Traceable Agriculture Supply Through Real-World Asset Tokenization

Presentation Deck: https://drive.google.com/file/d/1CmC3egrULqP4DYbJm4O0pp4rDJj30Fo0/view?usp=sharing

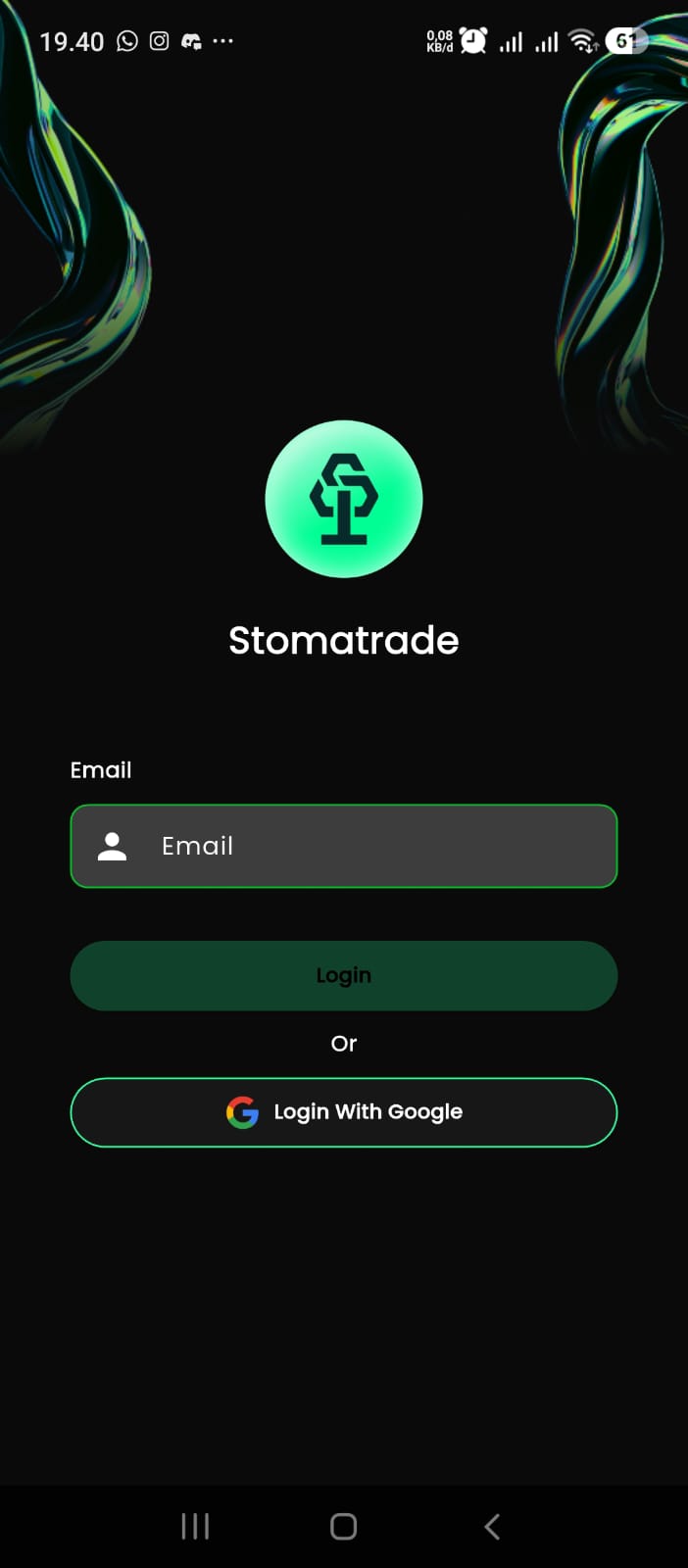

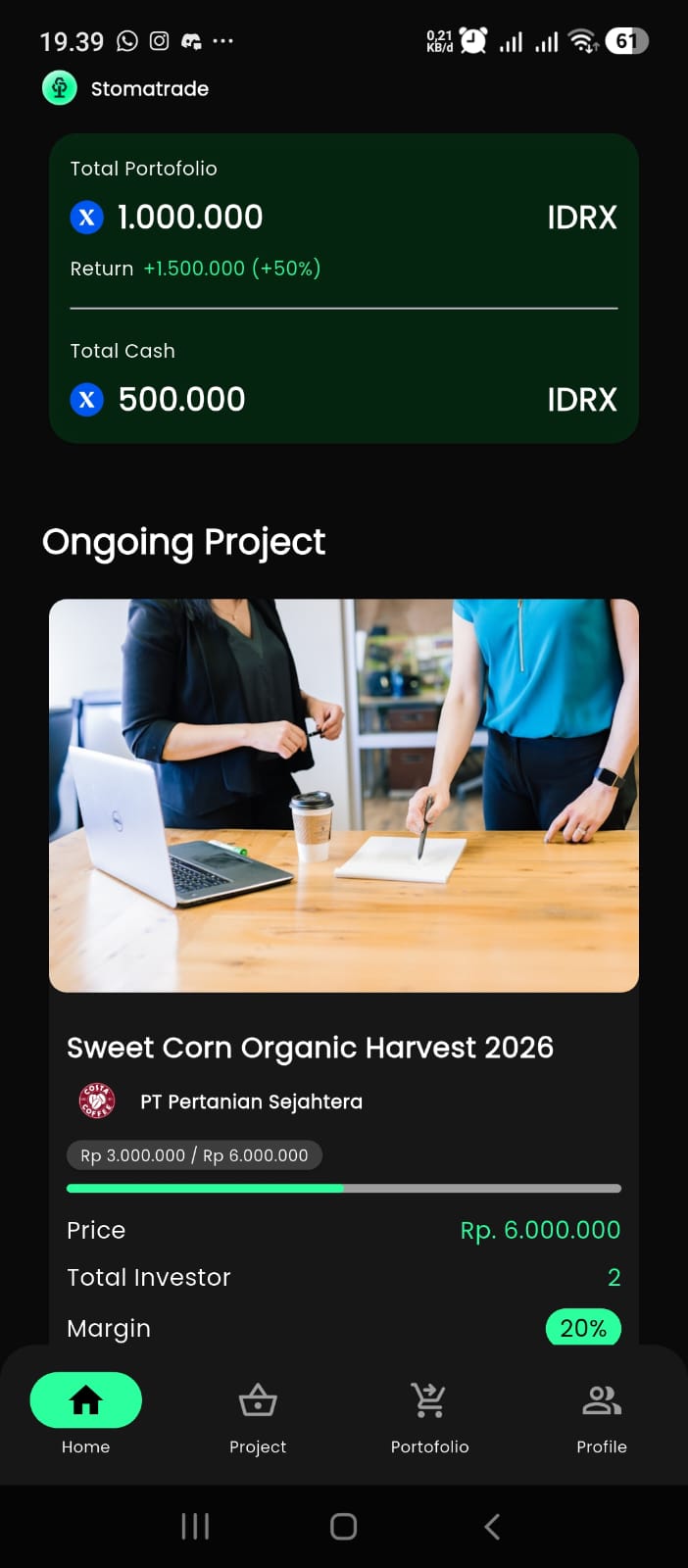

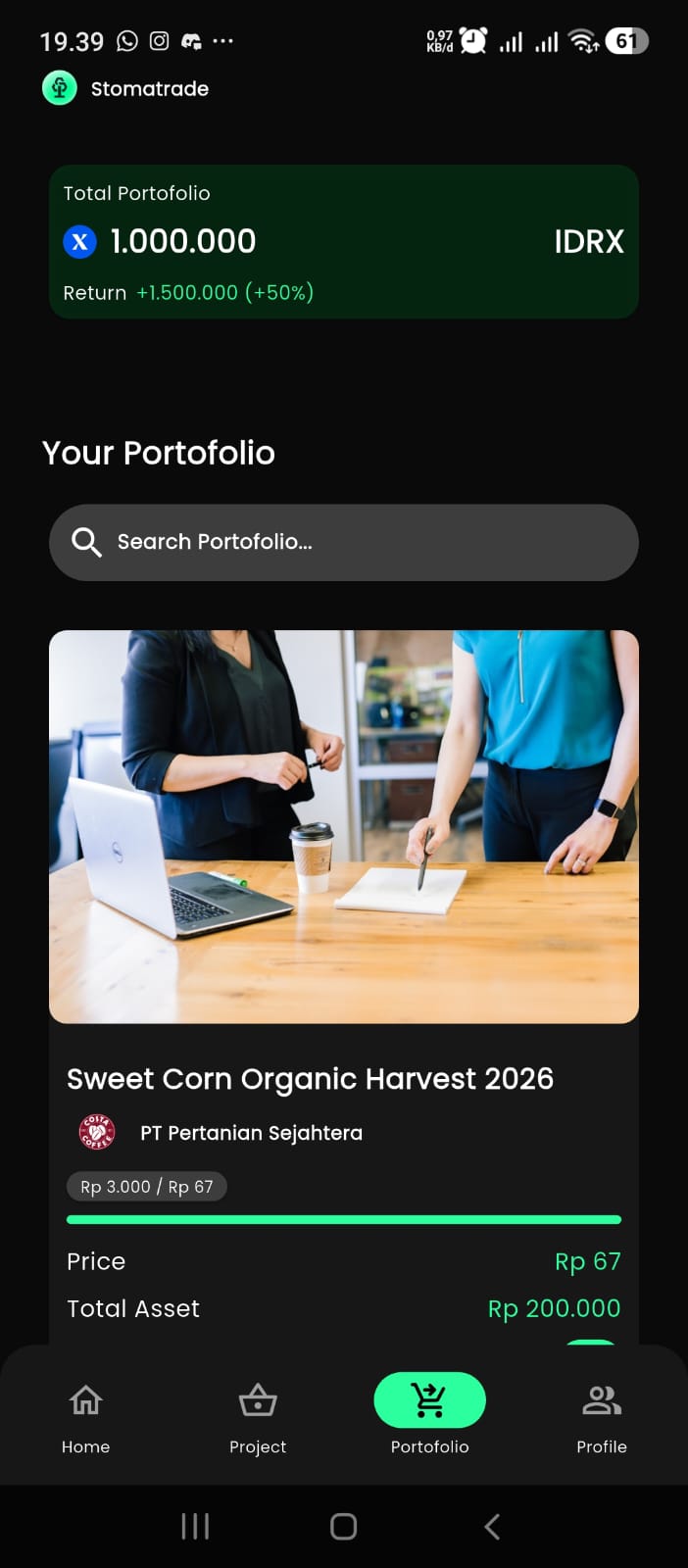

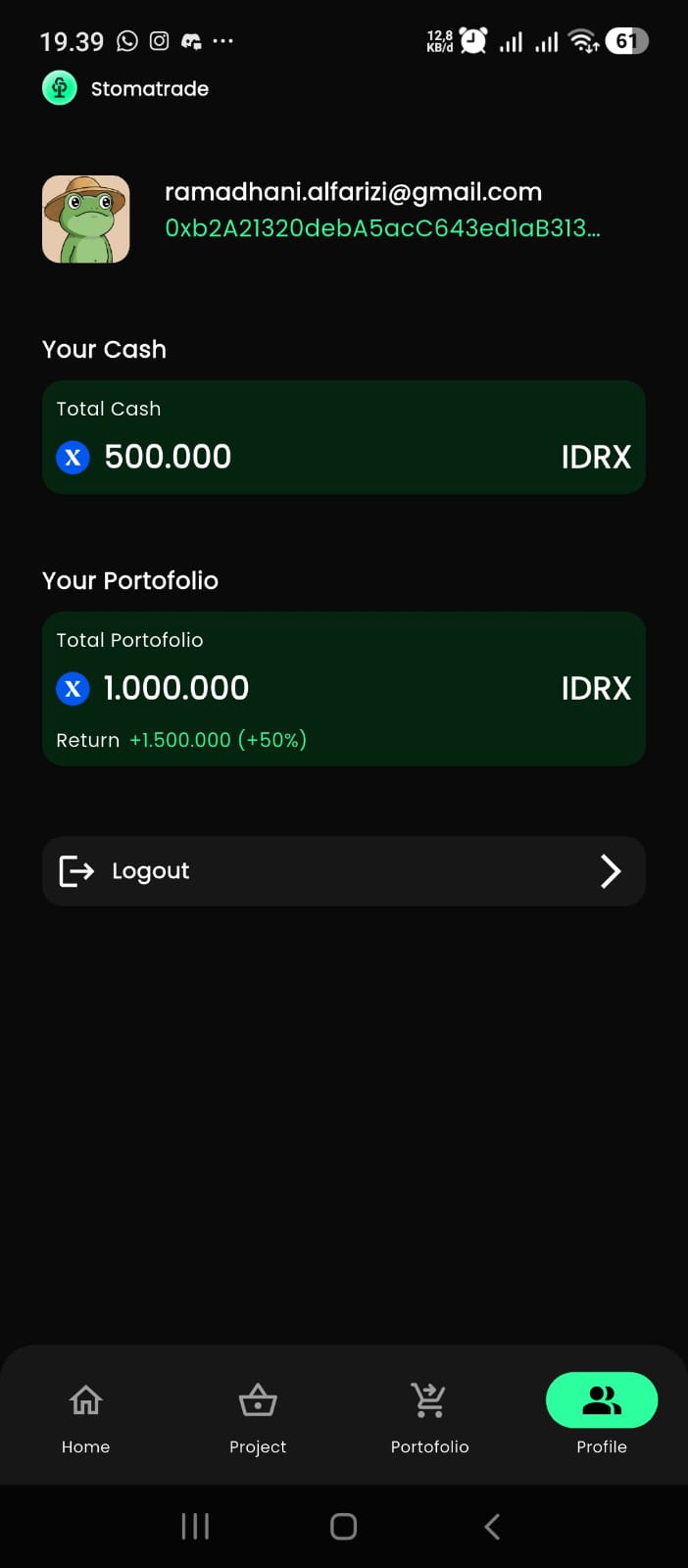

Mobile App url: https://appdistribution.firebase.dev/i/73e1fa0df6ad9309

Web Url: https://stomatrade.netlify.app/

Sepolia Mantle Scan: https://sepolia.mantlescan.xyz/address/0xB65a44b8c64264978EFACE91c4697aeF66Cd08e2#code

Stomatrade is an RWA-Fi (Real World Asset Finance) platform for the agricultural sector that delivers fast liquidity backed by real world assets. We connect farmers, aggregators (collectors), buyers, and investors within a transparent, traceable, and sustainable ecosystem.

By leveraging harvested crops as collateral, Stomatrade enables farmers and aggregators to access short term financing (±5 days) through a simple and efficient process. Investors can participate using stablecoins to earn short term yields backed by real world assets, while buyers gain access to verified and fully traceable supply.

Through asset tokenization, NFT based traceability, and smart contracts, Stomatrade builds trust across the agricultural supply chain accelerating cash flow, improving financial inclusion, and empowering local agriculture to compete in the global market.

Problem Want to Solve

The agricultural supply chain faces long standing challenges related to cash flow and trust. Farmers and aggregators require fast access to capital to sustain production and distribution, yet access to traditional banking remains limited due to strict requirements and slow disbursement processes.

On the other hand, buyers often operate with long payment cycles, despite their need for fast, compliant, and consistent agricultural supply. This situation is further exacerbated by the lack of reliable data and traceability systems, making it difficult for farmers and aggregators to obtain certifications, build trust, and access global markets.

As a result, aggregators lack sufficient working capital to absorb the full volume of farmers harvests, creating bottlenecks that hinder efficiency and slow the overall growth of the agricultural ecosystem.

Stomatrade Core Solutions

Stomatrade provides short term financing backed by harvested crops as Real World Assets, enabling farmers and aggregators to access fast liquidity within days. Through the platform, aggregators can apply for funding by using harvested crops as collateral, while investors participate by deploying stablecoins (IDRX) to finance verified agricultural projects.

Each harvest is tokenized and paired with NFTs issued to farmers, aggregators, and projects, ensuring full transparency and end to end traceability throughout the process. Once the buyer completes payment, funds are returned to investors along with profit sharing returns, while the platform generates revenue through service fees.

This model creates a fast, secure, and repeatable financing cycle delivering stable weekly cash flows while building trust across the entire agricultural supply chain.

Value Proposition Stomatrade

Stomatrade creates value for every stakeholder within the agricultural ecosystem. Farmers gain fast access to capital to sustain production without waiting for long payment cycles. Aggregators benefit from flexible working capital to optimally absorb harvests and ensure smooth distribution. Buyers gain access to legal, verified, and fully traceable suppliers, ensuring consistent quality and sustainable supply. Meanwhile, investors access short-term yield opportunities backed by real world assets, making investments safer, more transparent, and more sustainable.