A multichain oracle infrastructure that delivers reliable, real-time data for assets in emerging markets, enabling accessibility and Interoperability.

IFÁ Labs is a multichain oracle infrastructure that delivers reliable, real-time price data for local stablecoins and financial instruments - unlocking global accessibility and interoperability. We are building the first oracle intentionally optimized for emerging-market assets, starting with Africa and Latin America, and expanding to all RWAs and stablecoins onchain. On top of that, we built an oracle-based swap protocol that is engineered for stablecoin-to-stablecoin transactions. Unlike traditional AMMs, it prioritizes price stability, low slippage, and efficient execution - minimizing volatility and eliminating impermanent loss. We are creating the foundation for a robust and scalable stablecoin ecosystem.

Local Stablecoins & RWAs Are Invisible Onchain

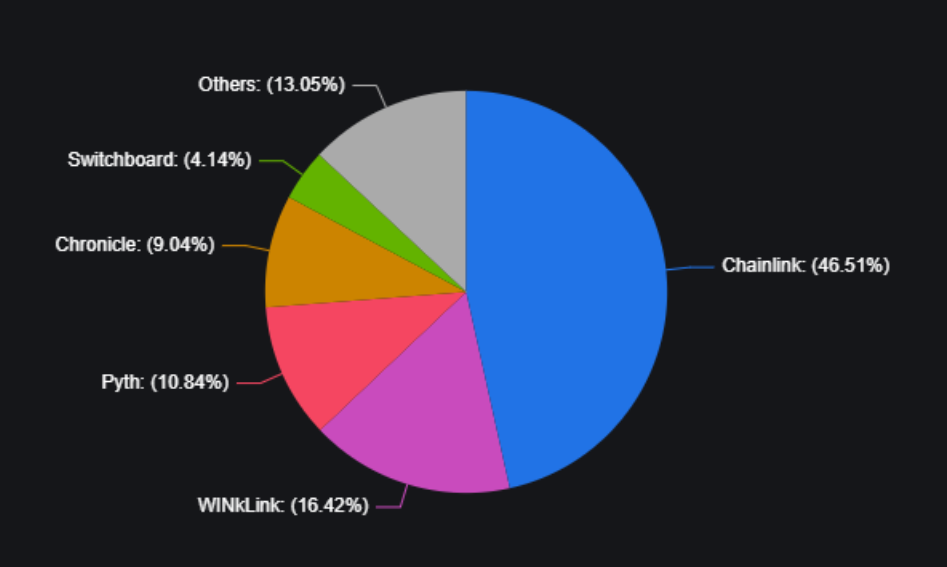

According to Cointelegraph, approximately 86.95% of DeFi products rely on Chainlink, Pyth, WINkLink, Switchboard, and Chronicle for price data.

Major oracle providers (Chainlink, Pyth, Chronicle, Switchboard, etc.) currently do not support local assets in emerging-market, largely due to high listing requirements, typically:

~$3M daily trading volume

~$9M liquidity

Multiple deep-liquidity markets

This excludes early-stage stablecoins like cNGN (Nigerian stablecoin), ZARP (South African stablecoin), BRZ (Brazillian stablecoin), CADC (Canadian stablecoin), local tokenized assets (MMFs, Cash crops, real estate etc), and limits them from being integrated into DeFi, RWAs, or payment products. It’s a critical infrastructure gap.

IFÁ Labs is designed to support emerging-market digital assets, real-world currencies, financial instruments, and real world assets (RWA).

Verified price feeds for global & local assets

Financial instrument feeds (T-bills, commodities, money-market instruments, etc.)

Custom feeds for tokenized RWAs

Oracle based-swap protocol

We make it possible for developers on Mantle to build FX-powered apps, Stablecoin DEXs, Remittance/payment rails, Lending/borrowing protocols, RWA tokenization platforms, Treasury and yield products

Onchain Oracles: Decentralized smart-contract–readable price feeds that deliver real-time, verifiable data for stablecoins, fiat FX, and selected crypto assets across multiple blockchains. These feeds are designed for DeFi protocols, lending markets, swaps etc.

Local & Emerging-Market Asset Support: Native support for local stablecoins and fiat currencies (e.g., cNGN, BRZ, CADC) that are typically excluded from major oracles due to high liquidity and volume requirements. This unlocks onchain accessibility for underserved markets.

Multi-Source Data Aggregation: Prices are aggregated from multiple sources. This reduces reliance on any single source and improves accuracy and resilience.

Price Verification & Integrity Layer: A dedicated verification system that checks timestamp freshness, source consistency, deviation limits, and peg stability before publishing prices. Onchain verifier contracts acts as a safeguard against stale or manipulated data.

Public Price Auditability: Every asset price published by IFÁ Labs is publicly auditable. Anyone can inspect price sources, timestamps, update frequency, and historical values- ensuring full transparency and trustlessness.

Oracle-Based Stablecoin Swap Protocol: A native swap protocol powered directly by IFÁ Labs price feeds, optimized for sawps. It prioritizes price accuracy, minimal slippage, and capital efficiency - without reliance on traditional AMM mechanics.

Developer Community & Ecosystem (Telegram): An active developer forum where builders gain Early access to oracle feeds and tooling, Technical support and integration guidance, Opportunities via hackathons, grants, and partnerships, and Direct feedback loops.

Mantle is positioning itself as a global hub for RWAs, stablecoins, and next-gen DeFi.

However, to unlock emerging-market RWA growth, Mantle needs rich, verifiable data beyond the standard crypto-only or USD-only assets supported by existing oracles.

This video explains the technical implimintention of IFÁ LABS

Deployment of the ifapricefeed: https://sepolia.mantlescan.xyz/tx/0xeff8c68d9c1e886da32e0cea9cc58d5ebfc75a2190fd114ca6f2891c259ccad2

Transactions of the ifapricefeed: https://sepolia.mantlescan.xyz/tx/0x5de9edb8b0312a4432051086f595180a4f20ad4dbaee4149a399664c312c11cc

Deployment of the ifapricefeedVerifier: https://sepolia.mantlescan.xyz/tx/0xf09c1ed107d99f35bfcc92645644077c4c55d97c5ccdc3f329d5c385a162c6ec

Transactions of the ifapricefeedverifier: https://sepolia.mantlescan.xyz/tx/0xf09c1ed107d99f35bfcc92645644077c4c55d97c5ccdc3f329d5c385a162c6ec#internal

Swap deployment:

IfaSwapFactory deployed at: 0x64a6Ba0e652215E71097a9B570d0A378125D1dB0

IfaSwapRouter deployed at: 0x07E28A311fbE531707340A5E402E25411eB1Fda6

Github: https://github.com/IFA-Labs/

Website: https://www.ifalabs.com/

Twitter: https://x.com/Ifalabs

LinkedIn: linkedin.com/company/ifalabs

Blog: https://paragraph.com/@if-labs

NOTE: All of the Stablecoin assets on IFA LABS are fully compliant and regulated.

Cheers,

IFÁ LABS team.