Pioneer incentivized exchange that eliminates idle capital

Right now, crypto makes you choose: your capital is either trapped in a limit order earning zero, or it's supplied in yield protocols completely unavailable for trading. There's no middle ground. Your portfolio can't serve as collateral for your own trading positions - it's insane when you think about it.

The truth is we’re all tired of missing out on opportunities while our capital sits completely unproductive.

Now You Realized How Much Opportunity We Missed?

Data From CryptoQuant : Around $25-45bil sits idle on CEX Orderbook last sear. So, we're building the most liquid infrastructure in the world.

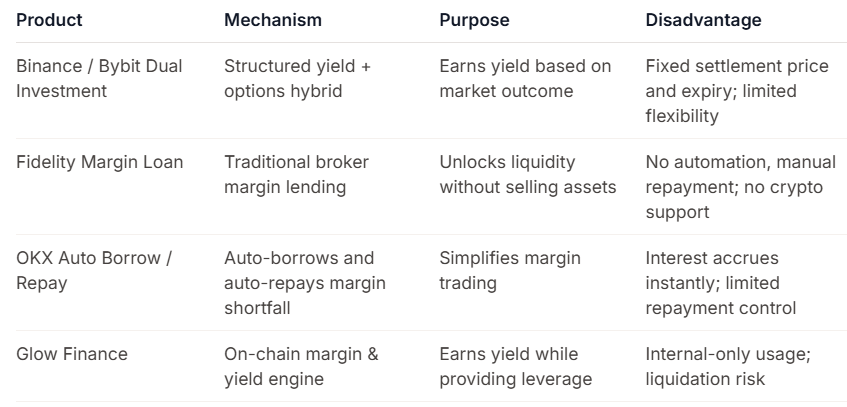

Plenty of platforms claim they're solving this, but the infrastructure is still fragmented and liquidity remains siloed. ScaleX takes a different approach with unified liquidity pools - letting traders execute strategies and earn yield seamlessly.

The protocol operates through five integrated components:

Balance Manger - Maintains 1:1 peg, tracks yields, and issues synthetic tokens when users deposit assets

Synthetic Token - ERC20 tokens representing 1:1 pegged underlying assets that trade on the order book while users earn yield from underlying deposits

Orderbook - High-performance CLOB with Red-Black Tree data structure for O(log n) price operations and integrated lending awareness

Oracle - Multi-timeframe TWAP oracle providing manipulation-resistant pricing for trading, borrowing, and collateral valuation

Lending Manager - Generates yield from real assets through native lending protocol with integrated order book access

Here our Mantle Testnet Deployment

ScaleX aligns perfectly with Mantle's vision of building scalable, high-performance DeFi infrastructure for real-world adoption. By leveraging Mantle's modular L2 architecture, we're solving a critical problem that affects every trader - the forced choice between yield and trading execution - while extending this solution to RWA assets like tokenized stocks (NVIDIA, Google, AAPL) and commodities (Gold, Silver). Mantle's low cost enable to deliver seamless liquidity for both crypto and traditional assets at scale, making our unified liquidity pool economically viable for all traders. We're demonstrating how Mantle's technology can power the next generation of capital-efficient infrastructure that bridges DeFi with traditional markets, making tokenized real-world assets as liquid and productive as native crypto.