A fully decentralized trading platform built on pharos, enabling spot and perpetual markets for trading crypto, stocks, forex, bonds, ETFs, commodities, & other RWAs using a fully on-chain CLOB model.

Omniliquid is a fully decentralized trading platform built on Pharos, enabling spot and perpetual markets for a wide range of assets including cryptocurrencies, stocks, forex, bonds, ETFs, commodities, and other real-world assets (RWAs). It utilizes a 100% on-chain Central Limit Order Book (CLOB) model for transparent and efficient price discovery.

Multi-Asset Support: Trade crypto, stocks, forex, commodities, and RWAs in a single platform

Spot & Perpetual Trading: Both spot markets and perpetual futures with funding rates

On-Chain Order Book: Fully transparent CLOB model with efficient matching

Cross-Margin Trading: Efficient capital utilization across different positions

Advanced Risk Management: Sophisticated liquidation and insurance systems

Synthetic Assets: Trade synthetic versions of any asset without requiring custody

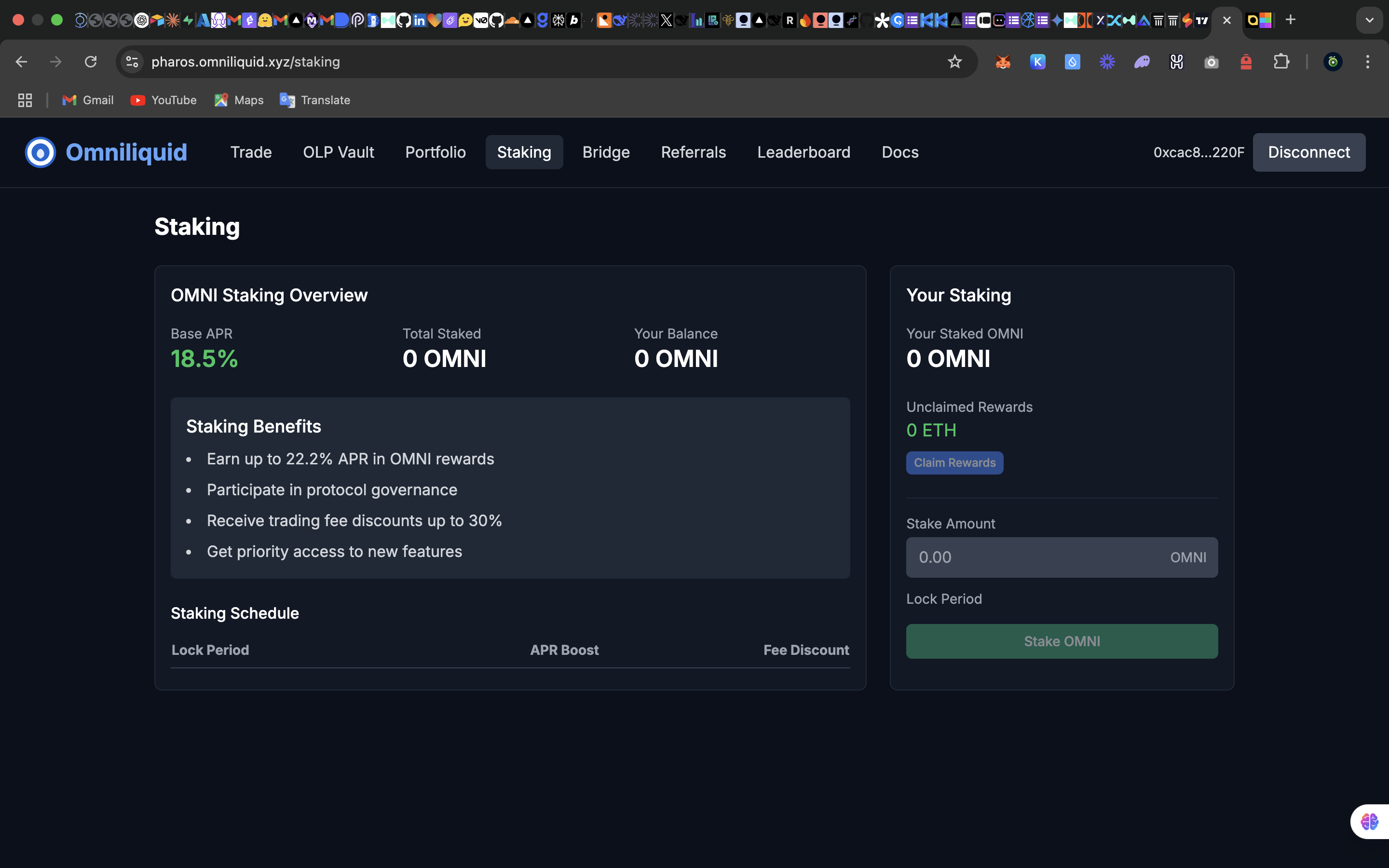

Staking & Governance: OMNI token for platform governance and fee discounts

Oracle Integration: Reliable price feeds via Supra Oracle

Omniliquid's architecture consists of several key components that work together to provide a comprehensive trading platform:

Asset Registry: Manages supported assets and their metadata

Collateral Manager: Handles user deposits, withdrawals, and margin requirements

Market & Position Manager: Core trading engine and position lifecycle management

Oracle System: Price feeds with TWAP support via Supra Oracle integration

Enhanced Orderbook: On-chain order matching with various order types

Funding Rate Manager: Calculates and applies funding rates for perpetual markets

Liquidation Engine: Monitors and liquidates underwater positions

Risk Management: Enforces position limits and system-wide risk parameters

TokenManager: Synthetic asset issuance and management

Fee System: Trading fee calculation and distribution

Insurance Fund: Protection against socialized losses

Governance: Protocol parameter management via OMNI token voting

The following contracts are deployed on Pharos Devnet:

Contract | Address |

|---|---|

AssetRegistry | 0xb801d7b1aA715c9297cbd8De56756ad7eEC36Ae9 |

SecurityModule | 0x9FF18F397dF0f82CD2E6e75DD4fd53D3c9d0193C |

FeeManager | 0xd3897f06448bC86eed32a770176491dC79bf9681 |

EventEmitter | 0x9836477De479cc13244A921394757914F001e05B |

InsuranceFund | 0xBd38DeCff758C0402f5B0179ed75D686aAE5A4AE |

Vault | 0xE1a2356e41609C5b05ff34451E3009AB12110Ba9 |

Oracle | 0x09617ea48B07f3e1a57DEC4DF533214861f01cdf |

TokenManager | 0xF0cb7756c71c4365b3f6BeDD6b3bcDF2fa224A0D |

ReferralProgram | 0xa3DaEc4e031D392F20aBA9075736BB1b0C62b523 |

CollateralManager | 0x0f7cb0945C38e906E54EfF2D95C5A9e4e215DF73 |

EnhancedOrderBook | 0x970e7d74D8c629d7F892A49E8C24e356766E2EBf |

FundingRateManager | 0x0412d58eAbf6d14eA8991ef5157f95d4bf951aD7 |

RiskManager | 0xa255c78CE8Ec0139afFBb4F76dC6Da46F647483b |

CrossMarginAccountManager | 0x7300c6c0eA253BC03bFAf8dB478C61d41b9c0141 |

Market | 0x67dc7eBfabDe202B3837c95c4512Ad89B15cDC91 |

ClearingHouse | 0xdb42f6fe6906448485398Fd743b96bA89F27D7b6 |

LiquidationEngine | 0x97Fdc2c6D38bD6a8b964858a862671245E8BF4f2 |

PositionManager | 0x74D002cB263a1590A46cEC34f525ce2e33C27C05 |

OrderExecutor | 0x4BC6a7262c0B030fCaFE3119dA2211380473A9E1 |

OMNIToken | 0x2e3ed7a1FbB37F82e2d8ae073606B16f1F2057fD |

OMNIStaking | 0xc84f7531cA7247fAA143fF12F4559F3413cb5a01 |

FeeDistributor | 0x5863964994Bd8376853619d510320f77E12E34Ba |

The Omniliquid platform is accessible at https://pharos.omniliquid.xyz

Before trading, users need to deposit collateral in ETH:

Connect your wallet to the Omniliquid interface at https://pharos.omniliquid.xyz

Navigate to the "Portfolio" section

Enter the amount of ETH you wish to deposit

Confirm the transaction in your wallet

Your collateral balance will be updated once the transaction is confirmed

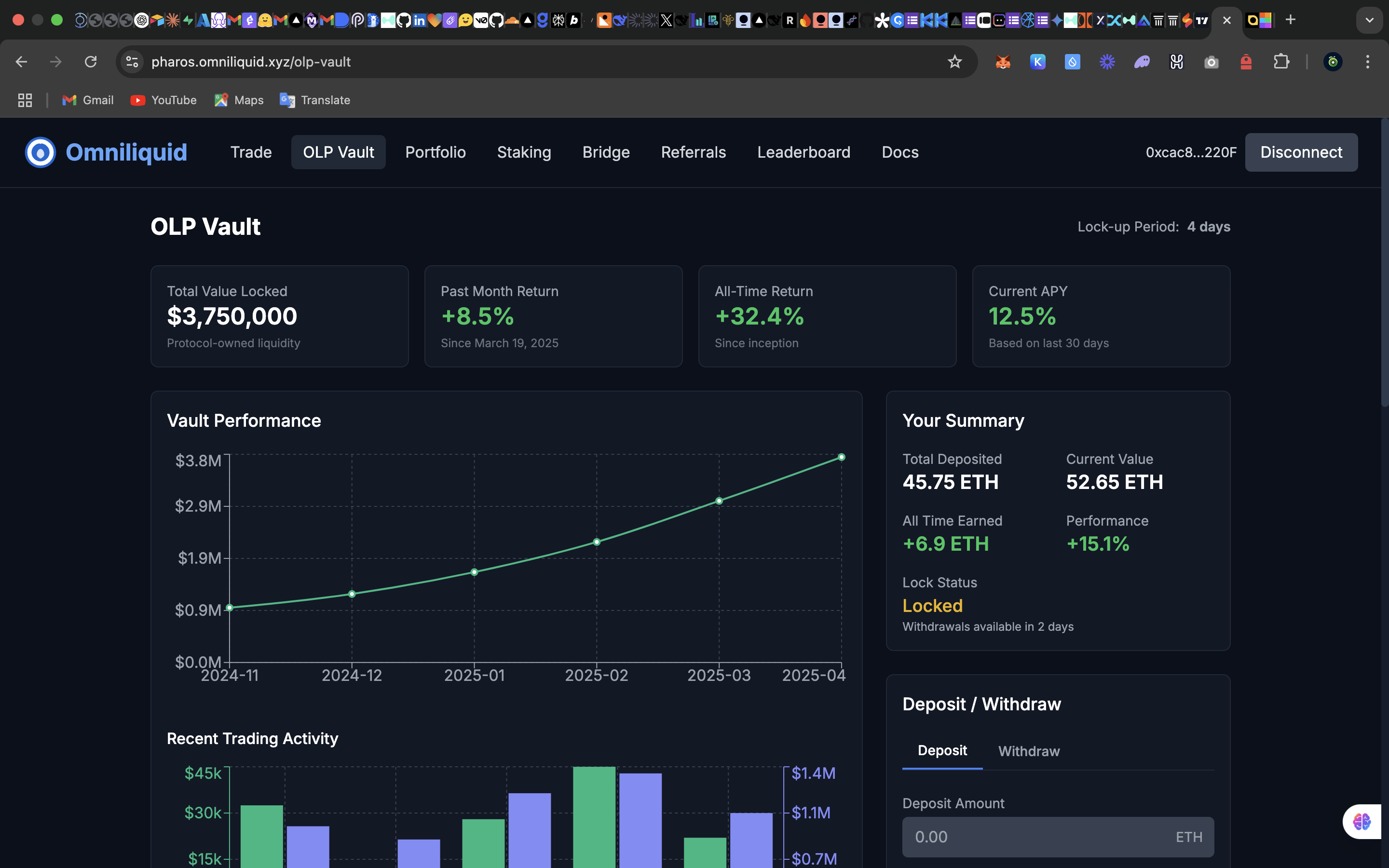

The OLP (Omniliquidity Provider) Vault is a community-owned liquidity pool that powers Omniliquid's exchange, enabling users to earn returns from market making and liquidations.

The OLP Vault allows any user to participate in providing liquidity to the protocol, democratizing access to market making rewards typically reserved for privileged parties on other exchanges. By depositing ETH into the vault, users:

Contribute to the protocol's market making activities

Support liquidation processes

Enhance overall liquidity depth

Earn a share of trading fees and protocol profits

Navigate to the OLP Vault page at https://pharos.omniliquid.xyz/olp-vault

Review current vault statistics including TVL, APY, and historical performance

Connect your wallet if you haven't already

Enter the amount of ETH you wish to deposit

Confirm the transaction in your wallet

Receive OLP tokens representing your share of the vault

OLP Vault interface showing statistics and deposit options

4-Day Lockup Period: After depositing, funds are locked for 4 days to ensure liquidity stability

Real-time Performance Tracking: Monitor your earnings and vault performance

Proportional Rewards: Earn returns based on your percentage share of the vault

Transparent Metrics: View detailed statistics on vault activities and returns

When you're ready to withdraw:

Navigate to the OLP Vault page

Select "Withdraw" and enter the amount of OLP tokens to redeem

If the lockup period has passed, confirm the transaction to receive your ETH plus earnings

If still within lockup period, a warning will be displayed with the unlock time

Visit the trading interface at https://pharos.omniliquid.xyz/trade to access all trading functionality.

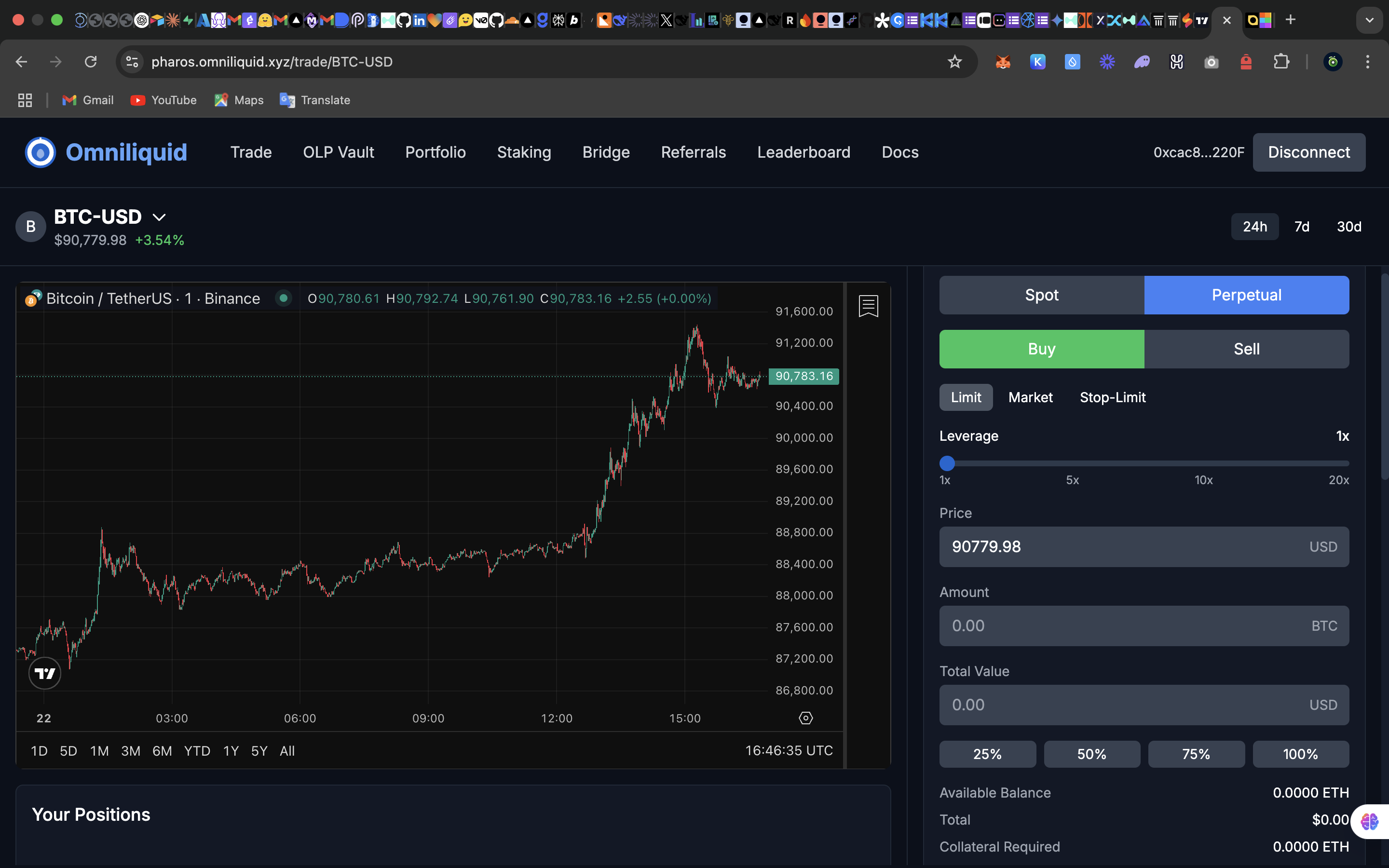

Omniliquid's comprehensive trading interface

Select the asset you want to trade (e.g., BTC, XAU, TSLA)

Choose "Spot" trading mode

Enter the amount you want to trade

Select order type (Market, Limit, etc.)

For limit orders, set your desired price

Click "Buy" or "Sell" to place your order

Confirm the transaction in your wallet

Select the asset with "-PERP" suffix (e.g., BTC-PERP)

Choose your leverage (1x-20x)

Enter the position size

Select long or short direction

Choose order type and set price if needed

Add optional stop-loss or take-profit levels

Click "Submit" and confirm the transaction

View your open positions in the "Positions" tab

Monitor PnL, liquidation prices, and funding payments

To modify a position:

Increase/decrease position size

Add/modify stop-loss or take-profit orders

Add more collateral if needed

To close a position:

Click "Close" on the specific position

Choose full or partial closure

Confirm the transaction

Acquire OMNI tokens through trading or external exchanges

Navigate to the "Staking" section at https://pharos.omniliquid.xyz/staking

Choose your staking duration (longer durations offer higher rewards)

Enter the amount of OMNI to stake

Confirm the transaction

Track your staking rewards in real-time

Claim rewards anytime, but tokens remain locked for the selected duration

Week 1: Team Formation Week 2: Ideation & Brainstorming Week 3: Research & Pitch Deck design Week 4: Smart Contracts Develeopment Week 5: Web Interface Development Week 6: API & SDK Development Week 7: Partnership

Private Round