Unlocking $1.8T in SME liquidity via Arbitrum Stylus. The first RWA lending protocol with a Rust-based Risk Engine, offering 99% gas savings for micro-loans in LATAM.

The Problem: The $1.8 Trillion Gap

In Latin America, Small and Medium Enterprises (SMEs) are "asset-rich but cash-poor." A local bakery owns $20k in industrial ovens, but traditional banks classify them as "unbankable" because auditing the depreciation of physical assets is too slow and expensive for legacy finance.

The Solution: Colateral-X

Colateral-X is an institutional-grade RWA (Real World Asset) lending protocol built on Arbitrum Stylus. We allow businesses to collateralize machinery and inventory to access instant liquidity on-chain.

Technical Innovation: Why Stylus?

Traditional RWA protocols fail because running complex depreciation logic (e.g., Double Declining Balance) on Solidity is prohibitively expensive ($5+ per tx).

We built a Hybrid Architecture:

1. Liquidity Layer (Solidity): Standard ERC-20 pooling for compatibility.

2. Risk Engine (Rust/Stylus): We moved the heavy computation to Rust.

* Result: A 99% reduction in gas costs.

* Impact: Validating a $4,500 oven loan now costs cents, making micro-lending finally viable.

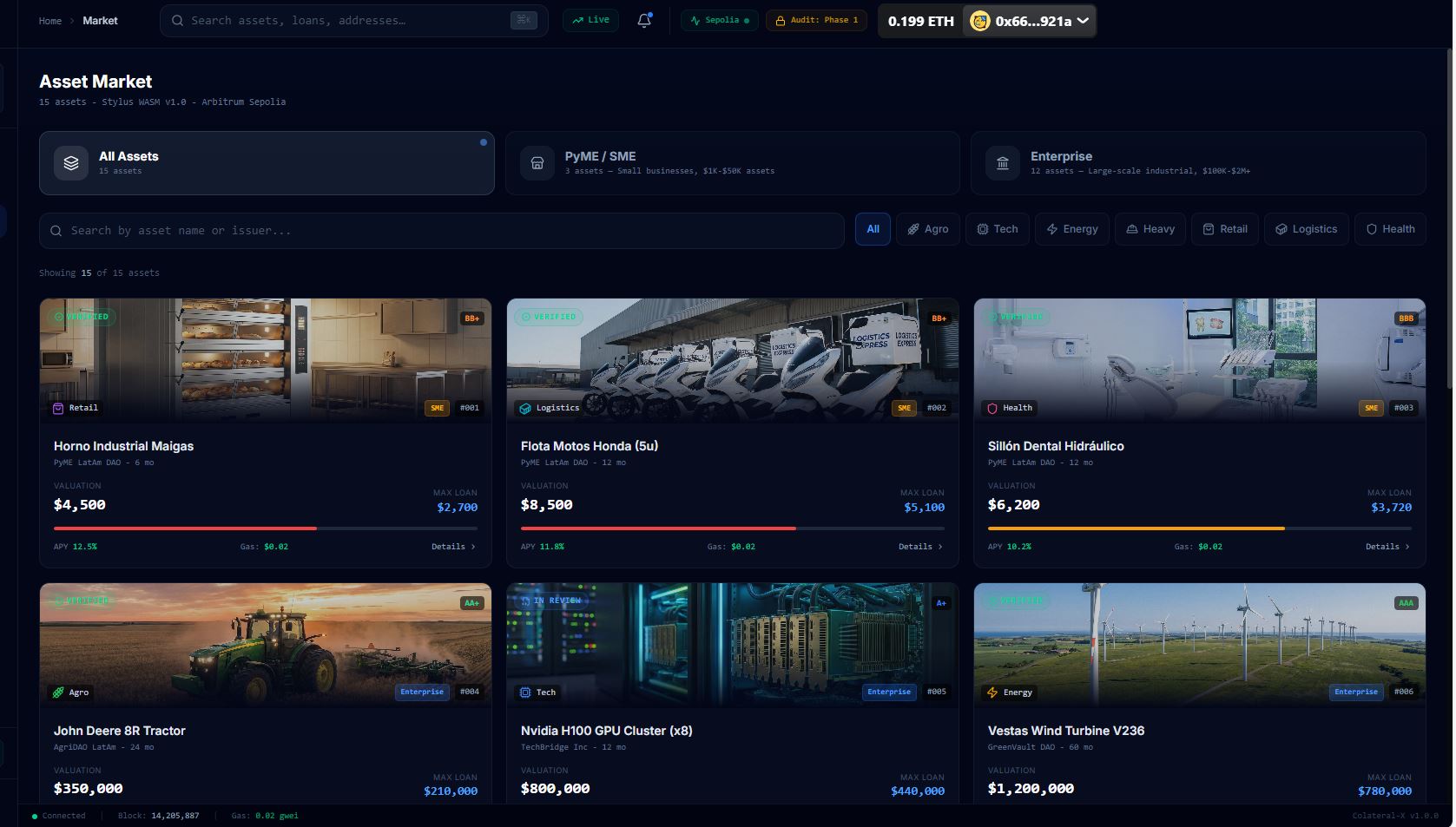

### Key Features

* Market Segmentation: Two-tier system supporting "SME Assets" (Ovens, Bikes) and "Enterprise Assets" (Turbines, GPU Clusters).

* On-Chain Valuation: Real-time asset pricing based on model year and usage, executed in Rust.

* Cached in ArbOS: Our Stylus contracts are cached for maximum performance.

### Roadmap

* Q4 2026: Chainlink CCIP integration for cross-chain liquidity.

* 2027: Legal wrapper integration for Mainnet launch in Chile and Brazil.

MVP Completed. Smart Contracts (Rust & Solidity) deployed on Arbitrum Sepolia. Frontend fully integrated with Mint/Approve/Borrow flow.

Bootstrapped