Subterra AI

Subterra AI: Where Bittensor miners drill deeper than any rig—turning seismic noise into gushing subnets of black gold.

Videos

Tech Stack

Description

Subterra AI

Oil & Gas Exploration Subnet offers massive appeal to energy majors and sovereign funds, targeting the industry's $4T annual spend where AI can cut exploration costs by 30-50% through superior subsurface modeling.

Core Value Proposition

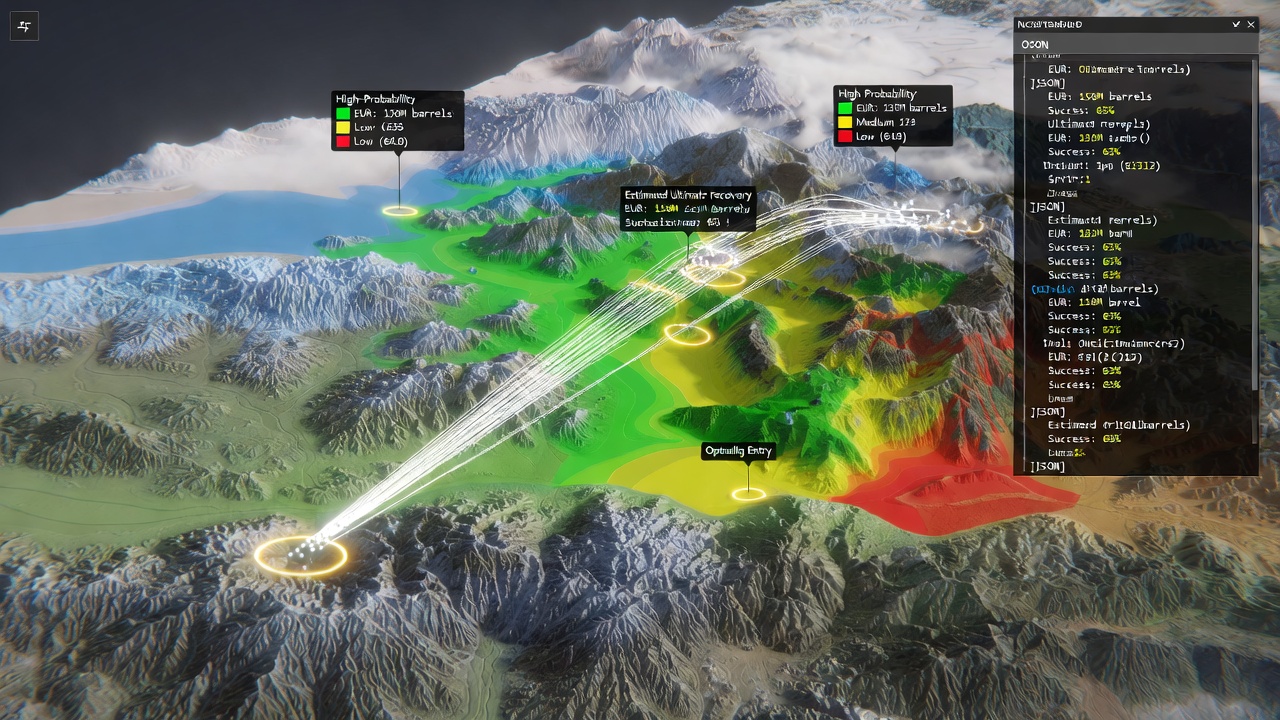

Miners compete to deliver "digital geologists" that process seismic volumes (3D/4D cubes up to 100TB), well logs, gravity/magnetic surveys, and satellite gravity gradients into actionable insights: reservoir location probabilities, trap geometries, fluid saturation maps, and optimal well trajectories. Validators score outputs against ground-truth production data, reducing dry-hole rates from 70% to under 30%. This creates a decentralized SLB/ION Geophysical alternative with 10x better economics via miner rivalry.

Miner Tasks & Specialization

Miners respond to validator queries with structured outputs:

Seismic Interpretation: Fault picking, horizon mapping, salt dome detection using diffusion models or FWI (full waveform inversion) approximations.

Reservoir Characterization: Porosity/permeability grids, NTG (net-to-gross) maps from inverted impedances.

Prospect Ranking: NPV estimates blending volumetric uncertainty, trap seal risk, and migration pathways.

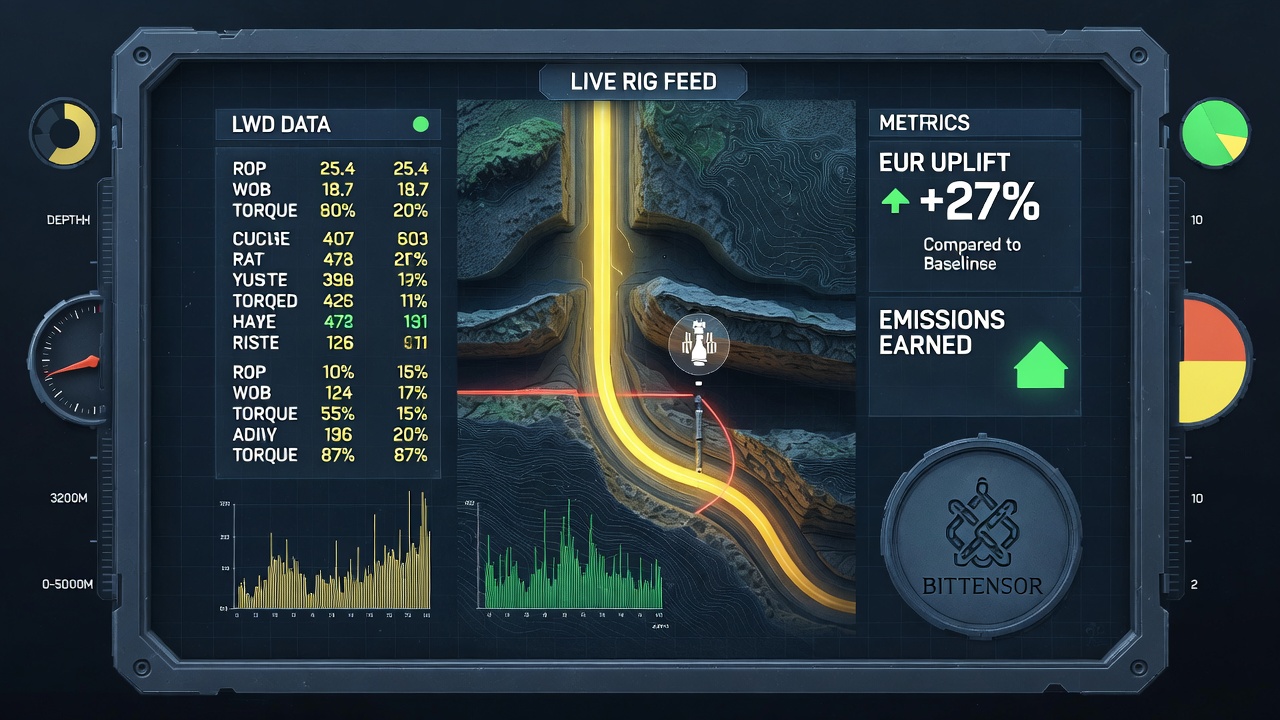

Drilling Optimization: Real-time trajectory corrections during deviated wells, using LWD/MWD feeds.

Specialization paths let teams shine:

Vision-heavy seismic AI (e.g., ConvNets + transformers on vibroseis data).

Physics-informed models enforcing rock physics constraints.

Multi-modal fusion (seismic + EM + CSEM).

Basin modeling for play fairway analysis.

Validators run standardized benchmarks:

Historical Replay: Feed Permian Basin or North Sea seismic cubes; score vs known field discoveries (EIA/USGS data).

Synthetic Challenges: Generate realistic noise-corrupted volumes; measure recovery accuracy.

Live Fire Drills: Blind tests on recent lease blocks (partner-provided, anonymized).

Economic Ground Truth: Weight scores by ex-post EUR (estimated ultimate recovery) and finding costs.

Yuma Consensus allocates emissions based on composite score: 40% technical accuracy, 30% uncertainty quantification (calibration), 20% compute efficiency, 10% interpretability (feature importance maps).

Technical Architecture

Data Formats: SEG-Y (seismic), LAS (logs), ZGY (compressed volumes), GRDECL (reservoir models).

Compute Profile: H100/A100 clusters; expect 80GB+ VRAM for 3D volumes.

Axon Protocol: gRPC endpoints for volume slicing queries (

/interpret_slice,/rank_prospects,/optimize_trajectory).Subnet dTAO Economics: Launch with TAO liquidity pool; miners stake dTAO for priority queuing on high-value jobs.

Revenue Model (Enterprise-Facing dApp)

API Subscriptions: $50k/mo for unlimited seismic interpretation (top-5 miners routed automatically).

Per-Prospect Pricing: $10k-100k based on acreage size, paid in USDC/TAO.

Joint Ventures: Equity kicks on commercial discoveries (e.g., 0.5% royalty).

Data Marketplace: Miners/validators contribute proprietary datasets for curation bounties.

Target clients: ExxonMobil (Permian), Shell (deepwater GoM), Aramco (carbonate reservoirs), Occidental (CCUS sites). Pilot with minnows like Kosmos Energy first.

Go-to-Market Path

MVP Launch: Q2/Q3 2026 on Bittensor testnet with public North Sea datasets.

Pilot Program: Partner with 2-3 IOCs for blind tests on lease rounds.

Subnet Registration: 300-400 TAO

dTAO Flywheel: Early wins → validator stakes → emissions → token price → miner capex.

Competitive Moats

Data Flywheel: User-submitted seismic → better training → superior models.

Miner Diversity: Basin-specific specialists (shales vs carbonates vs subsalt).

Cost Edge: Decentralized GPUs 70% cheaper than on-prem HPC.

Auditability: All interpretations logged immutably on Bittensor chain.

Risks: Data sensitivity (use federated learning), compute intensity (needs H200+), regulatory hurdles (seismic IP). Upside: First subnet to crack Big Oil unlocks $B ARR potential.

Progress During Hackathon

TBD

Fundraising Status

Require help from Bitstarter