pump.fun for IP assets

Introducing, whip.finance - pump.fun for Story Protocol.

Crypto degens might be annoying, but there is an undeniable truth: They bring volume. So we took one problem, and taped it with high-volume trading.

Everybody wants to earn something, especially if they have created any form of media (art, music, book, etc.). But this is not always the case.

whip.finance gives you a second chance to turn your assets into passive revenue by making it tradable on a degen marketplace.

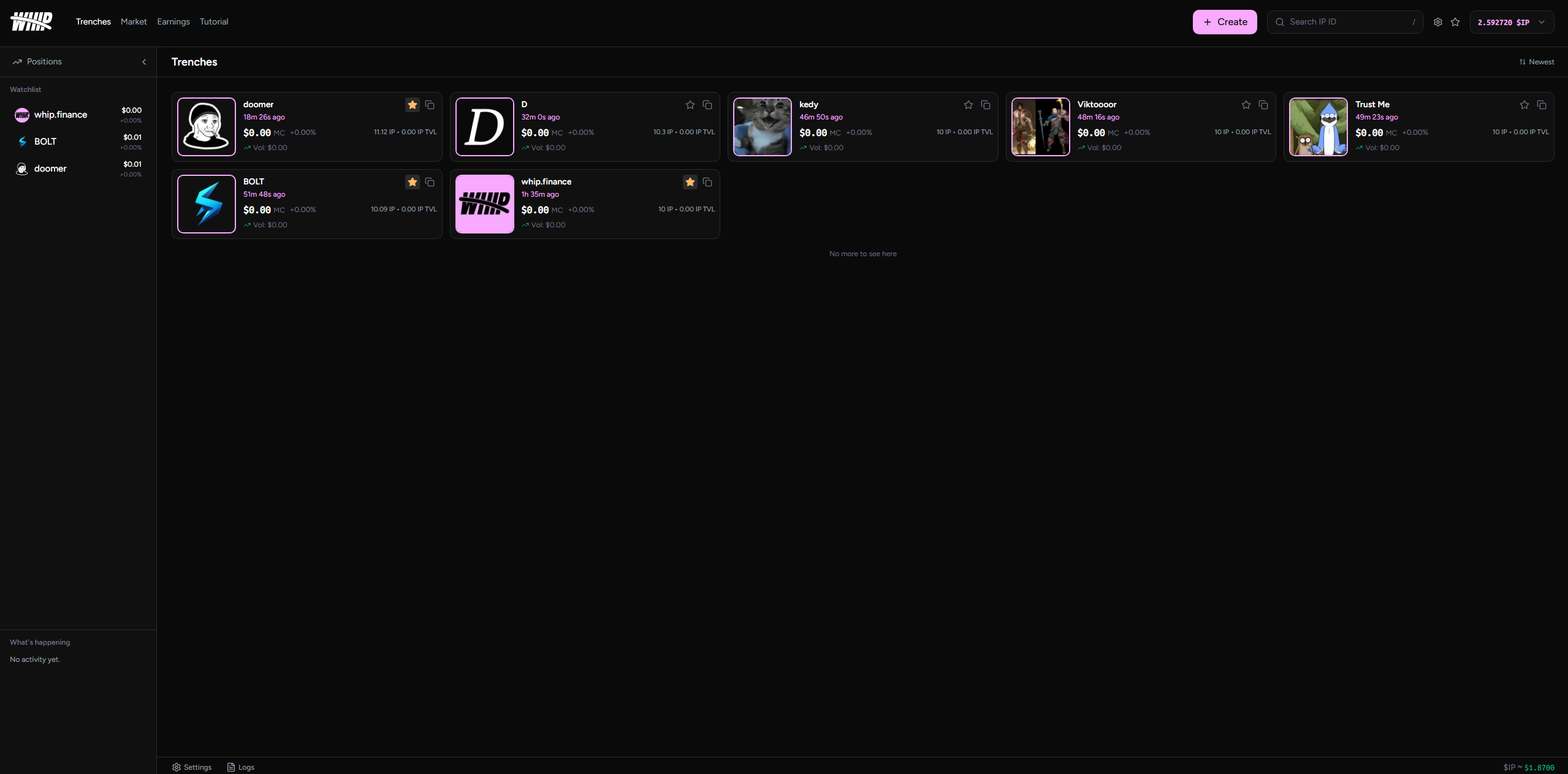

This is whip.finance — the first decentralized marketplace where any IP can launch its own market, and creators finally earn from the attention they generate.

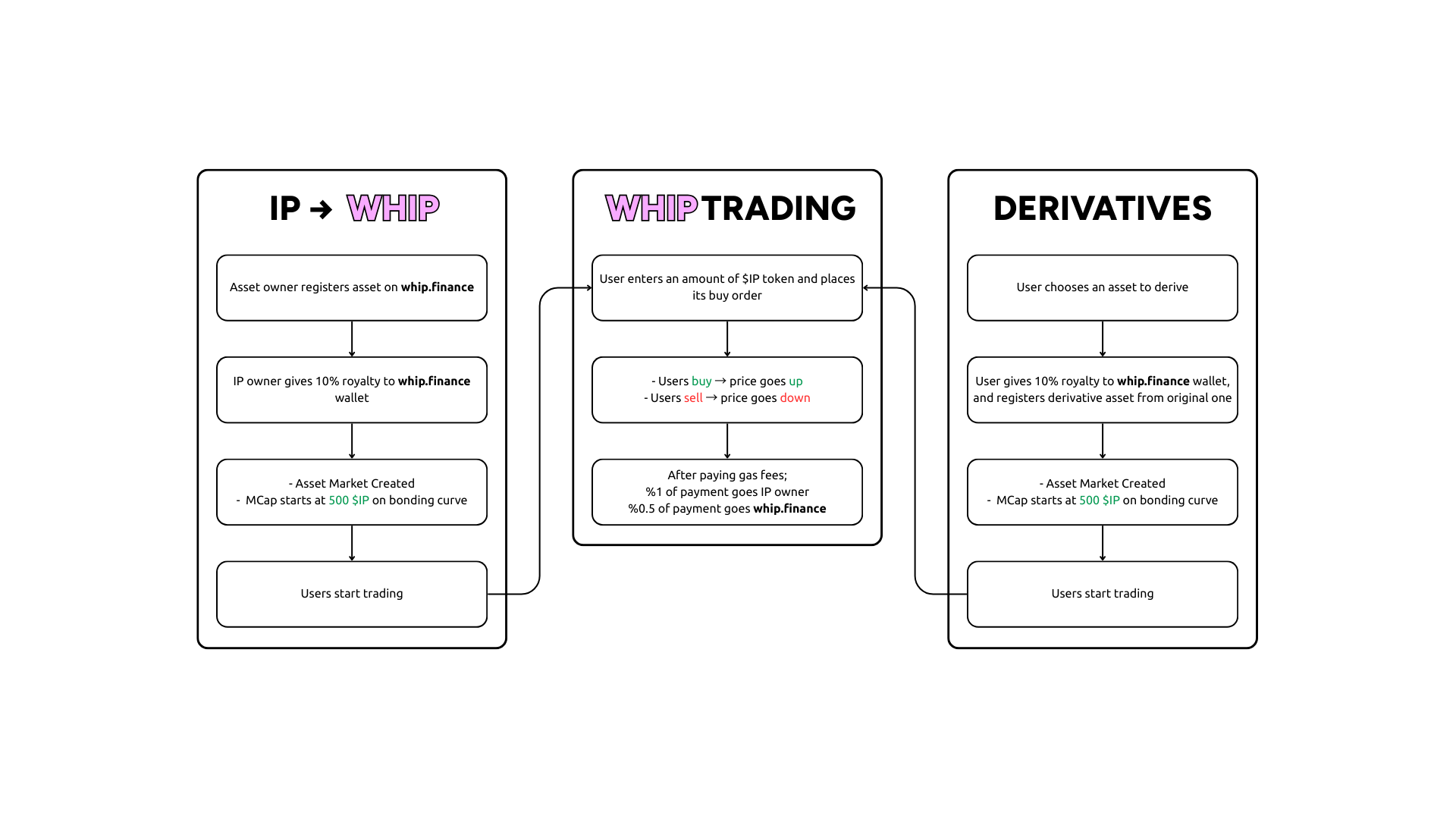

Let's break whip.finance down in simple words, then explain it in a more technical sense.

Story Protocol has on-chain IP assets. Fundamentally, these assets are NFTs.

Each IP Asset is an on-chain ERC-721 NFT

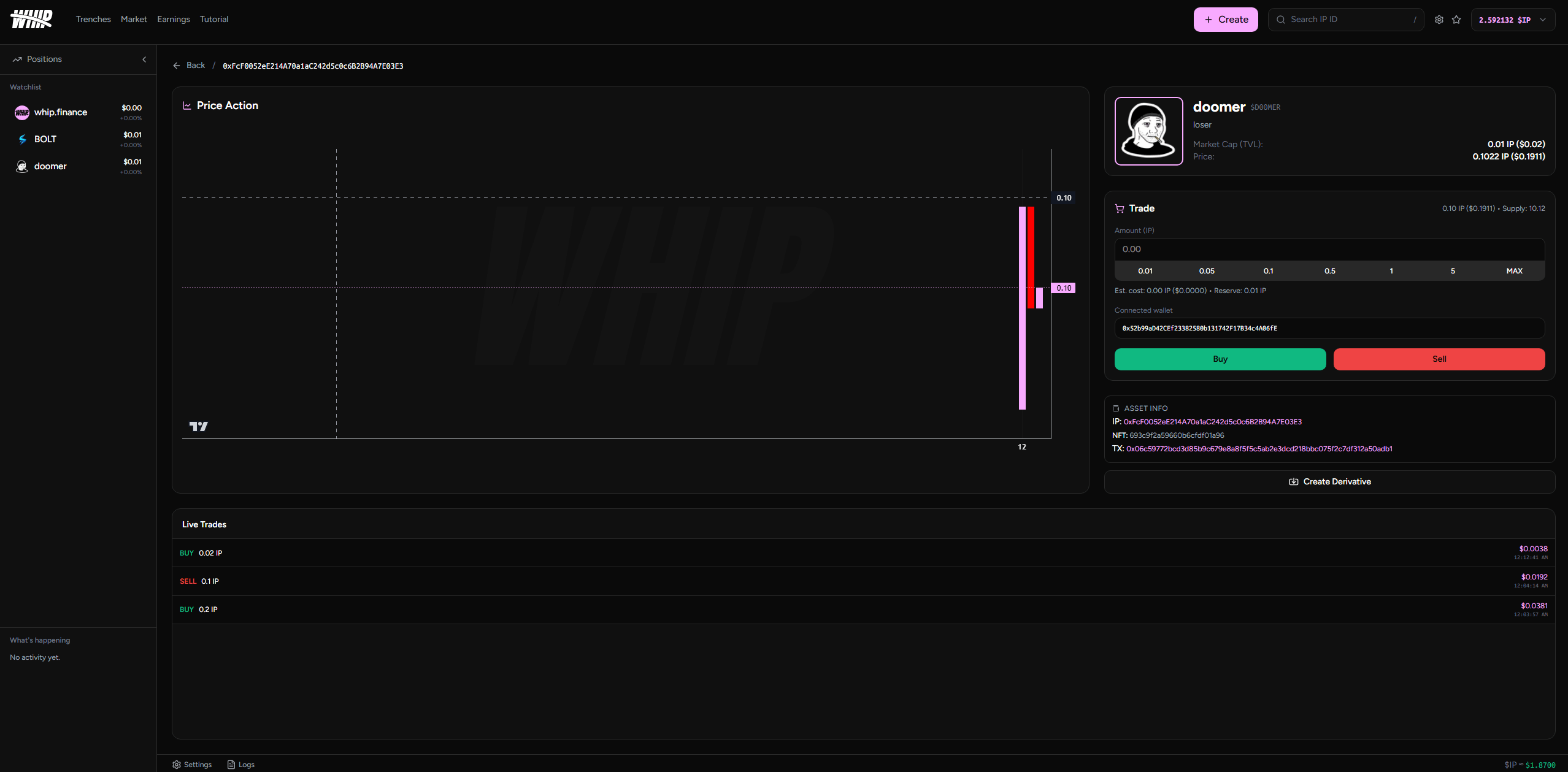

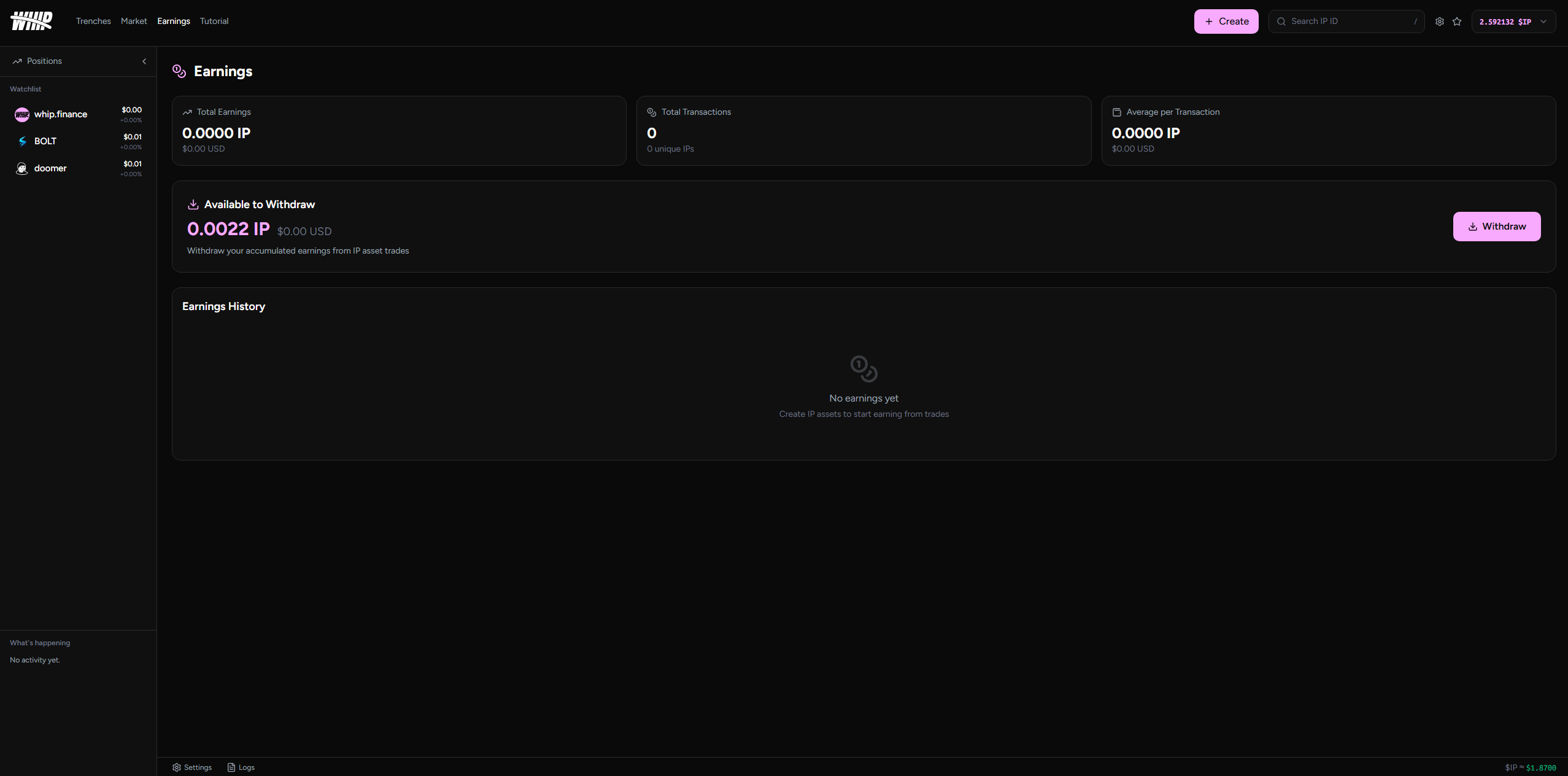

We let users register their assets on the platform, and a market (or a trench) is created for it. Now it is tradable. "What's the motivation?" you may ask. IP owners who register their assets on whip.finance earns 1% from the total volume. This is an insane revenue opportunity. And they don't even have to lock or transfer their assets.

If you are an asset owner, you can create a derivative based on your original asset. Then it will be tradable.

If you don't own an asset, you can mint an NFT and register with just one click!

Every trade action (buy/sell) is a smart contract call. There are 2 smart contracts deployed on the Aeneid network at the moment:

Vault.sol - 0x30afd90FA0A2EFdd627e587d44a86B308B4c97a3

Earnings.sol - 0xa7A4Cad1d48159DE6cA87DE64E7B5D02Cfad128f

Vault contract is responsible for holding a record of trades, and forwarding fees to the Earnings contract. The earnings contract is responsible for storing the fee earnings of the platform and the IP owners.

Example: Supply is currently 50 tokens

Calculate cost:

Cost = ∫ from 50 to 51 of (0.001 + 0.01×s) ds

Cost ≈ 0.505 IP

You pay for the area under the curve, not just the endpoint price.

Fee deductions:

IP Creator fee: 1% -> 0.00505 IP

Protocol fee: 0.5% → 0.002525 IP

To vault reserve: 0.497425 IP

Supply increases: 50 → 51 tokens

New price: 0.501 IP → 0.511 IP

Market Cap (TVL): Reserve = 0.497 IP

Watchlist for your favorite assets

2 types of asset registration

Real-time data update

Low initial market cap for more volatile markets

No registration, no KYC. Completely decentralized

We have a lot to do

Verified marketplace for assets that exceed the threshold market cap.

Easier asset creation & registration

Live on Mainnet

Go to whip.finance now and test by yourself!