Vine Finance is a decentralized, modular revenue strategy protocol.

👋Intro

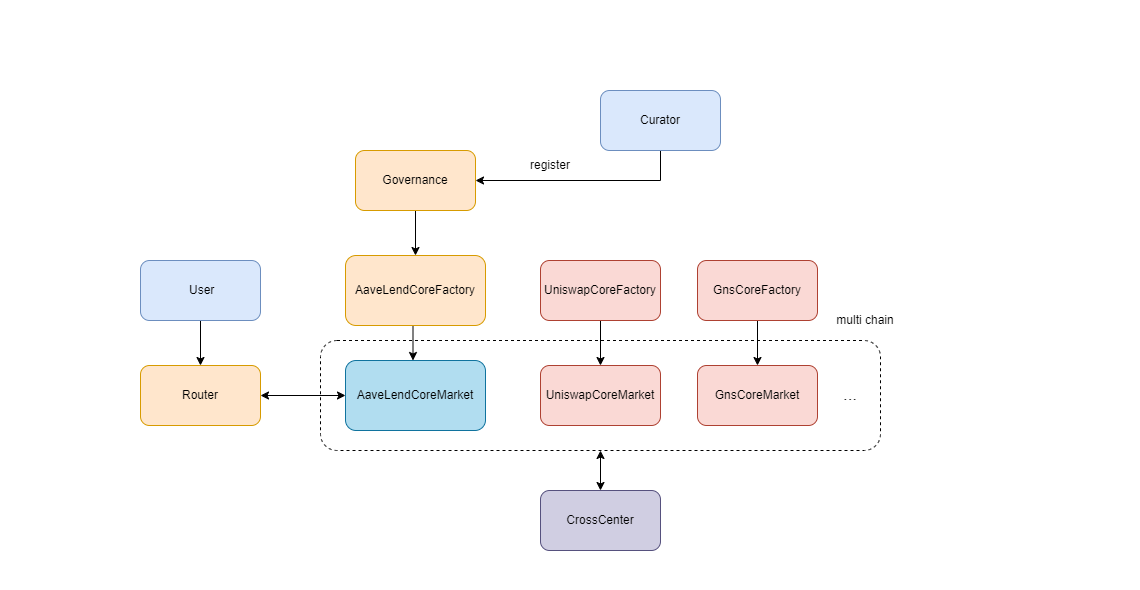

Vine finance is an innovative modular DeFi revenue protocol that enables seamless integration with multiple DeFi protocols on different blockchains through powerful cross-chain technology. In the EVM ecosystem, Vine supports deep docking with mainstream Defi protocols such as Aave V3, Compound, Uniswap V3, Uniswap V2, Morpho, Gains, and Aerodrome. In the Solana ecosystem, it integrates with premium protocols such as Raydium, Jup and Kamino; In the Move ecosystem, compatibility with protocols such as Cetus and Navi is supported.

The unique strength of Vine finance is that it empowers users with flexibility and creativity. Users can create a personalized investment strategy based on their own needs, or choose to follow the curator's strategy mix. With facilities that support cross-chain communication, users can capture higher returns on other chains on a single chain without having to migrate assets to other chains, significantly increasing the efficiency of capital utilization.

🧐Why use vine?

There are already thousands of chains on the blockchain, but chains are independent of each other, resulting in a large amount of capital dispersion, and many of these funds are used in Defi. For example: Aave V3, ordinary users want to go to Defi pledge farming, but because there are different chains of Aave V3, and these funds are not interworking, the benefits between different chains are different, which causes users want to deposit into the protocol, but can not get the high-yield part of the protocol, especially on the Ethereum main network. The dreaded high Gas prices are terrifying to the average retail investor. If a user goes through Vine, then he can capture, for example, Ethereum's current highest pledge yield on a cheap layer2.

🙋Become a curator

Users can register as a curator directly through Vine's Governance and then choose trusted factory modules to create their own policies.

function register( uint16 _feeRate, uint64 _bufferTime, uint64 _endTime, address _feeReceiver ) external;⚙️Vine Infrastructure

🎉🎉🎉Demo

Test account private key: 0x77724b3384c67fa4ee3d02c83be254d85dd3e5b4f50c5bde0ced8ce4dc741857

Live demo:

https://www.vinefinance.net/lend

🧙♂️Deploy contracts

//Arbitrum Sepolia

Governance: 0x7fdF06F59a4Fa429c0Cee56d7009624bdF396f90

CrossCenter: 0xEc2D417D61bAf83e2244b3d58b76d1C882368507

VineAaveV3LendMainFactory: 0x4d354C90651B07Be872fC0205AA4D1CD7630e2e5

VineRouter: 0x33FeCACBcd38C2D87DFA5c77Ac3656464e69eDD9

Market0: 0xAe6271f75b159e00203A8b9f97Dc3E3812d19468

Market1: 0xD860F06364B112e40a012518c8591F21b216AB32

//Op Sepolia

VineHookCenter: 0x88105C02c8c803032D0092aD48373324d0559d48

CrossCenter: 0xcA43aA3b5d882840368d1e299f9B6d6eCD8fe443

VineInL2LendFactory: 0x83527e33C2F7D13DeBe578Ff0C926b121c46c7dc

Market0: 0xd409d1De3c77f00781bbD1546e2B4a922E75b83F

Market1: 0x614aa77CFA407fc9a11e8A1eF425aA6B99a3824D

//Base Sepolia

VineHookCenter: 0xE3940D2eeeb6920DB9565c4E3c5944888Ca93eab

CrossCenter: 0x210B1A76Ded6efA2846D85E91C0D67C439EfE811

VineInL2LendFactory: 0x0db31d955A6e6DB2F35BF5f27C5D913CdF3E6e4C

Market0: 0x44fa87860fAc0866eCb228677a07a7143E9ad003

Market1: 0xfE481a07148a5B8Ed745efbb05515E31fe72ce8A

//Sepolia

VineHookCenter: 0xAa98C14031AF07647547bE1c7A24715EF0784472

CrossCenter: 0x08F7e93ac2EE0508D59d9fd176a5b7Cb06D93948

VineInETHLendFactory: 0x50e8480F2Ca26371378F14673085D36730003600

Market0: 0xA4d26e3adC27DC96d0cfA1a7295b5cFE1B13A963

Market1: 0x748E01fCDF1A5010ee069FE069E3F81914f875FC