Tokenise, invest, borrow, and earn yield on real-world assets - verified once, executed on Mantle, and usable across any chain with a single source of truth.

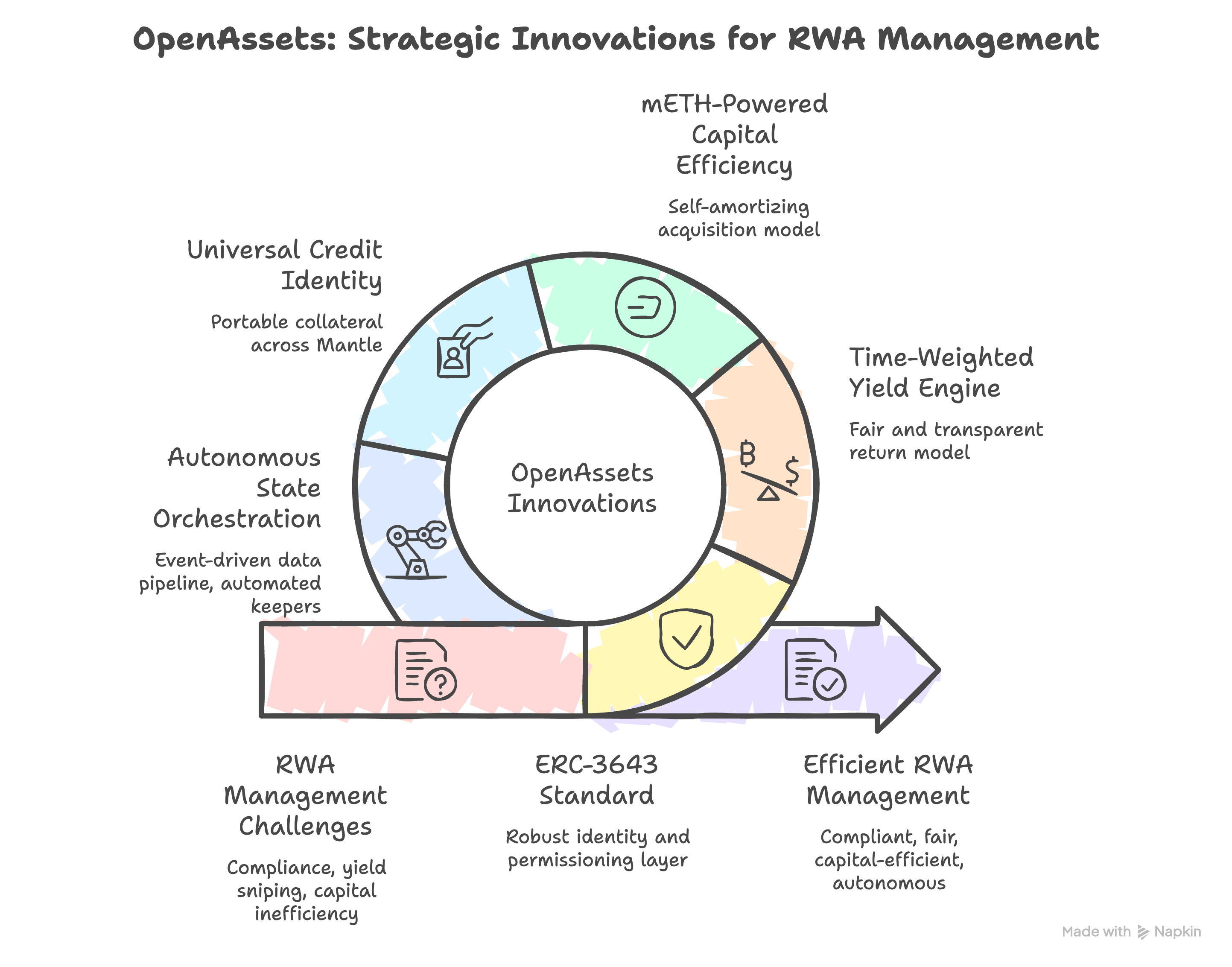

OpenAssets is not just another tokenization platform; it is a capital formation engine built natively for the Mantle Network. We believe the true potential of Real-World Assets (RWAs) remains untapped because they are currently treated as static digital certificates. OpenAssets changes the paradigm by transforming off-chain cash flows,starting with trade receivables into dynamic, credit-enabled financial primitives.

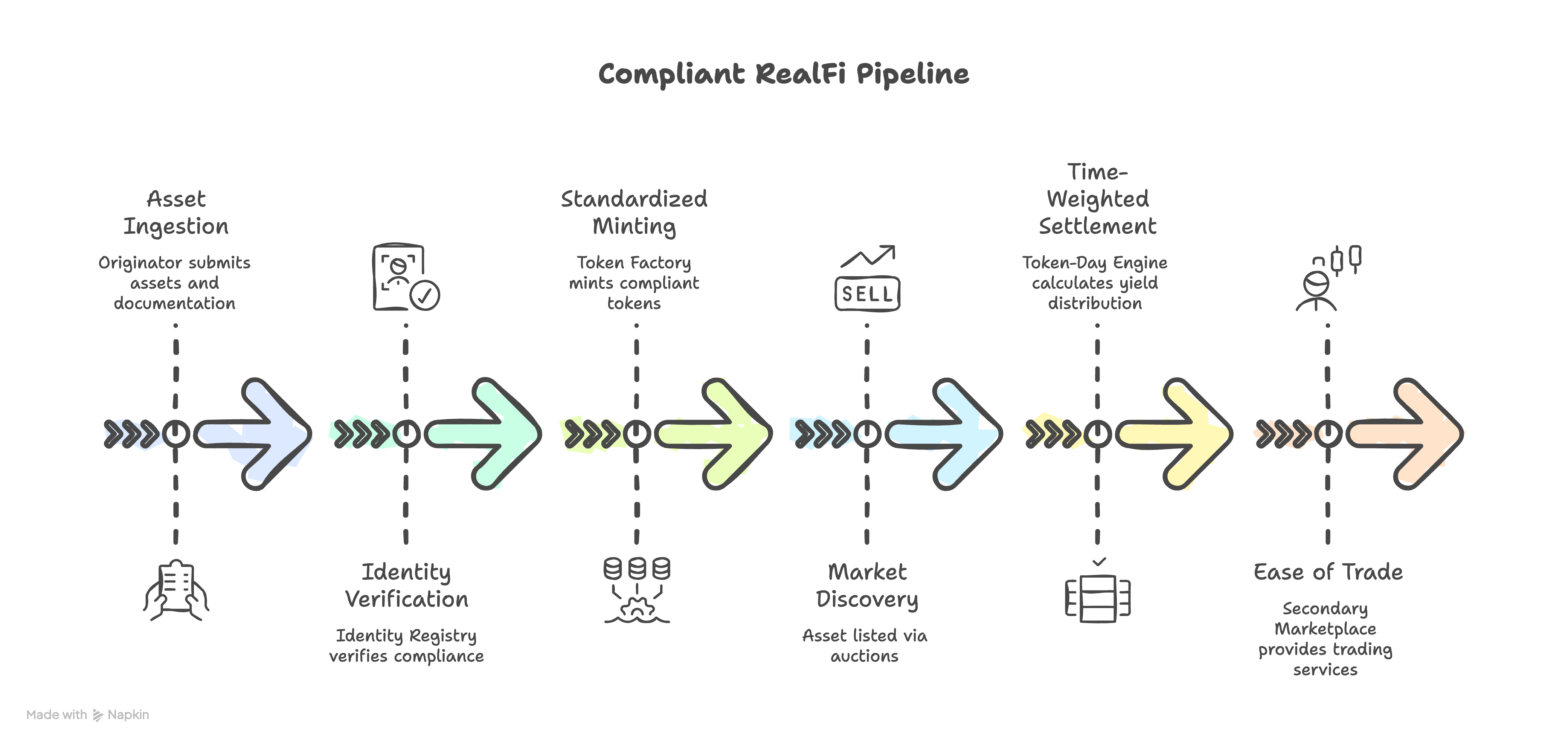

By anchoring the entire lifecycle, from compliant issuance to secondary market settlement into a deterministic on-chain state machine, we allow RWAs to move at the speed of DeFi.

The Issue: Capital is held hostage by maturity dates.

The Problem: Traditional RWA tokens are "maturity-locked." Once an investor purchases a tokenized invoice or bond, their capital is effectively "frozen" for 30, 60, or 90 days.

The Impact: This creates a massive opportunity cost. Investors cannot react to market volatility or pivot to new opportunities because their RWA is "dead weight" in their wallet it has value, but no velocity.

The Issue: "Last-Holder-Takes-All" logic destroys secondary markets.

The Problem: Most on-chain yield models pay whoever holds the token at the exact moment of maturity. If an investor holds an asset for 99% of its duration but needs to sell a day before settlement, they lose 100% of their accrued yield to the buyer.

The Impact: This encourages "Yield Sniping" and penalizes long-term holders. It makes secondary markets toxic, as there is no mathematical incentive to provide liquidity mid-cycle, leading to stagnant, illiquid RWA ecosystems.

The Issue: Collateral is siloed and non-composable.

The Problem: To borrow against an RWA today, you must usually move your asset into a specific, siloed lending protocol. This creates "Liquidity Islands" where your collateral is only recognized by one lender.

The Impact: This forces users into risky, high-friction migrations. If you want better terms elsewhere, you have to withdraw, bridge, or transfer your collateral, losing time and paying excessive gas. There is no "Universal Credit" identity that allows RWA collateral to be portable across the Mantle ecosystem.

OpenAssets introduces a deterministic lifecycle for RWAs on Mantle, engineered to ensure that every stage, from capital formation to final settlement is mathematically optimized for liquidity and institutional trust.

We move beyond simple asset "wrapping" by adopting the ERC-3643 (T-REX) standard. By embedding Identity Registries and permissioning logic directly into the token's DNA, we ensure that every invoice remains compliant across its entire on-chain journey. This creates a non-reversible state machine on Mantle that offers the institutional-grade auditability and custody modeling required for sovereign-level RealFi.

We have pioneered a capital-efficient acquisition model that turns Mantle Staked ETH (mETH) into a productive collateral engine. By utilizing mETH as primary collateral, our Leverage Vault automatically harvests native staking yield to service the loan interest, of the position created to buy any RWA. This creates a self-amortizing lending strategy where investors maintain leveraged exposure with net-positive yield outcomes, deep-linking RWA utility with Mantle’s core DeFi liquidity.

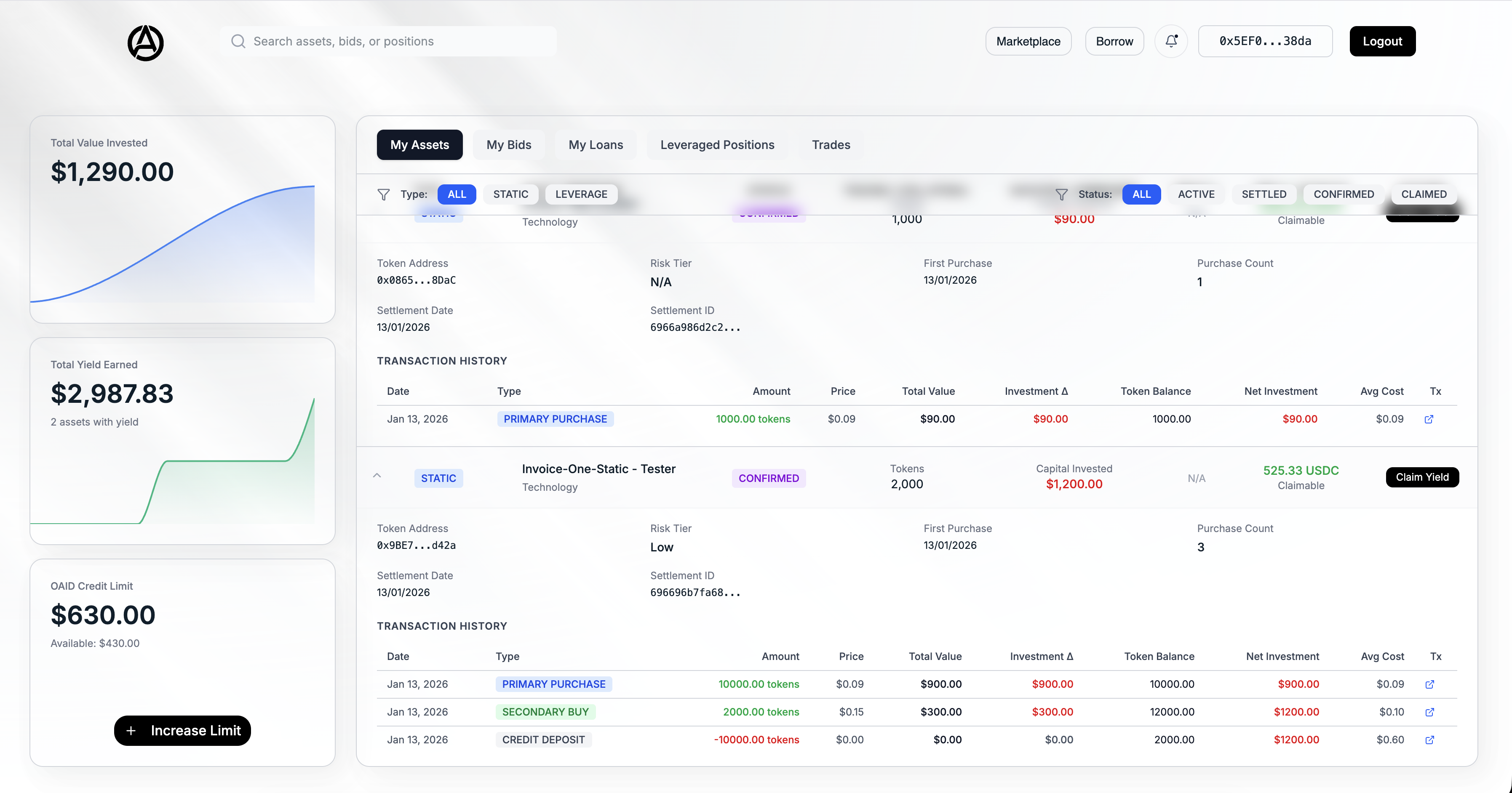

We introduce the Open Access ID (OAID), a universal credit identity that fundamentally decouples asset custody from capital utility. By securing assets within our Solvency Vault, RWA collateral is transformed into a portable credit line. This allows users to "Deposit Once, Borrow Everywhere," tapping into multiple Mantle lending markets and yield optimizers simultaneously without moving the underlying asset.

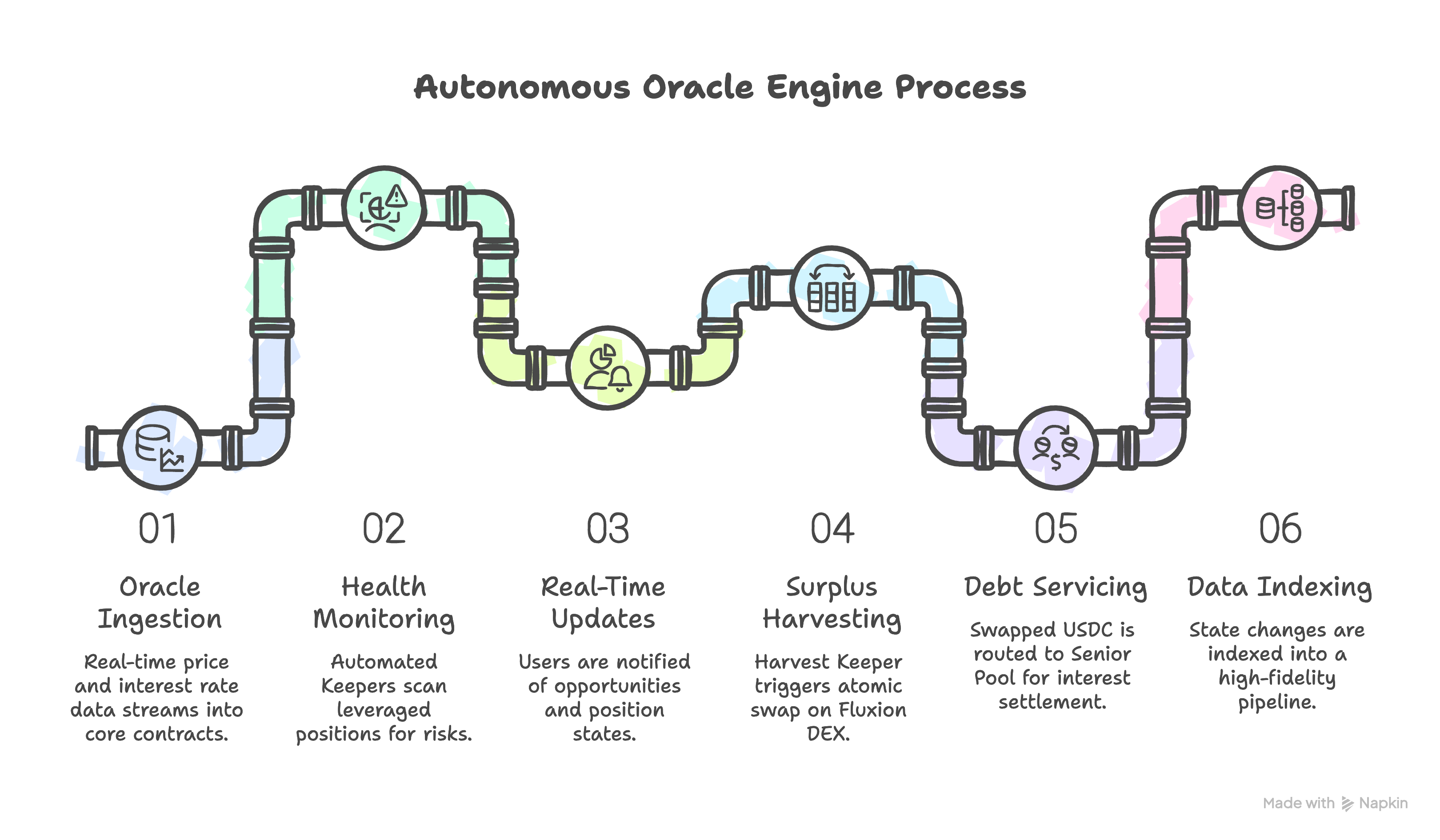

The protocol is governed by an Event-Driven Coordination Layer that synchronizes Mantle-native price feeds with off-chain asset maturity. Our Automated Keeper System acts as an on-chain autonomous agent—continuously monitoring Health Factors and executing interest-servicing swaps on the Fluxion DEX (mocked for sepolia ). This replaces manual asset management with a deterministic data pipeline, ensuring protocol solvency via real-time oracle integration.

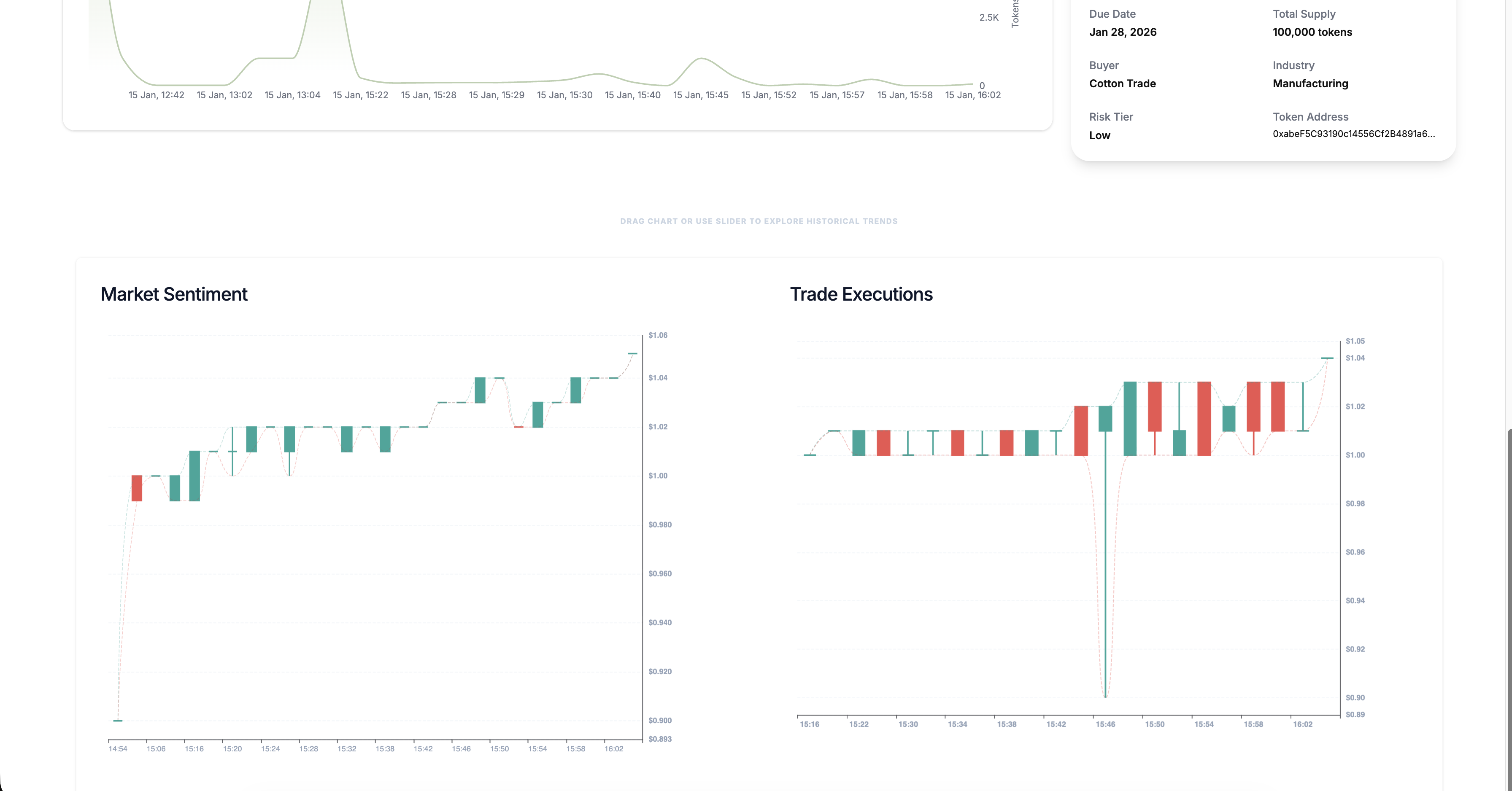

To fuel a healthy secondary market, we’ve built an Algorithmic Yield Engine that tracks ownership duration down to the second. By distributing returns based on "Token-Days," we mathematically eliminate "Yield Sniping." This ensures compliant yield distribution where every participant,from primary buyers to secondary traders is rewarded precisely for their specific duration of risk.

Issuance • Discovery • Leverage • Credit • Settlement

Official Website: openassets.xyz

Documentation (Notion): OpenAssets Core Proposal & Docs

Interactive System Sitemap: How it Works

Project Roadmap/Changelog: Changelog

About the Team: About Us

Client (Frontend): TOA-Client-Mantle

Server (Backend/Contracts): TOA-Server-Mantle

X (Twitter): @TheOpenAssets

Discord: Join Community

Telegram: Chat Hub

Onboarding & Discovery

Authenticate:

Asset Registration:

Marketplace Discovery:

Trading & Auctions

USDC Purchase:

Auction Bidding:

Secondary Market Trading:

Mantle-Native Innovations

mETH Leverage System:

OAID Credit Line Creation:

Borrowing Logic:

Repayment & Collateral Reclaim:

Management

Portfolio Overview:

2026 OpenAssets.

All rights reserved.

Built with precision for the Mantle Network ecosystem.

Mantle Synergy Study: Researched the Mantle LSP (mETH) mechanics to design the "Surplus Yield" harvesting logic for interest servicing.

Architecture Mapping: Designed the OpenAssets State Machine (Draft → Registered → Issued → Active → Settled) and the monorepo structure using NestJS and Hardhat.

Protocol Core: Developed and tested a suite of 18+ interconnected smart contracts, including the AssetRegistry, YieldVault, and OAIDRegistry.

Compliance Integration: Implemented ERC-3643 compliant identity logic, ensuring only verified participants can interact with RWA tokens.

The Orchestrator: Wrote a complex, idempotent deployment script that handles the mutual authorization and linking of the entire 18-contract stack in a single execution.

Leverage Logic: Built the FluxionIntegration and LeverageVault to handle atomic mETH/USDC swaps for yield-servicing.

Real-time Indexer: Built a high-speed event listener in NestJS to reconstruct protocol state into a MongoDB cluster for sub-millisecond frontend response.

Automated Keepers: Developed the Health Monitor (monitoring LTV/Liquidation risk) and the Harvest Keeper (automating the mETH interest servicing cycle).

Credit Abstraction: Implemented the OAID indexing logic to track global credit headroom across multiple loan positions.

High-Fidelity Dashboard: Developed a professional-grade interface using Next.js 14 and Tailwind CSS, focusing on complex financial data visualization.

Simulators: Created the mETH Leverage Simulator, allowing users to visualize their health factor and projected APY before committing capital.

Marketplace Discovery: Built the bidding interface for Uniform-Price Dutch Auctions, complete with real-time WebSocket updates via Redis.

End-to-End Testing: Conducted full-lifecycle testing on Mantle Sepolia, simulating invoice issuance, investor auctions, mETH-leveraged buys, and final USDC settlement.

Documentation: Produced 11+ feature walkthrough videos and comprehensive technical documentation to ensure project accessibility.