返回

NTU MOOC Study Notes - Session 9 Fintech in Web3

Study Notes

By HackQuest

Aug 11,20244 min readDate: 9-10:30 AM SGT, July 30th 2024 / 9-10:30 PM EST, July 29th 2024

Session Title: Fintech in Web3

NTU I&E x HackQuest MOOC is free and open to all individuals interested in Web3. This session focuses on the intersection of fintech and Web3 technologies, led by Dr. Ernie Teo. For those who prefer having a text summary and review material, this study note provides a recap of what’s covered during the MOOC. Happy learning!

Overview

Main Topic: Understanding the integration of fintech within the Web3 ecosystem.

Objectives:

1.Learn about the evolution and current state of fintech.

2.Explore decentralized finance (DeFi) and its impact on traditional finance.

3.Understand real-world applications and innovations in Web3 fintech.

Section 1: Introduction to Fintech

1.1 What is Fintech?

Definition: Fintech is the application of technology to improve financial services, aiming to compete with traditional financial methods by enhancing user experience, reducing costs, and increasing revenue.

●Key Points:

●Fintech includes various applications such as electronic fund transfers, digital stock exchanges, and mobile banking.

●It aims to offer innovative financial services through technology, disrupting traditional financial models.

Section 2: Evolution of Fintech

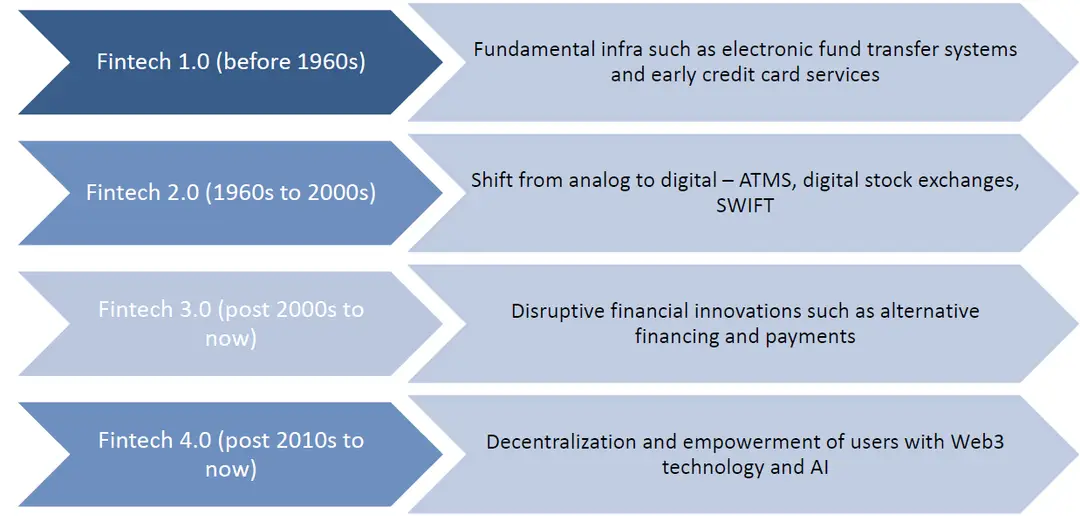

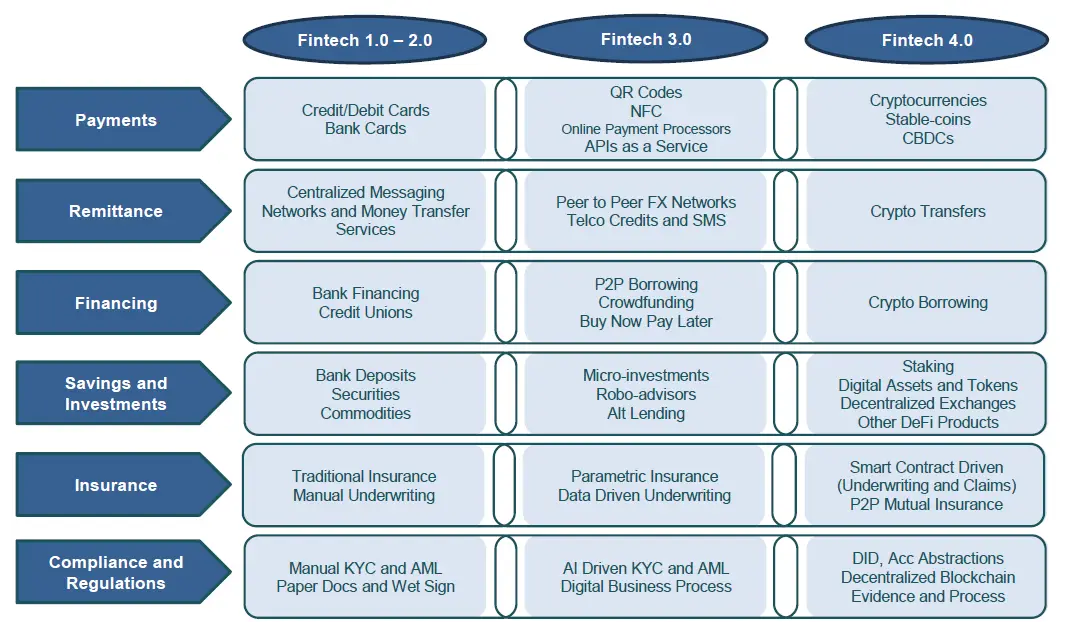

2.1 Versions of Fintech

●Fintech 1.0 (Before 1960s):

●Introduction of fundamental infrastructure such as electronic fund transfer systems and early credit card services.

●Fintech 2.0 (1960s to 2000s):

●Transition from analog to digital systems, including ATMs, digital stock exchanges, and SWIFT.

●This era saw the digitization of banking processes and the introduction of online banking.

●Fintech 3.0 (Post-2000s to Now):

●Emergence of disruptive financial innovations like alternative financing and payments.

●The rise of mobile banking apps, peer-to-peer lending platforms, and digital wallets.

●Fintech 4.0 (Post-2010s to Now):

●Focus on decentralization and user empowerment with Web3 technology and AI.

●Integration of blockchain technology, smart contracts, and decentralized finance (DeFi).

Section 3: Decentralized Finance (DeFi)

3.1 Introduction to DeFi

●Definition: DeFi refers to a financial ecosystem that bypasses traditional financial intermediaries by combining digital assets and smart contracts on blockchain technology.

●Key Points:

●Greater transparency for financial transactions.

●Democratizing access and ownership, providing financial services to the unbanked globally.

●Examples of DeFi applications include lending platforms, decentralized exchanges, and yield farming protocols.

3.2 DeFi vs Traditional Finance

Example:

●PoolTogether

A no-loss game where participants deposit stablecoins into a common pot. At the end of each month, one lucky participant wins all the interest earned, and everyone gets their initial deposits back.

Section 4: Real-World DeFi Applications

4.1 Opening of Illiquid Assets

●Innovation: Tokenizing assets to represent unique or fungible proxies for something physical of value.

●Applications: Digitalization and trading through standardized requirements for asset ownership transfer.

●Examples:

●Tokenized Real Estate: Allows fractional investment, reducing costs and increasing financial inclusion.

●Aspencoins: Tokens representing fractional equity ownership of the St. Regis Aspen Resort.

4.2 Crowd Financing

●Innovation: Tokenization of private equity and debt for crowdfunding.

●Applications: Simplified issuance of debt as tokens, reducing costs and enabling real-time investments.

●Examples:

●ICOs (Initial Coin Offerings): Blockchain projects raising funds through token sales to a broad base of investors.

●Fractionalized Securities: Fintech firms offering fractional ownership of stocks and bonds, increasing accessibility and liquidity.

4.3 Fractionalizing Investment Securities

●Innovation: Selling fractionalized securities to increase accessibility and diversification.

●Applications: Fintech firms like Robinhood and SoFi offering fractionalized equity securities.

●Examples:

●BondbloX: Selling fractional interests in corporate bonds as blockchain-recorded tokens.

●DBS Digital Bond: Issued for $11.3 million with a 6-month expiry paying 0.6% interest per year, fractionalized into increments of $7,600.

4.4 Real Estate Tokenization

●Innovation: Tokenizing real estate to facilitate fractional ownership and trading.

●Applications: Security tokens representing property ownership.

●Examples:

●Aspencoins: Tokens representing fractional equity ownership of the St. Regis Aspen Resort.

●Primalbase: A flex-office concept where token-owners get free access to all Primalbase locations worldwide.

4.5 Real Estate Debt Tokenization

●Innovation: Tokenizing debt securities to improve efficiency and reduce costs.

●Applications: Blockchain-based smart contracts for programmatically issued dividends and automated debt servicing.

●Examples:

●OpenLTV: An open, tokenized passive investment platform where investors can invest in loans backed by U.S. real estate debt.

Section 5: Central Bank Digital Currencies (CBDCs)

5.1 Introduction to CBDCs

●Definition: CBDCs are digital currencies issued by central banks.

●Key Points:

●Two types: Wholesale (for financial institutions) and Retail (for public use).

●CBDCs can enhance efficiency, transparency, and interoperability in financial systems.

5.2 Project Ubin

●Overview: Singapore's multi-phase project exploring blockchain for payments and securities settlement.

●Key Points:

●Demonstrated the viability of a blockchain-based multi-currency payments network.

●Engaged over 40 financial and non-financial firms.

●Goals: Improve domestic payments, reduce risks and costs for cross-border settlements.

●Examples:

●Project Jasper: Real-time gross settlement (RTGS) system using distributed ledger technology.

●Project Cedar: Securities settlement using blockchain to streamline post-trade processes.

5.3 Project Orchid

●Overview: Exploring the feasibility of introducing a digital version of the Singapore dollar.

●Key Points:

●Purpose-bound Singdollar: Allows senders to specify conditions for its use.

●Trials included redeeming government-issued vouchers and disbursing grants for SkillsFuture training providers.

5.4: Purpose Bound Money (PBM)

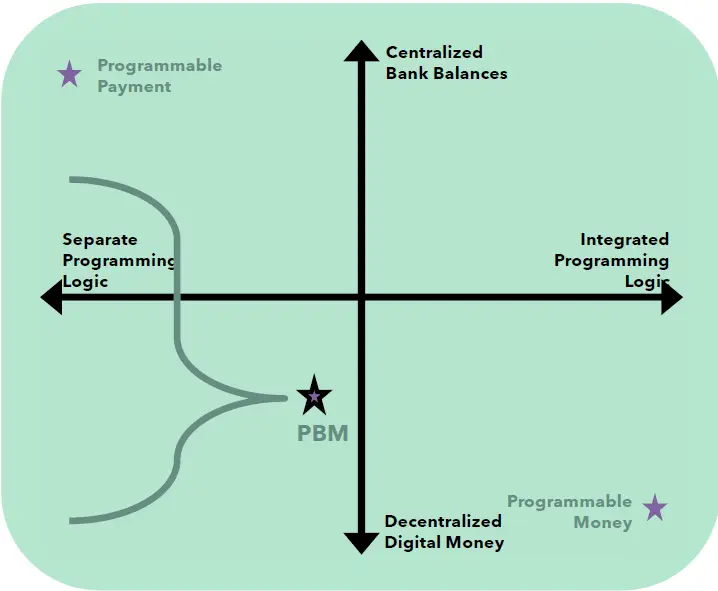

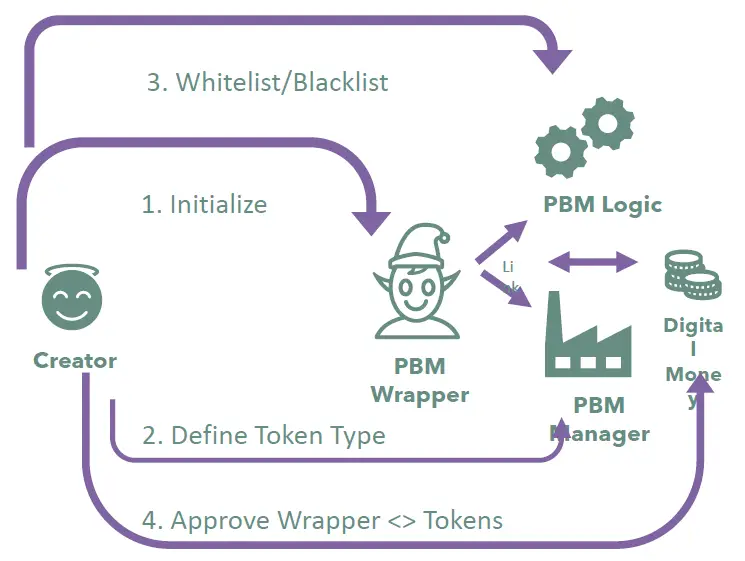

●Overview: Purpose Bound Money (PBM) is a new concept introduced under Project Orchid that allows the creation of programmable money with specific conditions attached to its use. PBM can be applied to various forms of digital money, such as CBDCs, stablecoins, cryptocurrencies, and other digital asset tokens, enabling more controlled and flexible financial transactions.

●How It Works:

●Initialization:

●PBM Manager: The process begins with the PBM manager initializing the system.

●Define Token Type: The manager defines the type of token to be used, ensuring it meets the necessary conditions.

●Whitelist/Blacklist: Addresses are whitelisted or blacklisted to control who can receive and use the PBM.

●Approve Wrapper: The PBM manager approves the wrapper that links the tokens to the PBM logic.

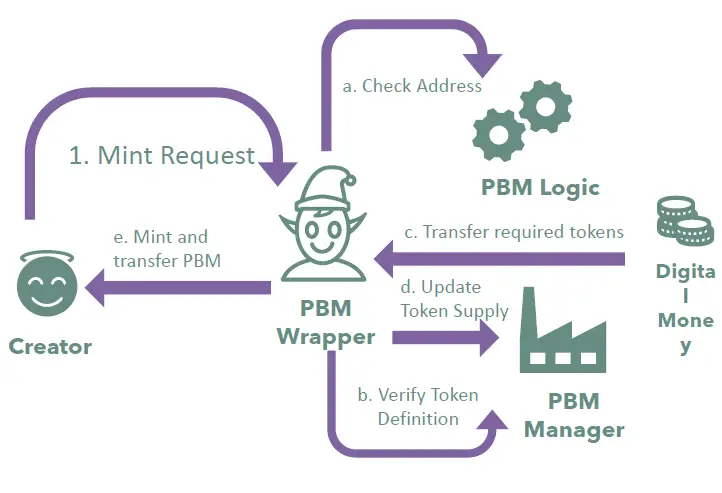

●Minting:

●Mint Request: The creator initiates a request to mint PBM.

●Verification: The system checks the address and verifies the token definition.

●Token Transfer: Required tokens are transferred to the PBM wrapper.

●Minting: The PBM is minted and transferred to the specified PBM holder.

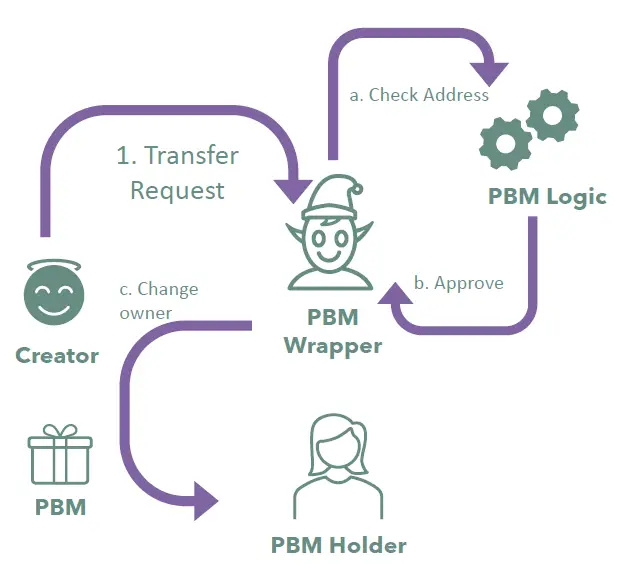

●Transfer:

●Transfer Request: The PBM holder can request a transfer of the PBM.

●Approval: The system checks the address and approves the transfer.

●Ownership Change: The ownership of the PBM is transferred to the new holder.

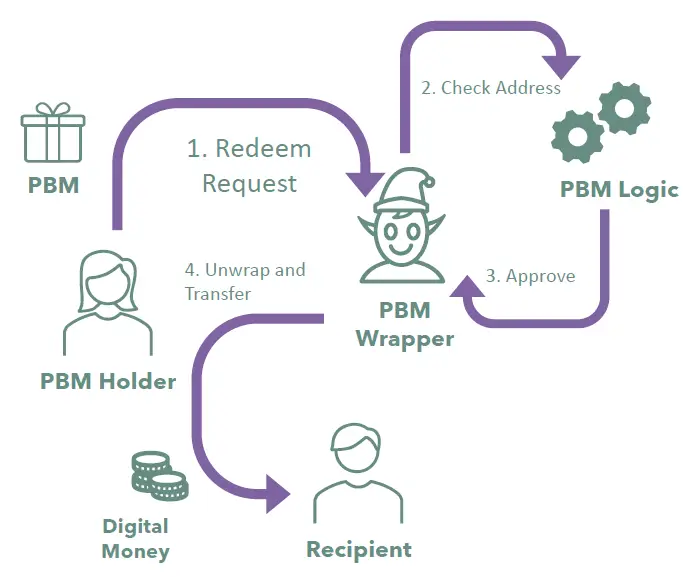

●Redemption:

●Redemption Request: The PBM holder requests to redeem the PBM.

●Verification: The system checks the address and verifies the conditions for redemption.

●Unwrap and Transfer: Once approved, the PBM is unwrapped, and the digital money is transferred to the specified recipient.

●Key Features:

●Separate vs. Integrated Logic: PBM can operate with separate or integrated programming logic, offering flexibility in how the money is controlled and managed.

●Centralized vs. Decentralized: PBM can be applied to both centralized bank balances and decentralized digital money, providing a versatile tool for various financial environments.

●Programmable Payment vs. Programmable Money: PBM allows for both programmable payments, where the logic dictates how payments are made, and programmable money, where the logic controls the money itself.

●Real-World Applications:

●Government Voucher Programs: PBM has been piloted for redeeming government-issued vouchers, where citizens can use the PBM-wrapped digital money to redeem services or products from specific merchants.

●Educational Grants: PBM has also been used to disburse grants for skills development programs, ensuring that the funds are used solely for the intended educational purposes.

Section 6: Trends and Future of DeFi

6.1 Key Trends

●Increased tokenization of real-world assets.

●Greater adoption of stablecoins.

●New developments in derivatives and options.

●Improved scalability and enhanced privacy protocols.

●Integration with AI and data.

6.2 Challenges and Risks

●Regulations: Legal challenges such as SEC lawsuits and proposed acts.

●Technology: Network congestion, bugs, and security breaches.

●Security: Hacks, scams, and fraud cases like the FTX exchange collapse.

Q&A

Q: What do you think will drive the next bull market in Web3, and what are some exciting areas in fintech across the world?

A: The DeFi industry has seen a lot of focus on hype-driven projects, with people chasing the next big thing. However, I believe the real value lies in projects that aim to improve people's financial lives. Decentralized exchanges, for example, significantly enhance the existing infrastructure and could influence traditional exchanges to adopt more decentralized models in the future. While hype, like the current interest in AI, can drive short-term gains, the next bull market will likely be driven by fintech innovations that genuinely address user needs and leverage technologies like AI to create meaningful insights from blockchain data.

Q: Could you elaborate on the future of Central Bank Digital Currencies (CBDCs), especially in emerging countries?

A: Initially, many developing countries explored retail CBDCs as a way to address the issue of underbanked populations. Retail CBDCs were seen as a solution to provide easier access to financial services in regions where traditional banking infrastructure is lacking. However, we are now seeing a shift towards wholesale CBDCs, where central banks issue digital currencies to commercial banks, which then distribute these as retail money. This model leverages the banks' ability to provide better user experiences and align with commercial incentives. We are also witnessing the rise of digital banking licenses, allowing digital banks to operate more quickly and incorporate CBDCs into their offerings. In emerging economies, CBDCs could play a crucial role in transparent government grant distribution and financial aid.