Back

NTU MOOC Study Notes - Session 6 Pitching and Venture Funding in Web3

Study Notes

By HackQuest

Jul 15,20244 min readDate: 4-5:30 PM SGT, July 15th, 2024 / 9-10:30 AM BST, July 15th, 2024

Session Title: Pitching and Venture Funding in Web3

NTU I&E x HackQuest MOOC is free and open to all individuals interested in Web3. The MOOC is led by top voices in crypto including Yat Siu (Co-founder, Animoca), Ed Felten (Co-founder, Offchain Labs), Sergey Gorbunov (Co-founder, Axelar), Scott Moore (Co-founder, Gitcoin), Haider Rafique (CMO, OKX), Austin Griffith (Developer Onboarding, Ethereum Foundation), Anna Yuan (Stablecoins Lead, Solana Foundation), and many more. For those who prefer having a text summary and review material, this study note provides a recap of what’s covered during the MOOC. Happy learning!

Overview

Main Topic: Strategies and Insights for Pitching and Venture Funding in Web3

Objectives:

1.Understand the preparation required for fundraising.

2.Explore the Web3 fundraising landscape.

3.Learn effective pitching techniques and strategies.

Section 1: Fundraising Preparation

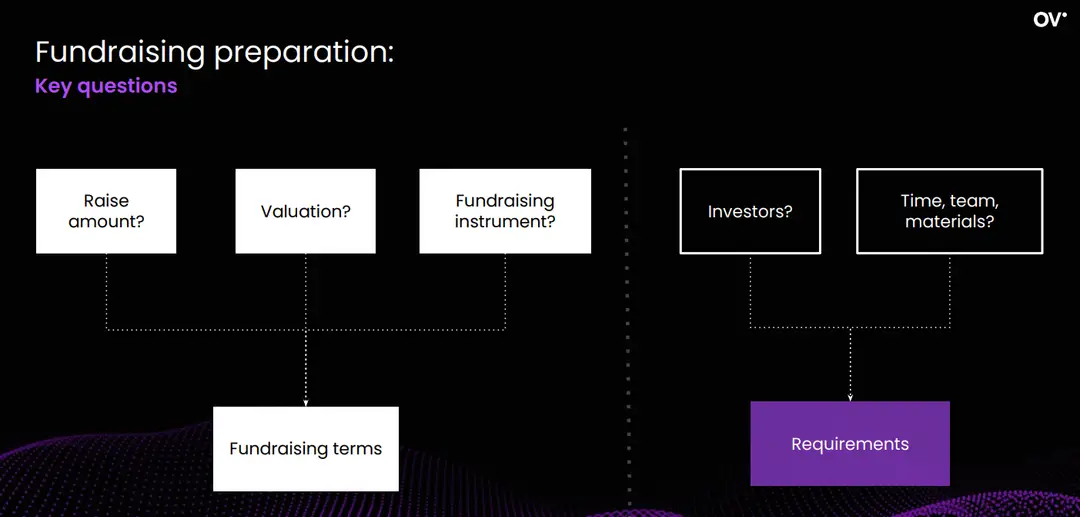

1.1 Key Questions

●How much to raise?

●What valuation to aim for?

●Which fundraising instrument to use?

●Who are the potential investors?

●What are the requirements in terms of time, team, and materials?

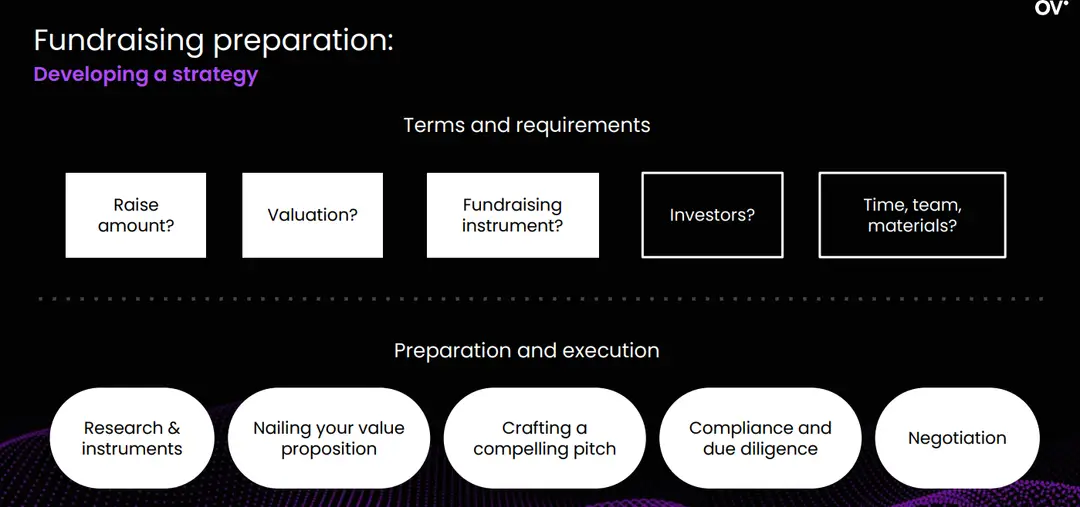

1.2 Developing a Strategy

●Research & Instruments: Understand various fundraising instruments available.

●Nailing Your Value Proposition: Clearly define the unique value your project brings.

●Crafting a Compelling Pitch: Develop a pitch that captivates and convinces potential investors.

●Compliance and Due Diligence: Ensure all legal and regulatory requirements are met.

●Negotiation: Effectively negotiate terms and conditions of the fundraising deal.

Section 2: Understanding Web3 Fundraising Landscape

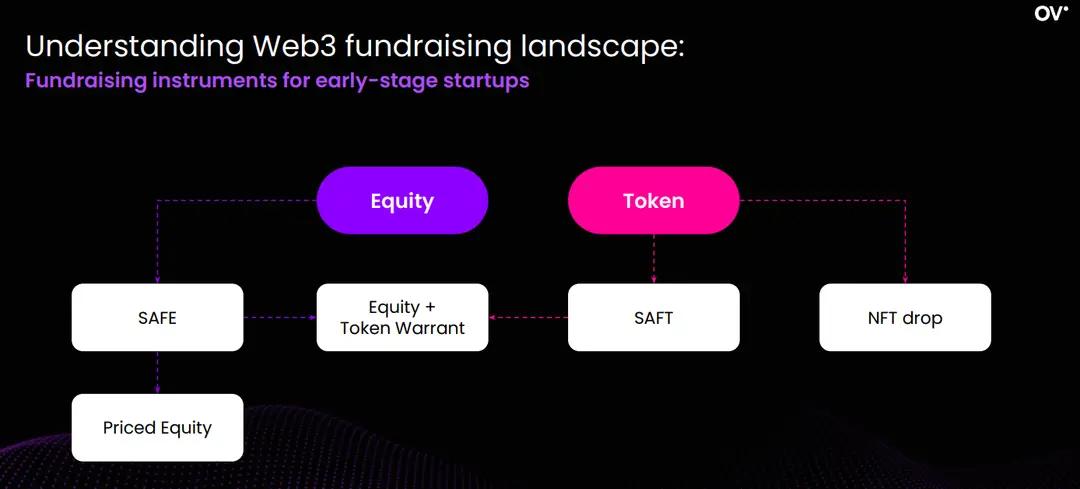

2.1 Fundraising Instruments for Early-Stage Startups

●Equity Token: A digital asset representing ownership in a company, typically offering voting rights and dividends.

●NFT Drop: The release and distribution of unique, non-fungible tokens, often associated with digital art or collectibles.

●Equity + Token Warrant: A financial instrument granting the right to purchase company equity and tokens at a predetermined price in the future.

●SAFT (Simple Agreement for Future Tokens): An investment contract promising the future delivery of tokens once the project is operational.

●SAFE (Simple Agreement for Future Equity): An investment agreement allowing investors to receive company equity in the future, typically upon a triggering event like a fundraising round.

●Priced Equity: The issuance of company shares at a specific valuation, establishing the price per share in an investment round.

2.2 Token Offerings

●ICOs (Initial Coin Offerings): The initial offering of a cryptocurrency token to raise funds using blockchain technology.

●IEOs (Initial Exchange Offerings): The initial token offering conducted on a cryptocurrency exchange, vetted and sold by the exchange.

●IDOs (Initial DEX Offerings): The initial token offering conducted on a decentralized exchange, managed by smart contracts.

●STOs (Security Token Offerings): The offering of security tokens representing real-world assets, compliant with securities regulations.

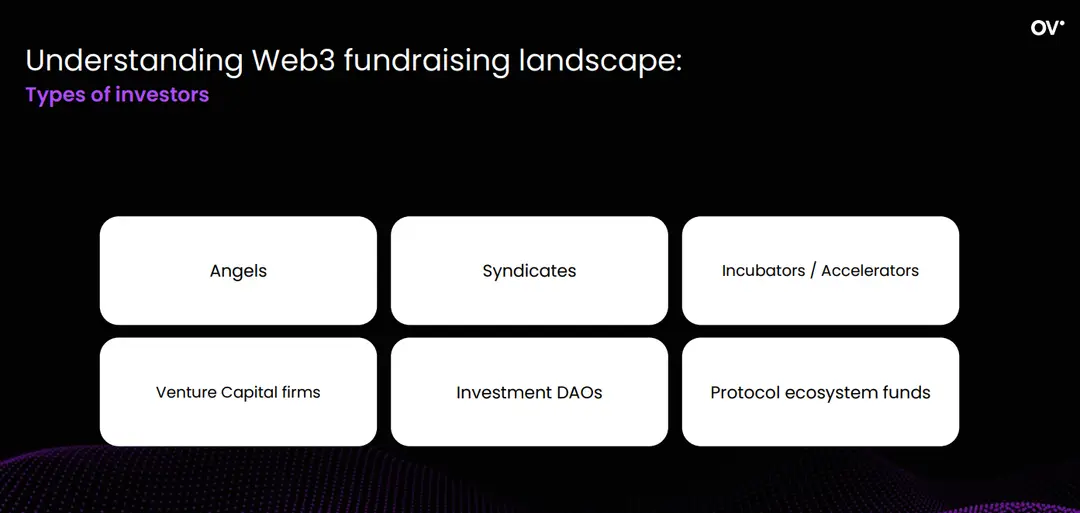

2.3 Types of Investors

●Angels: Individual investors who provide capital for startups.

●Syndicates: Groups of investors pooling resources.

●Incubators/Accelerators: Programs that support early-stage companies with funding, mentorship, and resources.

●Venture Capital Firms: Professional groups that invest in high-growth potential startups.

●Investment DAOs: Decentralized autonomous organizations that make collective investment decisions.

●Protocol Ecosystem Funds: Funds established by blockchain protocols to support projects within their ecosystems.

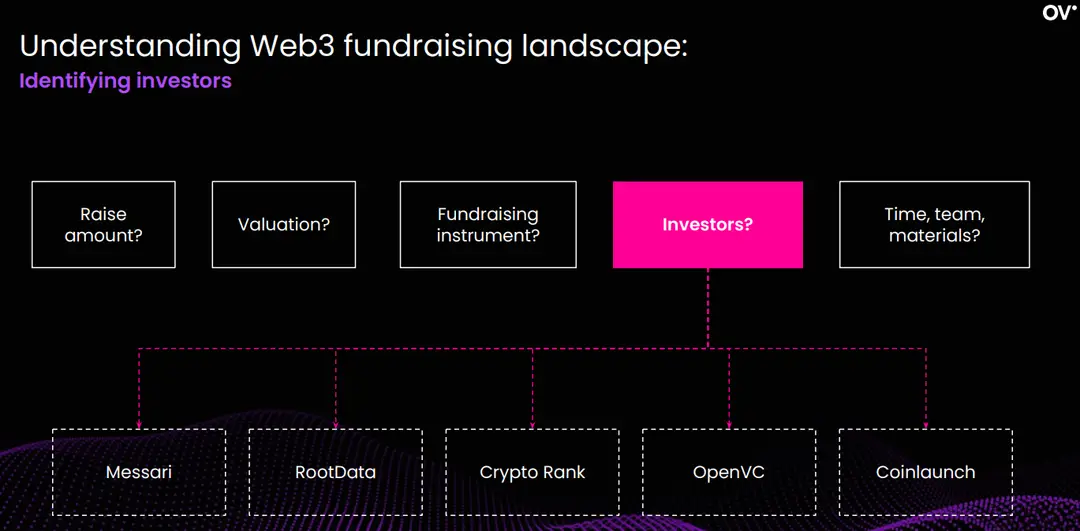

2.4 Identifying Investors

●Ticket Size: Understand the investment amount each investor is willing to commit.

●Instruments: Identify the preferred investment instruments of potential investors.

●Thesis & Portfolio: Match your project with investors' portfolios and investment theses.

●Research Tools: Utilize platforms like Messari, RootData, Crypto Rank, OpenVC, and Coinlaunch for investor research.

Section 3: Crafting a Compelling Pitch

3.1 Elements of a Compelling Pitch

●Design: Ensure visuals are consistent, branded, and engaging.

●Content: Know your audience, avoid congested slides, and use storytelling to layer content.

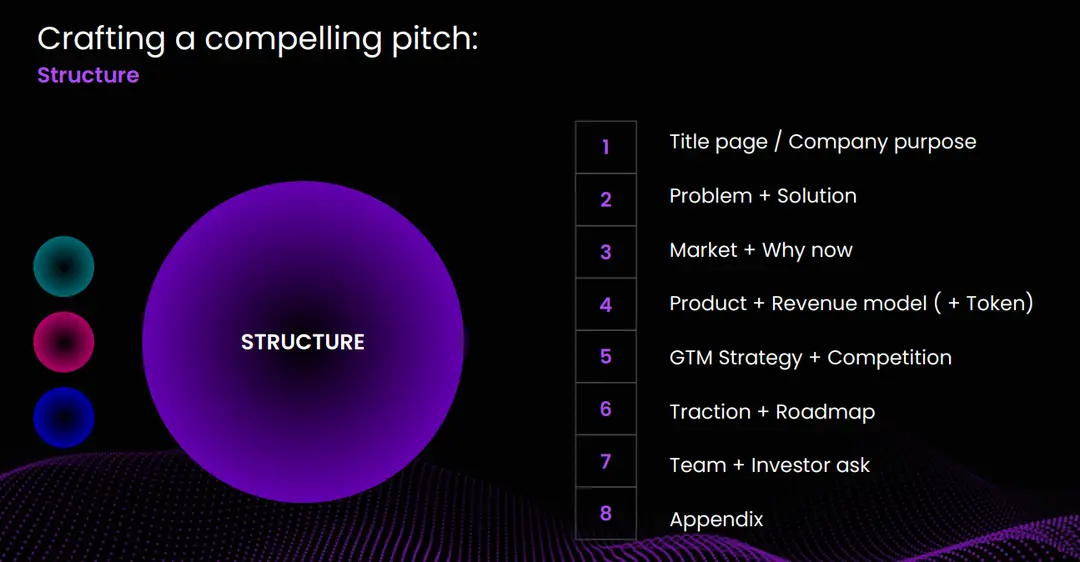

●Structure: Include a title page, company purpose, problem and solution, market opportunity, product details, go-to-market strategy, competition analysis, traction, roadmap, team, and investor ask.

3.2 Delivery

●Test Your Tech: Make sure all technical aspects are ready before pitching.

●Practice: Rehearse thoroughly to ensure smooth delivery.

●Speak Clearly: Maintain clarity and confidence throughout the presentation.

●Emotion: Engage emotionally with your audience to make a lasting impact.

●Call to Action: Conclude with a strong call to action.

3.3 Types of Pitches

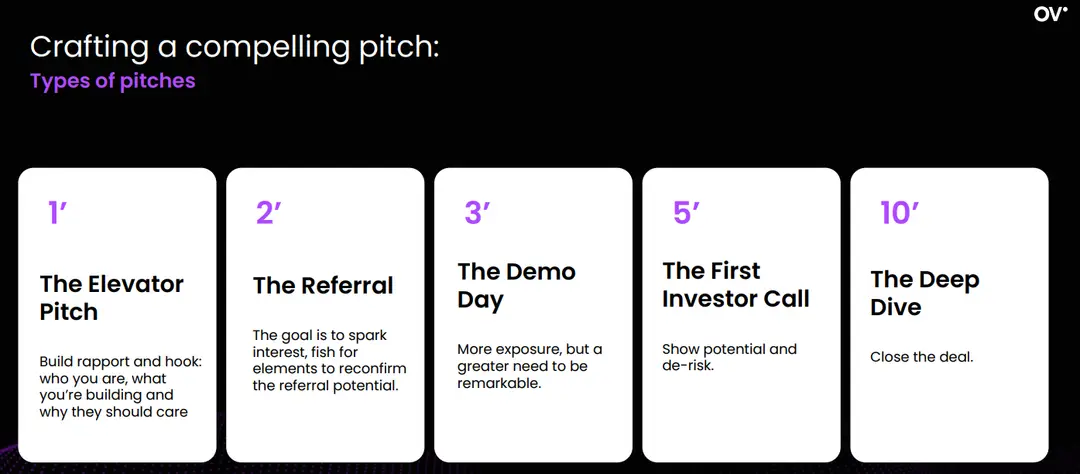

●The Elevator Pitch: A quick, engaging introduction (1 minute).

●The Referral Pitch: Spark interest and explore referral potential (2 minutes).

●The Demo Day Pitch: Stand out in a high-exposure environment (3 minutes).

●The First Investor Call: Show potential and minimize risks (5 minutes).

●The Deep Dive: Close the deal with a detailed presentation (10 minutes).

Key Takeaways

Fundraising in Web3 involves strategic preparation, understanding the diverse landscape of instruments and investors, and crafting a compelling pitch. Success requires aligning your pitch with investor expectations, practicing delivery, and iterating constantly. The dynamic nature of Web3 fundraising demands continuous learning and adaptation.

Q&A

1.Question 1: Can you share some recent examples of compelling one-liners that caught your attention and led you to want to hear more about a pitch?

Answer: Crafting a compelling one-liner is challenging. While I can't recall a specific example off the top of my head, the key is to make the one-liner intriguing enough to prompt further questions from the investor. For example, in the gaming space, a team I worked with, Introverse, created a platform that connects game studios and brands. Their one-liner highlighted this unique intersection, addressing the needs of both parties. The goal of a one-liner is to spark curiosity and lead to a deeper conversation.

2.Question 2: How is the current crypto market in regards to fundraising?

Answer: The market is gradually improving. Last year was tough due to limited new capital entering the market and a high demand for funds. Currently, there is more activity in the pre-seed stage compared to later stages. Pre-seed investors are more resistant to market fluctuations, leading to more stability in early-stage fundraising.

3.Question 3: How do crypto investors approach the AI-crypto sector, and which investors should I target?

Answer: Crypto investors are increasingly interested in the AI sector, especially in solutions that lower the cost of AI model training using decentralized technologies. For targeting investors, use resources like RootData and OpenVC to identify those who have invested in similar projects. AI in crypto often focuses on leveraging blockchain for cost efficiency and democratizing AI tools through decentralized governance.

4.Question 4: What are some current trends or challenges in the AI-crypto space?

Answer: A significant challenge is the high cost of GPU processing power needed for training AI models. Startups are exploring decentralized cloud processing as a solution. Additionally, there is interest in creating AI agents that operate on-chain and using blockchain for community-focused governance models. Early use cases, such as AI trading bots, serve as proof-of-concept for reliable on-chain AI activity.