Back

NTU MOOC Study Notes - Session 14 Incentive Design and Tokenomics

Study Notes

By HackQuest

Oct 18,20244 min readDate: 9-10:30 PM SGT, October 1st 2024 / 9-10:30 AM EST, October 1st 2024

Session Title: Incentive Design and Tokenomics

NTU I&E x HackQuest MOOC is free and open to all individuals interested in Web3. This session focuses on the role of stablecoins in establishing a solid foundation for on-chain financial infrastructure, led by Mohamed Ezeldin. For those who prefer having a text summary and review material, this study note provides a recap of what’s covered during the MOOC. Happy learning!

Overview

Main Topic: Tokenomics refers to the study of the economics of tokens in blockchain ecosystems. This session explores key concepts such as network effects, persona profiling, ownership, and incentive design.

Objectives:

1.Understand tokenomics and its components.

2.Learn how to design incentives to enhance network effects and engage participants in decentralized ecosystems.

3.Analyze real-world applications of tokenomics.

Section 1: Introduction to Tokenomics and Incentive Design

Tokenomics is the study of how tokens function within a decentralized ecosystem, influencing user behavior and platform growth. It encompasses the creation, distribution, and management of tokens, aligning incentives for participants such as users, investors, and developers. Well-designed tokenomics is key to the long-term sustainability of decentralized platforms, as it governs the flow of value and encourages active participation.

The incentive design in tokenomics ensures that users are rewarded for contributing to the network, whether through providing liquidity, staking tokens, or engaging in governance. By offering these rewards, decentralized platforms foster a self-sustaining ecosystem that drives user growth and network effects.

Short for token economics, refers to the:

●Design and implementation of the economic system surrounding a digital asset(s).

●It encompasses the creation, distribution, and management (governance) of tokens within an ecosystem.

●Aim to incentivize and reward desired behaviors.

●Ensure equitable distribution.

●Maintain a sustainable and valuable treasury.

Section 2: 4 Core Pillars of Tokenomics

2.1 Network Effects

Network effects occur when the value of a service or product increases as more people use it. In Web3 ecosystems, network effects are crucial because they promote the growth of decentralized platforms and the adoption of tokens. Strong network effects can create a feedback loop where more participants drive higher value, attracting even more users.

Types of Network Effects:

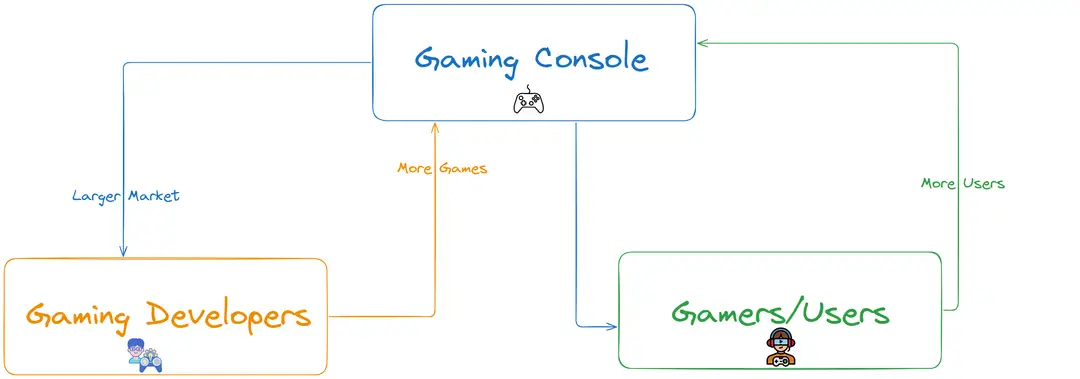

●Direct Network Effects: The value increases with the number of users (e.g., social media platforms).

●Indirect Network Effects: The value increases due to the availability of complementary products or services (e.g., video game consoles and games).

Key Point: The utility and value of the network enhance as more participants join and interact.

2.2 Incentive Design

Incentive design is about structuring rewards and motivations to encourage desirable behaviors within the ecosystem. Well-designed incentives drive engagement, participation, and loyalty, ensuring the long-term success of a decentralized platform.

Incentive Design refers to creating structures or mechanisms that motivate users to engage in a blockchain ecosystem in ways that contribute to the network’s overall success.

A well-designed incentive system ensures that participants’ interests are aligned with the long-term goals of the project.

These systems often include rewards like tokens, governance rights, or exclusive access that motivate users to contribute in ways that benefit both themselves and the network.

Exploring Incentive Design in Token Economies

●Incentive Design's Importance

Motivating desired behaviors through rewards and structures that align with network growth.

●Tokenomics and Ecosystem Growth

Effective tokenomics creates a decentralized, value-driven ecosystem, encouraging participation.

●Linking Incentives to Network Effects

Incentives create feedback loops where increased participation leads to higher network value.

2.3 Persona Profiling

Persona profiling is a critical component of understanding how to tailor incentives for different participants within an ecosystem. The goal is to identify user types, understand their motivations, and offer incentives that align with their behaviors.

●Definition: Persona profiling is the process of creating detailed, semi-fictional representations of different user types within a network or ecosystem.

●Objective: Understanding different user behaviors, motivations, and goals to design better engagement strategies.

●Key Components: Demographics, behavior patterns, goals, and challenges.

Why is Persona Profiling Important?

●Tailored Engagement: Helps design more effective incentive mechanisms by understanding user needs.

●Improved Product Design: Personas allow for better user experience design and communication strategies.

●Enhanced Network Growth: Knowing your audience allows for more targeted user acquisition and retention strategies.

●Key Benefit: Aligns incentives with user motivations to boost engagement.

Existing Personas in Crypto

●The Speculator: Focused on token price appreciation and short-term gains.

●The Developer/Builder: Seeks to build new dApps, products, or services on top of blockchain infrastructure.

●The Staker/Validator: Invests in long-term token holding and actively secures the network.

●The Governance Participant: Focuses on voting and contributing to decentralized governance.

2.4 Ownership

Ownership refers to the way token holders have a stake in the success of a decentralized project. Through governance rights, staking rewards, and voting mechanisms, participants can feel a sense of ownership over the project's direction and growth.

2.4.1 Core Value of Property Ownership

Key Points:

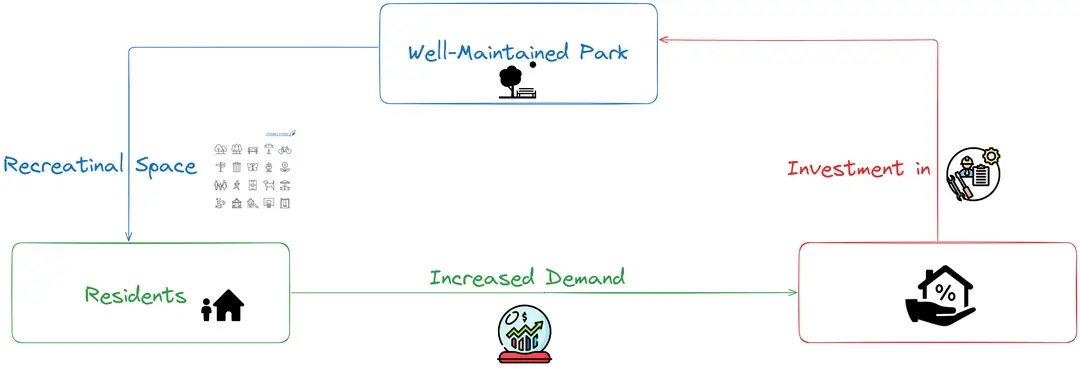

●Increased property value due to proximity to high-quality amenities.

●The attractiveness of the neighborhood draws in more residents.

●Similar to network effects where the value of participation increases as more participants join.

2.4.2 Property Ownership Analogy

Key Points:

●The desirability of the neighborhood attracts more residents, increasing property values.

●Similar to network effects, the value of being part of a network increases as the network grows.

●Incentive is living in a desirable area.

2.4.3 Symbiotic Relationships

Key Points:

●Positive interactions between different elements in a neighborhood create mutual benefits.

●Example: A well-maintained park attracts residents, which in turn increases property values around it.

●Similar to network effects where each new participant enhances the value for existing participants.

2.4.4 Predictable Rules and Investment of Resources

Key Points:

●Importance of Predictable Rules: Predictable rules and governance create a stable environment where participants feel secure to invest their time, resources, and efforts.

●Property Rights and Investment: In a physical community, clear property rights encourage homeowners and businesses to invest in improvements and development.

●Blockchain Networks and Predictable Incentives: Similar principles apply in blockchain networks where predictable incentives encourage participation and investment.

Section 3: Real-World Examples

3.1 YouTube and Network Effects

YouTube is a prime example of how network effects work in digital ecosystems. As more users upload videos, more viewers engage with the content. This drives higher advertising revenue, which in turn incentivizes more creators to join and produce content.

●Content Creation Incentives: YouTube's ad revenue-sharing model aligns the incentives of creators and the platform. Creators earn based on views, which motivates them to create engaging content, driving more traffic and higher engagement.

●Community Engagement: YouTube fosters a community-driven platform, where users not only consume content but also engage through comments, shares, and likes. These non-monetary incentives drive social validation and further engagement.

3.2 Instagram and Incentive Design

Instagram has built its success on social validation incentives. While there are no direct financial rewards for users, the platform’s design focuses on social interaction. Users are driven to post and engage with content due to the visibility of likes, comments, and follower counts.

●Influencer Marketing: Instagram's network effects are also leveraged by influencers, who can monetize their content through brand partnerships. This creates a cycle where influencers attract more followers, which in turn attracts more advertisers.

●Non-Monetary Incentives: Users are incentivized to post content regularly to maintain or grow their follower base. Social validation through likes and comments keeps users engaged and active on the platform.

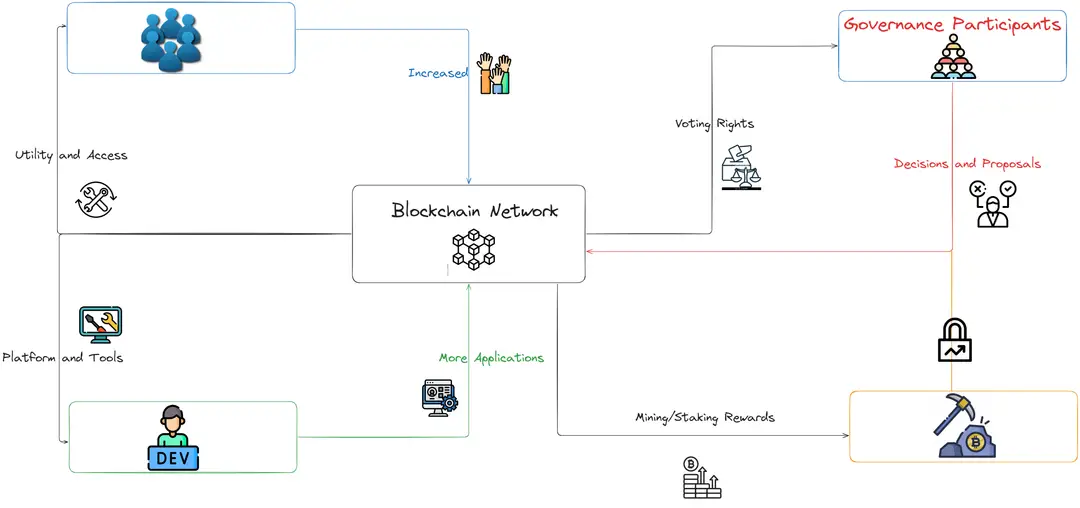

3.3 Network Effects in Blockchain-based Ecosystems

Key Points:

●Token Incentives as Digital Property Rights: Tokens in blockchain networks act as digital property rights, providing incentives for early participation and investment.

●Growth Through Participation: The value of a blockchain network grows as more users and developers join, benefiting all participants.

●Comparison to Traditional Property Ownership: Similar to property ownership in a desirable neighborhood where value increases with more residents and amenities.

Section 4 How Incentive Design Enhances Network Effects

4.1 Amplifying User Growth and Engagement

●User Acquisition Incentives: Reward early adopters and referrers, accelerating network growth.

●Retention Incentives: Ongoing rewards like staking or governance tokens drive long-term engagement.

●Developer Incentives: Encourage developers to contribute through rewards, expanding the ecosystem.

4.2 User Acquisition Incentives

Fueling Growth through Referrals and Airdrops

●Referral Programs: Users are rewarded for bringing in new participants, growing the network’s size and value.

●Airdrops & Token Giveaways: Free distribution of tokens to early adopters incentivizes participation and spreads awareness.

●Example: Uniswap: Uniswap’s UNI token airdrop rewarded early users, leading to rapid growth and higher participation.

4.3 Onboarding and Developer Incentives

Encouraging Participation and Building Infrastructure

●Onboarding Incentives: Referral programs and airdrops offer tokens or NFTs to early adopters and referrers, simplifying the onboarding process.

●Developer Incentives: Grants and bounties reward developers for building dApps or improving infrastructure, while revenue sharing ensures long-term engagement.

4.4 Retention Incentives

Sustaining Long-term Engagement

●Staking Rewards: Users are incentivized to lock up tokens, contributing to network security and earning passive rewards.

●Governance Participation: Token holders earn rewards for voting on key decisions, driving continuous engagement.

4.5 Value Feedback Loops

Scaling Incentives with Network Growth

●Increasing Rewards: As user or developer participation increases, rewards grow (e.g., through liquidity mining or yield farming).

●Compounding Utility: The more participants contribute, the more valuable the network becomes, creating a positive feedback loop.

Section 5: Growth as an Iterative Process

Growth in tokenomics is not a linear process. Ecosystems must continuously evolve, adapt, and iterate to remain relevant and sustainable. This involves adjusting incentive structures, revisiting governance models, and incorporating user feedback.

The need for iteration, not all growth is equal

Incentive Design as an Iterative Process:

Adapting Incentives to Match Growth Stages

●Early Stage Incentives: Attract early adopters with aggressive rewards like airdrops and referral bonuses to build momentum.

●Growth Stage Incentives: Focus shifts to retention with staking rewards, governance tokens, and developer grants to sustain engagement.

●Maturity Stage Incentives: Evolve incentives with lower token emissions but higher utility, focusing on governance and platform usage.

Q&A Session

1.Q: What are some things you paid special attention, especially with so many stakeholders in the case? How do you make the token valuable?

A: When we began OpenCampus, the idea was to start with Publisher NFTs, primarily because of the stakeholders we had at the time. We only had TinyTap, an ed-tech platform for teachers to create gamified content. It allowed teachers to build content without code, and the revenue model was based on subscriptions paid by parents and schools, with revenue shared according to the platform’s algorithm.

We then created Publisher NFTs by tokenizing the revenue from the top-performing courses and allowing people to buy into future revenues. We launched six Publisher NFT drops in November and December 2022, raising over $400,000. Half of the proceeds went to the teachers who created the content, with one teacher earning more than her annual salary of $37,000 from a single NFT drop.

2.Q: What was the role of Binance in OpenCampus?

A: Binance was crucial for OpenCampus. Listing on Binance gave us a more significant treasury due to the higher token price typically associated with being listed on such a major exchange. This treasury allowed us to expand operations and execute new initiatives like the Global Educator Fund, designed to provide grants for educational content creation.

1.Q: What challenges did OpenCampus face when creating educational content?

A: One of the big issues we encountered was that much of the content created through grants wasn’t developed by teachers and therefore wasn’t fit for its intended purpose. This realization led to the creation of the OpenCampus Accelerator, where we onboard developers to build the necessary infrastructure while addressing the need for better credentialing and reputation systems within the Web3 space.

1.Q: How does reputation factor into Web3 governance?

A: Reputation is a significant challenge in Web3 governance. Voting tends to be token-based, meaning individuals with more tokens have more voting power, which doesn’t necessarily align with their knowledge or understanding of the issues they are voting on. Building a reputation system takes time but is crucial for ensuring that votes are meaningful and that governance reflects true expertise.

1.Q: What future developments are planned for OpenCampus?

A: OpenCampus is working on several initiatives, including an EDU chain where the EDU token will function as a gas token. This structure mirrors the value accrual model of Ethereum but with a finite token supply. Tokens will be recycled and held in the treasury for certain periods, which will help stabilize the token price as the network grows.

Additionally, we are working on a solution that brings together all the different stakeholders—developers, users, stakeholders, and governance participants—into a cohesive ecosystem. We plan to present this proposal within the next two to three weeks.