Permissionless Cross-Chain Lending & Borrowing Protocol via Chainlink CCIP

Welcome to Embacon Finance, a permissionless cross-chain lending and borrowing protocol seamlessly integrated with Chainlink CCIP, Chainlink Data Streams, and the MetaMask SDK. Embacon is built to address one of DeFi’s fundamental challenges: fragmented liquidity across blockchains. By leveraging Chainlink’s secure and reliable cross-chain infrastructure, Embacon allows users to deposit collateral on one chain and borrow assets on another without the need for centralized bridges, wrapped tokens, or custodial intermediaries.

At the core of Embacon’s cross-chain functionality is the Chainlink Cross-Chain Interoperability Protocol (CCIP), which enables secure and atomic messaging and token transfers between disparate blockchains using a burn-and-mint model. This architecture ensures consistency in asset supply across networks, minimizes trust assumptions, and unlocks capital efficiency across ecosystems.

In parallel, Chainlink Data Streams deliver sub-second, real-time price updates from aggregated and decentralized sources. This empowers Embacon to maintain accurate and dynamic collateral valuations, support real-time loan-to-value (LTV) tracking, and lay the foundation for future risk management features such as automated alerts, position health monitoring, and liquidation mechanisms.

To make these capabilities more accessible, Embacon integrates the MetaMask SDK, which enables seamless wallet connectivity across web, desktop, and mobile environments. Through this integration, users benefit from simplified wallet onboarding via MetaMask Extension, persistent and secure dApp sessions, and automated network switching that streamlines cross-chain interactions. Acting as a trusted gateway between users and Embacon’s smart contracts, the MetaMask SDK ensures that every cross-chain and collateral operation is executed in a secure, intuitive, and user-friendly environment.

Embacon Finance is a permissionless cross-chain lending protocol designed to enable users to lend, borrow, and manage collateral seamlessly across multiple blockchain networks. It introduces a novel approach to decentralized finance by removing the constraints of single-chain operations and enabling interoperable financial interactions.

The core mechanism behind Embacon is powered by Chainlink CCIP, which facilitates secure cross-chain communication using a burn-and-mint model. When a user deposits collateral on one chain and wishes to borrow on another, CCIP ensures that the transaction is executed atomically and trustlessly, without relying on centralized bridges or synthetic wrapped assets.

To support real-time valuation of collateral and borrowing positions, Embacon integrates Chainlink Data Streams, which deliver sub-second, high-frequency price data directly on-chain. This ensures that users always interact with up-to-date information when assessing their borrowing capacity or adjusting their collateral positions.

To further enhance accessibility and improve user experience across platforms, Embacon also integrates the MetaMask SDK. This integration enables:

Seamless wallet connectivity

Unified session management for persistent, secure dApp interactions

Cross-network detection and switching, simplifying complex cross-chain user flows

By using MetaMask SDK, Embacon ensures that users can easily sign transactions, approve collateral operations, and track their positions. All from the familiar MetaMask interface on any device.

In addition to its cross-chain capabilities, Embacon features a built-in collateral swap mechanism, allowing users to modify their collateral composition within the protocol without needing to exit or unwind their positions. This functionality provides enhanced flexibility in adapting to market conditions. To ensure accurate and up-to-date valuations during the swap process, Embacon again leverages Chainlink Data Streams, which deliver real-time pricing data from decentralized and aggregated sources. This integration helps preserve protocol integrity and ensures that collateral swaps are executed based on fair market values.

Embacon combines these elements into a unified, modular architecture that prioritizes security, precision, capital efficiency, and accessibility. Positioning it as a next-generation lending layer for the evolving multichain DeFi ecosystem.

Embacon Finance facilitates decentralized lending and borrowing across multiple blockchain networks without the need for centralized intermediaries or permissions. Users are able to supply collateral on one chain and borrow assets on another, enabling efficient cross-chain capital utilization. This open-access model promotes financial inclusion while maintaining full user custody and sovereignty over assets. Through the integration of MetaMask SDK, users benefit from a seamless and secure wallet connection experience across platforms. This allows for persistent sessions and frictionless signing of lending and borrowing transactions, simplifying user interaction with multi-chain DeFi operations.

Embacon Finance leverages the Chainlink Cross-Chain Interoperability Protocol (CCIP) to securely transmit data and token instructions across disparate blockchain environments using a burn-and-mint mechanism that ensures atomicity, supply consistency, and eliminates reliance on custodial bridges. This approach reduces systemic risk and enables a composable DeFi infrastructure across chains. Enhancing this flow, the integration of the MetaMask SDK automates wallet-network interaction handling, allowing users to interact with multiple blockchains seamlessly without manual network switching, while maintaining an intuitive and consistent experience when signing cross-chain intents.

To support precise risk management and informed borrowing decisions, Embacon integrates Chainlink Data Streams, delivering real-time, high-frequency pricing data from aggregated sources to enable accurate and dynamic loan-to-value (LTV) assessments, enhance user transparency, and lay the groundwork for future implementations of automated risk controls and liquidation mechanisms. Combined with the session persistence provided by the MetaMask SDK, Embacon ensures that users can continuously monitor their LTV positions and access up-to-date valuations without the need to repeatedly reauthorize or reconnect their wallets, resulting in a seamless and reliable DeFi experience.

Embacon Finance includes a native collateral swap feature that allows users to adjust their collateral within the protocol without closing existing positions, providing flexibility in managing market exposure and responding to price movements. To ensure accurate and fair execution, this swap mechanism integrates Chainlink Data Streams, which deliver real-time and reliable price data that reflect current market conditions. Enhanced by the MetaMask SDK, the collateral swap process becomes a streamlined and user-friendly workflow, where approvals, confirmations, and execution are synchronized within a consistent interface—minimizing friction and delivering a smooth DeFi experience.

Embacon Finance is a next-generation cross-chain lending protocol built with a focus on seamless user experience, accessibility, and secure interoperability. At the core of this experience is the MetaMask SDK, which empowers developers and users alike to interact with Embacon’s multi-chain features through persistent, secure wallet sessions and intuitive connection flows across platforms. By eliminating unnecessary friction in onboarding, transaction signing, and network switching, Embacon makes cross-chain DeFi interactions feel as seamless as single-chain ones.

We believe the future of DeFi lies in simplicity, accessibility, and open collaboration. With MetaMask SDK enabling effortless access and reliable wallet connectivity, Embacon provides a solid foundation for developers to build secure, user-friendly cross-chain financial applications.

We invite builders, contributors, and curious minds to collaborate with us. Whether you're integrating Embacon into your dApp, extending functionality, or helping shape the future of interoperable DeFi. Let’s create a world where capital flows freely across chains and users stay in full control, no matter where they are.

In building a permissionless cross-chain lending protocol, we identified the most pressing challenges in multichain DeFi and designed focused solutions through integrations that prioritize security, real-time data, and user accessibility, including with the MetaMask SDK.

Problem: DeFi users are often constrained by isolated liquidity pools on individual blockchains, limiting access to optimal borrowing or lending opportunities.

Embacon Finance's Solution: Embacon Finance solves this through secure cross-chain functionality powered by atomic messaging protocols, enabling users to deposit collateral on one chain and borrow on another without relying on centralized bridges or wrapped assets. This unlocks multichain capital access and improves capital efficiency across ecosystems. With the integration of the MetaMask SDK, users can interact with cross-chain features through a seamless and persistent wallet connection, removing the friction of managing multiple chains manually.

Problem: Traditional oracles often suffer from latency or low update frequency, resulting in outdated collateral pricing, miscalculated LTV ratios, and increased exposure to market volatility.

Embacon Finance's Solution: By integrating real-time price data feeds, Embacon ensures up-to-date collateral valuations and dynamic loan tracking, empowering users with accurate, real-time position insights. Combined with MetaMask SDK's session persistence, users receive these updates without needing to constantly reauthorize wallet access, maintaining a consistent and uninterrupted view of their loan health and exposure.

Problem: A significant number of lending platforms operate within closed ecosystems, relying on mechanisms such as whitelisting, centralized governance, or limited collateral support. These restrictions reduce accessibility, limit user autonomy, and compromise the principles of transparency and decentralization.

Embacon Finance's Solution: Embacon Finance is designed as a fully permissionless protocol, enabling any user to engage in lending or borrowing activities without the need for prior approval or reliance on centralized intermediaries. This open-access architecture fosters inclusivity, enhances transparency, and aligns with the core ethos of decentralized finance by supporting unrestricted global participation. MetaMask SDK integration reinforces this open design by allowing any user to connect instantly from supported platforms, without requiring complex configurations or centralized access control.

Problem: Other lending protocols require users to exit positions to adjust their collateral, incurring costs and friction during portfolio adjustments.

Embacon Finance's Solution: Embacon introduces a native in-protocol collateral swap mechanism, allowing users to seamlessly change their collateral type without closing positions. This feature is backed by real-time pricing infrastructure to ensure accurate valuations during the swap process. The experience is further streamlined through MetaMask SDK, which enables users to execute swaps, approvals, and confirmations through a unified interface, reducing friction and maintaining a smooth, responsive interaction flow.

Challenge: Implementing cross-chain functionality in DeFi often relies on custodial bridges or wrapped assets, which introduce significant security risks and systemic vulnerabilities. Embacon’s challenge was to deliver secure and verifiable cross-chain communication without compromising decentralization. While building on top of atomic messaging frameworks, Embacon had to ensure not only the integrity of token transfers but also the safe orchestration of protocol logic across multiple blockchain environments. This required careful handling of message validation, failure recovery, and trust minimization throughout the system. Additionally, ensuring that users could interact with these complex cross-chain operations securely and intuitively led to the integration of the MetaMask SDK, which played a key role in abstracting away the technical overhead of multi-network interaction, allowing users to focus on their intent rather than the underlying infrastructure.

Challenge: Other lending protocols may function with delayed price updates, but in a cross-chain setting, real-time valuation is essential. Embacon’s integration of real-time data infrastructure introduces challenges related to on-chain data consumption, synchronization across networks, and ensuring consistency during periods of volatility. These data feeds must be integrated in a way that balances responsiveness with gas efficiency. Moreover, to ensure that users can act on real-time information without interruption, Embacon relies on the MetaMask SDK to maintain persistent wallet sessions. Enabling seamless access to up-to-date borrowing limits and collateral health metrics, without forcing users to repeatedly reconnect or approve interactions across different networks.

Challenge: Relying on a single source of truth can expose lending protocols to manipulation or failure. Even when leveraging decentralized data aggregation, integrating real-time feeds into core protocol operations requires safeguards such as deviation thresholds, update throttling, and fallback logic. Embacon must ensure that external data, especially when used for critical functions like collateral evaluation or eligibility enforcement, does not become a vector for systemic failure. This challenge also extends to how users interact with sensitive data-driven processes. Through the MetaMask SDK, Embacon enhances user-facing reliability by reducing signature prompts and streamlining the UX around price-triggered events. Making data-heavy operations feel smoother and more transparent to end users.

Challenge: Running a lending protocol across chains introduces significant operational complexity. Embacon must account for chain-specific behaviors, execution timing, token standards, and fluctuating gas costs. Managing processes like token burning, message confirmation, and minting across heterogeneous environments requires precise coordination and extensive testing. Furthermore, maintaining a consistent user experience across chains is nontrivial. By leveraging the MetaMask SDK, Embacon ensures that users don’t have to manually switch networks or troubleshoot connection issues across environments. This abstraction enables the protocol to focus on cross-chain logic while the SDK handles network detection, session management, and secure access. All contributing to a more unified and frictionless user journey.

Embacon Finance achieves secure and verifiable cross-chain lending by leveraging Chainlink’s Cross-Chain Interoperability Protocol (CCIP) to facilitate communication and token transfer between blockchain networks. The protocol enables users to deposit collateral on one chain and borrow stablecoins on another without relying on centralized bridges or wrapped assets by utilizing a secure burn-and-mint mechanism.

In our current architecture, as illustrated:

On the Source Chain (Arbitrum Sepolia), users deposit collateral (e.g., MockWETH) into the Embacon Liquidity Pool. The deposited tokens are handled by BasicTokenSender.sol, which interacts with the Chainlink CCIP Router. This Router prepares a cross-chain message, processes transaction fees (in LINK or Native Gas Token), and initiates a burn operation of the deposited tokens, removing them from circulation and preventing supply duplication.

The burn-and-mint method, native to Chainlink CCIP’s token pool mechanism, ensures that tokens exist on only one chain at any time. The burn event is cryptographically verified and transmitted by Chainlink’s decentralized oracle network (DON), forming a secure proof of collateral transfer.

Once received on the Destination Chain (Base Sepolia), the corresponding CCIP Router invokes the LendingPool.sol contract. This contract verifies the message and proof, and accordingly credits the user with the right to borrow stablecoins (e.g., MockUSDC), which are minted or released from liquidity on the destination chain.

Both MockWETH and MockUSDC are continuously priced using Chainlink Data Streams, a low-latency oracle feed that ensures accurate and high-frequency pricing. These feeds are crucial for determining borrowing capacity, monitoring risk exposure, and enabling dynamic collateral swap logic within the protocol.

By combining CCIP and Data Streams, Embacon Finance unlocks native cross-chain borrowing with high levels of security, precision, and capital efficiency without relying on wrapped tokens or centralized liquidity hubs. This positions Embacon as a modular, interoperable DeFi primitive ready to scale across blockchain ecosystems.

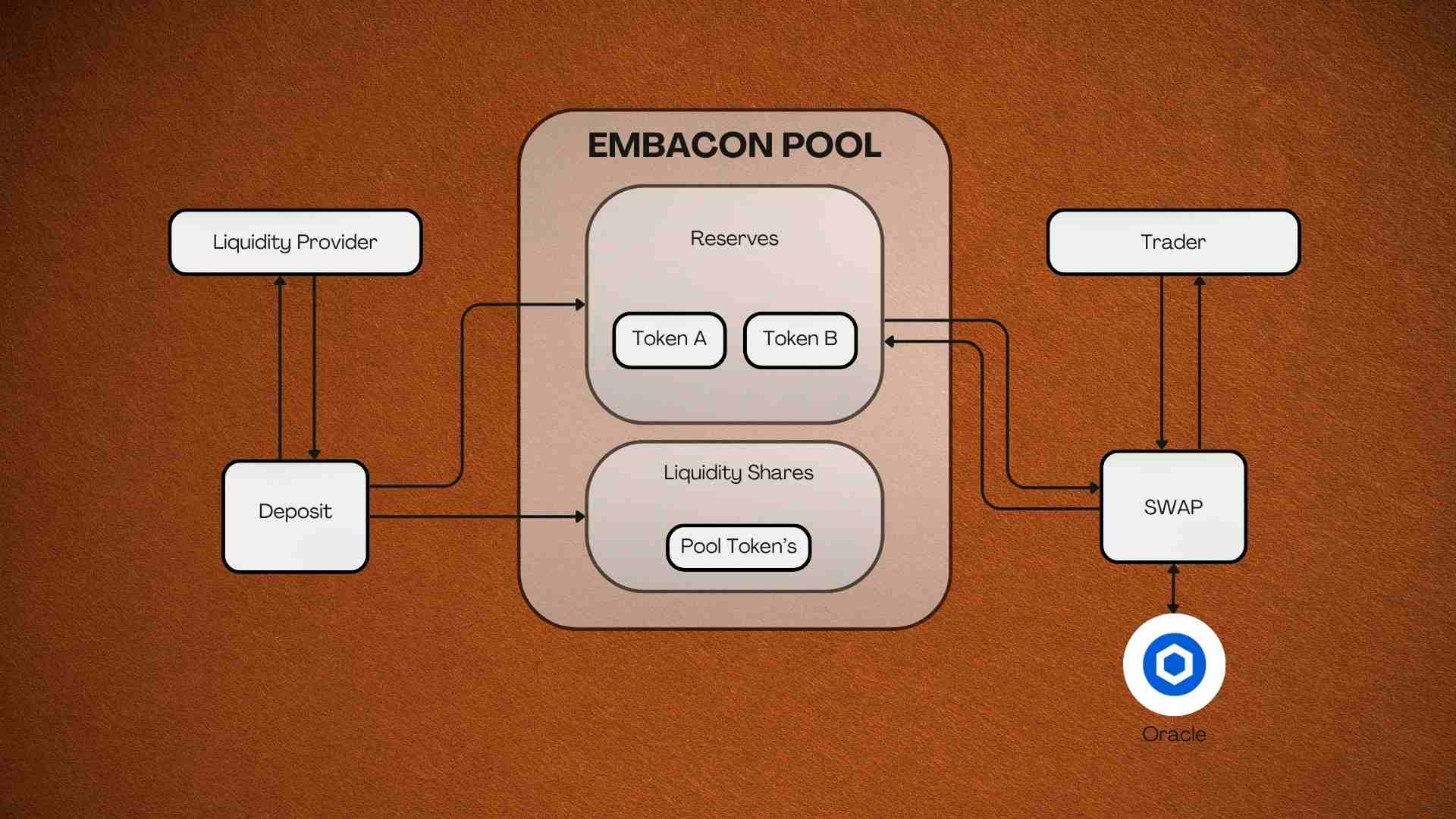

Embacon Finance incorporates a purpose-built collateral swap mechanism that enables users to modify their collateral composition directly within the protocol without exiting lending or borrowing positions. Inspired by the architecture of Automated Market Makers (AMM), the system is tightly integrated into the Embacon Pool to facilitate real-time, on-chain token exchange with minimal friction.

Liquidity Providers (LPs) contribute token pairs such as Token A and Token B into the Embacon Pool, which serves as the central liquidity reserve for swap operations. In return, LPs receive Pool Tokens, representing their proportional ownership and entitling them to a share of the accrued transaction fees from swaps.

The Embacon Pool maintains segregated reserves for each token and continuously adjusts these balances as swaps are executed.

Only users with active lending or borrowing positions are permitted to access the swap functionality. This requirement ensures that all swap operations are tied directly to collateral management, thereby improving capital efficiency and reducing unnecessary speculative activity.

When a user initiates a swap, such as swapping Token A for Token B, the swap logic references current reserve ratios and applies an AMM pricing formula (e.g., constant product model) to calculate the output amount. The system also integrates with Chainlink Data Streams to fetch real-time price references, ensuring fair execution and slippage protection.

To maintain accurate valuation of the swapped collateral, Embacon utilizes Chainlink Oracles. These oracles deliver tamper-proof, real-time price feeds for all supported tokens, ensuring that each swap maintains alignment with market value. This is critical for maintaining healthy collateralization ratios and reducing systemic risk across lending positions.

Each swap transaction incurs a small liquidity fee, which is distributed among active LPs based on their share of the pool. This fee structure incentivizes continued liquidity provision and supports the long-term sustainability of the swap module.

Two core Chainlink services, CCIP (Cross-Chain Interoperability Protocol) and Data Streams, form the foundation of Embacon’s decentralized architecture.

Chainlink CCIP: Secure Cross-Chain Messaging To support native cross-chain lending and borrowing, Embacon integrates Chainlink CCIP, a generalized interoperability protocol that enables smart contracts on different chains to securely communicate and transfer data When a user deposits collateral on a source chain (e.g., Avalanche Fuji) and initiates a borrow on a destination chain (e.g., Arbitrum Sepolia), CCIP executes a burn-and-mint mechanism. The token is burned on the origin chain, and a CCIP Router relays a cryptographically verifiable message to the destination chain. Upon verification, equivalent value is minted or registered, enabling the borrow transaction without reliance on centralized bridges or wrapped assets.

Chainlink Data Streams: Real-Time Price Feeds In addition to cross-chain messaging, Embacon uses Chainlink Data Streams to power its real-time pricing and risk assessment infrastructure. Data Streams provide high-frequency, low-latency market data sourced from multiple institutional-grade providers and updated directly on-chain. This integration enables Embacon to:

Monitor collateral valuation with sub-second latency Perform accurate borrowing limit calculations (e.g., LTV (Loan-to-Value)) Support collateral swap operations with live price validation Mitigate manipulation through multi-source aggregation Maintain transparency and determinism for all economic actions

By combining CCIP and Data Streams, Embacon achieves a robust and composable infrastructure for permissionless lending across chains. The synergy of these technologies ensures users enjoy a seamless, secure, and real-time DeFi experience without sacrificing decentralization, speed, or integrity.

Ethereum Sepolia

Chain ID: 11155111

Contracts:

Lending Pool: (Not yet deployed)

Factory: (Not yet deployed)

Position: (Not yet deployed)

Block Explorer: https://sepolia.etherscan.io

Destination ID: 0

Avalanche Fuji

Chain ID: 43113

Contracts:

Lending Pool: 0xe10e79324c133DA09426972c9401b503a7b48186

Factory: 0x694B5A70f83062308aa60ecf12074Bc8f694612d

Position: 0x9ee9F9158b872fe812C3F2204588dfc8b0FC4Eda

Block Explorer: https://testnet.snowtrace.io

Destination ID: 1

Arbitrum Sepolia

Chain ID: 421614

Contracts:

Lending Pool: 0x19b0b0F7895BFf7D32b0b6f0239EB76787BC4963

Factory: 0x0128FA2b8254359A3493AC9782059F7bb3508AA4

Position: 0x1D8aF8e5925397a4977734b4CeeA4bA1F526E69C

Block Explorer: https://sepolia.arbiscan.io

Destination ID: 2

Base Sepolia

Chain ID: 84532

Contracts:

Lending Pool: (Not yet deployed)

Factory: (Not yet deployed)

Position: (Not yet deployed)

Block Explorer: https://sepolia.basescan.org

Destination ID: 3

WETH

Addresses:

Ethereum Sepolia (11155111): 0x89d3acb10fc9f9bee444c05e1363e514e8a748da

Avalanche Fuji (43113): 0x63CFd5c58332c38d89B231feDB5922f5817DF180

Arbitrum Sepolia (421614): 0xCC1A31502Bd096d7AAdEBE25670ebe634671aD31

Base Sepolia (84532): 0x2769a1ce97cc2d21e3723ee986b29173de3fe4ac

Price Feeds:

Ethereum Sepolia (11155111): 0x86d67c3D38D2bCeE722E601025C25a575021c6EA

Avalanche Fuji (43113): 0x86d67c3D38D2bCeE722E601025C25a575021c6EA

Arbitrum Sepolia (421614): 0xd30e2101a97dcbAeBCBC04F14C3f624E67A35165

Base Sepolia (84532): 0x86d67c3D38D2bCeE722E601025C25a575021c6EA

WBTC

Addresses:

Ethereum Sepolia (11155111): 0xbe4d4858eb0849b038a0b5ecd38a7599d73bd923

Avalanche Fuji (43113): 0xa7A93C5F0691a5582BAB12C0dE7081C499aECE7f

Arbitrum Sepolia (421614): 0x773D46F1Ad10110459D84535A664B59Ae98CAC7E

Base Sepolia (84532): 0x548c22d340eb79915316f01e45b4133203a24e90

Price Feeds:

Ethereum Sepolia (11155111): 0x86d67c3D38D2bCeE722E601025C25a575021c6EA

Avalanche Fuji (43113): 0x86d67c3D38D2bCeE722E601025C25a575021c6EA

Arbitrum Sepolia (421614): 0x56a43EB56Da12C0dc1D972ACb089c06a5dEF8e69

Base Sepolia (84532): 0x86d67c3D38D2bCeE722E601025C25a575021c6EA

WAVAX

Addresses:

Ethereum Sepolia (11155111): 0x4314bb3ad93206ee8f7f18dbcc49943366503bbf

Avalanche Fuji (43113): 0xA61Eb0D33B5d69DC0D0CE25058785796296b1FBd

Arbitrum Sepolia (421614): 0x9b9d709ACAB5c4C784a7ADce5530ce8b98FcD662

Base Sepolia (84532): 0x322b3326b5f7de4abd7554f6a32217825770fd41

Price Feeds:

Ethereum Sepolia (11155111): 0x86d67c3D38D2bCeE722E601025C25a575021c6EA

Avalanche Fuji (43113): 0x86d67c3D38D2bCeE722E601025C25a575021c6EA

Arbitrum Sepolia (421614): 0xe27498c9Cc8541033F265E63c8C29A97CfF9aC6D

Base Sepolia (84532): 0x86d67c3D38D2bCeE722E601025C25a575021c6EA

USDC

Addresses:

Ethereum Sepolia (11155111): 0xab0c196dba12297e4c5b9a414013230a527b4a4b

Avalanche Fuji (43113): 0xC014F158EbADce5a8e31f634c0eb062Ce8CDaeFe

Arbitrum Sepolia (421614): 0xEB7262b444F450178D25A5690F49bE8E2Fe5A178

Base Sepolia (84532): 0xcba01c75d035ca98ffc7710dae710435ca53c03c

Price Feeds:

Ethereum Sepolia (11155111): 0x86d67c3D38D2bCeE722E601025C25a575021c6EA

Avalanche Fuji (43113): 0x86d67c3D38D2bCeE722E601025C25a575021c6EA

Arbitrum Sepolia (421614): 0x0153002d20B96532C639313c2d54c3dA09109309

Base Sepolia (84532): 0x86d67c3D38D2bCeE722E601025C25a575021c6EA

USDT

Addresses:

Ethereum Sepolia (11155111): 0xe8add858b8a2f6e41d67008a58058010b9c0ba04

Avalanche Fuji (43113): 0x1E713E704336094585c3e8228d5A8d82684e4Fb0

Arbitrum Sepolia (421614): 0x02d811A7959994e4861781bC65c58813D4678949

Base Sepolia (84532): 0x49f82b20894e6a1e66238fb50278ac60b57676ee

Price Feeds:

Ethereum Sepolia (11155111): 0x86d67c3D38D2bCeE722E601025C25a575021c6EA

Avalanche Fuji (43113): 0x86d67c3D38D2bCeE722E601025C25a575021c6EA

Arbitrum Sepolia (421614): 0x80EDee6f667eCc9f63a0a6f55578F870651f06A4

Base Sepolia (84532): 0x86d67c3D38D2bCeE722E601025C25a575021c6EA

These tokens are used for cross-chain lending, borrowing, and collateral swaps on testnet chains (Ethereum Sepolia, Avalanche Fuji, Arbitrum Sepolia, Base Sepolia). Chainlink price feeds ensure accurate, real-time valuation for collateral management, LTV calculations, and swaps, enabling a secure and efficient cross-chain DeFi ecosystem.

🌐 Website: https://embacon-fnance.vercel.app/

🏢 Organization: https://github.com/ahmadstiff/embacon-finance

Demo Video https://www.youtube.com

100%

-