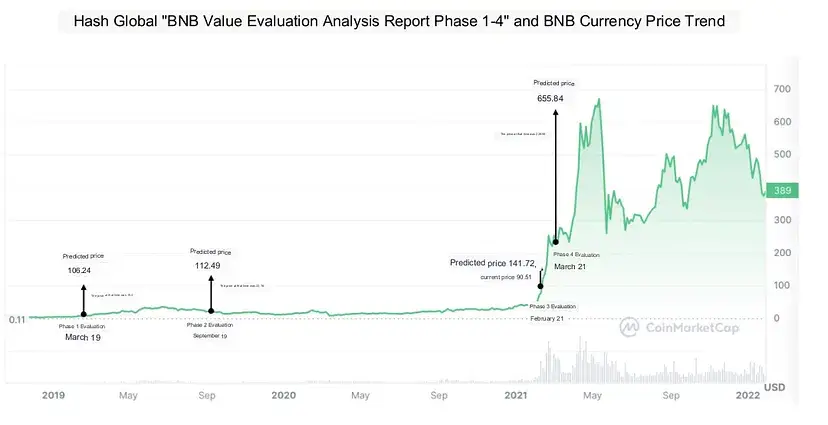

We have issued four reports in the past few years. The first issue was made in March 2019. We believed that BNB was undervalued. The coin price was 19 then, and we estimated 106.

CZ read and liked the article and reposted it. When he was in Shanghai, he played Texas Hold’em with me and asked me to invest in crypto when it was priced at $0.12. At that time, I didn’t understand it and missed out on the opportunity to invest. I finally grasped the concept until the price reached $20, missing out on the previous 150x return. Since then, we delved deeper into the market and actively participated in it. In 2021, I saw the price reach $655; later, it went up to $691. Additionally, we became one of the first 21 nodes of BSC.

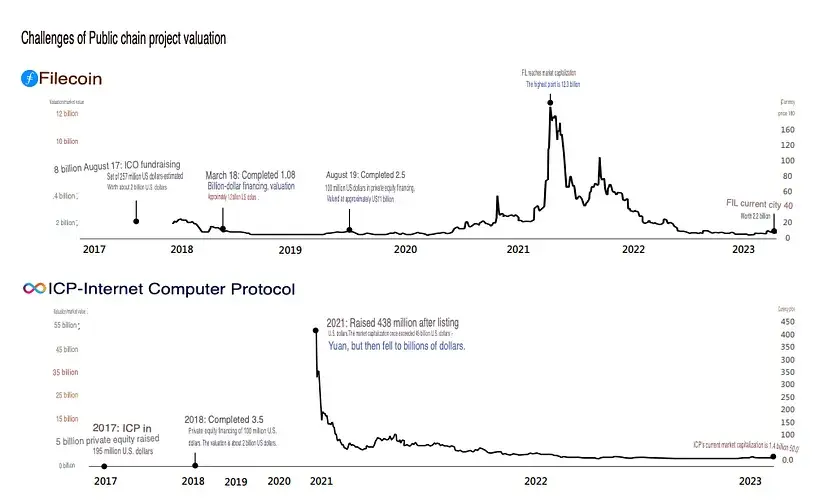

The challenges in valuing assets in this field are significant, and a market consensus is yet to be established. As a result, valuations in both primary and secondary markets are subject to significant fluctuations. Examples of such volatility can be seen in the cases of well-known public chains like Filecoin and ICP, but I won’t go into details here.

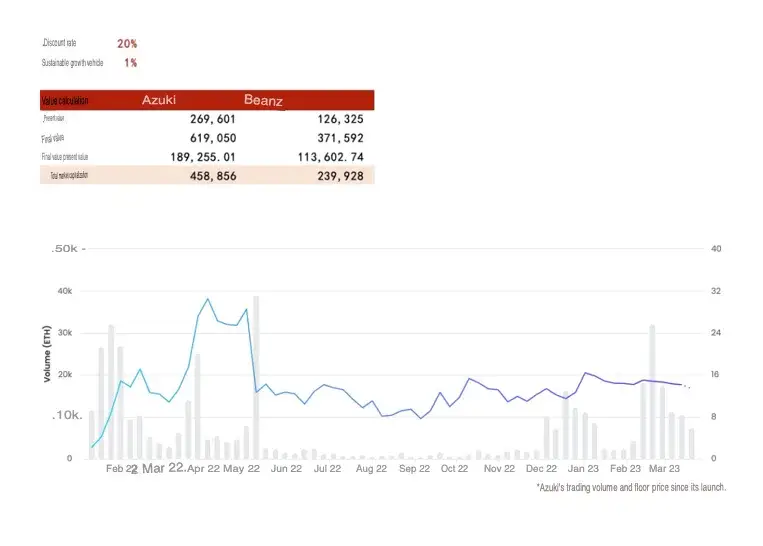

Internally, we have developed a new valuation method for the field of NFT, which we refer to as the DRIC model. This model evaluates the total value of community IPs such as Azuki or blue-chip NFT based on four value dimensions: Drop (airdrop), Right (right), IP (brand), and Community (community).

It is commonly known that NFT also has a value factor of rarity. We invested in a team called NFTGo, and they worked out a calculation method for the rarity parameter. Our analysis suggests that the floor price of Azuki should be 22 ethers, while currently, it is trading at around 14 ethers. You can consider buying one.

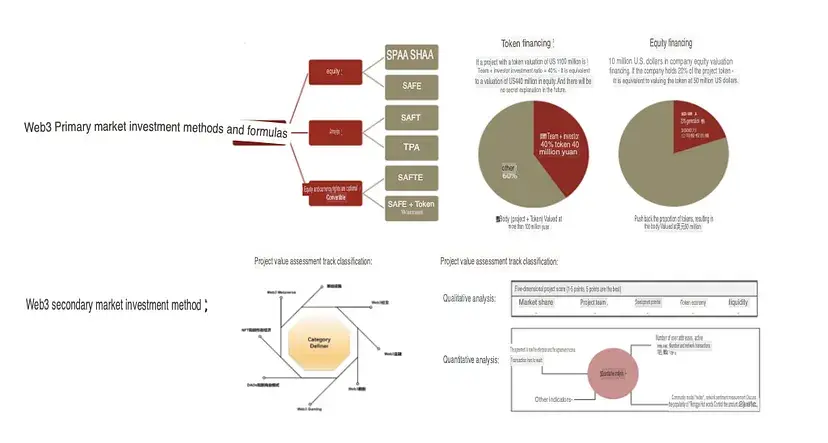

The primary investment approach in Web3 is significantly different from traditional VC. Two common funding methods for projects are token financing and equity financing. One of our key investors, Mr. Liang Xinjun of Fosun Group, suggested a useful method several years ago. We can utilize the ratio of the team’s and investors’ token amounts to convert the corresponding valuation of equity financing. This method has been helpful in discussing reasonable valuations with startups.

There are also many differences between Web2 VC and Web3 VC; I will not expand on them here.

In addition to VC investment, we also manage and operate a secondary market fund. For this fund, we invest in the leading projects in different sectors using the investment valuation methods for stock funds. We perform a qualitative analysis of the value of the projects based on five dimensions. Then we perform a quantitative analysis of the token value from various business perspectives. We will evaluate a target price for each token we build a position in to guide our investments.

Here is a summary of our valuation methodology for various new assets in Web3.

“A Breakthrough in Cognitive Paradigms”

Lastly, I would like to share a quote that I often use to remind myself not to be too attached to current knowledge frameworks. It was originally spoken by Voltaire in 1729:

“All state notes eventually reduce their value to nothing.”

Due to time constraints, I didn’t go over some sections in detail. If you’re interested in learning more about us, you can contact me @longwinsk or my colleague Will @willjiang_eth on Twitter.

In addition, we regularly share our investment perspectives and new insights on value investing on both our Twitter accounts and official website. I hope today’s insights have provided you with some inspiration. Thank you.