Resolv.Fi

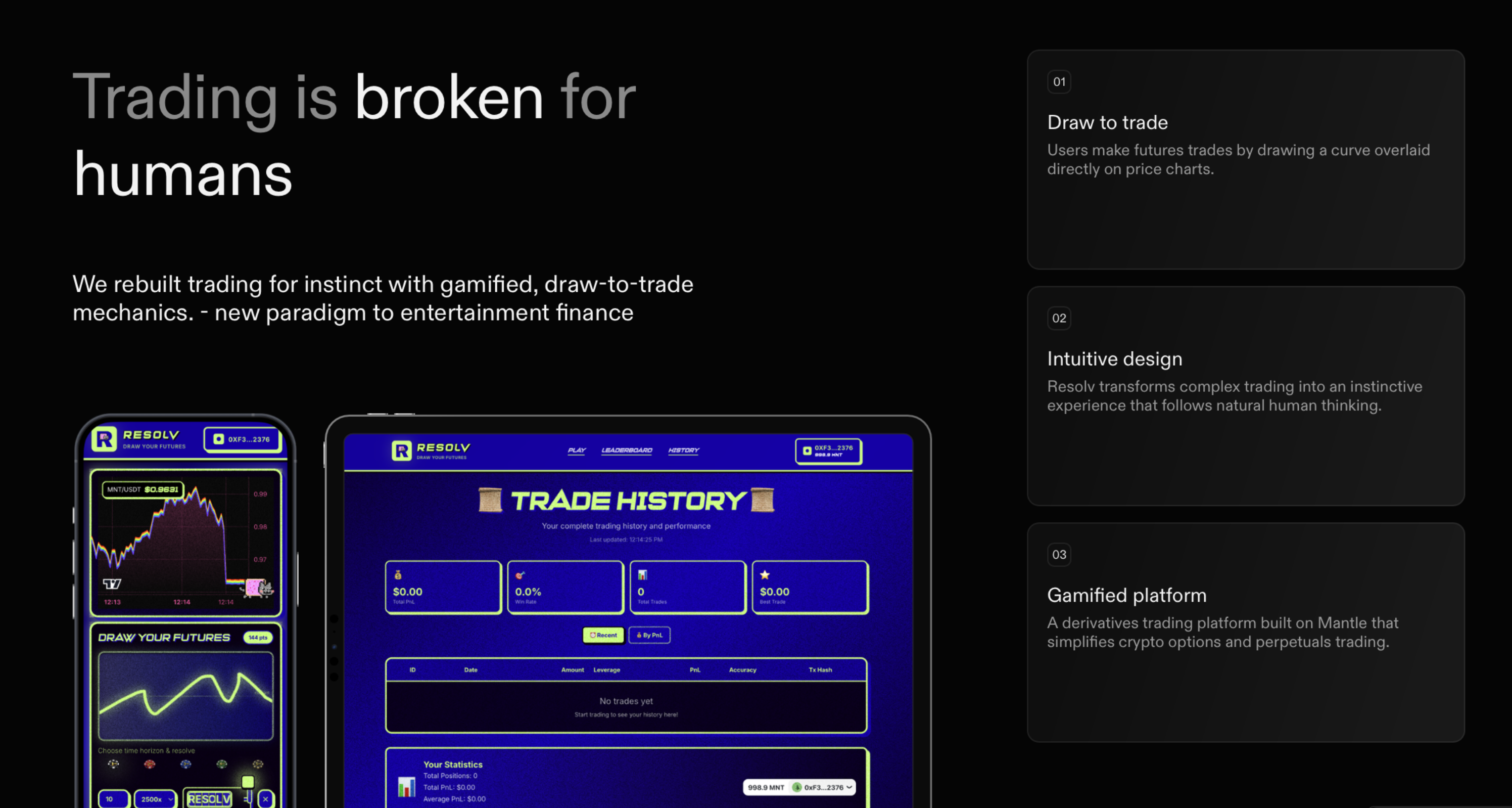

A gamified perpetual futures protocol transforming complex trading into an intuitive drawing experience

ビデオ

テックスタック

説明

> Resolv.Fi – Draw Your Predictions, Trade the Future

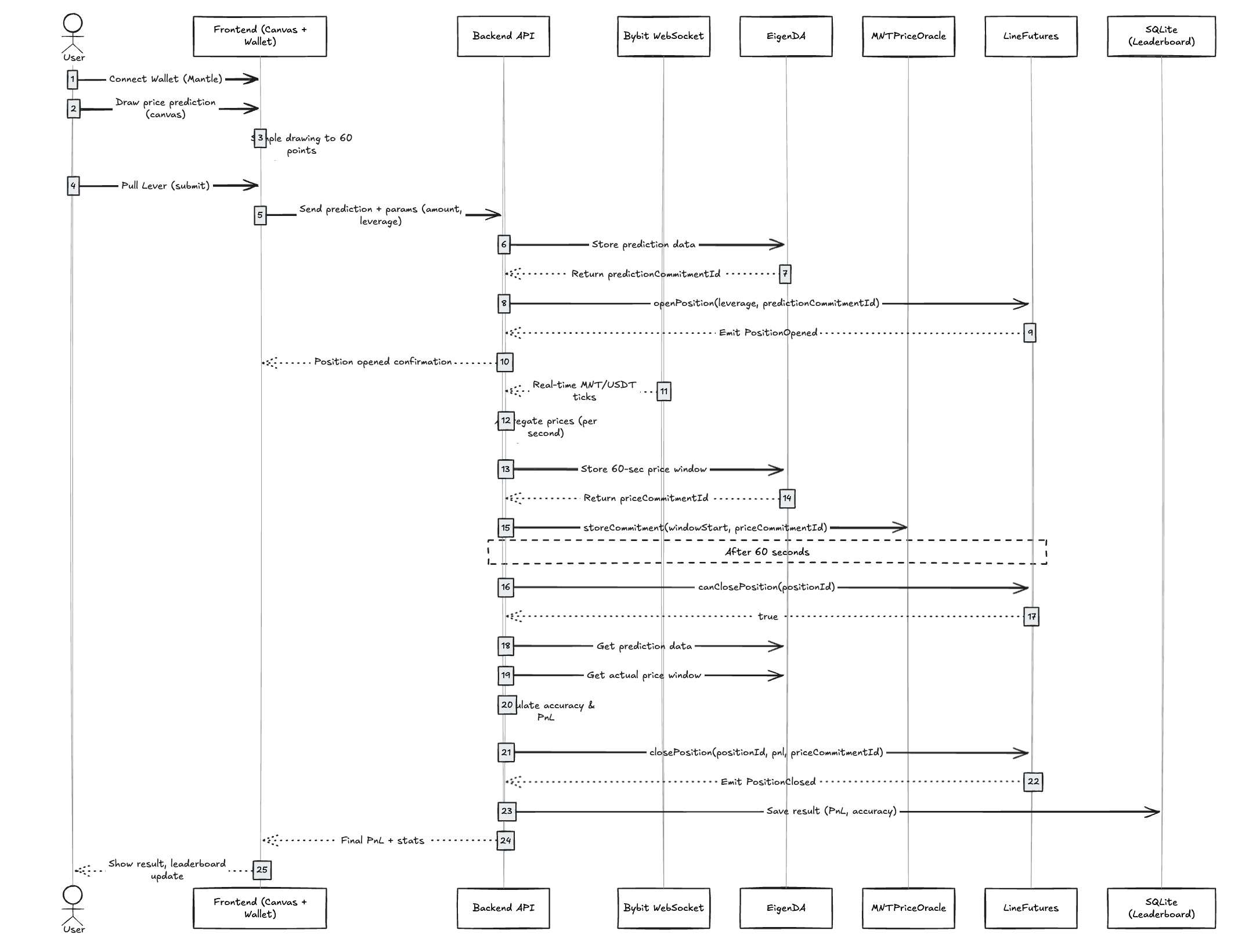

Resolv is a gamified perpetual futures protocol built on Mantle where users express market predictions by drawing price trajectories instead of placing traditional long/short orders. By turning trading into a visual, intuitive action, Resolv lowers the cognitive barrier of derivatives trading while preserving real financial mechanics like leverage, PnL, and settlement.

At its core, Resolv reframes futures trading as pattern recognition rather than order placement, creating a new DeFi primitive that blends GameFi UX, high-frequency micro-futures, and trust-minimized off-chain data availability via EigenDA.

What Makes Resolv Unique

1. Draw-to-Trade Derivatives (New Interaction Primitive)

Instead of selecting “long” or “short,” users draw how they think price will move over the next 60 seconds. This drawing is sampled, committed, and treated as a continuous futures position. PnL is calculated based on directional accuracy, not just price delta.

This makes trading:

More expressive than binary positions

Skill-based (pattern recognition over magnitude guessing)

Accessible to non-traders and gamers

2. Directional Accuracy PnL Model

Resolv introduces a novel settlement mechanism where profits depend on how often the predicted direction matches the actual market direction, point by point.

50% accuracy → breakeven

100% accuracy → max profit (leverage applied)

0% accuracy → max loss

This creates a fair, transparent scoring system that feels intuitive while remaining mathematically rigorous.

3. High-Frequency Micro Futures on Mantle

Positions auto-settle every 60 seconds, enabling:

Rapid feedback loops

High engagement trading sessions

Low latency experimentation

Mantle’s low fees and high throughput make this viable. Without Mantle, this UX would be economically infeasible.

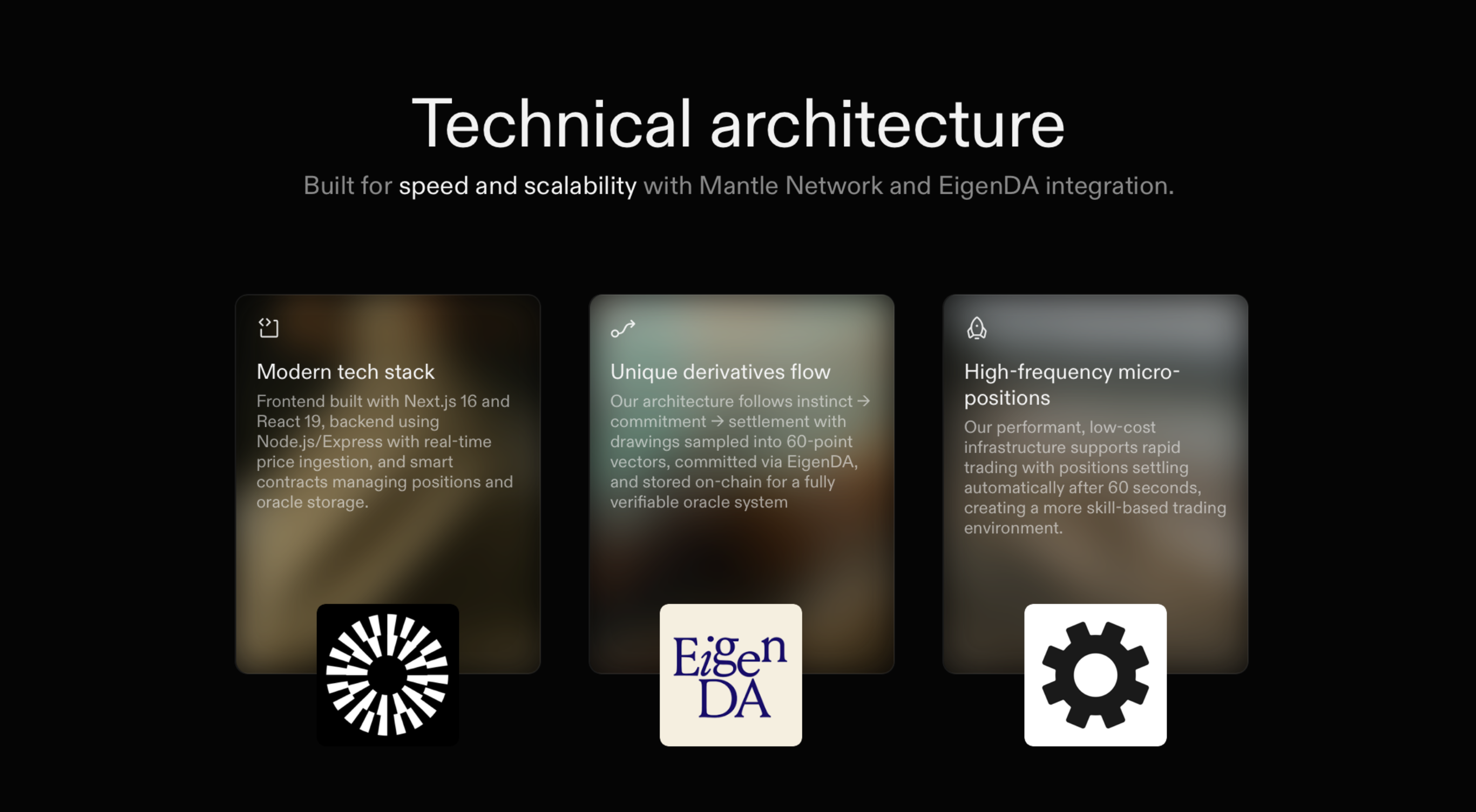

Technical Architecture

Resolv uses a modular, verifiable architecture:

Mantle smart contracts handle position lifecycle, settlement, and funds

EigenDA stores high-frequency price windows and user predictions off-chain

Only lightweight commitment hashes are stored on-chain

Anyone can independently verify outcomes by fetching data from EigenDA

Privy Wallets to give users seamless trading experience.

This clean separation enables:

Scalability without bloating L2 storage

Trust-minimized resolution

A pattern that other real-time DeFi apps can reuse

Mantle Integration (First-Class, Not Cosmetic)

Resolv is natively designed for Mantle:

Deployed on Mantle Sepolia

Uses MNT as the native trading asset

Optimized for low-cost, high-frequency settlement

Fully EVM-compatible contracts with gas-efficient batching

Mantle is not just the deployment layer; it is what enables Resolv’s core mechanic to exist.

Real-World Applicability

Resolv sits at the intersection of:

Perpetual futures

Prediction markets

GameFi

Potential users include:

Casual users intimidated by traditional trading UIs

Gamers familiar with timing-based skill games

Traders who want rapid hedging or short-term speculation

Communities experimenting with social or competitive trading

This model can extend beyond crypto prices into:

Event prediction markets

Volatility games

Crowd sentiment visualization

Long-Term Ecosystem Potential

Resolv introduces a new DeFi building block: drawable, verifiable predictions.

Future extensions include:

Multi-asset markets (ETH, BTC, indices)

Prediction NFTs (successful drawings as collectibles)

Liquidity vaults and LP participation

Social and collaborative prediction markets

AI-assisted pattern drawing

Composability with other Mantle DeFi protocols

As usage grows, aggregated drawings become a powerful on-chain sentiment signal.

Why we think, this is great for the hackathon

Technical Excellence: Novel PnL model, EigenDA integration, clean contract separation

User Experience: Intuitive, playful, instantly understandable interaction

Real-World Relevance: Applies to real markets with real leverage

Mantle-Native: Built for Mantle’s strengths, not ported onto it

Ecosystem Potential: Introduces a new interaction paradigm for DeFi

Resolv doesn’t just gamify trading.

It turns market intuition into geometry.

Built with love for the Mantle ecosystem.