Outrun

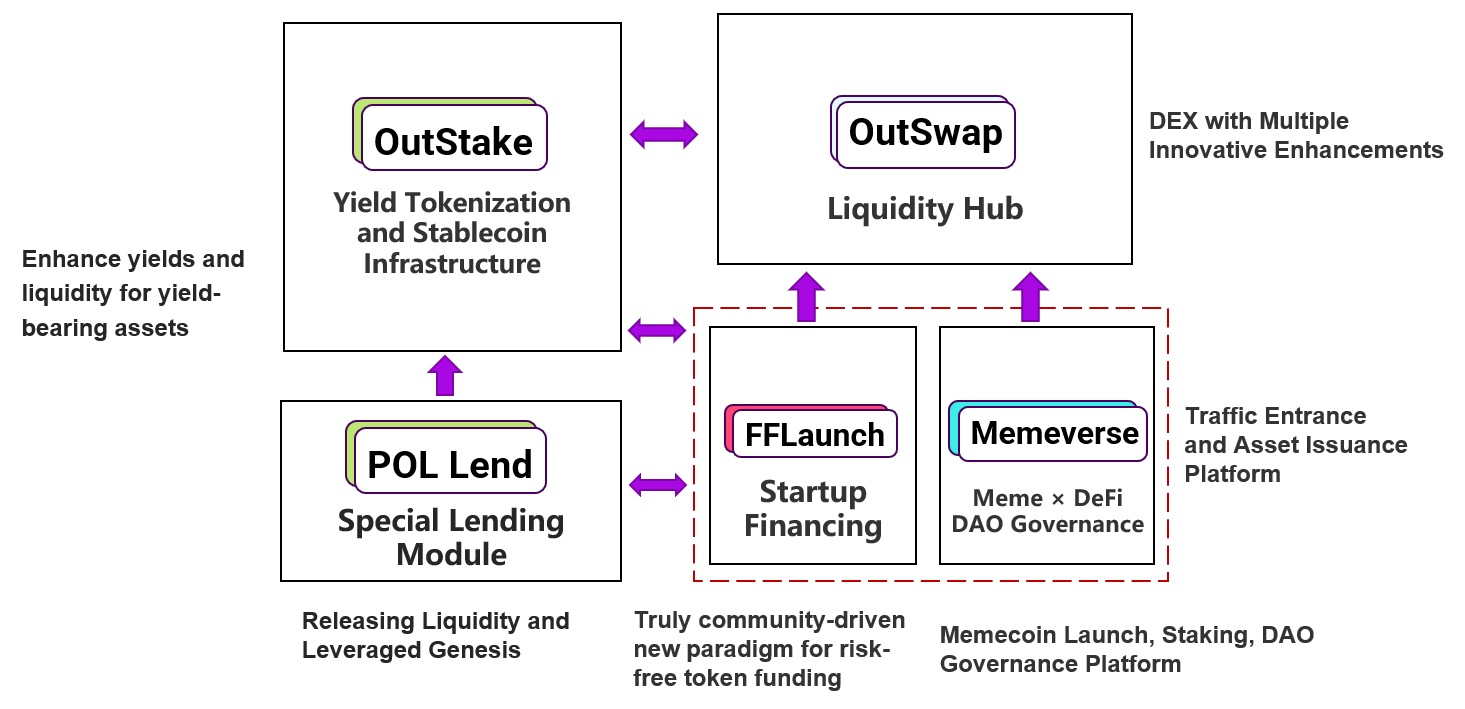

Multi-Module Combination, a Closed-Loop Super App Ecosystem Yield Tokenization × Stablecoin × Memecoin × DAO

Videos

Tech Stack

Description

Introduce

Outrun is committed to becoming a pioneer in the next-generation DeFi and Web3 industries, driving the expansion of Web3's native value into the real world. Through innovative yield tokenization, decentralized stablecoins, fair launch models, and community sustainable construction, it unlocks DeFi yields with higher capital efficiency for users, while leveraging Memecoin as a pivot to promote the widespread adoption of DAOs in Web3 and the real world. The Outrun ecosystem currently comprises five major modules—OutStake, OutSwap, FFLaunch, Memeverse, and POL Lend—encompassing yield tokenization, stablecoins, DEX, risk-free community financing new paradigms, and Memecoin × DeFi × DAO.

OutStake is a yield tokenization and stablecoin module built around yield-bearing assets. It employs a novel mathematical model to construct perpetual YT and UPT stablecoins, resolving the liquidity fragmentation issues in existing yield tokenization protocols (such as Pendle). At the same time, it captures the native yields from idle liquidity within the ecosystem, providing stakers with additional yields, thereby greatly enhancing capital efficiency and composability.

OutSwap's first version, known as Outrun AMM, is built on the constant product AMM and includes several innovative improvements. The most important among them is that Outrun AMM integrates the first real-time settlement native on-chain referral commission engine, allowing anyone to develop their own referral services based on Outrun AMM to guide liquidity and earn commissions.

FFLaunch is the first "risk-free" community financing paradigm under the standard of fair and free. It avoids the risk of project teams rug-pulling (protecting investors and providing free project tokens), prevents project teams and investors from using the secondary market as an exit for liquidity (protecting the secondary market), and enables project teams to obtain sustainable funding streams to accelerate development, achieving a triple-win outcome.

Memeverse is an omni-chain community consensus launcher pivoted on Memecoin. By integrating Memecoin Staking and Memecoin DAO Governance, it transforms Memecoin from a mere speculative asset into a community asset with sustainable value, while accelerating the iteration and evolution of DAOs as a novel mode of human collaboration. At the same time, it is built on the principles of FFLaunch, enabling users to participate in the Memecoin ecosystem with "lower risk or even risk-free," thereby meeting the needs of users with diverse risk preferences—even the most conservative investors can safely engage in Memecoin ecosystem development, rather than it becoming a battlefield for a tiny elite of PVP experts.

POL Lend is a special CDP (Collateralized Debt Position) module within the Outrun ecosystem. Unlike MakerDAO, it enables users to conduct "uncollateralized" borrowing by paying only interest when participating in FFLaunch and Memeverse, providing users with leverage without liquidation risk, thereby greatly enhancing the liquidity and capital efficiency of the Outrun ecosystem.

Multi Module Combination

Outrun has built a unique, multi-module closed-loop Super App Ecosystem that addresses pain points in various scenarios through modular design. Each module serves a specific function, yet achieves interoperability through data and resource sharing, creating a synergistic effect that drives the continuous operation of the growth flywheel. This design significantly enhances the ecosystem's network effects and capital efficiency.

Let's take a look at the module architecture diagram of the Outrun ecosystem:

OutStake is the yield tokenization and stablecoin infrastructure of the Outrun ecosystem, serving as the foundational module. UPT Stablecoin, as the lifeblood of the Outrun ecosystem, flows through all modules, connecting the entire system.

OutSwap is the liquidity hub of the Outrun ecosystem, providing efficient liquidity support for assets issued by OutStake, FFLaunch, and Memeverse, acting as the heart of the ecosystem.

FFLaunch and Memeverse are the traffic entry points and asset issuance platforms of the Outrun ecosystem, located at the top layer, are the areas with the highest user activity, and serve as powerful engines driving the growth flywheel.

POL Lend is a specialized CDP (Collateralized Debt Position) module, distinct from MakerDAO. By integrating the POL Token with yield tokenization engine, it enables users to conduct "uncollateralized" borrowing by paying only interest, thereby allowing them to autonomously "create efficient capital out of thin air" like a central bank, greatly enhancing the liquidity and capital efficiency of the Outrun ecosystem.

Why do we need multi modules?

Staking protocols' revenue relies on commissions, leading to low profit margins and limited growth potential, Must create diversified revenue through ecosystem synergy.

OutStake is also a stablecoin module. The key to stablecoins is adoption for settlements or pricing, not becoming unsustainable dollar-yield schemes reliant on points or token incentives.

In the Outrun ecosystem, modules aren't isolated but tightly linked, building multi-layered growth flywheels through composability and interoperability. This drives efficient capital flows, greatly boosting network effects and capital efficiency.

Outrun believes Web3's endgame isn't a flood of infrastructure, but Super App — so building a modular, scalable super-app ecosystem is key to long-term success.

Business Model

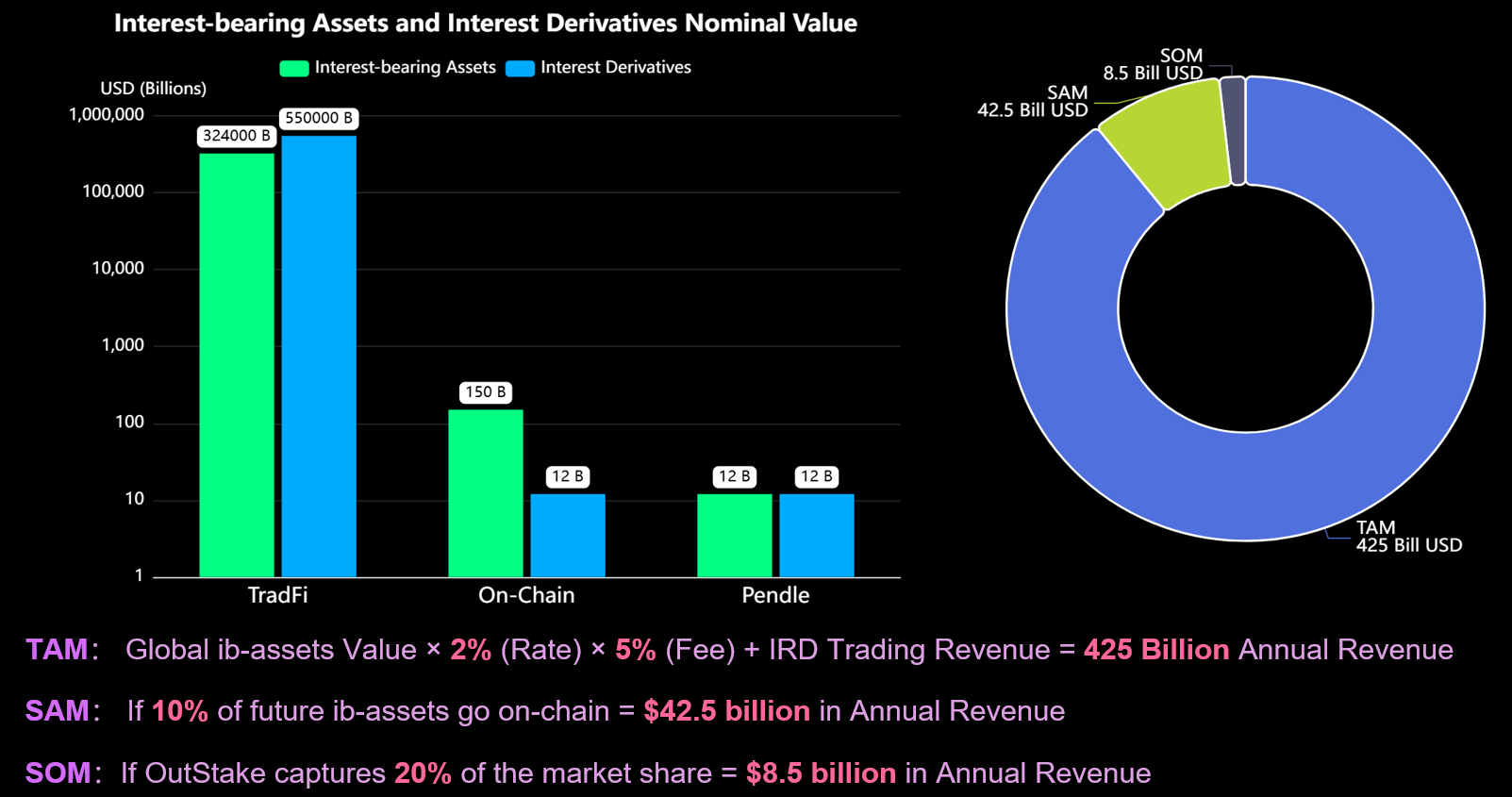

OutStake:

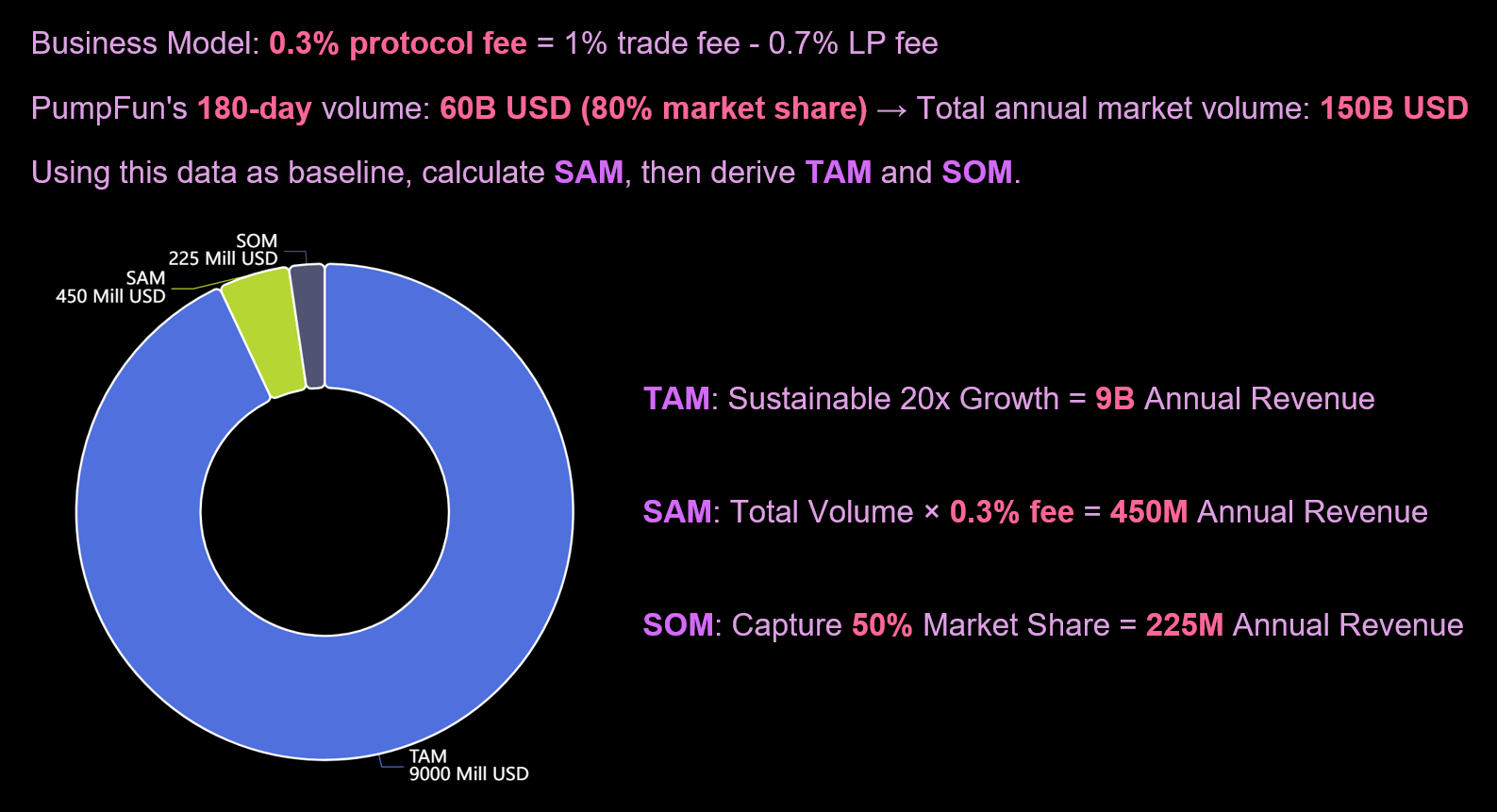

FFLaunch / Memeverse:

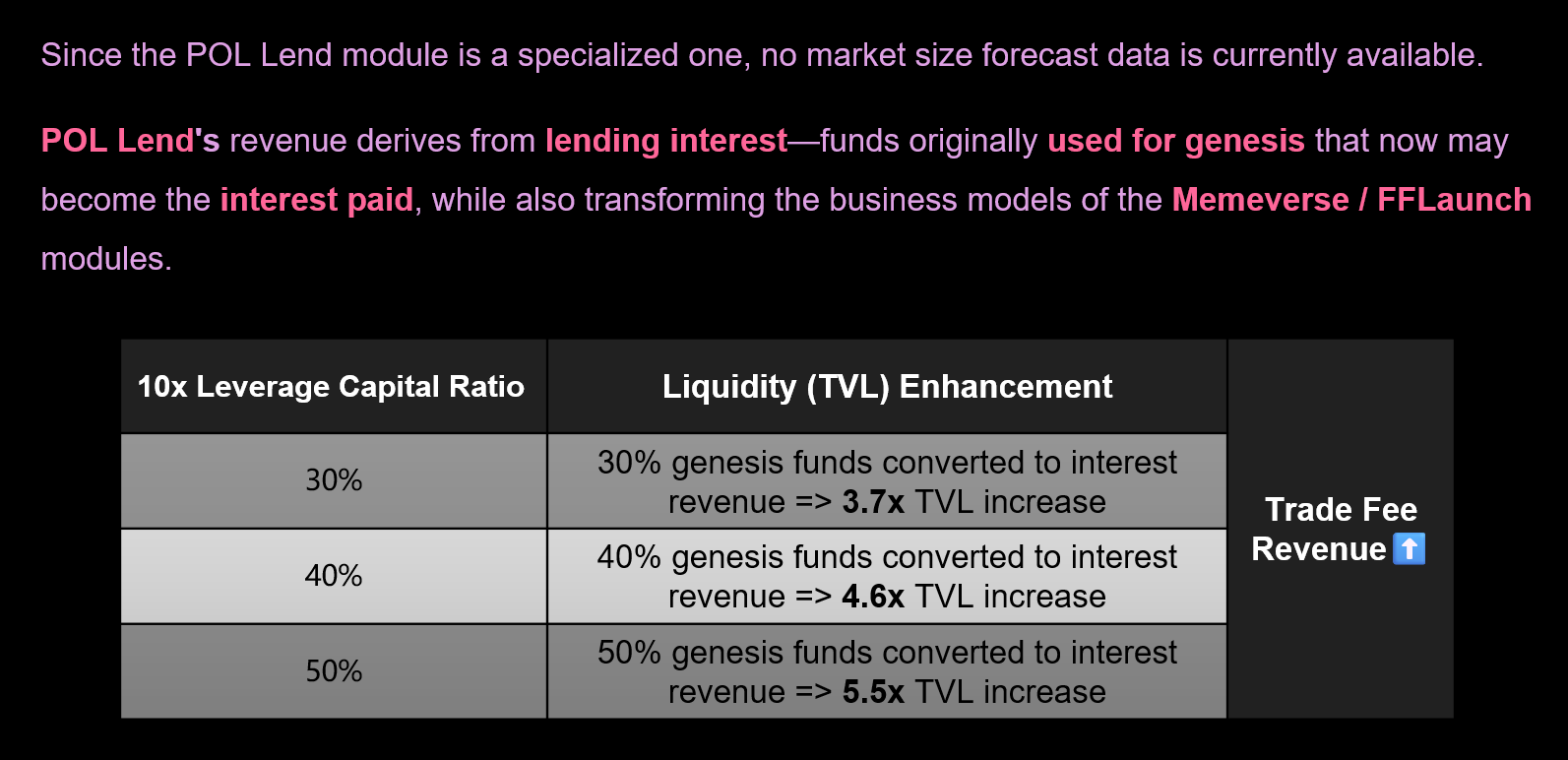

POL Lend:

RoadMap

Outrun has undergone multiple rounds of small-scale closed betas, iterating through several versions, and is now the final version before the public testnet.

Stage | Time | Key Milestones |

Pre-Testnet Building | 2025 Q3 |

|

Public Testnet | 2025 Q4 |

|

Mainnet Launch | 2026 Q1 |

|

Eco Expansion | 2026 Q2 |

|

Scaling | 2026 Q3-Q4 |

|

Team

Name | Responsibilities | Key Experiences & Achievements |

Jason (Founder) | Product Design, Contract Development, Operations |

|

Javen | Full Stack Development |

|

Dawn | Full Stack Development |

|

Appendix

Demo: https://ui.outrun.build

MVP: https://testnet.outrun.build

Product Doc: https://outrun.gitbook.io

Twitter: https://x.com/outrunbuild

Flow Testnet Contract

OutStake

UETH: 0xB9930439fB53287F6b076133089B63Acea6c0F70

UUSD: 0xCDe14f62a2B584dAF03110E369626515BCE36FF6

Faucet: 0x184a3E5D9Ac52047E30d236F23640A8612D3267f

MockUSDC: 0x0cAa33066fFE019d3D1359482aB10324856497f3

MockAUSDC: 0xFDe8dF138b8C53d86D343a54684Ce5F59b2351aD

MockSUSDS: 0x6933B3BC6B135b9B5E06247000f3c89dF9EdF1C4

MockAUSDCOracle: 0xdDDb257Cc455DF389fB6954e9C56646fA7815129 MockSUSDSOracle: 0x3d0A27F4EE9dF4dA1Ff2951d96Cf0321dd58036e

Mock SY aUSDC: 0xcb6a32627e3c7b2e55d06276E762c06031DE390e

Mock SP aUSDC: 0xe39dE8e338104B2080c1a178261bC07B7348d7D6

Mock YT aUSDC: 0x408e297b7Fb7f20630AD6360ae1db7AEE9a64E70

Mock SY sUSDS: 0xf06bd78bF3d067C6F29a1E29e3db4f28BdE1d12E

Mock SP sUSDS: 0x17cC379E97A13D83d93F31910d6ab254521A834A

Mock YT sUSDS: 0x163B6d468F8D2B968d5c8F2ca638708B1aDE60BB

OutSwap

PairImplementation: 0xfaA398B2c9cE11Da26cA8AAeae14732d170937eA

MEVGuard: 0xa44B46e9860a1D0A4Fe9528DCC842f3FCdc5654C

OutrunAMMFactory(0.3% Fee): 0xd25533E9B5559D57b2679123A2a0c4d9Ab1f9902

OutrunAMMFactory(1% Fee): 0x741e37f83cd719B429A69aDF27A88f6e9C184124

OutrunAMMRouter: 0x48508642bBDCddBCFAcCA415759f4e0219204C91

Memeverse

MemeverseRegistrationCenter: 0x8ddEdf8730279150166bE41d068e919C8BaEA2B2

MemeverseCommonInfo: 0xaB4259C46278C6F1282971151f4bD0D83Fee48e7

MemeverseRegistrar: 0x27574a4cBbFCFe51266263c7c94B3B434B48ab00

MemeverseProxyDeployer: 0x61da1Be61D12c8BB9D63B91a8653C15Ec51666F3

MemeverseOFTDispatcher: 0xc80E128DCBAa9f42E23D2A5AA5bE6099B399709e

MemeverseOmnichainInteroperation: 0x111A9d6E0c18dDE94E2f554D824BbcE56CD50515

OmnichainMemecoinStaker: 0x3ECAc01D3817A518d4bAd5b03501198c8bebDE90

MemeverseLauncher: 0x7148D32eaB3dC3fa39d40E4BccF8701b08ecc400

MemecoinImplementation: 0x262C3dDefE3a5B30644eF34128CDcE37C43Da7c6

MemecoinPOLImplementation: 0xff0fE64971573110381e9792E5Aa9BF2f1573E41

MemecoinYieldVaultImplementation: 0x51c87fCf0f0Df4564285D1469CeF651B5E0F6E14

MemecoinDaoGovernorImplementation: 0xE68c7fD2a146217203622479c200bdA2eC4aF837

GovernanceCycleIncentivizerImplementation: 0x7Fc395c1BBb81933a1Fe6A53d5aa1DE1FABaB250