Caér Finance

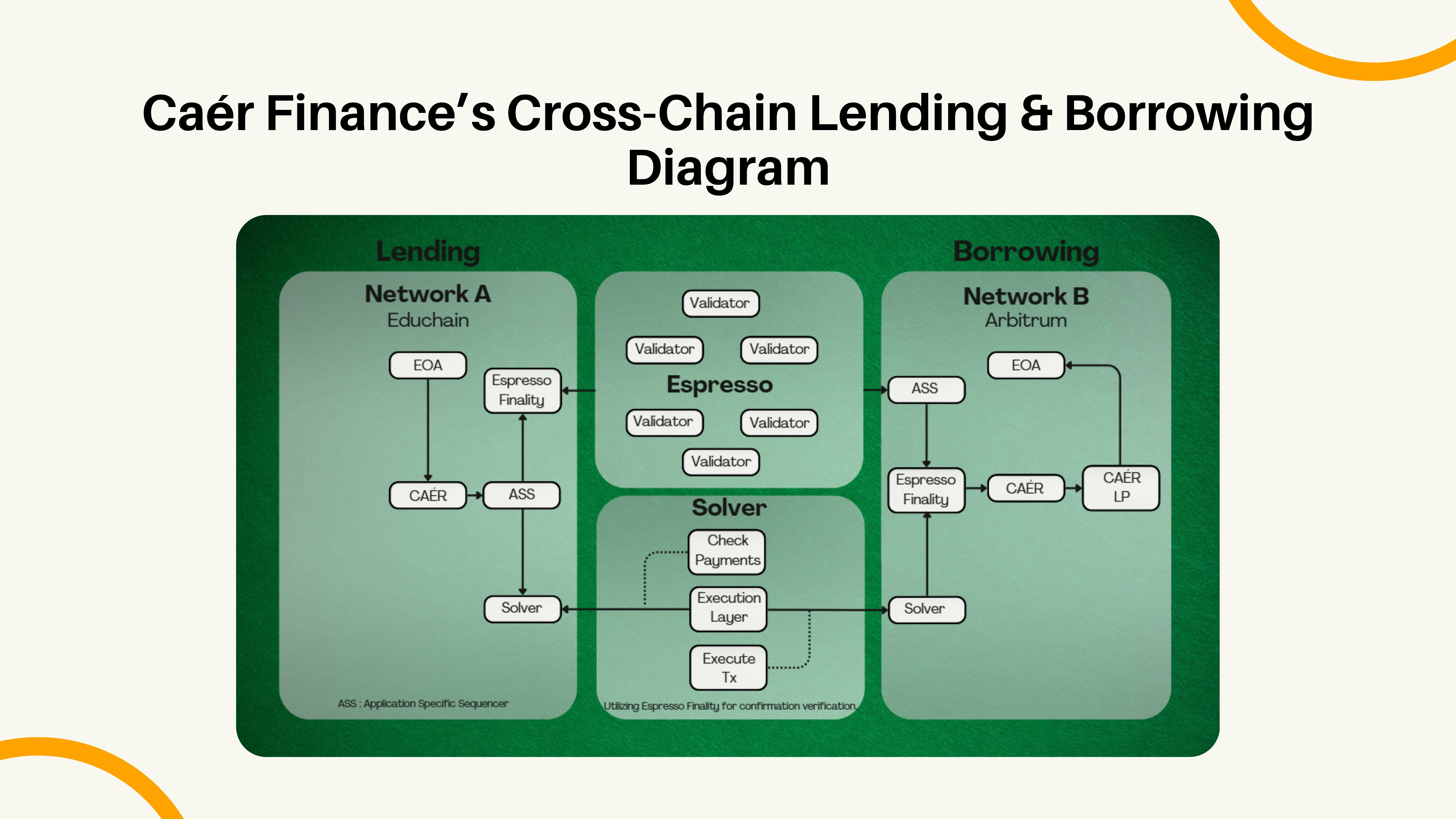

Caér Finance is a modular cross-chain lending and borrowing protocol on EduChain. Powered by ASS, it enables secure, fast, and trustless DeFi interactions across multiple blockchain networks.

Videos

Tech Stack

Description

Overview

Caér is a next-generation lending and borrowing protocol designed to enable seamless cross-chain interactions through Espresso integration. By leveraging Espresso's cutting-edge verification system, Caér ensures efficient, secure, and decentralized liquidity access across multiple blockchain ecosystems. With a sequencer and solver, Caér redefines decentralized finance by optimizing capital efficiency while maintaining a trustless execution model. The sequencer build on Application-Specific Sequencer (ASS) to verify, secure, and crosschain efficiency. Application-Specific Sequencer (ASS) purposes to make Caér’s crosschain lending protocol more faster, and secure.

Application-Specific Sequencer (ASS)

Caér uses an Application-Specific Sequencer (ASS) to verify data from the main or other chains, ensuring secure and efficient cross-chain lending. Unlike general-purpose sequencers, it is tailored to handle collateral verification, transaction processing, and seamless execution. By integrating Espresso’s finality, the sequencer guarantees instant confirmation and prevents unauthorized transactions. This approach enhances security, reduces delays, and optimizes cross-chain liquidity, making Caér’s lending model faster and more reliable.

How We Achieve Cross-chain Capability

To enable seamless cross-chain lending and borrowing in Caér, we utilize a structured process that ensures security and efficiency. Our system leverages the Application-Specific Sequencer (ASS), Espresso confirmations, and solvers to facilitate interactions across different chains. ASS plays a crucial role in verifying data across chains, ensuring valid transactions, and maintaining system integrity.

Below is an overview of our cross-chain lending mechanism:

The user deposits 1 WETH as collateral on Chain A.

The user initiates a request to borrow 100 USDC on Chain B.

ASS verifies the deposit on Chain A to ensure the user has sufficient collateral.

The ASS cross-checks the deposit status before approving the loan request.

The sequencer leverages Espresso confirmations to ensure transaction finality within sub-15 seconds.

Once confirmed, ASS generates a signature, verifying that the deposit exists and the loan request is valid.

The generated ASS signature is embedded into the transaction, enabling secure execution on Chain B.

The solver, upon receiving the verified ASS signature, releases 100 USDC to the user's address on Chain B.

By integrating ASS, Caér ensures trustless execution, fast transaction finality, and enhanced cross-chain security, making lending and borrowing seamless and reliable.

Note: For the purposes of this hackathon, we are using mock tokens to simulate transactions and interactions within the platform. Additionally, the platform is operating on a testnet environment.

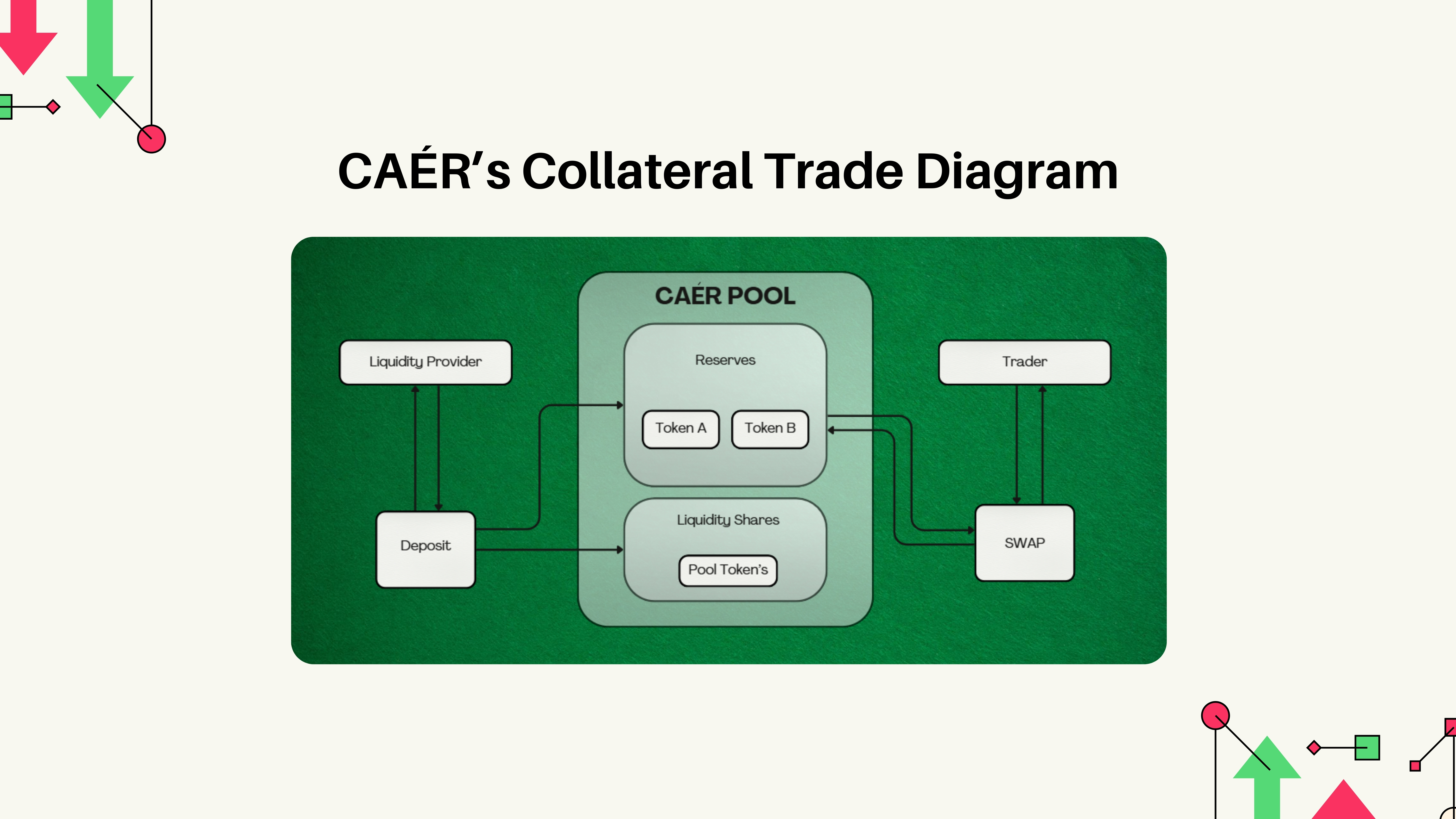

The Innovation that we bring to Educhain

User create trading position

Supply the collateral assets

Just go trade the collateral to prevent the liquidation with your strategy

Repay your debt using your active position

Note: For the purposes of this hackathon, we are using mock tokens to simulate transactions and interactions within the platform. Additionally, the platform is operating on a testnet environment.

Links

Presentation: Caér Finance Presentation

Repository: Caér Finance Github Repository

Documentation: Caér Finance Documentation

Website: Caér Finance Website

Demo Video: Caér Finance Demo Video

Pitch Video: Caér Finance Pitch Video

Get Faucets: Caér Finance Faucets