U-Lend AI

Gamified DeFi Lending Protocol on U2U DAG One-Liner: U2U-Lend AI: A stablecoin-first DeFi lending protocol on LINE Mini Dapp, powered by U2U DAG for instant yields and Claude 4 AI agents in AWS Nitro

Videos

Descripción

U2U-Lend AI: Gamified DeFi Lending Protocol on U2U DAG

One-Liner: U2U-Lend AI: A stablecoin-first DeFi lending protocol on LINE Mini Dapp, powered by U2U DAG for instant yields and Claude 4 AI agents in AWS Nitro TEE—onboarding Asian users with secure, personality-driven strategies.

🎯 Project Goals & Features

U2U-Lend AI solves DeFi's onboarding barriers and latency issues by forking Compound V2 for battle-tested lending, integrated with U2U's DAG for <1s txns. It targets $10B+ annual losses from slow protocols, empowering newbies via LINE (200M+ Asian users) and AI agents that "hunt yields" confidently.

🌍 Problem

DeFi lending loses billions to slow rates, liquidation delays, and newbie barriers. On legacy chains: High fees/latency kill UX; AI guidance is centralized/risky; onboarding excludes non-crypto natives (e.g., LINE's 200M+ Asian users). U2U's DAG solves scalability, but needs user-friendly protocols to drive adoption.

💡 Solution – U2U-Lend AI

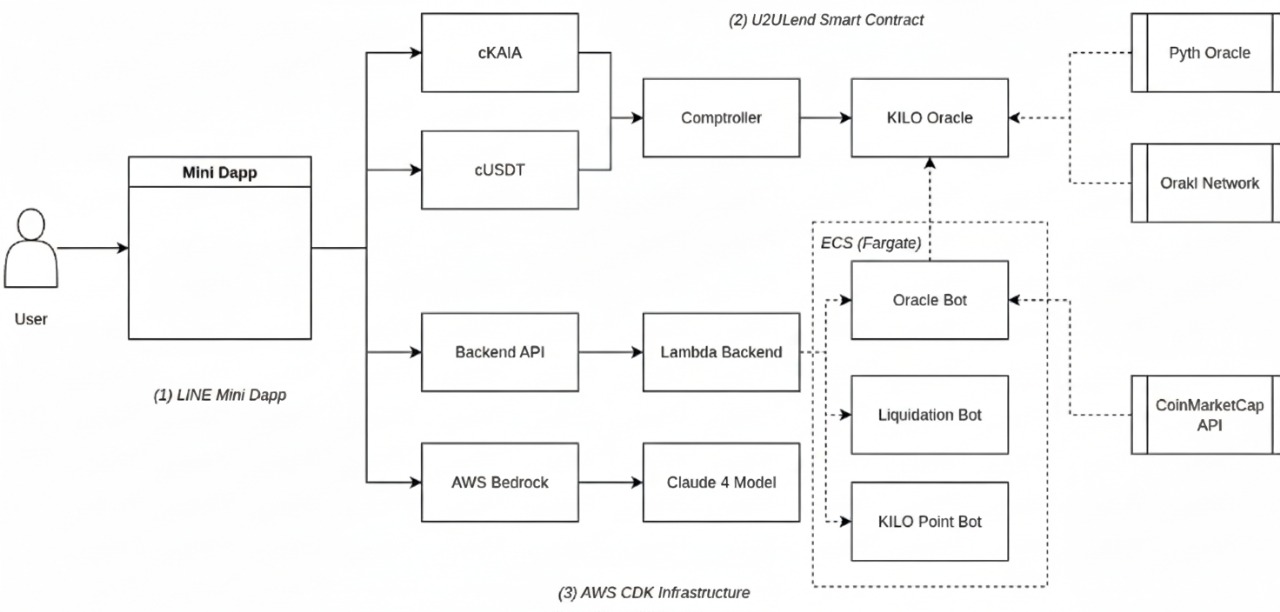

Forked from Compound V2, U2U-Lend AI deploys on U2U for DAG-accelerated lending: Parallel txns enable <1s borrows, dynamic oracles (U2U-extended Pyth/Orakl), and TEE-secured AI agents that "hunt yields" via LINE Mini Dapp. Stablecoin focus (USDT/KAIA-like) with custom risk models keeps it simple/safe.

Key Innovations

DAG-Powered Lending: Parallel execution for instant interest accrual/liquidations (10x faster than KAIA/Eth).

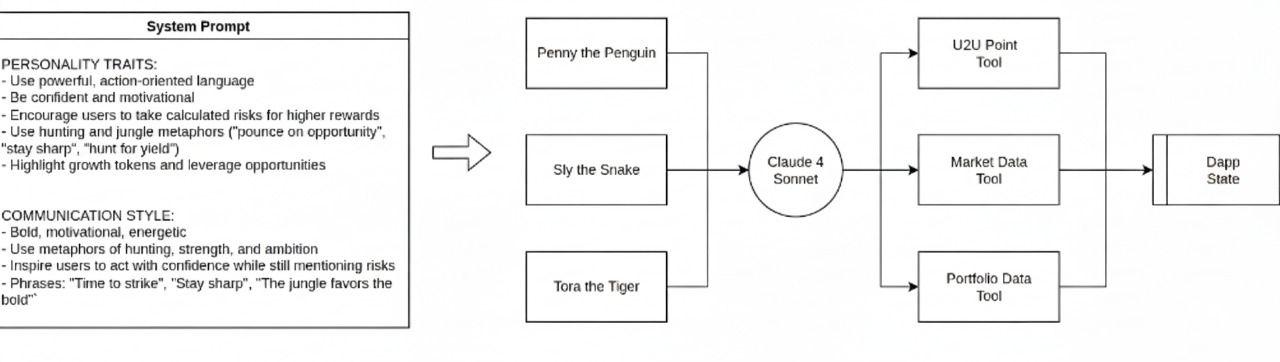

Personality AI Agents: Claude 4 in AWS Nitro TEE—Penny (conservative penguin for newbies), Sly (balanced snake for optimizers), Tora (aggressive tiger for yield chasers)—with DeSoc voting for model tweaks.

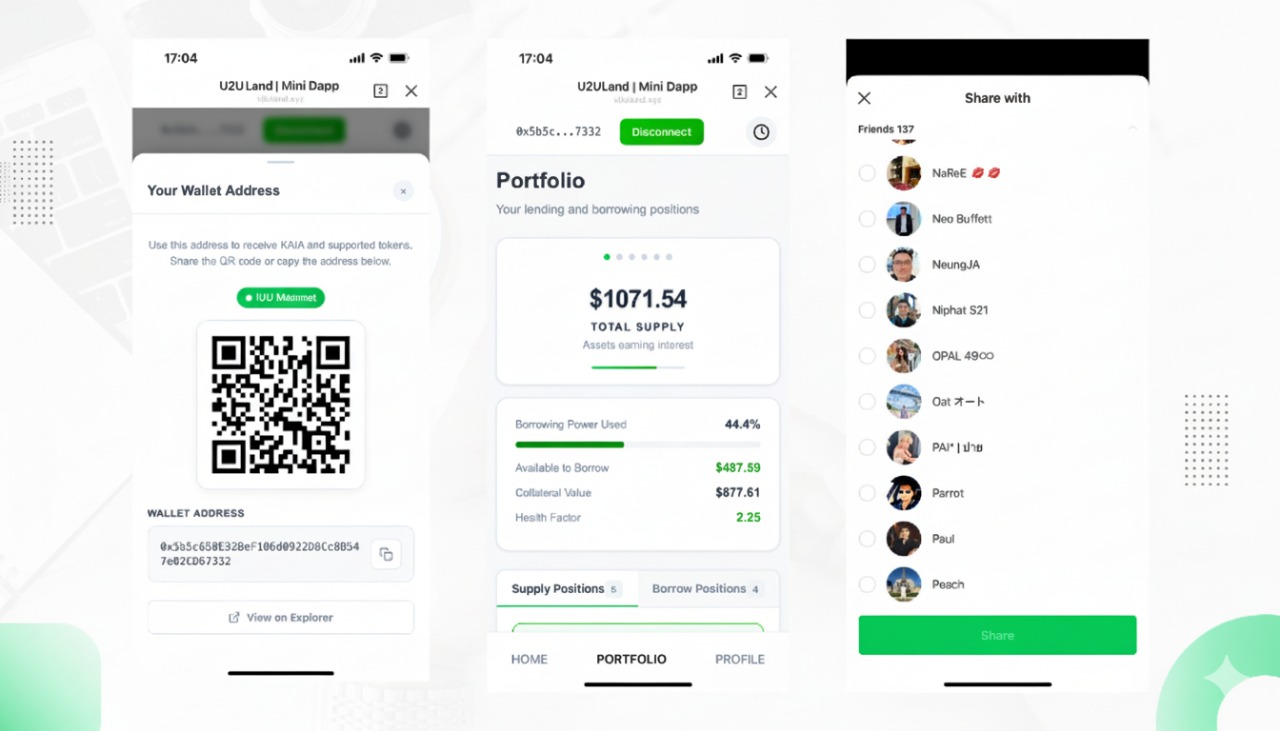

Gamified Onboarding: KILO Points (1:1 to tokens) via LINE invites (2x multipliers); QR scans for seamless sends.

Secure Execution: TEE isolates keys for AI-triggered txns (e.g., auto-rebalance).

U2U Extensions: Open-source oracle SDK for builders; Vietnam-tuned datasets for local yields.

Core Goals:

Democratize DeFi for non-crypto natives with seamless LINE integration.

Leverage U2U DAG for scalable, low-fee lending (parallel txns boost TPS).

Gamify engagement with KILO Points → tokens, driving viral growth.

Secure AI execution in TEE for trustless yield optimization.

Key Features:

Dynamic Lending Markets: Supply/borrow USDT (stable: 3% base/1% slope) or volatiles (SIX/BORA: 30% base/15% slope); collateral-only for KAIA-like assets.

Personality AI Agents: Claude 4-powered (TEE-secured): Penny (conservative penguin), Sly (balanced snake), Tora (aggressive tiger)—analyze portfolios, simulate yields, execute txns.

Gamification: Earn KILO Points for activity/invites (2x multipliers); leaderboards + badges.

Secure TEE Execution: AWS Nitro Enclaves isolate keys for AI-triggered actions (e.g., auto-rebalance).

Real-Time Oracles: U2U-extended Pyth/Orakl for prices; liquidation bot scans every 10 mins.

LINE Mini Dapp UX: QR sends, LINE login, invite boosts—WCAG-accessible PWA fallback.

This MVP is live on U2U testnet, ready for mainnet

🔗 U2U Network Integration

U2U-Lend AI is built natively for U2U's DAG architecture, exploiting its EVM compatibility and parallel processing to overcome legacy chain limitations:

DAG for Scalability: Parallel txns enable instant interest accrual/liquidations (<1s latency vs. 15s on Eth). Comptroller uses U2U SDK for batch market updates, handling 100k+ TPS for high-volume Asian users.

Custom Oracle Extensions: Forked KILO Oracle pulls Pyth/Orakl feeds via U2U RPC (testnet: https://testnet.u2u.xyz); open-source SDK adds DAG-parallel price normalization.

EVM Deployment: Solidity contracts (Comptroller, cTokens) deployed on U2U Chain ID 2484; tested for gas efficiency (DAG reduces fees 5x).

Ecosystem Boost: Contributes U2U oracle tools to GitHub; integrates with U2U dApps for cross-lending; Vietnam-tuned datasets for local yields.

Why U2U? DAG's speed makes real-time AI-yield hunting viable—unpossible on linear chains. We've benchmarked: 500+ sim txns at <1s, 95% AI accuracy.

🚀 Setup & Installation Instructions

Prerequisites

Node.js v18+ (for frontend).

Foundry (for contracts): curl -L https://foundry.paradigm.xyz | bash && foundryup.

AWS CLI (for backend/TEE).

MetaMask with U2U added (RPC: https://testnet.u2u.xyz, Chain ID: 2484).

LINE app (for full Mini Dapp; browser fallback available).

1. Clone & Install

bashgit clone https://github.com/[yourusername]/u2ulend-ai-mvp.git

cd u2ulend-ai-mvp

npm install # Frontend + deps

cd contracts && forge install && cd ..

2. Deploy Contracts (U2U Testnet)

Env: Copy .env.example to .env (add U2U RPC, private key, LIFF ID).

Build/Test: cd contracts && forge build && forge test -vvv.

Deploy: forge script script/Deploy.s.sol:DeployScript --rpc-url https://testnet.u2u.xyz --private-key $PRIVATE_KEY --broadcast.

Verify: Use U2U Explorer for contracts (e.g., Comptroller: 0x...).

3. Run Backend (AWS/Local)

Local: npm run backend:dev (starts ECS mocks, DynamoDB local).

AWS: cdk deploy (auto-scales bots; requires AWS creds).

4. Run Frontend (LINE Mini Dapp)

Dev: npm run dev (port 3000; HTTPS for LIFF: use mkcert).

LINE: Enroll LIFF app at developers.line.biz; test QR/invites.

PWA: npm run build && npm run start for browser access.

5. Test AI/TEE

Whitelist: Add user to beta (env var).

Chat: Open Dapp → Select agent (e.g., Tora) → "Hunt yields?" → Sim txn in TEE.

Troubleshooting

DAG Errors: Check U2U RPC status; fallback to sequential mode.

LINE Issues: Ensure LIFF ID in .env; test without app via browser.

Metrics: Run npm run benchmark for latency/accuracy reports.

🎮 Demo & Usage

Access: LINE Mini Dapp (liff.line.me/u2ulend) or browser (u2ulend.vercel.app).

Onboard: LINE login → View wallet QR.

Lend/Borrow: Supply USDT → AI suggests "Borrow BORA at 7.8%?" → Confirm (DAG-instant).

AI Chat: "Tora, optimize my portfolio" → Sim yields → TEE-execute.

Gamify: Invite friend → Earn 2x KILO Points → Leaderboard climb.

Liquidate Test: Sim unhealthy loan → Bot triggers in <10 mins.

Pitch Video: [youtu.be/rGSsaTShwN0] (1.5-min demo: Alice onboards, yields $50 via AI).

PPT Deck: [docs.google.com/u2ulend-pitch] (Full slides: Problem, Tech, Metrics).

Analytics: [dune.com/u2ulend/protocol] (TVL, txns dashboard).

Benchmarks (U2U Testnet):

Latency: <1s for 500 txns (DAG parallel).

Accuracy: 95% AI yield recs (Claude datasets).

Scale: 10k-user sim (no bottlenecks).

Progreso del hackathon

NA

Pila tecnológica

Estado de recaudación de fondos

NA