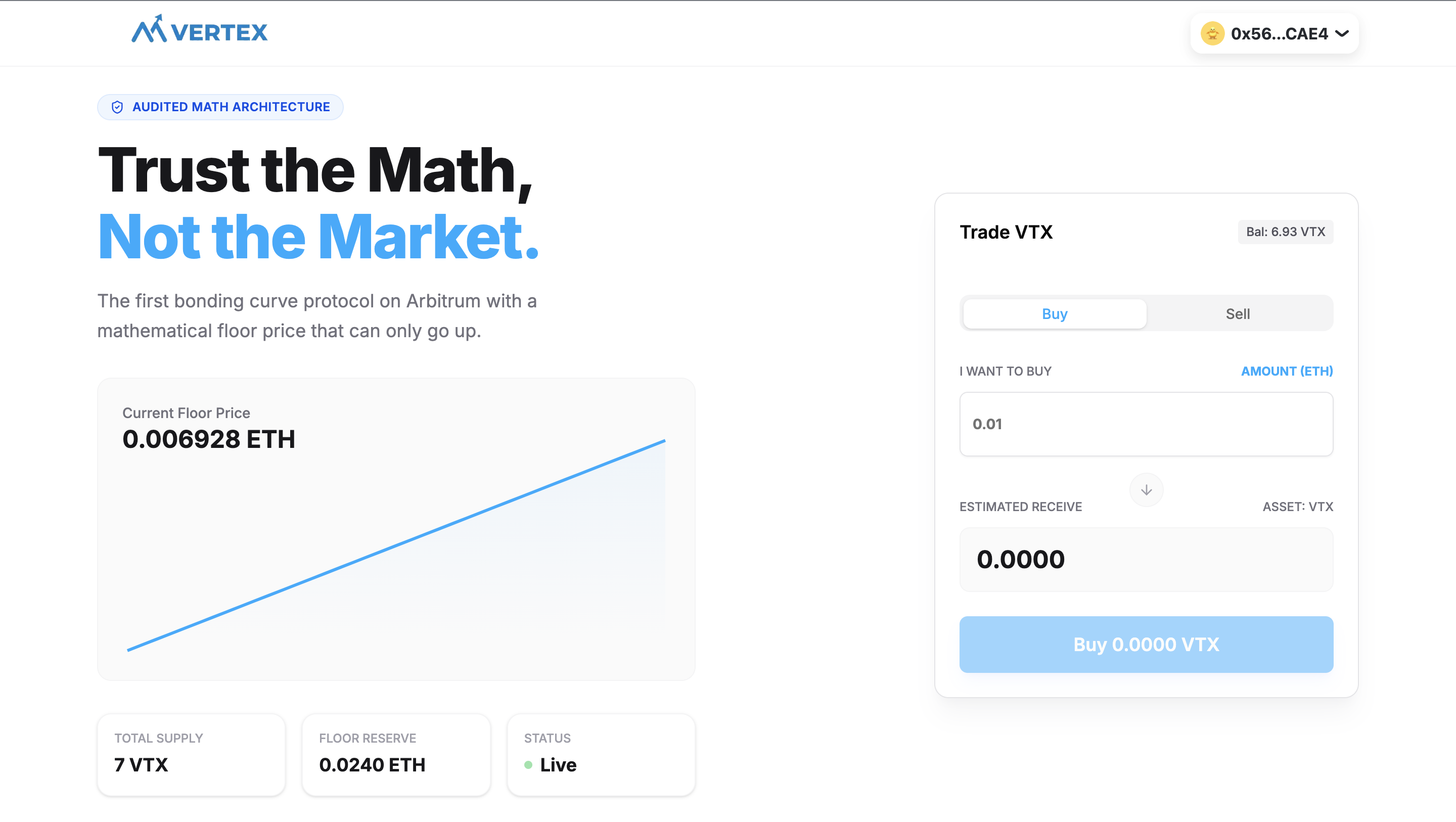

A capital-protection protocol built on Arbitrum. VERTEX uses math-based reserves to lock in a rising floor price, offering users a safer way to hold assets on-chain.

Vertex is a bonding‑curve protocol on Arbitrum that provides always‑available on‑chain liquidity and a mathematically enforced rising price floor. Pricing is deterministic and transparent, derived from an on‑chain curve rather than an order book, so users can verify and predict execution.

Problem Statement

Community tokens and early‑stage projects often face two fundamental issues:

1. Thin liquidity, making prices easy to manipulate and trades unreliable.

2. No credible floor, which undermines trust because the price can collapse to zero.

What Vertex Solves

Vertex addresses these problems with:

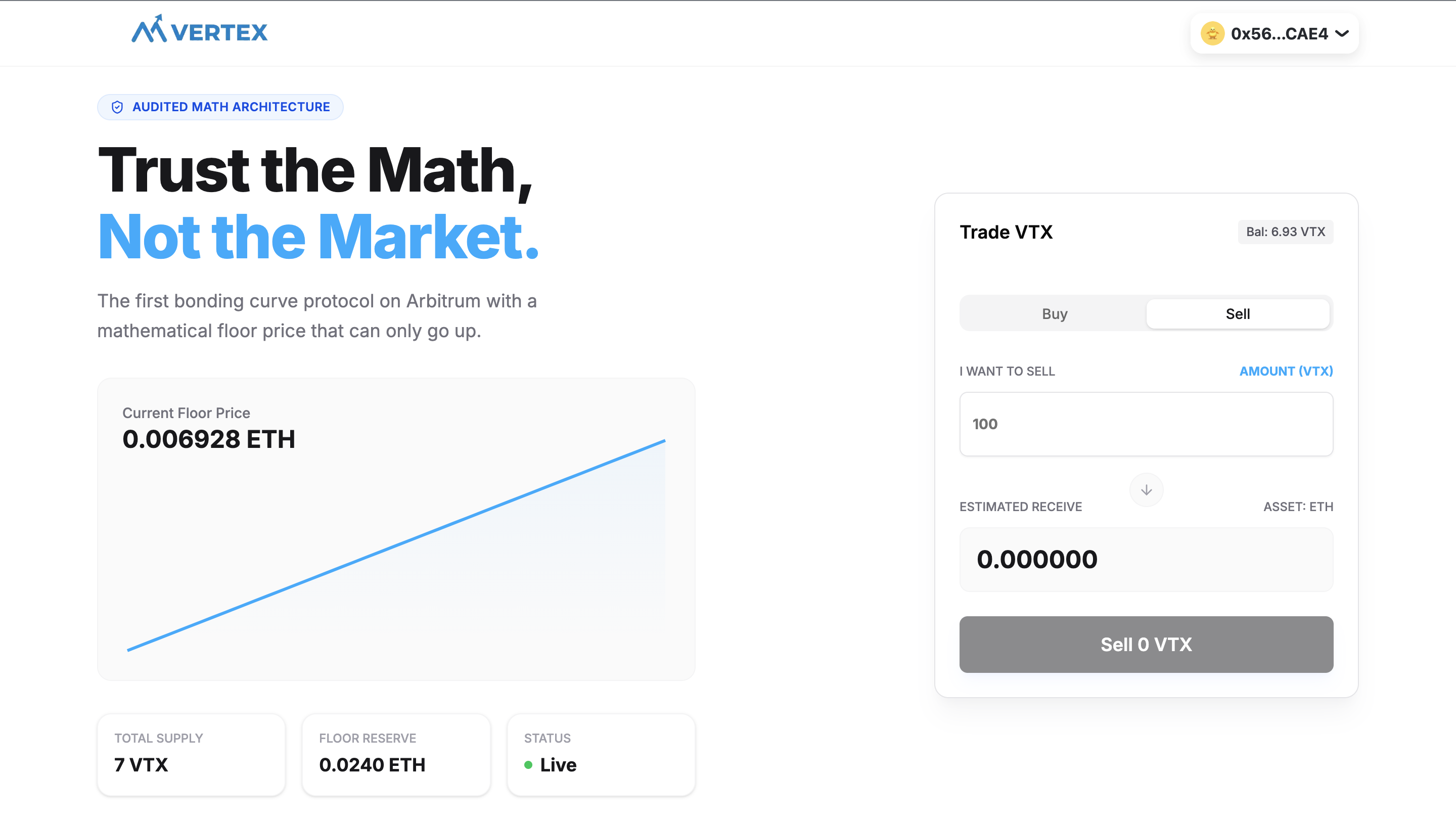

- Always‑on liquidity: buy and sell are always available via the bonding curve.

- Transparent pricing: the curve defines price deterministically on‑chain.

- Rising floor reserve: a portion of fees accrues to reserves, driving the floor price upward over time.

- Simple UX: users enter ETH/VTX, get a quote, and execute without manual order management.