Introducing GasGuard, a decentralized intelligence subnet that predicts gas costs and execution failure risks for complex DeFi transactions before they are executed, helping users avoid consequences

A decentralized intelligence subnet that predicts gas cost, execution failure risk, and safety for complex composed DeFi transactions using miner-submitted simulations and validator-enforced scoring.

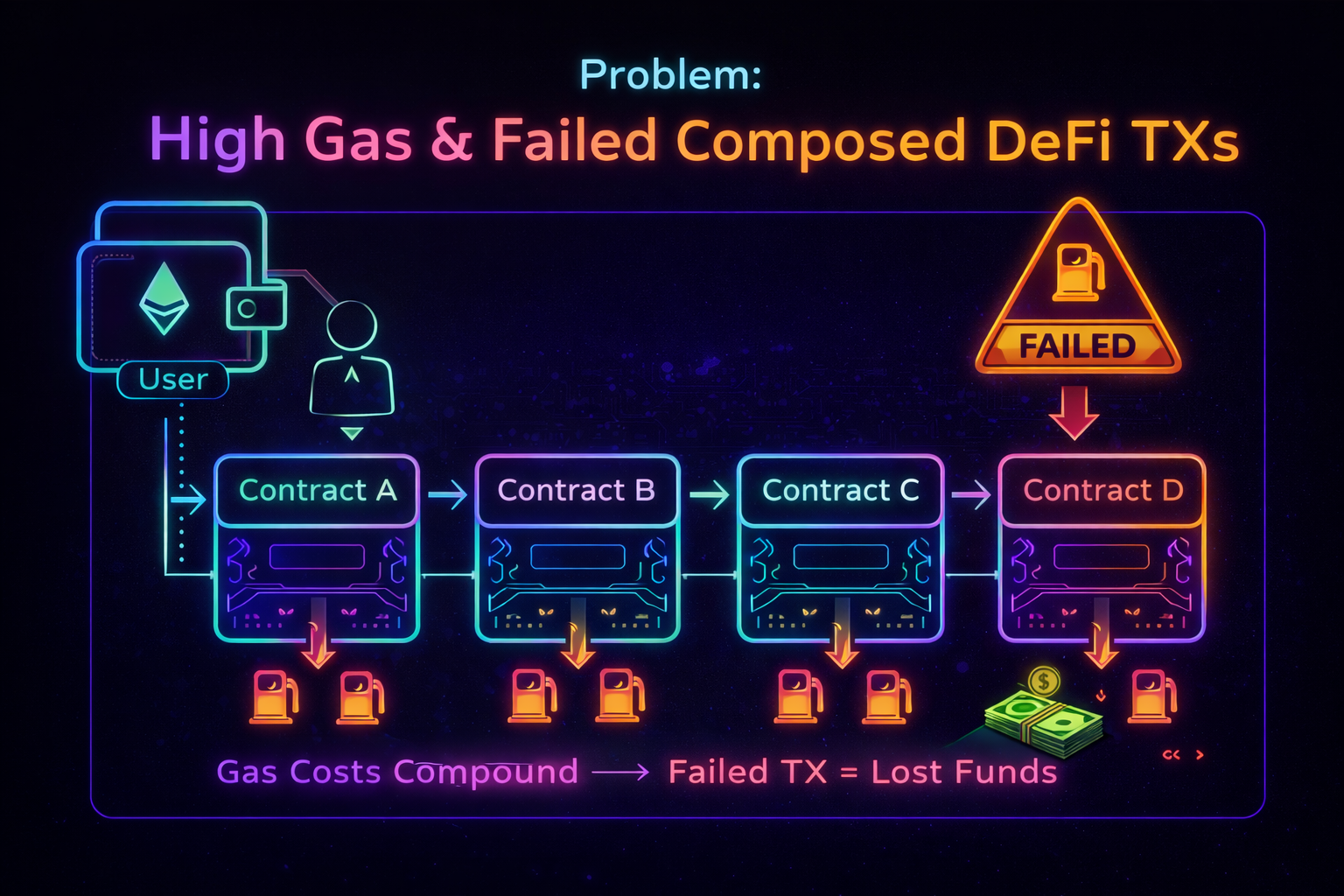

DeFi composability is powerful but costly. As transactions span multiple protocols, gas usage becomes unpredictable, failures increase, and users lose funds. GasGuard transforms this uncertainty into actionable execution intelligence.

Description

In composed transactions, users interact with multiple smart contracts in a single execution.

User

→ Contract A

→ Contract B

→ Contract C

→ Contract D

Each interaction introduces:

Function dispatch overhead

Context switching

Validation logic

Storage access

Impact

Gas costs grow rapidly

Execution becomes inefficient

Users pay more for the same intent

Description

Independent protocols repeatedly perform the same checks:

Balance verification

Permission validation

Storage reads

Even when these checks were already performed earlier in the same transaction.

Impact

Duplicate computation

Wasted gas

No shared standards to reuse validations

Description

Storage writes (SSTORE) are among the most expensive EVM operations.

In composed transactions, protocols often:

Update balances in multiple contracts

Persist intermediate states

Overwrite the same storage slots multiple times

Impact

Gas usage spikes

Transactions hit block gas limits

Failed transactions still burn gas

Local gas optimizations within individual protocols

Layer 2 rollups (lower cost, same structural problems)

Manual batching by developers

System-level understanding of composed transactions

Cross-protocol gas coordination

Predictive tooling to prevent failures before execution

Shared optimization standards

Current tools react after failure.

GasGuard acts before execution.

GasGuard does not try to rewrite DeFi protocols.

Instead, it provides execution intelligence that enables better decisions.

It addresses each problem with a specific solution class.

Transaction Bundlers

What it does

Analyzes multi-step transactions

Collapses multiple calls into a single optimized execution plan

Minimizes external calls and storage writes

Outcome

Fewer contract hops

Lower gas consumption

More efficient execution

Gas-Optimized Composition Patterns

What it does

Defines reusable standards for:

Shared validation logic

Stateless intermediate execution

Shared execution context

Outcome

Eliminates redundant checks

Reduces repeated storage reads

Improves composability efficiency

Predictive Gas Estimation & Risk Intelligence (Primary Focus)

What it does

Simulates full composed transactions

Detects storage-heavy execution paths

Predicts gas usage and failure probability

Warns users before execution

Outcome

Fewer failed transactions

Reduced wasted gas

Higher user trust

Transaction Analyzer

↓

Gas Simulation Engine

↓

ML-Based Risk Analyzer

↓

User Warning / Recommendation

👉 https://app.eraser.io/workspace/NkHOTU5CX8bUGDV0pzDZ

Transaction Analyzer

Extracts call depth, protocol types, storage operations

Gas Simulation Engine

Runs dry-run simulations on forked state

ML-Based Risk Analyzer

Predicts failure probability and risk class

Learns from historical transaction outcomes

User Warning Layer

Converts predictions into actionable guidance

Gas cost estimates

Failure probability scores

Risk classification (Low / Medium / High)

Failure reason attribution

This intelligence is:

Non-trivial

Computation-heavy

Continuously improvable

User submits transaction payload

↓

Miners simulate & analyze

↓

Validators evaluate prediction quality

↓

Rewards distributed based on accuracy & effort

Who earns rewards

Miners → accurate, timely predictions

Validators → honest, correct scoring

Reward factors:

Reward ∝ Accuracy × Confidence × Timeliness × Reputation

Miners

Must run real simulations

Must produce calibrated predictions

Low-quality or spam outputs are penalized

Validators

Score miner outputs against ground truth

Penalized for dishonest or collusive behavior

Compete with other validators

Simulation

Feature extraction

Model inference

Cannot be cheaply faked

Better heuristics → better rewards

Better models → higher reputation

Learning compounds over time

Validator publishes transaction payload

Miners simulate and predict outcomes

Validators compare predictions

Scores computed using accuracy + calibration

Rewards distributed per epoch

Tasks

Simulate composed transactions

Predict gas and failure risk

Input

Encoded calldata

Chain context

Output

{

"estimatedGas": uint,

"failureProbability": float,

"riskLevel": enum,

"confidence": float

}

Performance Metrics

Accuracy

Calibration

Speed

Consistency

Evaluation

Reference simulations

Cross-miner comparison

Consensus-weighted scoring

Cadence

Per epoch

Rolling history

Incentives

Honest scoring rewarded

Malicious behavior penalized

Millions lost to failed gas fees

No neutral execution-risk oracle exists

Centralized estimators

Wallet heuristics

Protocol-specific tools

❌ None are decentralized, composable, and incentive-aligned.

Initial Users

DeFi power users

Wallet developers

Yield aggregators

Distribution

Wallet plugins

APIs

Dashboards

Bootstrapping

Boosted early rewards

Free risk queries

Validator incentives

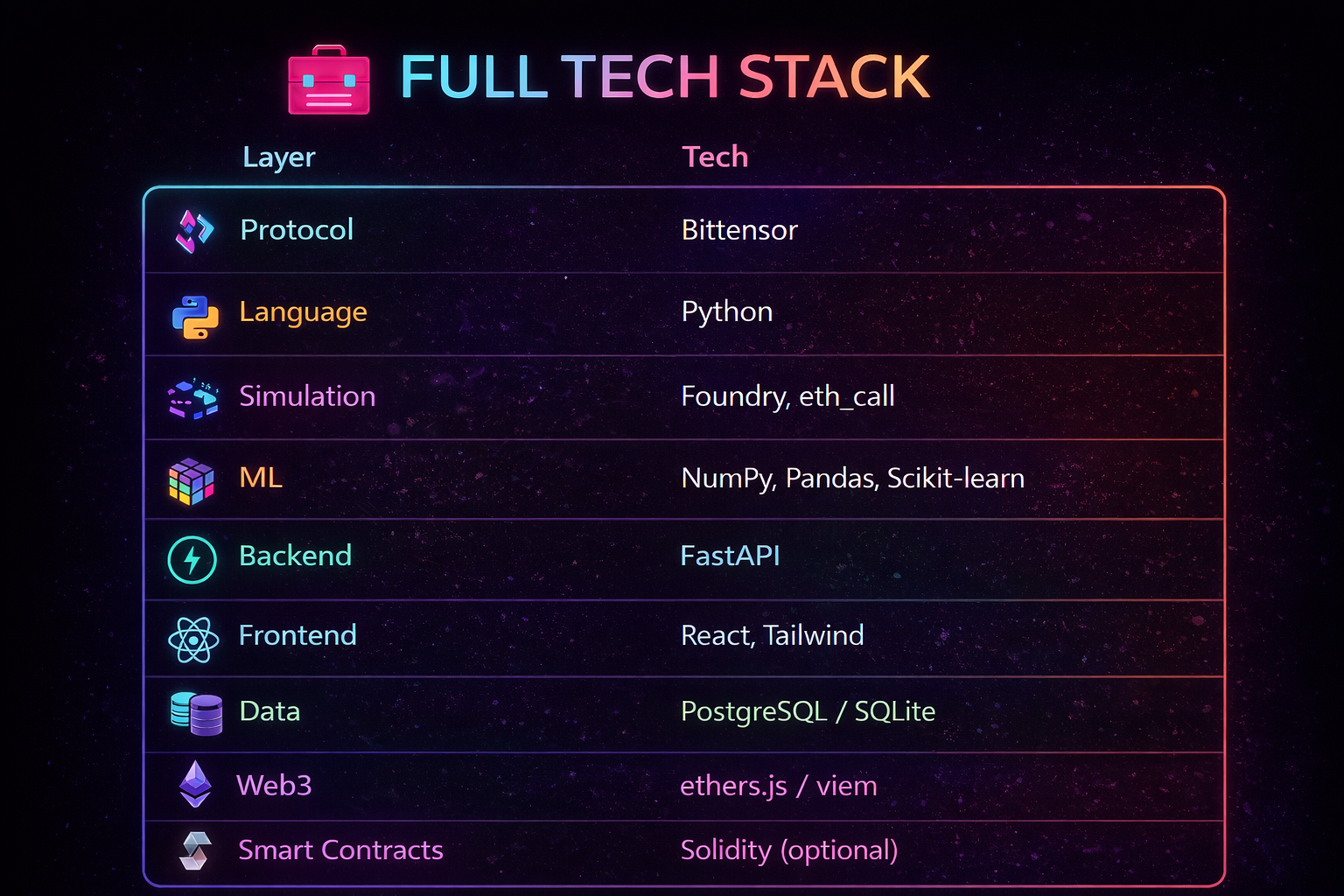

Tech Stack

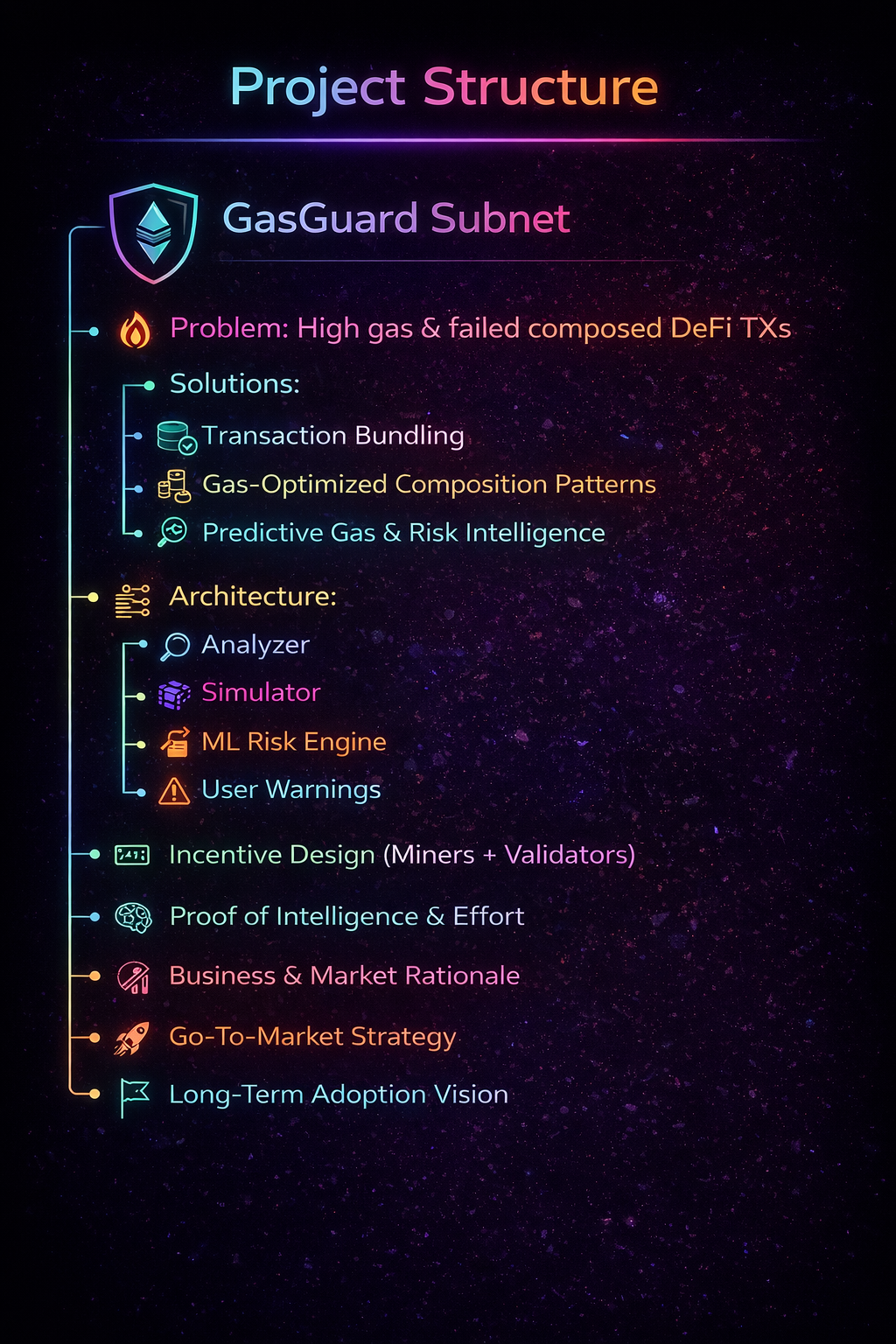

Final Project Structure(Textual Representation)

GasGuard Subnet

├── Problem: High gas & failed composed DeFi TXs

├── Solutions:

│ ├── Transaction Bundling

│ ├── Gas-Optimized Composition Patterns

│ └── Predictive Gas & Risk Intelligence

├── Architecture:

│ ├── Analyzer

│ ├── Simulator

│ ├── ML Risk Engine

│ └── User Warnings

├── Incentive Design (Miners + Validators)

├── Proof of Intelligence & Effort

├── Business & Market Rationale

├── Go-To-Market Strategy

└── Long-Term Adoption Vision

Final Project Structure(Visual Representation)

GasGuard is currently in the ideation phase

Not raised