Back

Moonshot Mafia #21 | Arkreen: How can DePIN become an important narrative in the next cycle?

Fireside Chats

By Moonshot Commons

Aug 27,202318 min read

Arkreen is a data infrastructure network that connects globally distributed renewable energy equipment, hoping to promote the deployment of more renewable energy equipment and maximize resource utilization in the form of Web3, and ultimately achieve the global zero carbon goal.

At the 2023 Hong Kong Web3 Carnival, Arkreen, together with HashKey and Hash Global, released the “Bitcoin Block Computing Carbon Neutral Application” and “DePIN Hong Kong Initiative” to promote the further development of the DePIN (Decentralized Physical Infrastructure Network) ecosystem.

At Moonshot Commons’ Web3 Fireside Chat #21, we invited Leo Lin, founder of Arkreen, to share his views on green energy data and the DePIN track.

Before jumping into our conversation with Leo, let’s briefly touch on today’s key takeaways, as well as the emergence of DePIN and Arkreen.

Source: Arkreen

Key Takeaways:

1.Carbon neutrality has become a critical concern in contemporary society due to the increasing carbon dioxide emissions. Web3 technology offers solutions to address energy-intensive practices like Bitcoin mining.

2.“Green Web3” focuses on achieving carbon neutrality through “On-chain Greening” and “Greening on the Chain,” where digital assets related to carbon neutrality are programmable and tradable. ReFi plays a crucial role in combining carbon and green assets with DeFi protocols for enhanced liquidity and transparency.

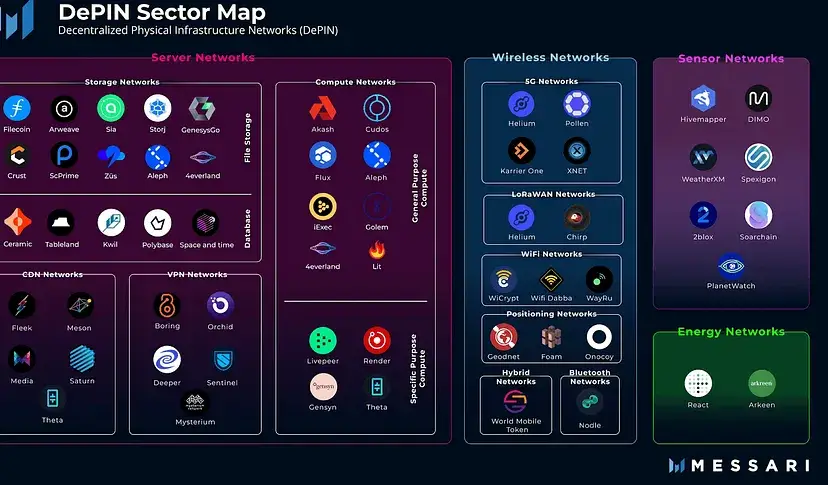

3.DePIN (Decentralized Physical Infrastructure Network) is a global community-driven initiative that enables collaboration through tokens to establish and maintain physical infrastructure. It can address waste-related challenges and has potential applications in various industries beyond green energy.

4.Arkreen is a data network for globally distributed renewable energy facilities, incentivizing large-scale collaboration through tokens. It connects renewable energy equipment and aggregates verifiable data into a network, fostering carbon neutrality efforts.

5.Arkreen’s REC Tokenization Bridge protocols transform green data into tokenized green certificates, allowing broader participation in carbon neutralization efforts. Tokenized RECs can offset carbon emissions and hold significant value for companies seeking carbon neutrality.

6.DePIN complements the new infrastructure and enables large-scale community collaboration for infrastructure development. It can positively impact various industries by leveraging decentralized approaches to constructing valuable networks.

The energy issue is the common concern of all mankind.

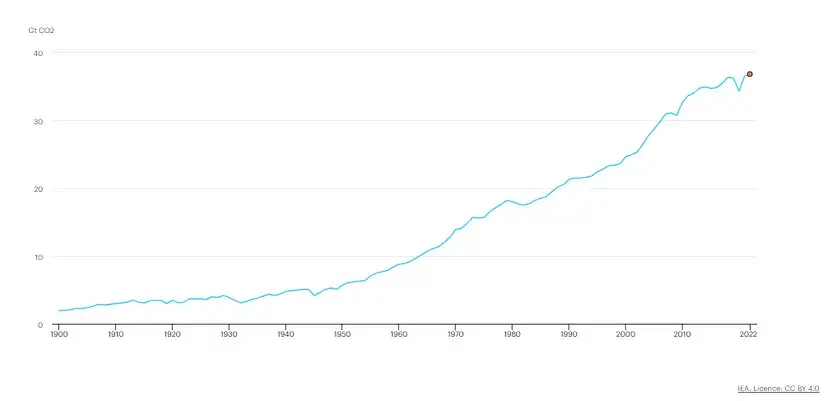

The International Energy Agency (IEA) pointed out that carbon dioxide emissions will increase by 0.9% in 2022, exceeding 36.8 billion tons, a record high. Carbon neutrality has become the most important issue in contemporary human society.

Global CO2 emissions from energy combustion and industrial processes, 1900–2022. Source: IEA

With the advent of Web3, the issue of Bitcoin’s energy-intensive mining practices has drawn significant public scrutiny, owing to its substantial energy consumption and easily quantifiable attributes.

“The energy network also needs to be globalized and digitized,” said KK, the founder of Hash Global. “We no longer lack green energy production equipment and technology, and the use of green energy has been greatly expanded. However, the energy ecological network has not been effectively constructed, and I think that the core reason is the lack of credible data spanning the entire network.”

To foster sustainable growth within the industry, the concept of “Green Web3” emerged, giving rise to two approaches: “On-chain Greening” and “Greening on the Chain.”

Among them, “Greening on the Chain” is to convert digital assets related to carbon neutrality into programmable digital assets through blockchain technology, to realize digitization, tradability, and programmability.

In this way, the goal of carbon neutrality can be achieved, and the deep integration of environmental protection and the digital economy can be promoted through the digitization, credibility, and verifiability of relevant data and information. Renewable finance (ReFi) is an important narrative in this context.

Simultaneously, the divide between Web3 and the real world has prompted cryptographers to ponder: How can Goodwill be effectively manifested in the real world using blockchain technology?

Source:Bitstamp

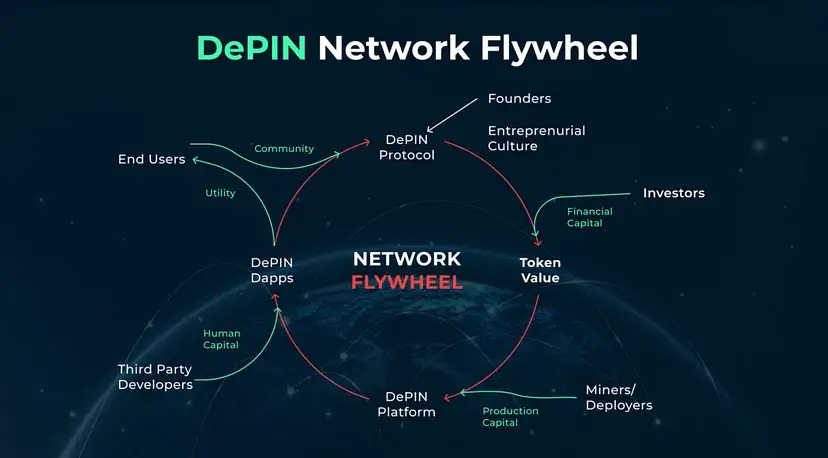

DePIN (Decentralized Physical Infrastructure Network) refers to a global community-driven initiative that fosters extensive collaboration through tokens, uniting individuals to collectively establish, maintain, and operate physical infrastructure. Addressing waste-related challenges has sparked heightened governance participation from a diverse array of individuals, showcasing their proactive involvement.

Messari predicts that the DePIN market, including cloud, wireless network, and energy network, will have a scale of 2.2 billion USD and will grow to 3.5 billion USD in 2028.

“Arkreen”, which taps into the green energy data network in the DePIN model, is the star project of this track.

Moonshot Commons:

Hi, Leo! Could you give us a quick overview of Arkreen?

Leo Lin:

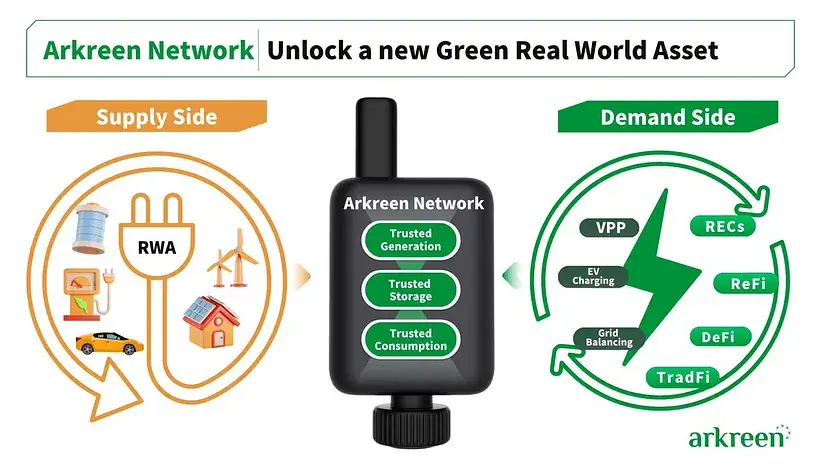

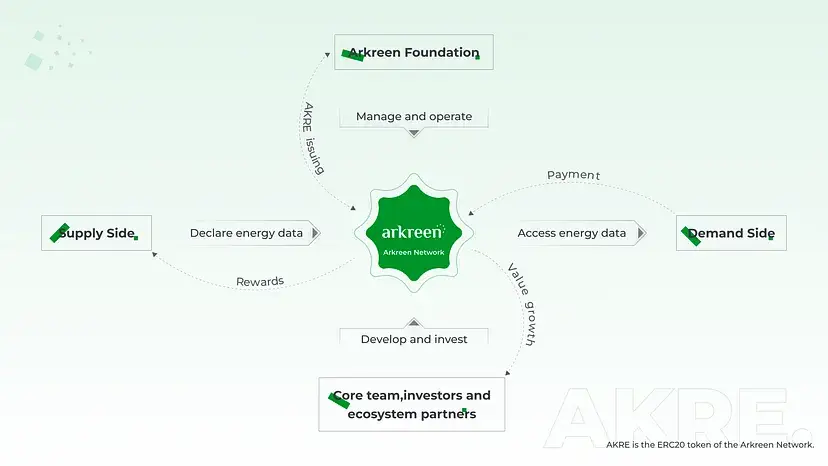

Sure. Arkreen is a data network for globally distributed renewable energy facilities. It mobilizes large-scale collaboration in the global community through the token incentive mechanism, links household photovoltaics, energy storage batteries, charging piles, and other renewable energy equipment, aggregates verifiable data into Arkreen’s network, and builds the supply side of renewable energy data using the DePIN model.

Simultaneously, on the demand side of the Arkreen network, a series of REC Tokenization Bridge protocols have been implemented. These protocols enable the transformation of credible and verifiable green data, aggregated on the Arkreen network, into green certificates that can be tokenized, facilitating broader participation in carbon neutralization efforts. This is also an important direction of ReFi, combining carbon assets and green assets with DeFi protocols and applications to improve liquidity and transparency and lower the threshold for participants.

Source: Arkreen

Moonshot Commons:

What sparked the inception of the Arkreen project?

Leo Lin:

Our team had been thinking about how to apply blockchain technology to IoT (Internet of Things) scenarios for the past few years.

At the beginning of last year, we had a lot of exchanges with the Singaporean government and enterprises to discuss the business scenarios of the Internet of Things and blockchain. The results of the discussions all pointed to decarbonization and sustainability. We hope to use digital technology, such as the IoT, to collect emission-related green data in the scenario in real-time, and at the same time, the trusted data of IoT terminals can be uploaded to the chain to realize the verifiability and immutability of green data in scenarios such as photovoltaics, charging piles, energy storage batteries, and air conditioners throughout the entire life cycle.

And a very important driving force behind the project is that the green data itself needs to be fair because it needs to be verified by a third party such as government regulatory departments, financial institutions, upstream and downstream enterprises, and carbon exchanges.

Another very important driving force is that green data has a strong financial attribute. Reducing carbon emissions can generate carbon credits to form additional benefits, and real carbon emission data can effectively reduce carbon taxes.

Source: Arkreen

So we started to plan the direction of green carbon data on-chain.

There are many types of green carbon data, and we focus on renewable energy equipment that is relatively easy to digitally transform, such as photovoltaics, energy storage, charging piles, etc., which make it easier to use the resources of our Internet of Things industry.

Then, we further focused on PV (Photovoltaic) equipment within renewable energy equipment. Because the sun shines on the earth universally, not just in one place, it is very consistent with the distributed characteristics of Web3.

Smart Logger for Solar PV to access Arkreen Network. Source: Arkreen

Due to the regional universality of the sun, in addition to today’s highly digitalized centralized large-capacity photovoltaic power plants, we also have a large number of long-tail household small-capacity distributed photovoltaics. Their green data value is not fully utilized today.

Because the green data value of a single distributed household photovoltaic device is not high, the ROI of digital transformation cannot be calculated. But if we can use Web3 to connect these long-tail distributed photovoltaics and gather the green data generated by these ten thousand, one hundred thousand, or even one million distributed rooftop photovoltaics, we can form a relatively large data asset. It can be sold as a green certificate asset.

This data can also be provided to energy service providers such as virtual power plants for forecasting and dispatching on the power generation side and power consumption side, so as to fully tap the value of green data assets in this long-tail market.

Therefore, we decided to use Web3 to build a data infrastructure network for distributed renewable energy equipment and launched the Arkreen project.

Moonshot Commons:

Why do the green data of these globally distributed renewable energy devices need to be on-chain? What is the real value of it?

Leo Lin:

Taking photovoltaics as an example, the electricity generated by photovoltaics is clean energy, so it is called “Green Energy”. For every 1,000 kWh of electricity generated by photovoltaic solar energy, 1,000 kWh of green energy is generated accordingly.

Once the data of this action is validated, a financial product called REC (Renewable Energy Certificate) can be generated. Purchasing a REC can offset the use of 1,000 degrees of Brown Energy (a type of traditional energy, such as thermal power in power plants) carbon emissions.

Source: Google Data Centers

For example, leading technology companies such as Microsoft and Google will claim that their data centers are green and Net Zero (Net Zero Emissions). A data center may use hundreds of millions of kilowatt-hours of electricity a year. These come from the “Brown Energy” from power plants.

In the medium and long term, photovoltaic power plants or wind power plants will be deployed next to the data center to directly provide clean energy to the data center, but it will take a relatively long construction period.

In the short term, data centers need to purchase RECs from the market to offset the carbon emissions resulting from their electricity consumption to achieve their carbon-neutral objectives.

Consequently, an increasing number of companies are now contemplating the adoption of green certificates as a means to achieve carbon neutrality. This underscores the tremendous potential value of power generation data from globally distributed photovoltaic energy equipment on the demand side.

Moonshot Commons:

What are the main advantages of DePIN’s model for building this long-tail market of the globally distributed green energy data network?

Leo Lin:

In the past, RECs were mainly developed for large assets such as centralized photovoltaic power stations. No company had been able to develop these small assets of distributed photovoltaics on the roof with relatively high efficiency and low cost.

Simultaneously, distributed photovoltaics represent a substantial long-tail market, with a substantial portion of solar energy harnessed on rooftops through such systems. The aggregation and development of this data hold the potential to become an expansive data asset.

Source: Arkreen

In the DePIN model, employing a collaborative community co-build approach, each participating individual takes responsibility for the hardware costs, personally installing IoT hardware on the photovoltaic inverter, and ensuring ongoing operation and maintenance. With this decentralized method, each individual bears both the CAPEX (Capital Expenditure) and OPEX (Operating Expense) of infrastructure construction.

This way, it is possible to develop this long-tail distributed photovoltaic data market bottom-up with relatively high efficiency and low cost in the form of collaborative organization of global communities.

Moonshot Commons:

Are there any practical use cases that can reflect the transformation of the green energy scene under the DePIN model?

Leo Lin:

In the development of green certificates, under the traditional model, the government, institutions, enterprises, and other entities need to send personnel to each photovoltaic power station to perform on-site audits, check the capacity of each power station, and submit power generation data on a regular basis. With this method, they confirm how many kilowatt-hours of electricity the power station has generated in total and issue a corresponding number of green certificates according to the amount of power generated.

Under this process, they must either send people to the site, which has a relatively high labor cost, or invest in a complete set of digital solutions, install various IoT devices for real-time collection, and have high one-time costs such as hardware, cloud, and digital platforms. Therefore, people are more inclined to build a centralized large-scale photovoltaic power station with higher returns.

Source: Cointelegraph

We can see that the current digital infrastructure construction is mostly a national effort and a top-down construction; DePIN introduces an alternative perspective, leveraging extensive bottom-up community collaboration to address large-scale infrastructure investments beyond what enterprises can individually support. This novel approach involves distributing the investment burden among community builders, fostering a collective effort to construct an infrastructure network with heightened efficiency and reduced costs.

Moonshot Commons:

What are the specific operating mechanisms such as co-construction and incentives in the Arkreen community?

Leo Lin:

The DePIN project provides a good model, and the hardware investment for building digital infrastructure is now undertaken by the builders in the community.

In the community, this hardware is called the Mining Device, but it is different from the mining device for Bitcoin mining. It is actually POPW (Proof of the Physical Work), that is, the workload of the builder in the physical world is accurately measured through IoT devices and registered in the blockchain ledger in real-time. It is used for the fair distribution of incentives in the infrastructure construction phase and the fair distribution of external income after the network effect of subsequent infrastructure is formed.

The incentive model in the DePIN network can regularly distribute token rewards based on the physical world workload contributed by each builder and registered on the blockchain.

Source: Arkreen

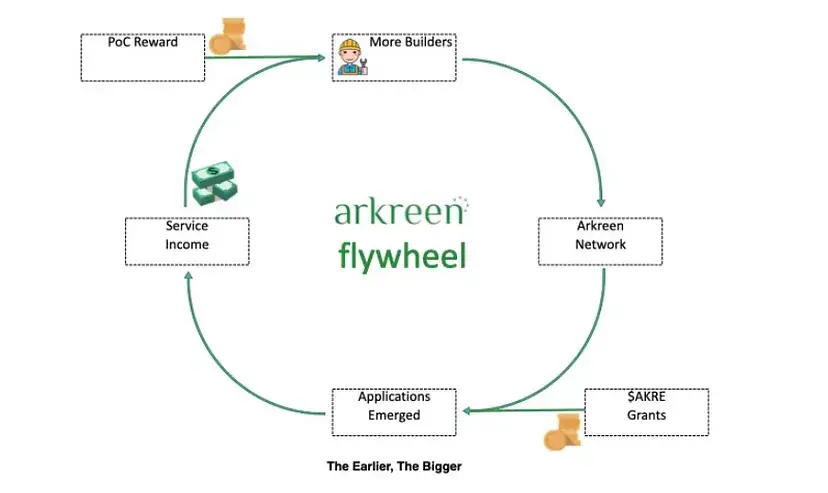

During the project’s initial cold start phase, early participants among the builders stand the chance to receive increased token incentives. This strategic approach aims to incentivize a larger pool of individuals to partake in early-stage infrastructure construction, consequently expediting the “go to market” process more effectively.

Once a compelling demonstration effect takes root in the secondary market, a surge in token purchases by additional investors can be expected. As the token price escalates, the ROI (Return on Investment) for builders will increase, further fueling their motivation to procure more mining machines and invest in additional infrastructure projects, achieving a virtuous cycle.

We have observed that Helium has successfully capitalized on the market’s upward trend in recent years, fostering a harmonious interaction between builders and investors. This symbiotic relationship has enabled rapid growth from inception to 10,000 units, and further expansion from 10,000 units to hundreds of thousands. We also hope to rally the community to build Arkreen’s infrastructure with a similar approach.

At the beginning of this year, Arkreen launched the test network and started a small-scale community test.

Moonshot Commons:

Is there any difference in the demand for green certificates between Bitcoin mining farms and traditional data centers?

Leo Lin:

Bitcoin mining farms consume a lot of energy. Although an increasing number of mining farms are starting to use clean energy today, 100% coverage cannot be achieved yet.

To realize the greenification of Bitcoin mining and to offset the large amount of carbon emissions generated by previous mining activities, communities need to purchase RECs to offset the carbon emissions of the Bitcoin network. This will be a great demand in the future.

Bitcoin Mining Center. Source: Jasmin Merdan via Getty Images.

The use of traditional green certificates has certain requirements on the location of energy consumption. The green certificates need to be generated where energy is consumed.

However, block generation within the Bitcoin network results from the collaborative computations of mining machines worldwide. Consequently, the energy consumption associated with the Bitcoin network is distributed and not confined to specific locations. As a result, utilizing green certificates to offset the carbon emissions from block generation in the Bitcoin network can also be location-agnostic, given its decentralized nature.

This creates conditions for the homogenization of green certificates, and there is an opportunity for tokenized RECs to have higher liquidity.

Moonshot Commons:

What is Arkreen’s business model?

Leo Lin:

We need to connect more distributed renewable energy equipment on the supply side while gathering more green energy data. As this dataset grows to a certain scale, we can transform these credible and verifiable records of green power generation into valuable green certificate products, which can then be marketed and sold to enterprises or projects seeking to achieve carbon neutrality.

On the other hand, companies that need to subscribe to this data on the Arkreen network need to pay the corresponding fees based on the Arkreen token.

Arkreen Value Flow. Source: Arkreen

Of this part of the income, 80% will be distributed back to the builder who contributed the corresponding data; 10% will be reserved for Arkreen treasure, and the other 10% will be used to repurchase Arkreen tokens and burn them to form certain deflation.

Moonshot Commons:

As the physical foundation connecting the real world and the virtual world, how will DePIN affect the traditional infrastructure? Which other industries will also benefit?

Leo Lin:

DePIN is a great complement. This is consistent with the current new infrastructure, but with DePIN, these digital infrastructures may no longer be built only by the government and large enterprises but can be completed through a large-scale collaboration of the global community.

Source: CoinMarketCap

For example, some places in the United States and Europe have poor network coverage. The core reason may be that the input-output ratio of building a base station in the local area is too low. In the future, through DePIN, it is possible to build more infrastructure to cover blind areas. Many industries have the opportunity to rebuild through DePIN.

Also, there are currently DePIN projects in the community for the Internet of Vehicles, weather stations, cameras, and map crowdsourcing collection. As long as it is a digital infrastructure project, there is an opportunity to use the DePIN model to reconstruct it.

Moonshot Commons:

What challenges may be encountered and will need to be addressed concerning technology, market, or policy during the future development of DePIN?

Leo Lin:

In terms of technology, the first is how to ensure the authenticity of the data. To prevent fraud and cheating, more security measures need to be considered in the hardware part, including how to make Oracle more effective.

Now, DePIN relies heavily on IoT hardware to measure the workload in the physical world and register it on the chain, which will pose relatively large challenges to the chain. For example, higher frequency interactions will put higher requirements on the throughput performance of the chain.

Source: CryptoDaily

In terms of the market, we believe that we should first start with the C-end.

Because the core of the DePIN project is to be able to accept token incentives, it is necessary to choose a scenario where individuals can decide whether to install and deploy the hardware. If the scenario is determined by the enterprise, many managers may not be able to accept this incentive model from the perspective of the operation of the enterprise itself, considering financial, legal, compliance, and other issues.

Moonshot Commons:

What is the understanding behind the “Web3 DePIN Hong Kong Initiative” launched by Arkreen and Hashkey, regarding the development of the DePIN ecosystem in Hong Kong?

Leo Lin:

Hong Kong has released friendly signals towards Web3 since December last year. DePIN uses the token incentive mechanism to allow the global community to collaborate on a large scale to build a valuable infrastructure network from the physical world, which is very relevant to the real world. In other words, it is very related to the real economy.

In addition, the DePIN project uses hardware to realize the proof of work in the physical world, so it is very dependent on the supply chain and industrial resources, which will highlight the unique advantages of Hong Kong, which is backed by the Greater Bay Area (Guangdong-Hong Kong-Macao), the world’s factory.

Hence, Arkreen, in collaboration with HashKey and Hash Global, aspires to partner with global DePIN project parties, prominent investment institutions and research institutions on the DePIN track, hardware equipment manufacturers, industrial partners, and all DePIN community builders to jointly launch the DePIN Greater Bay Area Hong Kong Initiative to foster robust growth within the DePIN community and ecosystem.

Source: Hong Kong Web3 Festival, 2023

With the solid foundation of Hong Kong and the Greater Bay Area, our hope is for more industries to seamlessly integrate with Web3 innovation through the transformative DePIN model. By doing so, we aim to empower more Web3 builders to uncover valuable real-world use cases within the DePIN project and jointly weave a compelling narrative of Web3 in Hong Kong.

At the start-up stage of a DePIN project, half of the team’s energy needs to be spent on integrating industrial resources such as hardware and supply chain. Currently, the hardware partners of the DePIN project are mainly located in the Greater Bay Area.

If the project party is in the United States, once there are some problems with the hardware partner, it will take more than ten hours to come to coordinate; if the project party is in Hong Kong, it may only take half an hour to go to the Shenzhen factory. We believe that DePIN represents a significant potential narrative in the upcoming cycle, and Hong Kong stands out as a distinctive global platform to amplify this narrative and can foster superior development for numerous DePIN projects.

On the other hand, DePIN, being an infrastructure project, also presents itself as one of the more favorable avenues for Asian teams to excel. Because this has relatively high requirements for the project team on the integration of supply chain and industrial resources, it offers Asian teams a valuable opportunity.

Moonshot Commons:

There are not many projects on the DePIN track. There is the benchmark, Helium, in front of it, as well as React Network, Filecoin, etc. What are the differences between them? How do you view some of the industry’s controversies over Helium?

Leo Lin:

Helium is indeed a benchmark project in the DePIN ecosystem, and everyone is more or less learning from its model.

In terms of technical architecture, economic model design, community governance, supply chain management, mining machine anti-cheating management, etc., it has given a lot of reference to the subsequent DePIN projects, which is very beneficial to us. Helium is very community-based. From the very beginning, their internal discussions and information are all publicly available on the Internet.

People have some doubts about the external revenue of Helium’s current network. I suggest that you can compare it with the usage of the new 5G infrastructure of the same type of centralized telecom operators. The initial investment in the infrastructure business is substantial, but once the infrastructure is built, it can generate a strong and stable cash flow that lasts for a long time.

A Helium Hotspot. Source: Solana

If the infrastructure is to provide services for enterprise users, it will take a certain time, such as 6–9 months, to onboard enterprise customers. After enterprise customers decide to use it, it will take a certain time to gradually increase the volume.

React Network, similar to us, is working on a decentralized green energy infrastructure network. In the short term, on the supply side, they primarily start with household energy storage batteries, and we primarily start with photovoltaics on the power generation side. On the demand side, their use cases are mainly VPPs (Virtual Power Plants), and our use cases are mainly green certificates.

In the medium and long term, we will also extend from the power generation side to the household energy storage and power consumption side, and they will also extend from household storage to photovoltaics, etc. Our use cases may gradually converge. Everyone hopes to set a benchmark in this market.

Filecoin, predating Helium, operated when the DePIN track was not yet established. Their model involves leveraging large-scale community collaboration, with individuals purchasing mining machines to offer storage services, thus creating a decentralized storage infrastructure network. Similarly, Bitcoin constitutes a decentralized computing power infrastructure network.

Moonshot Commons:

How do you interpret “DePIN will become a significant narrative in the next market cycle”?

Leo Lin:

People are more and more concerned about what value Web3 can bring to the real world and Real-World Assets (RWAs).

Source: The Block

We believe that a class of assets with boundless potential exists in the real world — DePIN-like assets. These tokens, associated with the DePIN project, represent the intrinsic value of the right to utilize the real-world infrastructure network. As the DePIN network expands through the network effect, an array of valuable applications and services will emerge. This conviction underpins our belief in DePIN’s potential to become a significant narrative in the upcoming cycle.