NinjaQuant API

NinjaQuant is a quant backtesting and analytics API on Injective Mainnet using real Market IDs to simulate perpetual futures strategies with comparison, regime detection, and risk metrics.

Videos

Tech Stack

Description

🥷 NinjaQuant – Injective Strategy Backtesting API

Injective Python FastAPI Quant Framework

Demo : https://devtrad.onrender.com/docs

Repo : https://github.com/Suganthan96/Devtrad

🚀 Built on Injective Mainnet

NinjaQuant is a production-ready quantitative backtesting and analytics API built on Injective Mainnet perpetual futures markets.

It provides a structured intelligence layer on top of Injective’s derivatives infrastructure, enabling:

Strategy backtesting

Parameter comparison

Market regime detection

Risk analytics

Professional performance evaluation

🔗 Injective Mainnet Integration

✅ REAL Injective Market IDs (Mainnet Verified)

This API uses hardcoded, blockchain-verified Market IDs directly from Injective Mainnet.

📊 Supported Markets (Mainnet)

🔐 Verification Details

✅ Mainnet Market IDs

✅ Verified on Injective Explorer

✅ Connected to Pyth Oracle feeds

✅ Blockchain-validated market mapping

Server logs confirm usage:

✅ Using Injective Market ID

Market ID: 0x9b9980167ecc3645ff1a5517886652d94a0825e54a77d2057cbbe3ebee015963

Oracle: Pyth

🎯 Problem

Injective provides rich on-chain derivatives data.

However, developers lack:

A structured backtesting engine

Risk-adjusted performance metrics

Market condition analytics

Strategy comparison tools

A quant abstraction layer

Most APIs expose raw data — not evaluated trading intelligence.

💡 Solution

NinjaQuant provides a modular FastAPI-based quant intelligence engine that:

Uses verified Injective Mainnet Market IDs

Fetches historical OHLCV data

Executes strategy simulations

Computes professional metrics

Classifies market conditions

Performs risk analysis

Compares multiple strategies in one request

It transforms Injective into a quant research-ready ecosystem.

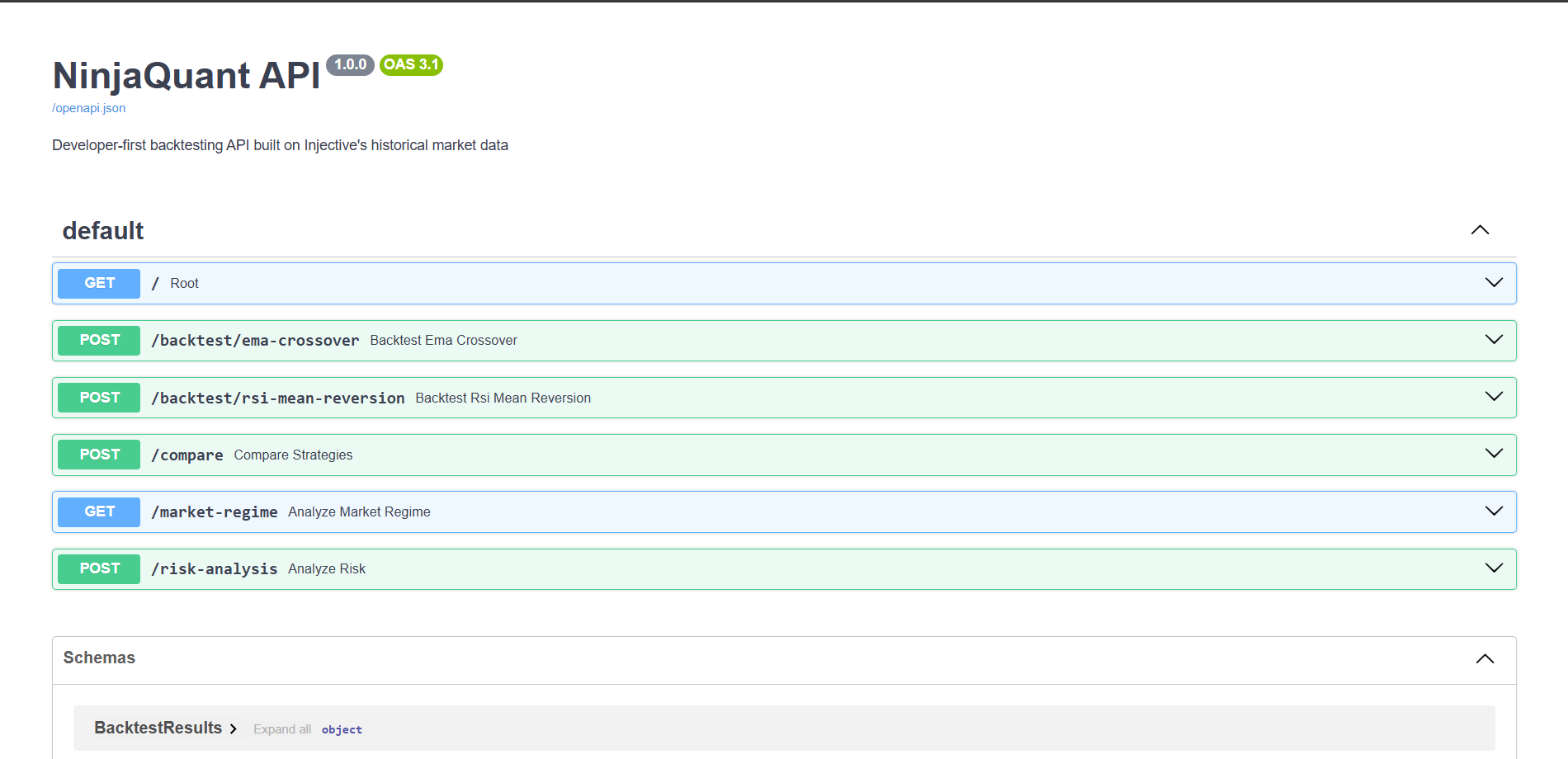

📡 API Routes

🧪 Core Backtesting Endpoints

🔹 POST /backtest/ema-crossover

Backtest EMA crossover strategy on Injective Mainnet markets.

POST http://devtrad.onrender.com/backtest/ema-crossover

Content-Type: application/json

{

"market": "BTC/USDT PERP",

"timeframe": "1h",

"parameters": {

"short_period": 9,

"long_period": 21

},

"initial_capital": 10000

}

🔹 POST /backtest/rsi-mean-reversion

Backtest RSI mean reversion strategy.

POST https://devtrad.onrender.com/backtest/rsi-mean-reversion

Content-Type: application/json

{

"market": "ETH/USDT PERP",

"timeframe": "1h",

"strategy": "rsi_mean_reversion",

"parameters": {

"period": 14,

"oversold": 30,

"overbought": 70

},

"initial_capital": 10000

}

🚀 Advanced Quant APIs

🔬 POST /compare

Compare multiple strategy configurations in one request.

Example:

EMA(9,21) vs EMA(12,26)

RSI(14,30,70)

Automatically identifies best performing strategy.

POST http://devtrad.onrender.com/compare

Content-Type: application/json

{

"market": "BTC/USDT PERP",

"timeframe": "1h",

"strategies": [

{

"strategy": "ema_crossover",

"parameters": {

"short_period": 9,

"long_period": 21

}

},

{

"strategy": "ema_crossover",

"parameters": {

"short_period": 12,

"long_period": 26

}

},

{

"strategy": "rsi_mean_reversion",

"parameters": {

"period": 14,

"oversold": 30,

"overbought": 70

}

}

],

"initial_capital": 10000

}

🌡️ GET /market-regime

Classifies current market condition.

Returns:

Trending / Ranging / Volatile

Trend strength

Volatility level

Strategy recommendation

GET http://devtrad.onrender.com/market-regime?market=BTC/USDT PERP&timeframe=1h

Content-Type: application/json

📊 POST /risk-analysis

Professional risk metrics:

Return volatility

Value at Risk (VaR)

Max consecutive losses

Risk classification (Low / Medium / High)

POST http://devtrad.onrender.com/risk-analysis

Content-Type: application/json

{"market": "ETH/USDT PERP",

"timeframe": "1h",

"strategy": "rsi_mean_reversion",

"parameters": {

"period": 14,

"oversold": 30,

"overbought": 70

},

"initial_capital": 10000

}

🧠 Strategy Engine

1️⃣ EMA Crossover Strategy

Uses Short EMA & Long EMA

Golden Cross → Buy

Death Cross → Sell

Best for trending markets

2️⃣ RSI Mean Reversion Strategy

Uses RSI momentum oscillator

Oversold → Buy

Overbought → Sell

Best for range-bound markets

📊 Standardized Performance Metrics

Each backtest returns:

Win Rate

Total Return

Maximum Drawdown

Sharpe Ratio

Total Trades

Formulas:

Win Rate = Profitable Trades / Total Trades

Total Return = (Final − Initial) / Initial

Max Drawdown = Largest peak-to-trough decline

Sharpe Ratio = Mean Return / Std Dev Return

🏗 Architecture Overview

Injective Mainnet Data

↓

Data Layer (injective_client.py)

↓

Strategy Engine

↓

Metrics Engine

↓

FastAPI Routes

↓

Structured JSON Output