Back

Web3 Dev Huddle Panel 4 Recap: Unlocking the Potential of Future Finance in Web3

Events

By HackQuest

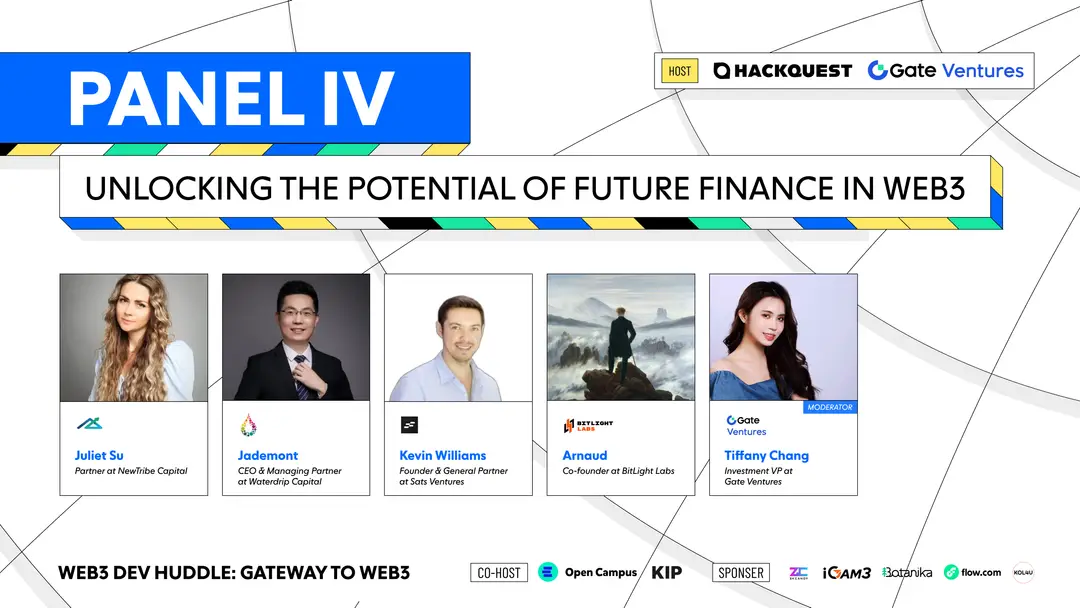

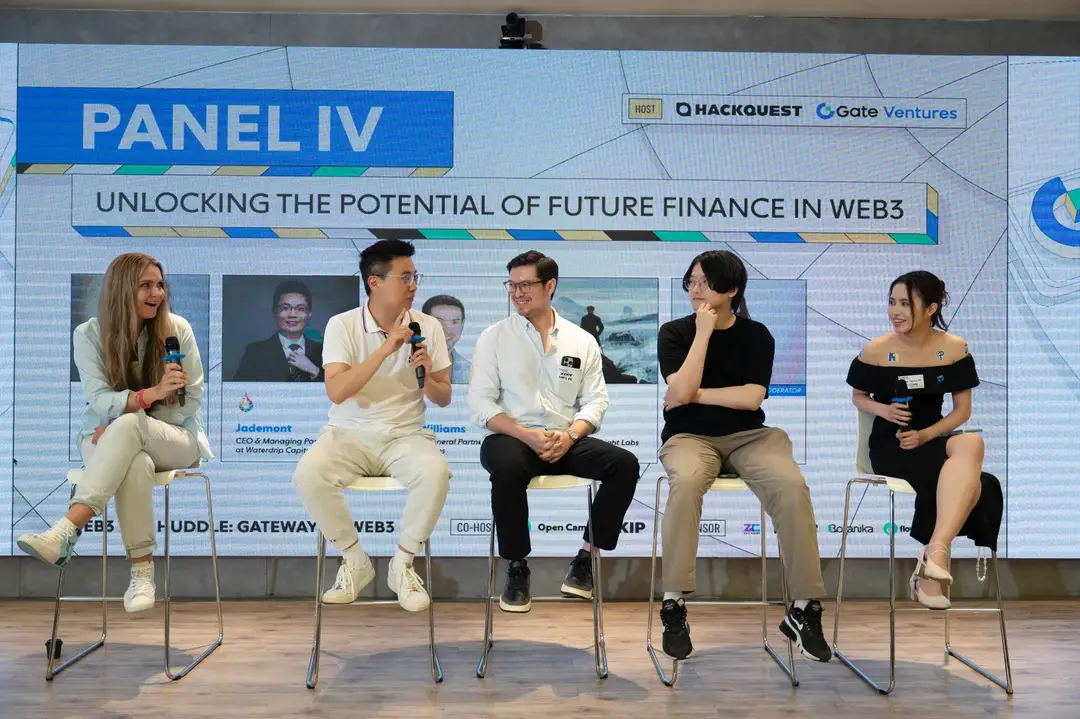

Nov 22,20244 min readOn November 14, 2024, HackQuest and Gate Ventures, alongside Open Campus and KIP Protocol, hosted the second Web3 Dev Huddle: Gateway to Web3 at Gaysorn Tower, Bangkok. This panel brought together venture capitalists and founders to explore the evolving landscape of Web3 finance and its intersection with Bitcoin and traditional financial systems. Panelists included Juliet Su (Partner at NewTribe Capital), Jademont (CEO & Managing Partner at WaterDrip Capital), Kevin Williams (Founder & General Partner at Sats Ventures), Arnaud (Co-Founder at BitLight Labs), and Tiffany Chang (Investment VP at Gate Ventures, Moderator). Read on for key insights from this panel.

Key Takeaways

●Bitcoin Ecosystem: Bitcoin is re-emerging as the foundation for Web3 financial systems, driven by scalability solutions, DeFi integration, and new Bitcoin-backed stablecoins.

●Institutional Adoption: The panel highlighted the role of regulatory clarity, Bitcoin ETFs, and real-world assets (RWA) in accelerating institutional participation.

●Future Trends: RWA tokenization, retail-driven adoption, and improved user experiences are paving the way for the next wave of Web3 finance.

Bitcoin as the Foundation of Web3 Finance

The panel emphasized Bitcoin's central role in the Web3 financial ecosystem, with advancements in stablecoins, scalability, and DeFi opening new possibilities.

Arnaud outlined Bitcoin's future potential as a payment settlement layer, noting, "With advancements like the Lightning Network and RGB protocol, we’re moving closer to Satoshi Nakamoto’s vision of Bitcoin as a peer-to-peer electronic cash system."

Kevin Williams highlighted Bitcoin-backed stablecoins as a critical innovation: "We invested in Bima, which lets users stake Bitcoin to mint USD-based stablecoins. This unlocks liquidity without selling your Bitcoin, which is a game changer for DeFi."

Institutional Adoption: A Gateway to Growth

Regulatory developments, Bitcoin ETFs, and partnerships between traditional financial institutions and Web3 projects are driving institutional adoption of crypto assets.

Juliet Su noted the growing appeal of stablecoins and RWAs to institutions, saying, "We’re seeing UAE banks issue stablecoins and tokenize assets as part of their move toward institutional mass adoption. These steps are critical to bridging the gap between retail and institutional players."

Jademont added, "In Hong Kong, the crypto industry is thriving with new licenses, and major players like Galaxy Digital and Bullish are setting up offices. RWA tokenization, such as bonds and real estate, is drawing traditional finance into the blockchain space."

Trends Shaping Retail and Institutional Finance

Retail adoption, driven by wealth effects and seamless user experiences, remains the cornerstone of Web3 finance, while institutions increasingly recognize the potential of blockchain.

Juliet Su explained the importance of meme coins as an entry point for retail adoption: "Meme coins are often the first interaction for retail users. From there, they explore more stable and rewarding avenues like DeFi."

Kevin Williams spoke about investing in early-stage Bitcoin infrastructure: "We focus on projects that bridge Bitcoin with underutilized ecosystems. For example, Echo Protocol bridges Bitcoin liquidity to Aptos, creating new DeFi opportunities."

The Role of Real-World Assets (RWA) in Web3 Finance

RWA tokenization is becoming a cornerstone of institutional adoption, enabling traditional assets to integrate seamlessly with blockchain technologies.

Jademont highlighted RWA’s potential: "RWA tokenization connects traditional finance with blockchain. We’re seeing APYs of 20–30% in P2P lending, far surpassing DeFi yields. This is drawing institutional investors into the space."

Arnaud added, "RWA allows blockchain to tap into a $300 trillion traditional financial market, offering a massive growth opportunity for Web3."

Future Directions for Web3 Finance

Scaling solutions, improved cross-chain interoperability, and Bitcoin-focused financial products are key to unlocking the full potential of Web3 finance.

Juliet Su emphasized the importance of simplifying user experiences: "Chain abstraction and cross-chain interoperability are essential for retail adoption. Users should be able to interact with blockchain seamlessly, without thinking about the underlying technology."

Arnaud concluded with a call to action: "The true value of crypto lies in solving real-world inefficiencies. Stablecoin payments and scalability solutions like Lightning Network are critical to making crypto finance a global reality."

Closing Thoughts

Panel IV of the Web3 Dev Huddle offered deep insights into the evolution of Web3 finance. By highlighting Bitcoin’s foundational role, RWA tokenization, and the importance of user-friendly interfaces, the panelists painted a compelling vision for the future. As Arnaud aptly summarized, "Web3 finance is about merging technology and real-world value to create a more efficient, inclusive global financial system."