AlphaEngine offers secure DeFi yield strategies on EDU Chain, enabling profits, empowering strategists to build effective alpha, and certifying traders via OC-ID and verifiable credentials.

AlphaEngine is an innovative DeFi protocol designed to simplify and democratize access to sophisticated yield-generating strategies. Built as a fork of the VEDA protocol and deployed on EDUChain, AlphaEngine allows strategists to securely manage assets through verified credentials, making advanced yield farming accessible, transparent, and highly profitable for all users.

Despite rapid growth, DeFi remains challenging for most users:

Complexity: Yield strategies often involve navigating multiple protocols and chains, requiring extensive technical expertise.

Trust Issues: Users hesitate to entrust assets to anonymous or unverified strategists.

Credential Gap: There's no standardized way to measure or verify the expertise of DeFi strategists.

Simplified Yield Access: AlphaEngine tokenizes complex strategies, turning them into easy-to-use products that any user can understand and invest in without needing advanced technical knowledge.

Verified Strategists: Strategists on AlphaEngine must possess OC-ID credentials, a decentralized identity verification provided by EDUChain. This ensures trust and accountability.

Safe and Secure: Utilizing a robust, modular smart contract architecture inherited from VEDA, AlphaEngine ensures safe deployment and management of user funds within clearly defined risk limits.

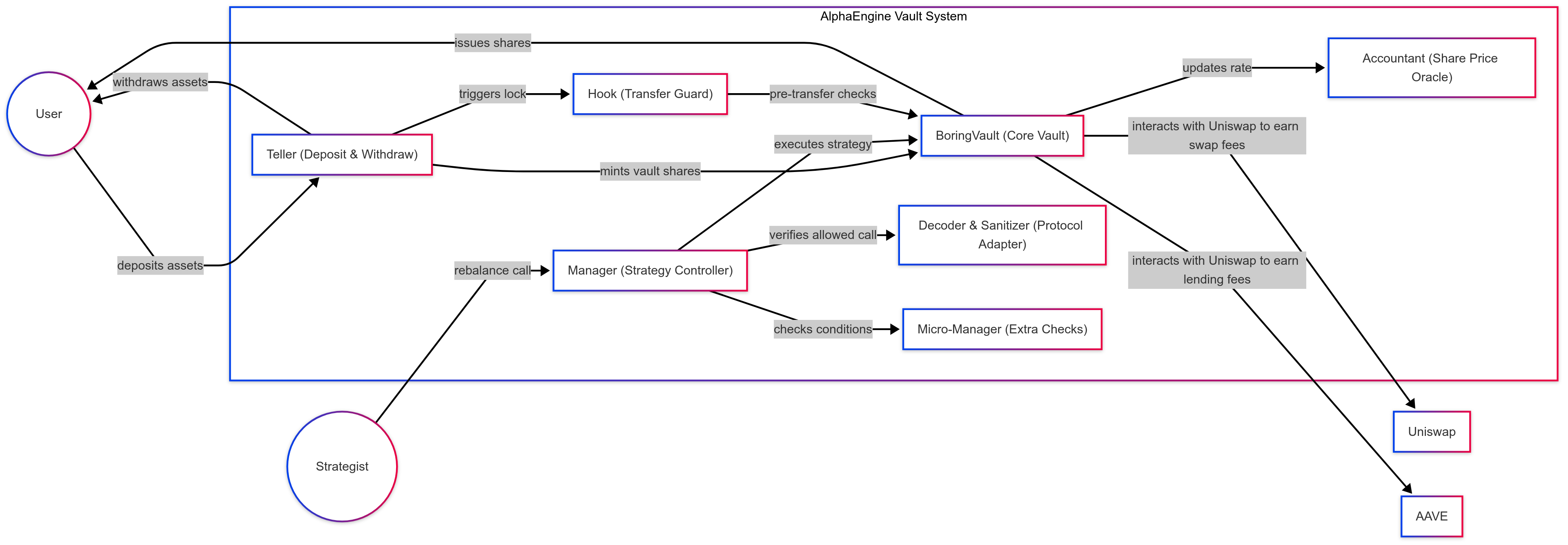

AlphaEngine architecture primarily involves the following key contracts:

Vault (BoringVault): Securely holds user assets, issuing vault shares to depositors.

Teller: Handles user deposits and withdrawals, ensuring safe asset management.

Manager: Allows verified strategists to implement and manage yield strategies.

Decoder & Sanitizer: Ensures that all interactions with external DeFi protocols are secure and validated.

Accountant: Maintains accurate exchange rate updates for transparent valuation.

Hooks and Micro-Managers: Provide additional checks and balances, enforcing strategy compliance and mitigating risk.

AlphaEngine leverages EDUChain specifically because:

Verifiable Credentials (OC-ID): Enables strategists to prove their qualifications and reliability through verified on-chain credentials.

Educational Integration: EDUChain's educational ecosystem offers upskilling opportunities, fostering continuous improvement of strategist performance.

Low-Cost Transactions: EDUChain's L3 architecture provides extremely low transaction costs and high scalability, enhancing user accessibility and enabling frequent strategy adjustments.

Built upon the audited, modular smart contract framework from VEDA.

Decentralized identity integration through OC-ID ensures strategist credibility.

Strategy management secured by robust validation mechanisms (Merkle proofs, decoder checks).

April 2025: Setup USDC-Vault Creation & enables user deposits

May 2025: Launch AlphaEngine MVP on EDUChain Testnet with basic strategy implementations.

Q2 2025: Fully integrate OC-ID credentialing and strategist verification.

Q3 2025: Complete security audits and launch AlphaEngine on EDUChain mainnet with initial vaults.

Q4 2025: Extend support for more assets vault

Q1 2025: Implement community-driven governance and expand strategist pools and vault offerings.

AlphaEngine seeks collaborations in several strategic areas:

Educational Institutions: Joint programs for training and credentialing DeFi strategists.

DeFi Protocols: Integrations for optimized capital utilization and liquidity management. Native support for use with Uniswap v4 hook to leverage liquidity from Uniswap v4 based swapping protocols

Identity Providers: Further enhancement of decentralized credential verification systems.

Wallet and Platform Providers: Direct integration to extend AlphaEngine’s ease of access to broader user communities.

AlphaEngine represents a unique intersection of advanced DeFi yield strategies and decentralized education, ensuring innovation, transparency, and inclusivity in the decentralized finance space.